“Bitcoin is what it is, something that enough people have agreed upon is an investable asset. But a banana has more utility; potassium, is a valuable nutrient to every person on the planet.”

– Mark Cuban

“Regardless of the dollar price involved, one ounce of gold would purchase a good-quality man’s suit at the conclusion of the Revolutionary War, the Civil War, the presidency of Franklin Roosevelt, and today.”

– Peter A. Burshre

______________________________________________________________________________________________________

One of the early stories of 2021 has been the rapid ascent of bitcoin into the mainstream. Most notably, Tesla reported that it had purchased $1.5 billion worth of the cryptocurrency in January, with plans to accept it as a form of payment in the not-too-distant future. The move came several months after Square, a technology payments company, reported that it had purchased $50 million worth of bitcoin, representing ~1% of the company’s assets. Over the past few days, another established company joined the fray, as Mastercard announced that it will begin facilitating cryptocurrency transactions in 2021. As a result, bitcoin hit a fresh all-time high this week, ascending past $55,000 per coin and to a mind-blowing market cap of $1 trillion.

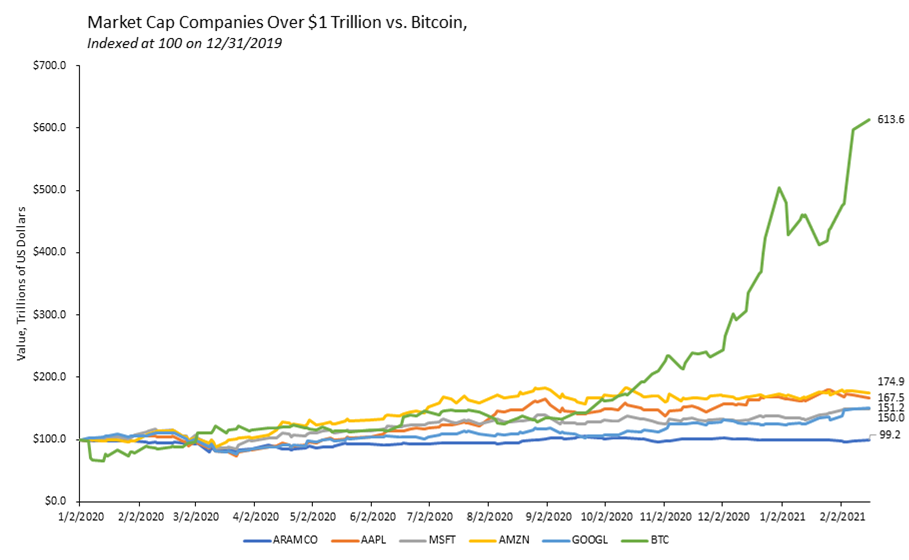

To put that number into context, only five companies globally – Apple, Microsoft, Amazon, Alphabet, and Saudi Aramco – are valued above the $1 trillion mark. Even more astounding is how drastically bitcoin has outperformed these high-flying mega caps since the start of 2020.

Source: Bloomberg, Evergreen Gavekal

This week we are presenting a month-old, but very pertinent, piece from Gavekal’s Will Denyer about whether investors should place a higher premium on bitcoin, gold, or fiat currencies. When Will wrote the article in January, the price of bitcoin had already made a vertical ascent worthy of Musk’s SpaceX Falcon 9 rocket to nearly $40,000 per coin. Some of the catalysts mentioned above have pushed the coin even higher over the last month, which begs the question: when – if ever – will the epic rally run out of steam?

Some bitcoin enthusiasts will tell you that this is just the beginning and that the coin will eventually be worth many multiples of where it is trading today. In November, a Citibank executive said the cryptocurrency would pass $300,000 and, one month later, Guggenheim's Scott Minerd stated it should be worth $400,000. If they’re right, the coin would be valued between $6-$8 trillion, putting it on par with the entire global fiat money supply.

