“A leader does not deserve the name unless he is willing to occasionally stand alone.”

-Henry Kissinger

“Deep doubts, deep wisdom; small doubts, little wisdom.”

-Chinese proverb

POINTS TO PONDER

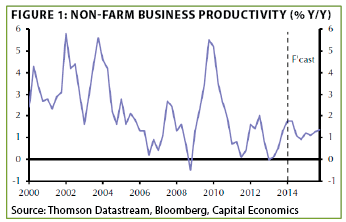

1. Last week’s EVA made the case that US productivity growth has slowed dramatically since the new millennium began. The following chart makes that clear outside of the fleeting surges after the conclusions of the past two recessions. (See Figure 1)

2. Total bank credit granted to consumers and businesses recently leaped at a 12% annual rate, in what could be the long-awaited turn in money velocity. Commercial and industrial loans went vertical—up at a 42% annualized rate—from mid-February to mid-March. At this point, however, it remains to be seen if this shift is related to weather-induced inventory factors, or is more sustainable and meaningful.

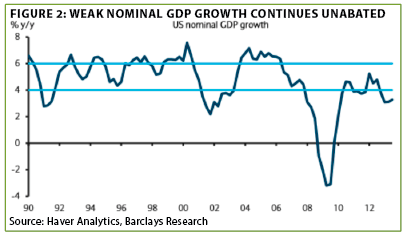

3. Despite high hopes for the mature and structurally slower growing US economy to catalyze a faster global expansion, nominal GDP remains exceptionally subdued. The fact that America’s GDP growth clip has been running at roughly half of its historic rate likely reflects a combination of demographics, misguided government policies, and two asset bubble implosions in tech and housing (partially as a result of the second factor). (See Figure 2)

4. Earnings expectations were muted going into the first quarter. Even so, the S&P 500 looks poised to undershoot the low bar of a 4% profits increase. According to data giant Factset, overall Q1 earnings are now estimated to actually decline, albeit slightly.

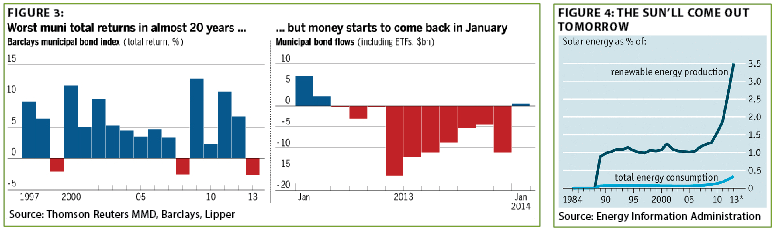

5. Municipal bonds logged one of their best quarters of performance in the opening months of 2014, producing a stock market beating return of 3.6%. This once again underscores the wisdom of buying when the mutual fund herd is fleeing, as they did in last year’s second half, when munis suffered their worst returns in nearly 20 years. Predictably, this triggered strong outflows, even as tax-free yields rose above those from taxable government bonds. (See Figure 3 below, left)

6. An EVA forecast from back in 2008 was that solar power production was entering a radiant era of rapid growth. Despite some serious growing pains, solar energy is gaining significant market share, partially as a result of the collapse in panel prices, which has materially narrowed the cost gap with traditional power sources. (See Figure 4 above, right)

7. The Canadian dollar has tumbled to a level that should meaningfully aid exports (around 90 cents to the greenback). Additionally, its economy grew at a better than expected 2.9% in 2013’s fourth quarter and would likely have expanded around 3.5% barring weather disruptions. Canada’s Department of Finance is projecting the loonie to trade at 93% of America’s currency this year and 95% in 2015, implying solid total returns for US investors buying Canadian debt.

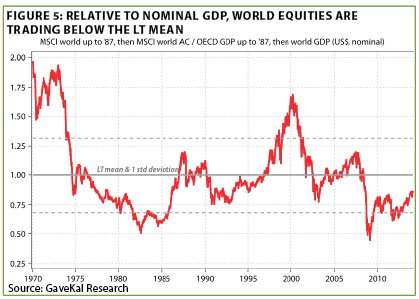

8. While the US stock market looks very expensive relative to GDP, globally the opposite is true (despite the elevating influence of US share prices). (See Figure 5)

9. A conundrum of the Chinese stock market is that while its largely fossilized state-owned enterprises (SOEs) mostly trade at single digit P/E ratios, truly private sector companies are trading at valuations even higher than comparable firms in the US.

