“Bitcoin should also be thought (of) in part as a Chinese financial weapon against the US…It threatens fiat money, but it especially threatens the US dollar.”

– Tech billionaire and long-time Bitcoin bull, Peter Thiel

“It’s Economics 101. The supply (of Bitcoin) grew 2.5% last year; it’s growing 2% this year. And is demand growing faster or stronger than 2%?”

– Bill Miller, who at one time held the record for number of consecutive years of outperforming the S&P 500.

______________________________________________________________________________________________________

Regular readers of the Evergreen Virtual Advisors (EVAs) written by yours truly have probably noticed that I’ve been unusually silent on Bitcoin and the other cryptos for a very long time. In fact, I can’t recall the last time I’ve made any comments on them; however, I do vividly remember when I should have.

For those of you who read our August 28, 2020 EVA on using technical analysis* as an aid to fundamental analysis, you may have retained the crucial message: multi-year highs are almost always to be bought. (If you didn’t, or forgot about it, here’s the link.) This is even more the case with all-time highs. In other words, if a particular investment breaks above a long-term resistance level—a price where it previously topped out—it will nearly always continue higher. If that breakout creates the highest price it has ever traded at, it’s an even more powerful buy signal.

* Price charts, support and resistance levels, etc.

Last fall, Bitcoin did exactly that; on November 30th, 2020 it exceeded the incredible apex it attained in late 2017 when I, and many other commentators, contended it was the biggest bubble in recorded history. As a result of its fantastic ascent, it went beyond even the astounding rise in tulip bulbs in Holland in the 1600s and the legendary bubble in Japanese stocks, as well as real estate, in the 1980s.

So egregious was its blow-off that it caused me to start writing a book in real-time called “Bubble 3.0: How Central Banks Created the Next Financial Crisis.” It was a source of some satisfaction to me that shortly after I called out Bitcoin as absurdly inflated, it began what would become a nearly 80% decline. After peaking at roughly $20,000 per coin in late 2017, right around the time of my attack on it, it would trough at $3,156.89 in 2018. This was actually the second implosion of 80% or more by Bitcoin in its short life, along with two others of a not insignificant 50% and 70% in 2013. (As an aside, it’s interesting how often asset classes/investments that are caught up in mega-manias end up going down by approximately 80%.)

Consequently, when Bitcoin surpassed its 2017 bubble-to-end-all-bubbles peak less than three years later, I was both perplexed and impressed. On the latter point, I almost put out a trading recommendation to buy it at the decisive break-out point of around $21,000. But I wimped out.

Source: Bloomberg, Evergreen Gavekal

One aspect that led me to believe it was heading considerably higher, besides the clear technical buy signal, was an almost total lack of retail investor euphoria last November. This was in vivid contrast to late 2017 when even normally rational and risk-averse Evergreen clients were bombarding my team and me with queries about taking on some exposure. (We advised against that which looked like very good advice…until last fall!)

Once again, buying a breakout to a new all-time high worked like a charm and I’m kicking myself for not at least suggesting it as a tactical trade in our Likes/Dislikes section, at a minimum for aggressive investors. But, frankly, I just couldn’t bring myself to give it a plug, mostly due to my failure to even remotely understand its fundamental value proposition – despite its obvious appeal as the ideal trading vehicle.

However, as it moved to $40,000 and, of late, all the way up to $64,000, it has reignited the investor euphoria it attained in the second half of 2017. More significantly, it is also attracting leading asset managers and Wall Street firms, not to mention corporations; the latter are increasingly using it as a placeholder for their excess cash (Tesla and MicroStrategy are the two high-profile proponents). Accordingly, it’s acquiring an aura of respectability it never had before.

So, am I now a convert to the cause? Spoiler-alert in weasel words: yes and no. Yes, I will concede there is much more force and durability to Bitcoin’s rise to essential asset class acceptance than I previously believed. No, in the sense that I think this is a poor time to be adding to it and/or initiating positions.

In fact, if I had been smart enough to have bought it years ago for a song, as did one of my close friends, I’d be methodically selling it down presently. By that I mean, after allowing it a 50% or so run beyond the $20,000 breakout point (i.e., to about $30,000) I’d have sold around 30% of my remaining position each time it went up that much (again, i.e., in the range of $39,000). If it made it to somewhere over $50,000, which it did, I’d have taken off another 30%. Arguably, it got high enough after that to have triggered another sell-down in the mid-$60,000 range (but it would have been a close call).