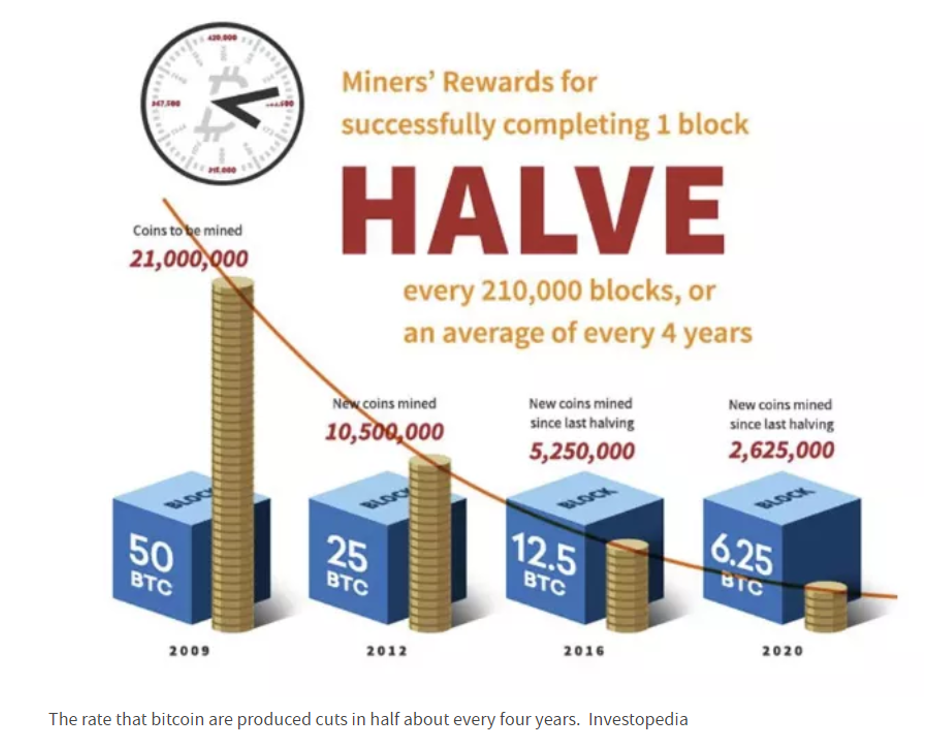

While we see this as an unlikely reality, one point we’ll make that many people miss when constructing a viewpoint on the cryptocurrency is that the supply of bitcoin is scarce. In other words, there are roughly 18.5 million bitcoin that have been “mined” to-date and will be a maximum of 21 million bitcoin in circulation once the coin is fully “mined.” Due to a phenomenon known as “halving,” newly minted coins take longer and longer to mine over time, which means it will take several more decades until all 21 million coins are in circulation.