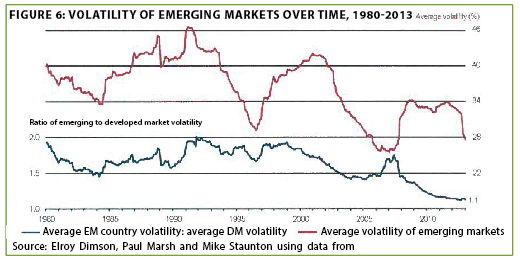

10. Emerging markets haven’t had much going in their favor until recently, when they’ve bounced somewhat. Yet, one positive longer-term trend is their declining volatility, which has nearly converged with that of developed markets. (See Figure 6 below)

THE EVERGREEN EXCHANGE

By Jeff Eulberg, David Hay, and Tyler Hay

Some things never change. As I embark on my ninth year at Evergreen GaveKal, I’ve learned over the better part of a decade that some events will happen every year without fail. For instance, I know every February and March I’ll spend a decent amount of time justifying the benefits of master limited partnerships (MLPs) to our clients and their certified public accountants (CPAs). And since MLPs have historically been one of the best performing asset classes for our clients, this is a rather vexing exercise. However, as many of our clients know, MLPs require a K-1 filing, on top of the tedious nature of taxes, and I fully understand the added annoyance of this extra step. That being said, I’d like to preempt next year’s annual defense of MLPs. Simply put, I’ll make a case why we remain bullish on these investments, despite the added tax-related frustrations they carry.

A quick background check. The MLP concept grew rapidly in the late 90s after Kinder Morgan founder, Richard Kinder, bought pipeline assets of the former Enron Corporation for $40 million, creating a business now worth more than $30 billion. By law, these partnerships are allowed to operate free of corporate tax because 90% of their income comes from energy production and related activities. This highlights one of the biggest differences between partnerships and corporations: Partnerships are exempt from paying tax at the corporate level. Similar to real estate investment trusts (REITs), most of the partnership’s net income must be distributed to the unit holders of the MLP. Traditionally, these entities invested in oil and natural gas pipelines throughout the US. But recently, some of the newer MLPs have expanded these investments to include exploration, production, and even refining. (It’s worth noting, these entities have a structure that includes a general partner who receives a portion, often significant, of the overall distributions. That’s a more complex conversation that’s not germane to the intent of this newsletter, so we’ll tackle that subject another time.)

Yearning for yield. So, now that we’ve quickly outlined what an MLP is and how it differs from the typical large corporations we are used to, why should we invest in them? Well, let’s start with some hard data. Since 2000, the MLP index (often referred to as the Alerian index) has returned 17.1% per year. As a reference point, the S&P 500 has returned 4.7% in that time period, with the Barclays Bond index a little better at 5.3%. As you can see, the MLP space has significantly outperformed the more traditional, and much more ballyhooed, stock and bond indexes.

As the US enters its sixth year under a zero interest rate policy (ZIRP), finding reliable cash flow these days can feel like searching for Sasquatch. The days where savers could buy quality fixed income and receive healthy yields above inflation are a distant memory. And, due to the aforementioned partnership structure, MLPs provide just that. The MLP universe currently yields around 5.5%, a healthy 3.5% above current inflation expectations. Not to mention, of the annual income that is received, only a portion of it is taxed at ordinary income levels. Some of the annual income is actually return of capital and, thus, lowers the cost basis, but avoids annual taxation. This unique aspect gives the unit holder the ability to control when the taxable event will occur.

On top of the attractive yields, this industry has tremendous tailwinds behind it. By now, almost everyone is aware of the American energy revolution taking place. The introduction of shale-fracking technology has opened a new door for exploration and production (E&P) companies. Namely, they can now access vast amounts of oil and gas, once thought to be trapped in underground rocks. One of the biggest issues now facing the industry is the transportation of the resources. Existing pipelines can’t handle the volumes being extracted from many of the rural areas, stranding large supplies of these valuable fossil fuels. As a result, you’re able to invest in an industry that pays solid annual cash flow with the potential to increase those distributions as efforts are made to rescue this glut of supply.

