Estate planning is never a “set it and forget it” exercise, as laws continue to evolve at both the federal and state level. 2025 has brought meaningful updates that could impact Washington families, particularly those with larger estates. Thoughtful planning can help reduce estate tax liability and ensure assets pass smoothly to the next generation.

Federal Tax Exemption Update

The 2017 Tax Cuts and Jobs Act (TCJA) temporarily doubled the federal estate and gift tax exemption, from $5.49 million to over $11 million per person. The current exemption is $13.99 million per person in 2025, or nearly $28 million for a married couple. Originally, this higher exemption was set to expire at the end of 2025, cutting the limit roughly in half. [1]However, Congress passed the OBBBA legislation, which instead raised the federal estate tax and lifetime gift exemption to $15 million per person ($30 million per couple) starting in 2026, with future inflation adjustments. This means fewer individuals and families will face federal estate taxes, but those above the exemption still need to plan carefully to avoid the maximum estate tax rate of 40%.

Washington State Tax Exemption Update

Even if families are exempt from federal taxes, many may exceed Washington’s state estate tax exemption. Effective July 1, 2025, Washington’s estate tax exemption increased from $2.193 million to $3 million per person.

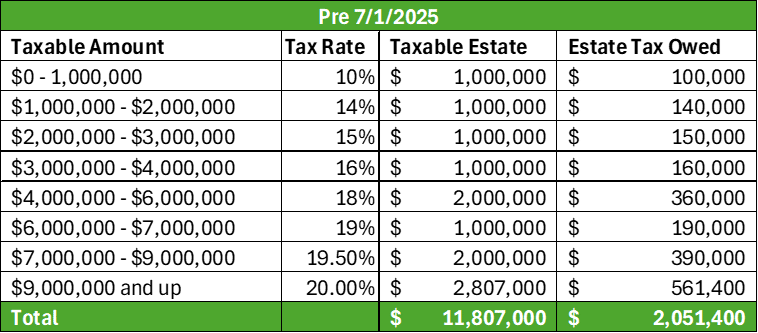

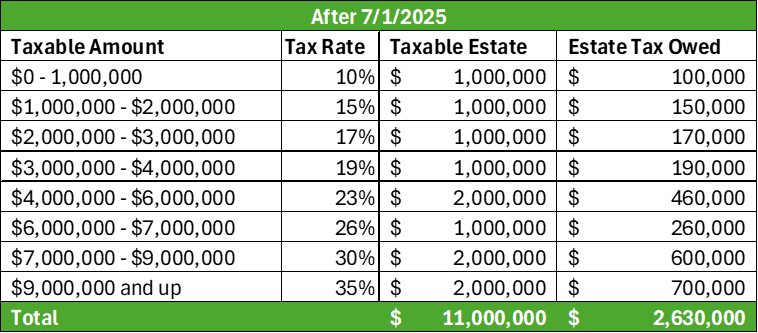

At the same time, estate tax rates are rising—the top rate jumped from 20% to 35%. Individuals with estates above $3 million and families above $6 million will need to implement thoughtful planning to account for higher tax rates.[2]

To illustrate how these changes will impact Washington residents, consider the following examples:

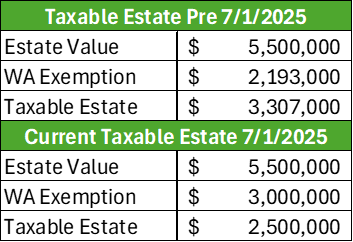

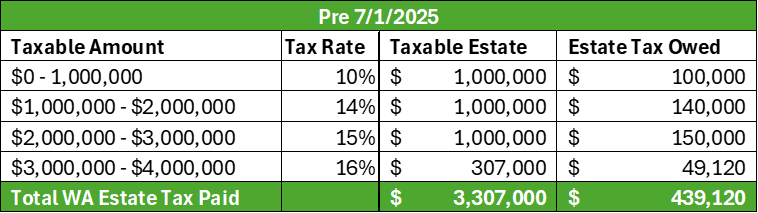

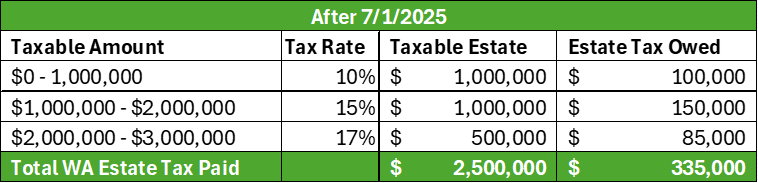

Example #1 - $5.5 Million Estate

For an individual with an estate of $5.5 million, the higher exemption reduces their taxable estate from $3.307 million to $2.5 million. Their effective estate tax bracket is similar, 13.28% under the old rules v. 13.40% with the current rules. Since their taxable estate is lower, they will owe slightly less tax under the new rules, $335,000 v. $439,120.

*This is shown for illustrative purposes for Washington state estates. Actual tax rates and tax owed are subject to change.

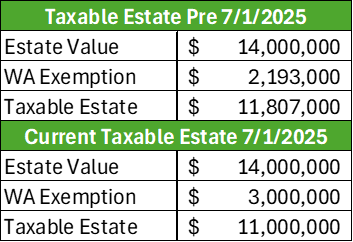

Example #2 - $14 Million Estate

Even with the higher estate exemption, with the higher tax rates those with large estates will pay significantly more under the new rules. For an individual with a $14 million estate, their effective estate tax rate jumps from 17% to 24%, resulting in an additional $578,60 of tax owed.

*This is shown for illustrative purposes for Washington state estates. Actual tax rates and tax owed are subject to change.

Key Planning Opportunities

There are a variety of techniques to help reduce taxable estates and pay necessary taxes. Often a combination of tools is necessary to fit everyone’s needs while satisfying legacy goals. The following can be implemented to plan at both the state and federal level.

Learn more about the pros and cons of those techniques in a previous blog post here.

Advanced Trust Strategies - These options can reduce your taxable estate while helping to achieve income and liquidity goals.

The Bottom Line

For Washington residents, estates above $3 million ($6 million for couples) may be subject to significant state-level estate taxes even if they avoid federal estate tax. A proactive plan that blends trusts, lifetime gifting, charitable strategies, and proper use of exemptions can minimize taxes and maximize the legacy you pass on.

Because the rules are complex and continue to evolve, now is the time to review your estate plan with your financial planner and estate attorney to ensure it aligns with the 2025 changes. Our planning team has tools that allow you to visualize how your estate would be impacted under the new law changes, so reach out to your wealth consultant to learn more. If you are not a current client, take our client compatibility survey to learn more.

[1] https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax

[2] https://dor.wa.gov/taxes-rates/other-taxes/estate-tax-tables#Wprior

DISCLOSURE: Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.

The information provided is general in nature and should not be considered legal or tax advice. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. The items included in this publication are our opinion as of the date of this piece, not all encompassing, and are subject to change without notice. Any tax or legal advice contained in this communication is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.