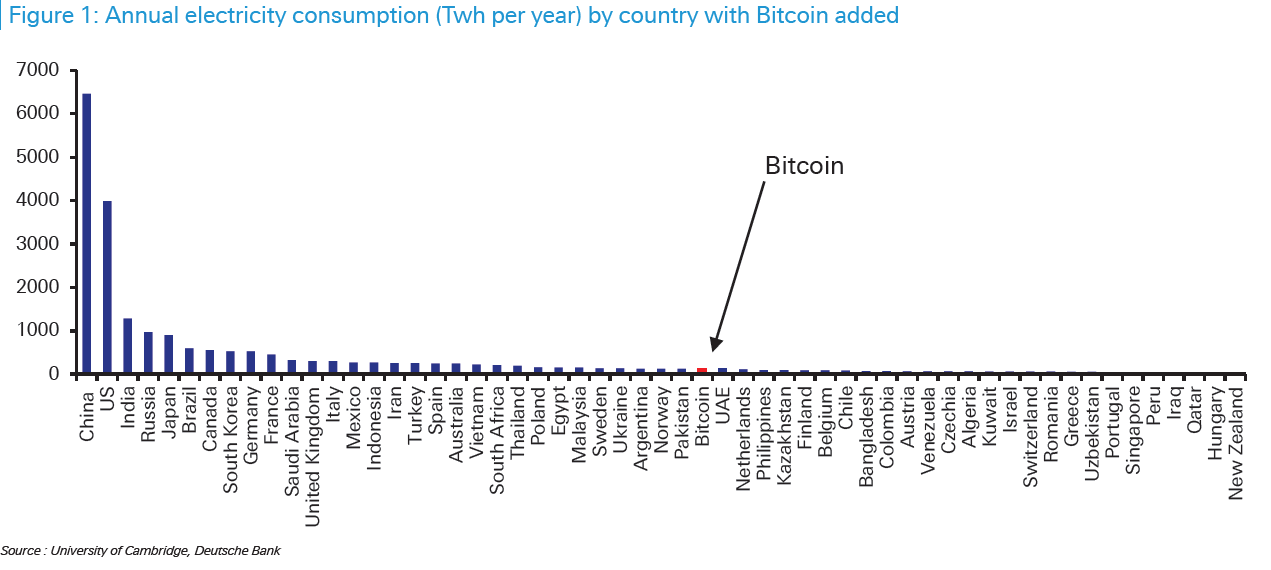

Another critical point is how much energy mining bitcoin already requires and the increased computing power that will be necessary as every subsequent BTC becomes more difficult to mine. University of Cambridge researchers found that cryptocurrency "mining" for Bitcoin — which uses heavy computer calculations to verify transactions — consumes around 121.36 terawatt-hours (TWh) per year currently. This places Bitcoin’s electricity consumption above several large countries, including the Netherlands (108.8 TWh) and the United Arab Emirates (113.20 TWh). But it’s not just bitcoin… Mining other cryptocurrencies is energy intensive too, and most don’t have the “hard-cap” that BTC has.

As any good macroeconomic professor will teach you, the unit price for a particular good, or financial asset, will vary until it settles at a point where the quantity demanded equals the quantity supplied.

Since the supply of bitcoin is constrained, and demand for the asset has extended beyond retail investors (and criminals) to institutions and corporations, it is plausible that the asset continues to rise over time – especially as investors weigh it against fiat currencies which can be printed infinitely.

However, the cryptocurrency has proven to be very unstable and has had a tendency to go from boom to bust in a matter of minutes, failing to provide investors with a reliable store of value. Additionally, when comparing the meteoric rise of bitcoin to the money supply of the world’s largest economies, it’s shocking that the cryptocurrency is now only trailing the United States and China in terms of total value. These points underscore the notion that, although bitcoin has its merits, the spectacular rise is yet another example of misallocated capital (see When YOLO Meets FOMO) deployed by euphoric buyers that have been blinded from any and all risks associated with the speculative asset.

Source: Money supply report | Bitgur

“Money is the bubble that never pops”, says angel investor and bitcoin enthusiast, Naval Ravikant. If a “bubble” is defined as a self-reinforcing belief that an asset will retain market value that far exceeds its expected usefulness in consumption, production or generating income, then this is the right way to think about money—and as it rallies to new highs, the right way to think about bitcoin. If the world’s favorite cryptocurrency keeps gaining acceptance as a medium of exchange, its usefulness and value will continue to rise. If not, the bubble will pop.

Governments and central banks around the world are certainly giving users of fiat money reason to consider alternative mediums of exchange and stores of value. It is no coincidence that bitcoin broke above its 2017 peak late last year after the Federal Reserve promised to keep interest rates near zero and its printing presses running, while the US Congress penned a US$900bn stimulus package—which nowadays qualifies as a “skinny” deal. Regulated entities excepted, holding money that a central bank is explicitly trying to devalue, while lending money to a highly indebted government at negative real yields is not for everyone.

Add official incontinence, negative real yields, exciting new tech and a fear of missing out, and there are the makings of a good rally. But are there the makings of a good money? Put another way, can bitcoin become a generally accepted medium of exchange in enough of the global economy? Because if it cannot, it is not clear what use it offers and what value it can store. I asked similar questions just before bitcoin peaked in late 2017. It promptly lost -80% of its value and has only recently recovered.

While volatility remains an issue, bitcoin has gained corporate followers like Nasdaq-listed intelligence company MicroStrategy, which last year invested a chunk of its treasury funds in the cryptocurrency. With every year that it survives and gains users, bitcoin is more likely to succeed due to network effects (more users make it more useful) and the lindy effect (the longer a nonperishable thing survives the longer it should persist). A more fundamental way to gauge how likely bitcoin is to make this jump is to assess how it stacks up against gold and fiat currencies on the basis of money’s core functionality; being a medium of exchange, a unit of account and a store of value.

Three types of goods

There are three types of economic goods valued by the market, as pointed out by German economist Karl Knies in the 19th century, and elaborated on by Ludwig von Mises in the 20th:

All goods fit into one or more of these categories even if our financially-minded clients might wonder about claims on one, or more, types of economic goods listed above (a bond or derivative contract is a claim on future money; an equity is a claim on production goods; frequent-flyer miles are claims on consumption goods; a bet at the races is a claim on future money, if your horse wins).

A few goods have been used for all three purposes. Gold, for example can be consumed (jewelry), is used in production (electronics) and has previously served as money, and some speculate it will do so again.

Fiat currencies and bitcoin, however, can only serve as a medium of exchange; they cannot be consumed and do not produce anything. This is not necessarily a problem, but unlike gold, silver, land, oil, or fine art, the value of both bitcoin and fiat money is entirely derived from its use, or potential use, as a medium of exchange. If bitcoin doesn’t have that functionality, it cannot be a store of value, as it will not have any value to store.