So what’s the catch? As you can see, MLPs obviously have an attractive story, and past performance has been quite strong. So what are the negatives? As discussed earlier, the biggest frustration is that K-1s are often sent out rather late in the tax filing season. So, if you’re the early bird when it comes to submitting your taxes every year, you’re probably cringing right now. And, you’re not the only ones. Late K-1s that trickle in between February and March often cause CPAs to hit the panic button. Unfortunately, we’re quite familiar with this backlash, as we’ve felt the wrath of CPAs expressing their “distaste” for this asset class. In fact, some have emphatically made their point by charging high fees to file each individual K-1. I surveyed several of the largest accounting firms in our area, and most don’t charge individually for K-1s. Still, they admit it takes about one to two hours of extra legwork for ten to fifteen K-1s to be filed. Some do charge for each individual K-1, but anything over $50-$75 per K-1 seems unjustifiable, in our opinion.

There are even some rather investment-savvy CPAs who will point out investment vehicles that gain MLP exposure without receiving a K-1. Unfortunately, most of these investments are mutual funds, exchanged traded funds, or exchange traded notes that charge other fees for the management of these entities. For some clients, we do choose this route, but usually we prefer to invest in individual MLPs that represent the quality characteristics we are looking for.

Some K-1 Novocain. Over the years we have discovered a few ways to make this process easier. Instead of waiting by the mailbox every day, there is a website that lists every K-1 for a given client (click here: K1support.com). Here, you can see when all of your K-1s are ready and can print them directly from the website. This provides you with one complete packet to give to your CPA. In fact, some CPAs we work with have just started printing the K1s off directly from the site, saving the client the hassle. This helps alleviate the CPAs’ frustrations about having to go back and update once a new K-1 has arrived. If you’re a current Evergreen GaveKal client, however, your client relationship manager is available to address any of these needs.

Finally, like any investment, we don’t think you should have a static allocation in MLPs. It’s true that, historically, we’ve definitely been major proponents of these investments. But, due to the current lack of yield in income investments, and the market’s belief that past returns will continue at the same rate, new investors are crowding the space and creating pockets of overvaluation. While our current allocation in MLP’s is lower than it’s been in the past, we’re anxious to get skin back in the game when valuations return to attractive levels. There are also some special situations currently that we are likely to purchase in the near future.

When making any investment, our team at Evergreen GaveKal is always looking at the net returns that our clients will receive. Thus, we consider not only the capital appreciation potential associated with a security’s yield, but also the underlying fees or taxes that come with any investment. Taking all these factors into account, plus a plethora of other considerations, we then prescribe what we think makes the most sense for the specific client. Over the last 14 years, all things considered, I’d be hard-pressed to find a better investment than MLPs. To that end, our team will be patient, keep a close eye on the MLP environment, and wait for the fundamentals to turn in our favor. Only time will tell whether or not MLPs will continue to outperform more popular segments of the market. But one thing’s for sure: It’s been a fabulous run for these pesky but lucrative investments and investors who stayed away from them because of K-1 concerns missed out on superb returns.

ABCs of ADV. In the cult-classic golf comedy, Caddyshack, Ty Webb (Chevy Chase) is a mysterious and talented golfer at the prestigious Bushwood Country Club. Judge Smails (played by the late Ted Knight), an overly competitive and rather pompous club president, is eager to assess Ty’s golfing prowess. In one scene, Smails asks Webb what score he shot that day. Webb responds by saying, “Oh, Judge, I don’t keep score.” A flustered Smails responds, “Then how do you measure yourself with other golfers?” The much taller Webb deadpans, “By height.”

In the investment business, the most common way registered investment advisors (or RIAs) measure their firm relative to others is by assets under management (AUM). It’s the number everyone wants to talk about. AUM is asked about before, in my opinion, more relevant qualifications, like client turnover, experience, investment methodology, fees, and even past regulatory actions, if any. Like it or not, clients, industry peers, and other interested parties have seemingly deemed it the ultimate qualification. So, I thought I’d take a little time to critique both its ubiquity and usefulness. In addition, I want to introduce you to a critical tool, which can help investors assess different wealth management firms.

