By: Louis Vincent-Gave

For all the growth in the Chinese economy over the past two decades, the returns on Chinese equities have been no better than pedestrian— demonstrating once again that the correlation between economic growth and stock market returns is a tenuous one, especially in emerging markets. However, every now and then the Chinese stock market goes on an absolute tear, delivering outstanding returns over a period that typically lasts 12 to 18 months. This is what we saw in 2006-07, in 2009, and again in 2014-15. Of course, the Chinese market can also deliver absolutely shocking returns. This happened in 2008, in the second half of 2015, the second half of 2018, and through 2021 and most of 2022.

Typically, the big bull runs followed periods when foreign investors either had failed to notice the growing importance of China in the global economic balance, as in 2006-07, or had convinced themselves that the Chinese economy was about to implode. Remember how in 2012-14, no macro conversation was complete without a discussion of the impending collapse of the Chinese real estate market and shadow banking system? And more often than not, the rollovers were triggered by Chinese policymakers, who deliberately stomped on the market to curb speculation by raising margin requirements, cracking down on big tech, or instituting tough lending restrictions on real estate. I rehash these points because in the last six weeks Chinese equities have been on a tear. And and in the first week of trading in 2023, they have left all other markets in the dust. This raises a few questions:

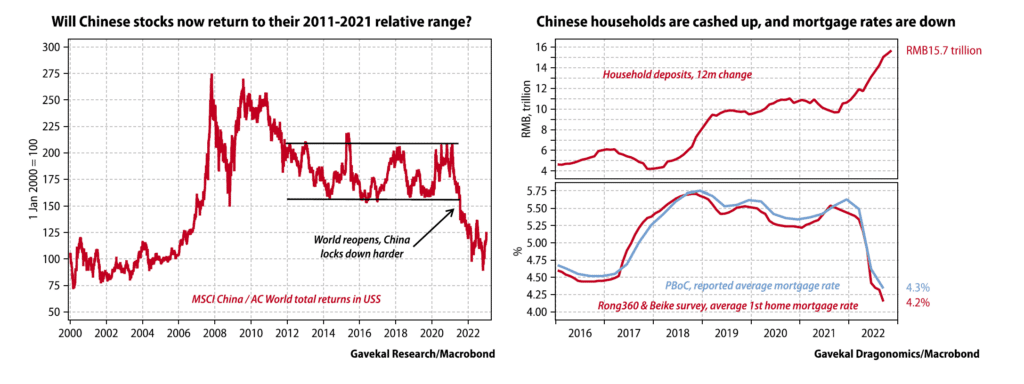

1. How far can the rally go? As the left-hand chart overleaf shows, Chinese stocks spent most of the 2011-21 decade broadly range-trading relative to global equities. Then, in 2021 the world reopened and China locked down harder, and Chinese equities fell out of bed in both absolute and relative terms. Now that China is reopening, is it too much of a stretch to think that China’s relative performance will return to the 2011-21 range? And if it is, what is it that will stop the Chinese equity market’s momentum?

2. Will it be foreigners that stop the momentum? Following the tech crackdown, the real estate consolidation, Xi Jinping’s power grab, the US semiconductor embargo and the fears over Taiwan, most investors spent last year convincing themselves that China had become “uninvestible.” As a result, the ability of foreigners to sell into today’s rally is almost nonexistent. Foreign investors can’t sell China if they don’t own China, and by now they do not own China in any meaningful volume. Today, the owners of Chinese equities are mostly the Chinese themselves.

3. Why does the predominance of Chinese investors matter? Chinese investors are first and foremost momentum investors. In speaking gigs, I sometimes describe a eureka moment I experienced in Macau. Standing around the roulette table with a group of friends celebrating a bachelor party, I saw that black had come up 10 times in a row. Figuring “red was due,” I duly put my chips on red. “Are you crazy?” my Chinese friends demanded. “You need to bet on black! Black is hot tonight.” In that moment, I understood there is an important cultural distinction between Europeans, whose investment instincts push them towards “return to the mean” trades, and Chinese, who are far more momentum driven. I highlight this because stocks are now going up. And they are going up at a time when Chinese households have never had so much cash in the bank. Finally, for good measure mortgage rates are at generational lows. This promises to be a potent combination for Chinese asset prices—unless the government decides to put an end to the party.

4. Will the Chinese government once again be a fun-sponge? Two months ago, few people believed that China would jettison its Covid restrictions as quickly as it did. This abrupt shift means that the disease is now running rampant, with all the accompanying stories of overflowing hospitals, bodies piling up in morgues, and crematoriums unable to cope. These stories may be exaggerated. But in all likelihood, China is going through the kind of excess mortality—largely among older people—that the West went through in the spring of 2020. If so, then the Chinese government has little choice but to try and make sure that the country’s reopening is a smashing economic success. Why? Because, a surge in deaths combined with a wet blanket of a recovery would be a bad look for an all-powerful Xi Jinping. Simply put, the recovery has to be good, if only to “justify” the mounting human toll. So cue a restructuring of local governments’ debt (as just seen in Guizhou), cuts in interest rates, and policy measures to boost the real estate market. All this means the Chinese government will be highly unlikely to apply the brakes on the unfolding rebound in Chinese asset prices over the coming months, and perhaps even over the coming quarters.

Against this favorable backdrop, the obvious concern is that foreign investors spent most of 2022 liquidating their Chinese exposure. It is therefore hard for foreign institutions now to turn around and say: “We were wrong last year. Let’s get back in at 35% higher.” And this is doubly true as a large part of the reason they liquidated their Chinese positions had to do with ESG concerns and the perceived geopolitical risks of China exposure.

So, will the lack of foreign money curtail the unfolding Chinese equity boom? It hasn’t so far, probably because—again—Chinese households have never before been this “cashed up” and interest rates have never been this low. In fact, the current set-up in China is not so different from the set-up in the US in June 2020: a reopening economy, cashed-up retail investors who feel wealthy in part thanks to record low interest rates, and an equity market with an accelerating positive momentum.

Should we really be surprised if the same causes produce the same effects?

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.