This process is my oft-touted strategy of dollar-cost-averaging on the sell side. Many institutional and other disciplined investors do that on the buy-side but, in my experience, precious few do that when it comes to selling—particularly, after massive price surges. In reality, most retail investors tend to buy an increasing amount of a hot asset class or security the higher it goes. Even professional money managers seem vulnerable to becoming intoxicated by parabolic moves. At the end of this note, I’ll come back to that point which I believe is of paramount importance when it comes to Bitcoin and the other so-called cryptocurrencies.

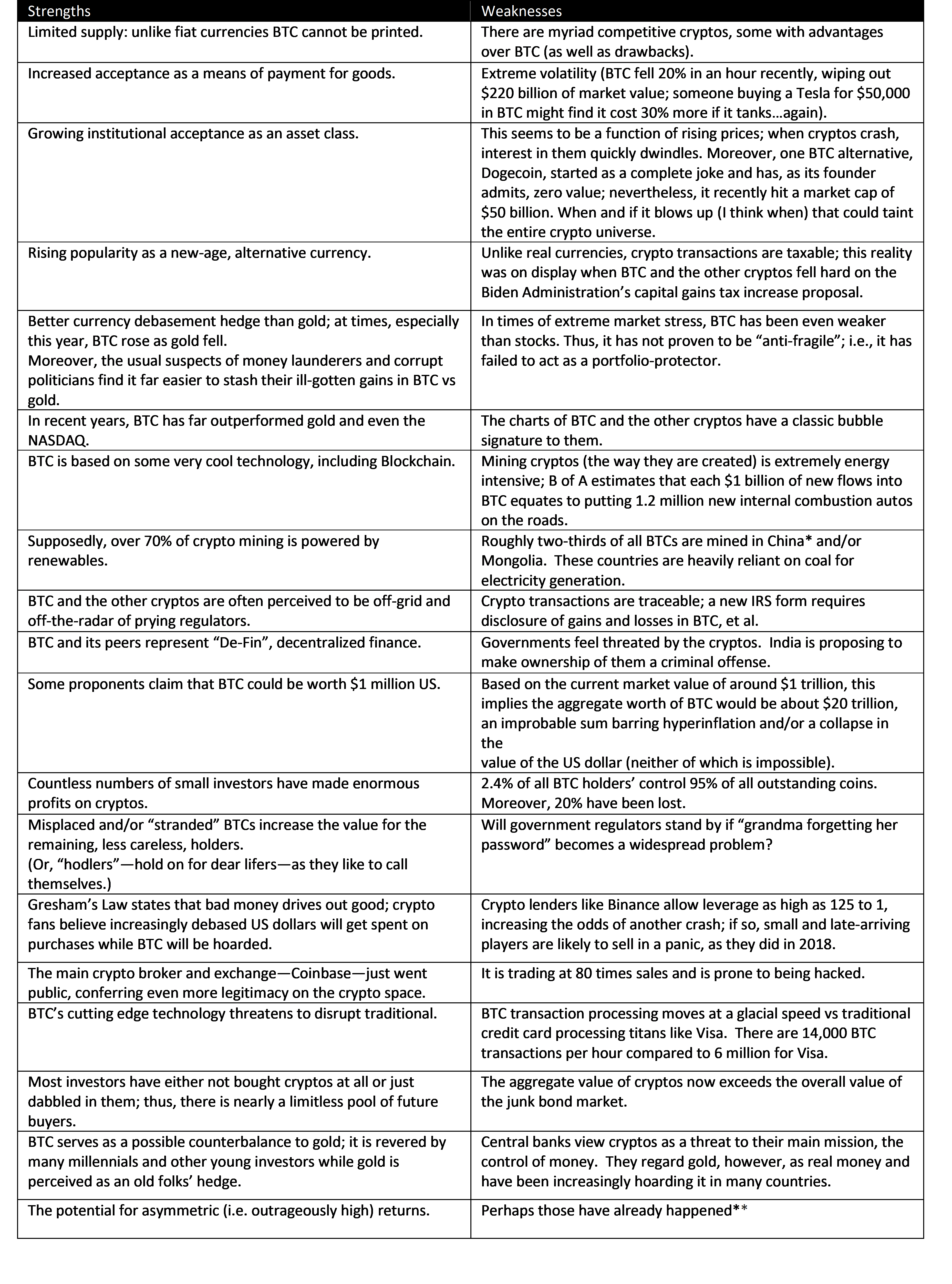

Because there is an almost limitless amount to cover on Bitcoin (BTC in the following table), I’ve created the below table to summarize what I think are the key positives and negatives. Perhaps I’ve missed these from other sources, but I don’t recall seeing this format, possibly because most articles on the cryptos are either very positive or very negative. My hope is that you’ll find this useful as a balanced go-to document whenever someone asks you about cryptos or you opt to get involved with them (if you haven’t already):