The most frustrating obstacle with using AUM is that most people take it at face value. Well-respected magazines constantly publish firms ranked by AUM. There are two distinct components of AUM—discretionary and non-discretionary. Discretionary is the “piece of the pie” where clients have entrusted an advisor to make investment decisions on their behalf. Non-discretionary specifies the area where investment managers do not have the authority to make investment decisions without the client’s permission. In general, if you’re hiring a firm to manage your assets and make investment decisions on your behalf, the amount of non-discretionary assets they have is really quite meaningless.

Finding the breakdown of non-discretionary and discretionary assets managed by a firm is available online. RIAs, such as Evergreen GaveKal, are required to file a very transparent and revealing document. The finished product of this report is called the firm’s form ADV, as in “ADV”isor (clever, huh?). Interestingly, there is no equivalent document in the brokerage world. The ADV is a publicly available document that is meant to give investors a peak under the hood of each firm, it’s structure, and how it operates. (Click here to view the website.)

As some of you may know, I have the dubious honor of being both our firm’s CEO and CCO (Chief Compliance Officer). This means I have become intimately acquainted with the ADV’s contents. It can seem intimidating at first, but with a little effort the following information about a firm can be gleaned in just a few minutes:

-Number of employees

-Firm ownership changes

-Disciplinary information

-Conflicts of interest with clients

-Assets under management (discretionary and non-discretionary)

-Number of accounts and clients

-General investment services

While this may seem like highly topical and fairly mundane information, it can be rather telling. I reviewed some of the firms listed in Seattle’s Puget Sound Business Journal with over $1 billion in AUM, revealing what should be at least of some interest to prospective investors. For example, one firm has discretionary authority on just 40% of the assets it “manages.” Another firm has a total of three employees running the entire firm! If only I could figure out how to run Evergreen GaveKal with such efficiency! Two firms with significantly more than $1 billion have experienced major ownership restructuring. Other prestigious RIAs have only a few concentrated clients constituting the majority of their assets under management. Lastly, a large RIA in the area bought another financial services firm, which it disclosed as an apparent conflict of interest.

Using the ADV as a starting point for examining a firm is a prudent step but the reality is that regardless of how many disclosures we are forced to file, no amount of documentation can deliver total transparency. A local Ponzi scheme that cost some well-known local firms’ clients millions of dollars can’t be found on their ADVs. I’m not condemning anyone, but simply pointing out that there are some limits to what the ADV discloses.

Finding an investment firm can be an arduous and intimidating task. The digital age has made it easier to research firms such as Evergreen GaveKal. If you’re considering a wealth manager I’d encourage you to analyze the firm’s ADV or take it to someone who can review it for you. If a financial advisor isn’t required to file an ADV, as is the case for brokers, the ADV provides a framework for asking appropriate questions regarding their business. Our industry has lost investors countless dollars hiding behind complex terms and pages of fine print. The ADV is progress for investors. Let’s hope that Wall Street won’t always be “suits” in tall buildings speaking a language you’re not sure they really want you to understand. Ronald Reagan, when talking about Russia during the cold war, said “trust but verify,” and the ADV is a key tool for investors to do the same.

![]()

Forever bullish. It is my suspicion that most clients are unaware of how much pressure there is on financial advisers to maintain a perpetually sunny outlook on the stock market. This is particularly true within large brokerage firms, but it is not limited to Wall Street’s “Fairy Tale Factories.”

A case in point was a recent email exchange I had with a friend who works for a very high-quality financial organization, an entity that operates with a much more client-first and fiduciary mindset than most of their larger competitors. (I should emphasize that there are many outstanding investment professionals who toil for “sell-side” firms; senior management, however, is all too frequently another story.)

My young friend (at least I think he’s young but, at my age, that’s becoming true of anyone under 50) has done an admirable job of riding the bull market for the last five years. When Evergreen GaveKal became cautious back in early 2012, he remained steadfastly—and correctly—bullish. Even more commendably, unlike those who don’t believe in “timing the market,” and hence almost never shift their clients into a more defensive posture, he has recently become increasingly uneasy with the prevailing cavalier attitude toward risk in both stocks and bonds (until this week, that is).

He also publishes a nifty weekly newsletter that I’m fortunate enough to receive. Lately, he’s authored some extremely mild cautionary comments about frothiness in certain market segments. Yet, despite his tactfulness, he’s been criticized for even hinting markets might be overcooked on the upside.