An uphill battle to become money

Money is the ultimate popularity contest, with powerful network effects. Carl Menger, founder of the Austrian school, argued in 1892 that the “most saleable” (most marketable or liquid) goods have the best shot at becoming money. And as consensus builds around this outcome, a medium’s marketability is enhanced, creating a reinforcing network effect that will tend to ensure its ultimate dominance over rivals. As von Mises put it: “There would be an inevitable tendency for the less marketable of the series of goods used as a medium of exchange to be one by one rejected until at last only a single commodity remained, which was universally employed as a medium of exchange; in a word, money.”

The reason the world has not settled on one money is that governments have carved up the global economy into multiple currency zones, forcing inhabitants of each zone to use a designated fiat currency. In Germany, some residents may trade US dollars, bitcoin or gold, but they all have to use euros, simply to pay taxes. This gives the euro a big advantage in the popularity contest to become German money, and is why one will struggle to pay for a coffee in Berlin with bitcoin, gold or even US dollars. This means that bitcoin, like gold, faces an uphill battle to become money. While many celebrate bitcoin’s advantage of being beyond the reach of any government, this comes with the disadvantage of not being able to insist that people use bitcoins. Rightly or wrongly, there are good reasons why the most popular mediums of exchange by a wide margin are fiat currencies.

It is possible that a government so mismanages its currency that confidence is blown and users are driven toward alternatives. But even then, history shows that governments can restore trust and reimpose a revised version of their fiat money. In Germany, the hyper-inflated “paper” mark was replaced in 1923 by the rentenmark, then the reichsmark, and eventually the euro. Fiat currencies are still accepted in Germany, Argentina and Vietnam, despite past transgressions.

It is conceivable that bitcoin, or gold, might carve out a niche that transcends national boundaries. Bitcoin could become a generally-accepted medium of exchange for transactions done online or across borders. It may develop as the go-to money for criminals, or for those trying to evade capital controls. Yet it still has to be attractive enough as a medium of exchange in these areas to justify the hassle of using it over established fiat currencies and gold.

Still, let us assume that despite fiat currencies’ unfair advantage, these unusual times mean that an alternative medium of exchange has a shot at gaining wide acceptance. What attributes would it need? And how does bitcoin compare to fiat money (the incumbent) and gold (a fellow challenger) on each front?

Fungibility: Slight advantage to bitcoin and fiats; gold does well enough.

Legitimate bitcoins and fiat “dollars” are perfectly substitutable, or fungible. There are costs to ensuring legitimacy (borne by taxpayers in the case of fiat, and by users for bitcoin) but both systems effectively ensure that most monetary units circulating are legitimate and perfectly fungible. In contrast, gold pieces differ in weight and purity, at least minutely. That said, gold pieces are fairly easy to assay and many come with reputable stamps (a Canadian maple leaf or South African Krugerrand). In practice, assayed gold is “fungible enough”, if not as perfectly fungible as bitcoins or fiat money.

Divisibility: Slight advantage to bitcoin and fiats, with gold a runner-up.

Bitcoins and fiats can be divided infinitely, by just adding decimals. Gold can be cut and melted into various denominations but the process is cumbersome and in the extreme, people could be forced to trade absurdly small shards. Claims on gold can be more easily divided or merged, mitigating some hassle but focusing on the underlying good, the advantage goes to fiat and bitcoin.

Storage and transport: Advantage bitcoin, yet gold and fiat money are good enough for most

Bitcoins are everywhere and nowhere. They can be accessed from anywhere, yet they have no government protection. Unlike gold, a private bitcoin key is not going to trigger customs interest at a border crossing. In practice, private keys can be lost or stolen (an estimated 4mn bitcoins have already been permanently lost), and there is usually enough of a trail for a motivated government to follow. Still, bitcoin does seem to score relatively well on transportability, storability and even hide-ability.

Fiat money can be stored in a bank, but in developed markets these deposits now typically generate negative real yields (analogous to storage fees). And bank accounts are not accessible to many in emerging markets. Bank deposits are also not attractive to criminals or those dodging rules like capital controls—or to people who don’t trust their government. One can keep fiat money in cash but that means a real-terms erosion, assuming some inflation. Cash, used in big amounts, also presents storage and transport headaches.

Gold’s physical nature adds to its storage and transport costs. Its physical presence also exposes it to theft and official confiscation. To be sure, gold’s high value relative to its weight and size makes it easier to store and transport than most things, but it is still at a disadvantage to bitcoin and fiat.