*The venerable and perpetually bowtie-festooned Jim Grant recently made this ominous point about China’s BTC mining dominance: “The high concentration of bitcoin mining in the Middle Kingdom itself raises other concerns, as anyone who controls 50% or more of bitcoin’s computing power can reorder bitcoin transactions and spend the same coins multiple times in a so-called 51% attack.”

**Here’s a fun fact in this regard. The first recorded BTC transaction occurred in 2010 when a software programmer/early miner in Florida bought two pizzas. The cost: 10,000 Bitcoins, now worth $680 million! I hope they came with extra cheese and pepperoni!!

Per the last bullet point, please consider these charts of both Bitcoin and Dogecoin (perhaps the latter should be renamed Dodgycoin; hey, at least the creator is honest that it’s just a dog with fleas). These images do beg the question: Are all the positives already fully reflected?

Source: Evergreen Gavekal

When it comes to Dogecoin the answer is an unequivocal yes—if there are any positives to be had—with the disclaimer that zany prices can always become more so, as illustrated this week after tweets from Elon Musk and Mark Cuban sent its price 20% higher. As far as BTC, though, it’s a tougher call, perhaps an impossible one given the extreme opinion polarity on it by super-bright people, many of whom I follow and respect.

However, I have great sympathy for those who own the cryptos because of the sheer folly of current US fiscal and economic policies. (Canada’s are similarly absurd; for a great takedown of Modern Monetary Theory—basically, unlimited money creation by central banks to fund their government’s deficits—by a brave and eloquent Canadian politician, please check out this link.)

Even the Congressional Budget Office (CBO) is projecting US federal outlays to grow eight times faster than revenues every year from 2025 to 2051. They also forecast publicly held federal debt to double from 102% of GDP to 202% by 2051. Based on the CBO’s exclusion of additional stimulus packages and implausibly low levels of discretionary spending, as well as interest rates, these are likely too optimistic. However, they are appalling enough.