As we’ve noted before in these pages, being cautious is bad for business and being bearish is usually committing career suicide, unless your timing is exquisite. The powers that be on “The Street” have little tolerance for anyone who might inhibit trading volumes, which, in turn, could impact the typically outlandish bonuses paid to the financial industry’s elite. As one of these grandees remarked back in 2007, when we were among those warning of the looming demise of the sub-prime mortgage scam, “As long as the music is playing, we’ll keep dancing.” It wasn’t long before he faced the music of being unceremoniously relieved of his command but, no worries—by then he’d already pocketed tens of millions in bonuses and stock options.

There is no doubt in my mind that if the Evergreen GaveKal investment team was employed, God forbid, by a brokerage behemoth, we would be prohibited from publishing most of our comments (some of you are probably thinking that might be a good thing). Presumably, that would particularly be the case when we are in the bubble-warning mode, as we were in 2007 and are once again. (In my earlier life as a portfolio manager at a major wire-house, I also issued warnings about the tech bubble, and vividly recall the battles with internal compliance over trying to put anything meaningful in writing.)

It’s also my belief that many EVA readers suspect that, in contrast to my young friend, I’m perpetually skeptical about the US stock market. While there is no question that as prices have continued to rise, and all of the items on our punch list with proven records are indicating underwhelming future returns, my team and I have become increasingly worried, even—gasp—bearish.

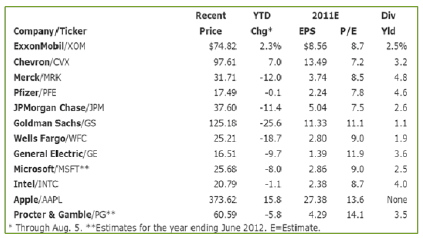

Moreover, given that it’s going on three years since the stock market offered decent value (again using an array of metrics that have proven out in the long run), I thought it might be beneficial to remind EVA readers of what we were saying back in the summer of 2011. For those of you with protective amnesia, that was a time when near panic conditions existed. Here’s what I wrote in the August 12, 2011 EVA:

Last call for yield? Over the last few weeks, the collateral damage from the eurozone, combined with the constant downgrades of economic growth in the US, has destroyed investor confidence, causing a stock sell-off of extraordinary intensity.

This has left most large cap US stocks at stunningly cheap prices. For example, the Nasdaq 100 (the biggest issues in that index)

are now trading at around 13 times this year’s projected earnings. Eleven years ago—admittedly in the mother of all bubbles

Nasdaq 100 also stood for its P/E ratio because it was trading at that earnings multiple or even higher!

When reviewing the valuations of a more diverse collection of blue chips, what is striking is how many are selling below 10 times earnings and often with dividend yields that are far above the paltry 2.2% return on 10-year Treasury notes. There is much we don’t know right now, such as whether a major euro institution or country will fail, whether US stocks will avoid an actual bear market then rally as they did last year, and whether we will have a follow-on recession. (It continues to be our view, though with reduced confidence, that we will avoid the dreaded double-dip; the fact that consumer spending is holding up, and jobless claims are at a four-month low would indicate we’re not totally in la la land.) Yes, there are acute problems that are going to take years to resolve. For sure, we are still very much in the “Age of Deleveraging.” Unquestionably, it’s looking more and more like we are going through a “Japan-lite” period of sluggish growth and collapsed interest rates.

However, all of these are reasons why there will continue to be tremendous value in securities that can reliably produce cash flow in the 7% to 8% range. Once the worst of this latest panic passes, investors will be facing the harsh reality of how to possibly earn a livable return at a time when interest rates are likely to stay below miserly.

It’s not often you get second chances in the investment world, but for those who are willing to buy into the selling tsunami, it’s

a chance to bring back the yield opportunities of 2007, if not 2008.

In many cases, this elite cadre of companies was trading at single digit P/E ratios. Their stocks were also yielding more than the 10-year Treasury. It’s remarkable to look back at how much most of them have risen since those high-anxiety days. Fortunately, we owned most of the names for our clients on this list above, and, in fact, still do.

Now, that’s my idea of investing with the odds in our favor! Trust us, those days are coming again, maybe sooner than you think.

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Evergreen Capital Management LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.