By Tan Kai Xian

Today we publish our Strategy Monthly chartbook, which argues that after a year of inflation being a singular global factor it is increasingly a variegated effect, region by region. In the United States, inflation remains the dominant economic issue impacting both politics and policymaking, yet we argue that inflationary forces in the world’s biggest economy are in fact weakening. A clear indicator of this effect can be seen in the US home rental market, where rising rents have been a key driver of high inflation throughout this year.

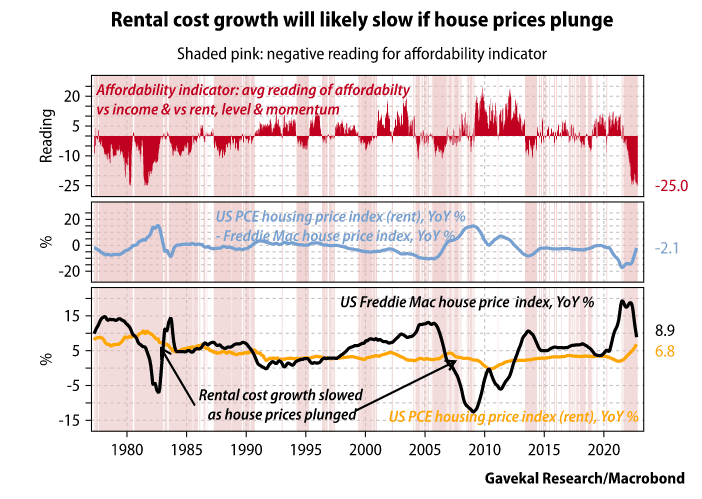

US housing rental inflation broadly depends on (i) wages, (ii) mortgage rates, and (iii) house prices. Higher wages support both rents and house prices. Higher mortgage rates and house prices make financing a new home more costly and encourage people to rent instead, pushing up its cost. Over the past year, the US saw all three variables rip higher, creating a perfect storm for driving up rents. However, those climatic conditions are reversing.

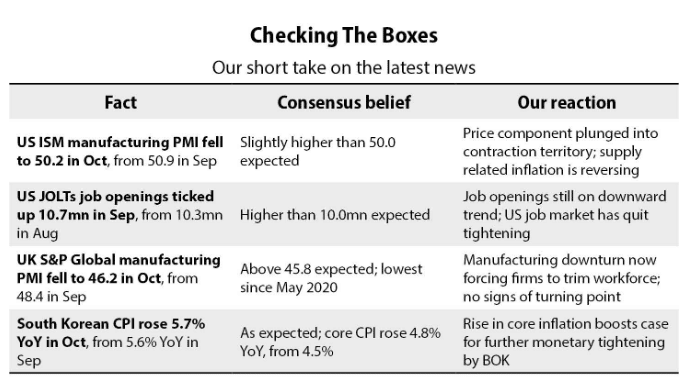

Household income growth is set to slow, as the once red-hot US labor market starts to cool due in part to the Federal Reserve’s tighter monetary policy. Job openings and the US “quit rate” have been trending down since April, which is not changed by the marginal improvement in September. These tend to be leading indicators of softer wages. Given that the share of income spent on housing is fairly stable, slower income growth implies slower growth rates for both rental costs and house prices.

US mortgage rates are now more likely to fall than rise. The nearly 400bp rise in mortgage rates in the past year was one of the steepest ever seen. Moreover, the spread between 30-year mortgage rates and 10-year treasury yields has reached gaping levels, as was the case in the 2008-09 crisis, suggesting potential for a convergence. Moreover, if a US disinflationary recession triggers a fall in US treasury yields, as Will Denyer and I expect (see Navigating A US Recession), mortgage rates have even more downside potential.

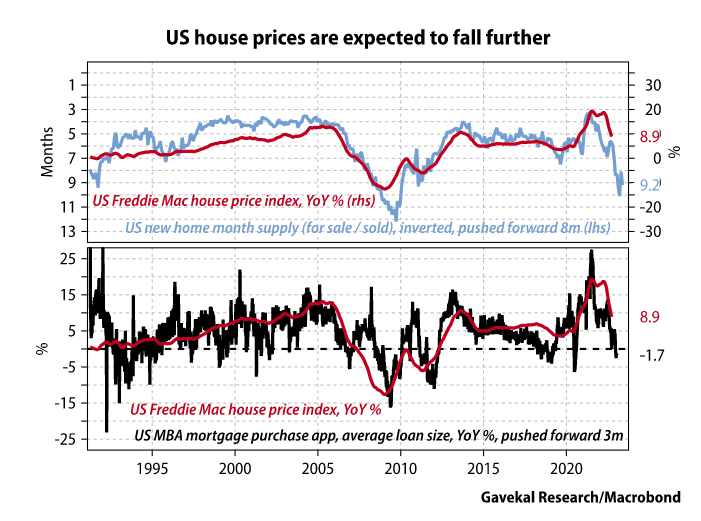

US house prices will likely fall further. Homeowners are not trying to sell up, as indicated by the low supply of existing homes hitting the market, but households have little appetite to buy new houses, as shown by soaring inventory levels. This effect can be seen in a contraction in the average loan size now being sought by mortgage applicants.

This all points to a moderation in US rental inflation, of which there are already early signs. Growth in the Zillow observed rent index, which tends to lead US rental inflation by about seven months, is slowing down. Since US home affordability has dramatically worsened, the most likely scenario is a sharp fall in prices, while individuals continue to rent rather than buy. That points to a repeat of 1981-82 and 2007-08, such that rental inflation moderates as house prices fall sharply.

There are already signs of overall US inflation moderating. There remains the risk of an energy price spike due to geopolitical effects, yet US energy prices have fallen over the past four months. Prices heavily impacted by supply chain bottlenecks, such as used cars, have eased back. If easing rents combine with other disinflationary forces, its large weighting in consumer price indexes will go a long way to ensure a rollover in inflation. To be clear, this is unlikely to change the Fed’s tightening path in the next few months, as the Fed remains in “believe it when I see it” mode. But it would open the way to a less hawkish Fed in the first half of next year.

DISCLOSURE: This material has been distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, are subject to change, and reflect the personal opinions of David Hay (an employee of Evergreen Gavekal) as of the date of this publication. This publication does not necessarily reflect the views of Evergreen’s Investment Committee as a whole. All investment decisions for Evergreen clients are made by the Evergreen Investment Committee. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed, and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this letter have been selected to illustrate the author’s investment approach and/or market outlook and are not intended to represent Evergreen’s performance or be an indicator for how Evergreen or its clients have performed or may perform in the future. Each security discussed in this letter has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in the aggregate, may only represent a small percentage of a Evergreen’s client holdings. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. Before making an investment decision, the reader should do their own research and/or consult with their financial advisor. Past performance is no guarantee of future results. All investments involve risk, including the loss of principal.