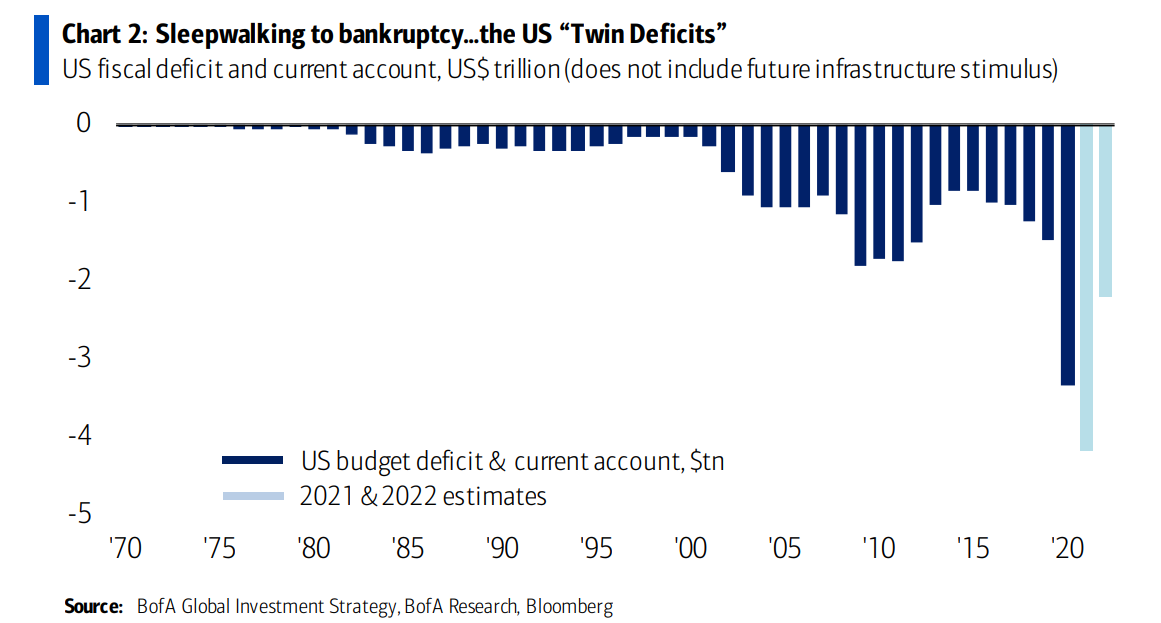

Moreover, America’s other deficit—as in trade—is exploding. This combination is the once-feared “Twin Deficit” scenario. Yet, these days, no one—save perhaps crypto traders and gold bugs—seems to care, much less fear. Per the below title, though, we do seem to be sleepwalking into bankruptcy.

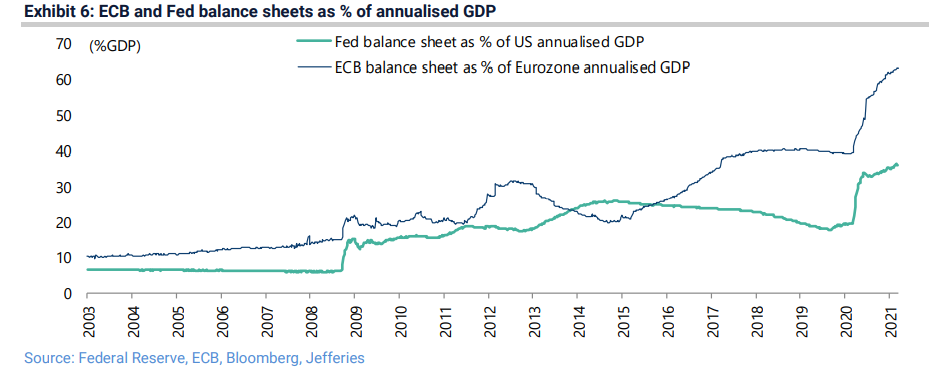

Meanwhile, the Fed appears to have no qualms about letting its balance sheet race up to the size of that of the European Central Bank (ECB). As you can see below, it’s got quite a lot of catching up to do.

Balance sheet expansion is such a benign term, dare I say euphemism. Yet, realize that it means the Fed would need to conjure up another $6 trillion from its Magical Money Machine to match the ECB. If you think that’s ludicrous, please be aware that two of the smartest men I follow—Felix Zulauf (former Barron’s Roundtable member) and Luke Gromen (author of the outstanding newsletter Forest For The Trees) believe it will ultimately increase by $30 trillion to $40 trillion. (They feel this may happen in the next couple of years; personally, I think it will take much longer but if you give the Fed a decade, I’ll buy those numbers.)

Consequently, where I think this all leads us is to some type of debt jubilee, as I’ve written in the past. In my view, that will likely be something along the lines of the US Treasury issuing a 100-year zero-coupon to the Fed in return for the cancellation of all of its interest-bearing bonds. Voila, problem solved! Actually, not so much. The big gotcha is likely to be inflation…and not just of the fleeting kind the Fed is convinced is the only risk in that regard these days.

As longtime disinflationist (a camp I formerly was in) David Rosenberg wrote earlier this year: “While there could be benefits from a debt jubilee…there is a risk that we would see runaway inflation and while that would surely make commodity producers, real estate operators and debtors smile, it will create a whole set of other problems since inflation, as Jimmy Carter famously said in 1979…is a tax on the poor and the elderly.”

Because I’m more fond of smiling than frowning, and I see exactly the above scenario unfolding over time, I want to own plenty of hard assets, including quality income-producing real estate, with conservative leverage (in order to pay back the debt with debased dollars). This is what Evergreen is attempting to do for its clients, with both public and private assets; I’m doing the same thing in my personal portfolio.

Now let’s wrap up this EVA with what I see as the biggest problem with Bitcoin and the other cryptos, one on which I haven’t seen much coverage. To illustrate this point, let me recap a story I relayed in an EVA long, long ago. Once upon a time in the US—like in the first decade of this century/millennium—a certain mutual fund produced 18% annual returns during a time when the overall stock market declined in value. None of its competitors came close to posting such over-the-top numbers. This success caused it, understandably, to be named Morningstar’s “Fund of the Decade”. But there was one itsy, bitsy problem…

Morningstar went to the trouble of doing a difficult but most revealing calculation: it’s called dollar-weighted returns. In other words, they looked at when investors bought and sold the fund. It told a somewhat different story—like 29% per year different!! Because of the terrible timing the investors in this fund used, they managed to convert an 18% per year positive return into an annual 11% loss. Impossible, say you. Possible say they. And here’s how…

In 2007, the fund was up an astonishing, greed-inducing 80%. As a result, investors poured in $1.5 billion of new money, roughly 70% of its year-end 2006 total assets. It then went down 48% in 2008, materially worse than the S&P. As usual, investors fled in droves rather than buying at bargain prices.

