“The time had come, as in all periods of speculation, when men sought not to be persuaded of the reality of things but to find excuses for escaping into the new world of fantasy.”

- John Kenneth Galbraith, “The Great Crash, 1929”

_____________________________________________________________________________________________________

This edition of our Gavekal EVA is written by one of my closest friends, who also happens to be my partner, Louis Gave. As Louis points out in this note, January market trends historically set the direction for the full year per his title “As January Goes”. Well, so far, not so good!

As I’m sure most EVA readers have noticed, 2022 is off to a rocky start so far, especially for the former high-flyers. Most of these were losing considerable altitude even before the calendar flipped to the new year.

In reality, the damage done in recent months goes beyond the frothy parts of the stock market and has impacted nearly all high-risk “assets”. Louis cites the poster child for aggressive investing, Bitcoin, which has tumbled almost 40% in just two months. For most asset classes, that would be a shocker but for the King of Cryptos it’s just another hiccup on the way to $1,000,000—or whatever is the latest aspirational price target by its die-hard fans. Regardless, it is a reflection of the “risk-off” mindset that has become increasingly evident and, as Louis discusses, this goes well beyond cryptocurrencies.

On the positive side, the energy sector is off to a strong start and Louis articulates why he thinks it has further upside. As you will see, he’s additionally upbeat on financial stocks and Japanese equities. Those are two of my most favored areas, as well. (He is also bullish on Chinese high yield bonds but those are nearly impossible for US investors to access.)

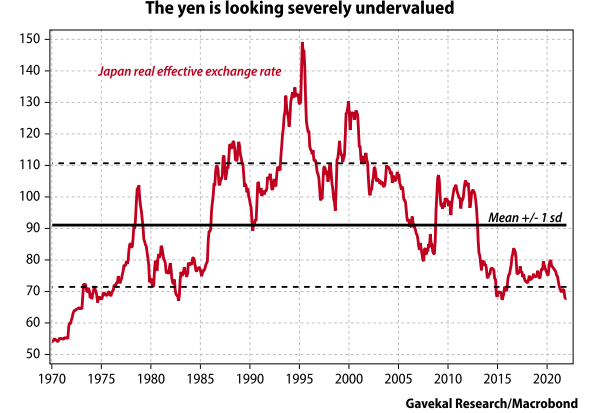

On a related note, Louis is also highlighting how cheap the Japanese yen is presently. While I agree wholeheartedly, I realize most investors are averse to betting on currency swings. However, there are two ETFs that track the yen, including one that provides twice the upside (and downside). A far more mainstream vehicle is the primary Japanese stock market ETF that should benefit from an undervalued yen due to Japan’s status as a major exporter. This has been a recurring recommendation of our Positioning Recommendations section (formerly, Likes/Neutrals/Dislikes) and, in my view, it remains appealing for the reasons Louis outlines.

That’s enough of a lead-in from me other than to wish all of our clients and readers a healthy and prosperous New Year!

We are only six days into the year, but most investors must hope that the adage “as January goes, so goes the year” does not hold true for 2022. After all, the S&P 500 is down -1.4% and the Nasdaq has shed -3.5%. And behind this pullback in the broader indexes, pain in the more speculative parts of the market is starting to add up. Since early November, the bitcoin price has fallen -36.5% and the Russell 2000 growth index is flirting with bear market territory after a -14.2% pullback. Aggressive growth names, SPACs, and meme stocks have all struggled.

Momentum seems to have turned. Momentum also seems to have turned for the more “value” parts of the market. Indeed, over the past few weeks:

Now, to be sure, it is too early to conclude that energy, financials, Chinese high-yield debt or Japanese equities have started a new bull market. Still, these are parts of the market that have undemanding valuations and seem to be enjoying favorable macro tailwinds (e.g. rising energy prices, steepening yield curves, easing Chinese policy and an undervalued yen). Therefore, as markets decide which way they want to go in 2022, waiting for clearer direction in these underowned and undervalued segments makes sense.

DISCLOSURE: This material has been distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, are subject to change, and reflect the personal opinions of David Hay (an employee of Evergreen Gavekal) as of the date of this publication. This publication does not necessarily reflect the views of Evergreen’s Investment Committee as a whole. All investment decisions for Evergreen clients are made by the Evergreen Investment Committee. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed, and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this letter have been selected to illustrate the author’s investment approach and/or market outlook and are not intended to represent Evergreen’s performance or be an indicator for how Evergreen or its clients have performed or may perform in the future. Each security discussed in this letter has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in the aggregate, may only represent a small percentage of a Evergreen’s client holdings. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. Before making an investment decision, the reader should do their own research and/or consult with their financial advisor. Past performance is no guarantee of future results. All investments involve risk, including the loss of principal.