Transaction costs: Advantage fiat.

If a country’s government wishes it, fiat money will always have an advantage. Even if an alternative medium of exchange offers lower transaction costs (a big if), governments could subsidize fiat transactions by running a clearing house at taxpayers’ expense.

Governments can also increase transaction costs on bitcoin by making its use illegal, perhaps justified on environmental grounds. That would add risks and potential costs for those who trade in defiance of the law.

It is also possible that governments get what they want without having to swing a big stick. While one can effectively travel anywhere with bitcoins, transferring ownership is costly and likely to get more so. Bitcoin “miners” add blocks to the chain, which record validated transactions on the ledger. They are rewarded for their efforts with new bitcoins (for now) plus transaction fees (paid by bitcoin senders and determined by a competitive marketplace). Yet for all the network’s embedded genius, the cost of validating new blocks on the chain must rise as the network’s market value rises. This is down to the potential reward of corrupting the system and stealing bitcoins rising in parallel. Thus, the cost from corrupting the system (e.g. in a so-called “sybil attack”) must also rise to keep such attacks uneconomical.

At present, miners are incentivized to defend the network as they are well rewarded with mining new coins (transaction fees are a nice bonus on top). Looking forward, however, new coin rewards halve every 210,000 blocks and will end completely when the 21 millionth bitcoin is mined around 2140.

Yet as mining rewards decline, the cost of validating the bitcoin network will continue to rise in line with its higher value. And since miners are profit seekers, transaction fees, as a share of the network value, must rise over time.

There are proposals to mitigate this problem, such as by adding more layers to the network (e.g. the Lightning network). But as I understand it, the nature of a decentralized system, with its required redundancies and protections against corruption makes it inherently costly to maintain. A centralized system like that on which fiat currencies operate will likely always be cheaper, and even if it isn’t, those costs can always be pushed on to taxpayers.

Gold ownership can be transferred cheaply to someone else using the same vault, but when it needs to be moved to another vault the costs go up.

Stable purchasing power: Fiat does best, followed by gold, with bitcoin lagging badly.

This ranking may surprise readers, since supply growth is limited for both bitcoin and gold, but not fiats. But consider also the variability of demand, and near-term price volatility (which is at least as important for the usefulness of a money as long-term value retention).

A well-managed fiat money will see its supply adjusted more or less with demand, thereby keeping its value fairly stable over the near to medium term. Most fiat managers today aim to inflate modestly—often at around 2% per year—which means the value will decline gradually over time. But if this inflation is reasonably stable and predictable, the fiat currency will likely be accepted as money. Economic actors can have a fairly good idea of what a US dollar acquired today will be able to buy tomorrow (which is ultimately where money derives its value). Demand is also supported by the governments’ ability to require tax payments in its chosen currency, and sometimes other methods of “encouragement”. Combine even half-decent supply management with artificially imposed demand, and the fiat currency is likely to be less volatile than potential challengers.

Gold comes in second on account of it having multiple sources of demand. As mentioned earlier, it has served as all three types of basic economic goods. Thus, someone buying gold today can expect to find three types of buyers tomorrow: consumers, producers, and investors. Demand from each type of buyer can vary, introducing price volatility that should exceed that of a decently managed fiat currency. But a diversity of potential buyers gives it an advantage over bitcoin.

When I last wrote about bitcoin, near the peak of 2017, I argued that (i) all of its value came from the chance to become a medium of exchange, (ii) it faced an “unfair disadvantage” to fiat currencies and (iii) suffered from the risk of “version hopping” to a new and better cryptocurrency. While bitcoin lost -80% of its value in the following year, it clearly did not die. The longer bitcoin sticks around and the more it extends its liquidity (or “saleability”) advantage over alternative cryptos, the better its chances of becoming money. And as a general fan of free markets and individual choice, I do hope it succeeds. But hopes and dreams aside, volatility is still a problem.

And with neither government-imposed demand nor non-monetary uses, the durability of bitcoin’s value will always be in question, and it could yet go to zero.

To conclude, fiat currencies have the upper hand in the popularity contest to be money. Multiple fiat currencies exist today because governments have artificially divided up the world and imposed their chosen token. Whether an alternative money can co-exist alongside fiats, without government support, is questionable. Gold has co-existed as a store of value, but like other commodities, land, and fine art, it is valued for uses other than as a medium of exchange. If it is to have value to store, there has to be a plausible case for Bitcoin becoming money. I am not yet convinced this is the case.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time