The underlying problem was that the fund had just 25 positions and, as a result of this concentration, in addition to an overall aggressive investment style, its returns were extremely volatile. Now, not Bitcoin volatile but enough to lure retail folks in right at the worst possible times.

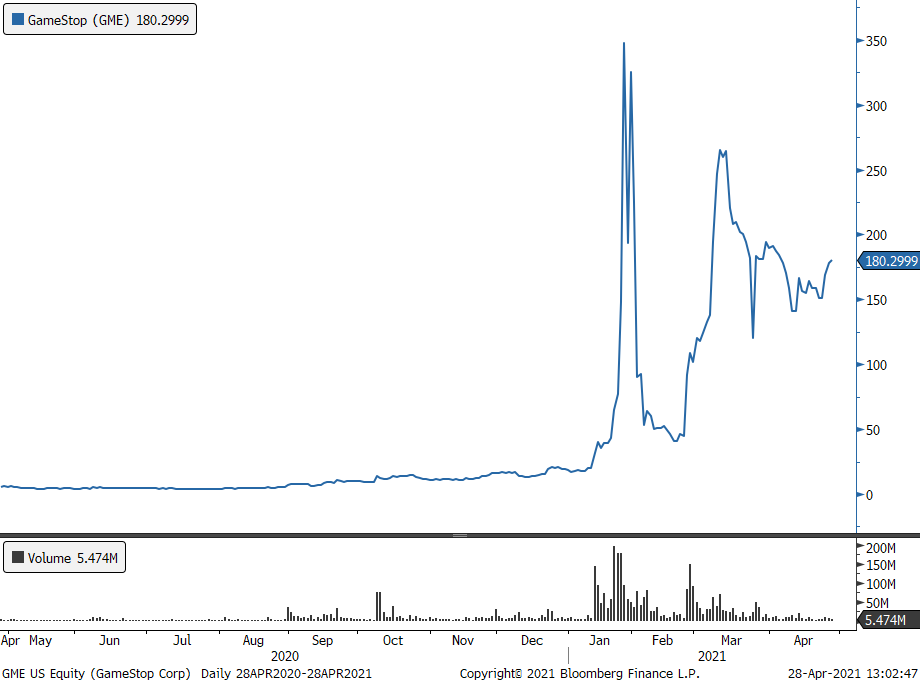

This is far from an isolated example. In fact, it’s representative of what happens over and over with hot investments and, particularly, those that garner extreme media coverage. If you want another much more recent example, consider what happened with stocks like GameStop earlier this year due to all the hype from the Reddit/Robinhood crowd, not to mention the egging on by billionaires like Elon Musk and Mark Cuban. Please check out these charts showing both its market price and volume. You can see that most of the trading activity occurred when the price was doing a moonshot.

Source: Bloomberg, Evergreen Gavekal

Consequently, a critical question to ask is how many regular Janes and Joes will hang in there if BTC drops 50% again, much less 80%. Maybe you are one of the precious few who will hang on through that kind of decline in pursuit of the eventual hoped for $1 million per coin. But I’m certain you will be among the minority.

Accordingly, the best advice I can give to those who just can’t stand to stay on the sidelines any longer is to buy a small amount, like 1% or 2% of your investable assets, and be prepared to dollar-cost-average in should your $10,000 punt shrivel to $5,000. If it goes to $1 million, you’ll make $200,000 (of course, those future dollars might only be worth $10,000 in today’s purchasing power but it’s a lot better than owning a US treasury bond during a time of Modern Monetary Madness).

And, if you’re already in and sitting on monster gains, don’t forget that dollar-cost-averaging approach to taking profits. Oh, and by the way, also don’t overlook that the leading central banks of the world are creating digital currencies of their own, with the Chinese once again in the lead. Something tells me they’re going to do all they can to give themselves a massive competitive advantage, including--maybe especially--against Bitcoin.

David Hay

Chief Investment Officer

To contact Dave, email:

dhay@evergreengavekal.com

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.