“If everyone is thinking alike, then somebody isn’t thinking.”

- George S. Patton Jr.

In this week’s Evergreen Exchange, we are introducing a new member of the Evergreen GaveKal team: Worth Wray. Worth is Evergreen’s Chief Economist, a contributing member of the investment team, and new EVA author. Previously, he served as Chief Strategist at Mauldin Economics, an online economic and investment research firm with over one million weekly readers (a firm with whom many of our EVA readers are most likely familiar). Worth’s e-book on China, “A Great Leap Forward?”, co-authored with John Mauldin, was a bestseller on Amazon, reaching as high as #1 on the Investment & International Economics lists and #4 on the overall Business list. We are pleased to have him on our team and hope our EVA followers are as excited as we are to read what he has to say.

THE EVERGREEN EXCHANGE

Tyler Hay, Worth Wray, Jeff Eulberg

Early scholars, dating back to Aristotle, believed in a geocentric model of the solar system, where the sun revolves around the earth. In 1543, Polish-born Nicholas Copernicus, who spent his life researching a heliocentric theory of the solar system, claimed the earth did in fact revolve around the sun. For fear of persecution, Copernicus kept this a secret until he was on his deathbed, where he finally revealed his momentous discovery. This new idea set a foundation for scientific understanding of the solar system. It also challenged almost 1500 years of conventional wisdom.

Conventional wisdom is pervasive in financial markets. It seems like there is a never-ending turnstile of “can’t miss” investment beliefs—they begin irrefutable and become inconceivable with the benefit of retrospect. This week, our Exchange authors will examine past forms of conventional wisdom that turned out to be false—or, at least, badly off-target. In addition, they will delve into a currently accepted belief that may likely be wrong further down the road.

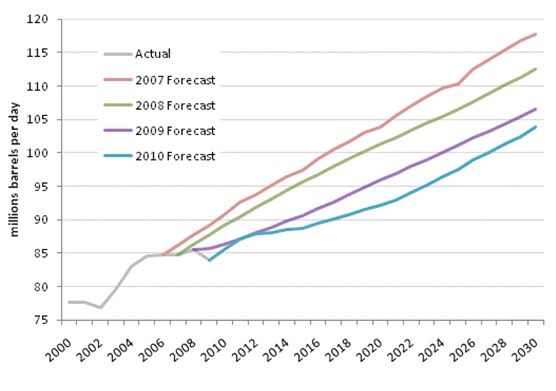

Crude Estimates. On September 7, 2008 oil was trading at $105/barrel. A day later, Barron’s ran an interview with Charlie Maxwell, who was the Senior Energy Analyst at Weeden & Co., titled: “What will $300-a-Barrel Oil Mean for You?” To be fair, he did say we’d have to wait until 2015 to see his prediction prove true. As of Friday July 31, 2015 oil is trading at roughly $47 per barrel, a miss of $253. Oops! While absurdly brash in the magnitude of his prediction, the direction was supported by the government’s US Energy Information Agency (EIA), which also saw prices going nowhere but northerly.

FIGURE 1: ACTUAL OIL PRICE IMPACT ON FORECASTS BY YEAR Source: US Energy Information Agency

Source: US Energy Information Agency

While you may find yourself chuckling at Mr. Maxwell’s slight miscalculation, he was not alone. Today, a debate as to what’s driving the massive decline in oil is raging. Some say it’s being driven by a lack of demand, signaling slow economic growth around the world. Others say it’s simply a matter of too much supply. Perhaps it’s both. But the purpose of revisiting the days of “peak oil” isn’t to analyze why it happened. Instead, I want to focus on just how embedded high oil prices had become into modern thinking.

At the time of peak oil, the government was subsidizing alternative energy companies because there was no relief in sight at the pump for consumers. Property owners began putting solar panels on their roofs and harnessing geothermal energy where Mother Nature allowed. Car companies and consumers became enamored with hybrids. Heck, Tesla (whose cars I love, by the way) and its $33 billion market cap might not be around at all if it wasn’t for the peak oil theory. It was all driven by the misguided belief that all of the oil in the world had been found and that demand would only increase.

Four years ago, if I would have told you that a terror group more destructive than Al Qaeda would emerge in the Middle East, and that Iran and Israel would move closer to conflict than peace, I doubt you would have predicted a 60% decline in oil prices. Clearly conventional wisdom was wrong. Gas prices at the pump came down and most people have gone back to leaving a big fat carbon footprint.

What happened? The markets adjusted to high prices. New technology became affordable that allowed previously untapped fields, particularly in the US and Canada, to start providing a massive influx of supply. Simultaneously, world demand seems to have flattened a bit. Once again, the old axiom “the cure for high prices is high prices” was validated.

Now that I’ve covered a past belief (and hindsight is showing it looks foolishly wrong), I’m going to shift toward a current one. Time will tell if my analysis is right, but I think the implications are critical to evaluating the investment landscape.

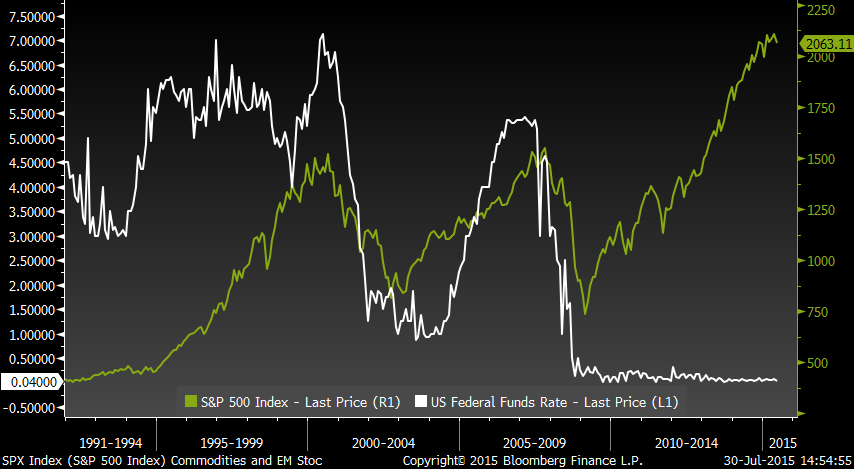

Even mild observers of financial markets are aware that the Federal Reserve has pursued a series of events meant to jumpstart the economy. One of their key tools has been to keep interest rates at an unprecedentedly low level for an equally unparalleled length of time. As we’ve written repeatedly, the consequences of this has been mixed at best for the US economy on the whole but massively beneficial for the stock market. The chart below shows the fed funds rate as well as the price chart of the S&P 500. Much has been written about what will happen when the Fed “takes away the punch bowl”—or when interest rates rise from zero. I think conventional wisdom is that if the Fed hikes enough it will likely serve as the pinprick that pops this market bubble. This logic could be true, but the keyword is “enough”.

FIGURE 2: FED FUNDS RATE VERSUS S&P 500 (AS OF 7/30/15) Source: Evergreen GaveKal, Bloomberg

Source: Evergreen GaveKal, Bloomberg

If history is any guide, rate-hiking cycles don’t usually send the market into a free-fall. Since 1982, there have been eight rate-hiking cycles, six of which by the end have seen the stock market higher. The average return from start to finish for the market has been 9.6%. Of the two declines one was insignificant with a market decline of 0.8%. In the early 1970’s, however, the markets dropped -24.8% as the Fed tried to corral inflation. If you like probabilities it seems that those people who want a reason to stay long the market have some modestly reassuring news when looking in retrospect. And, while I happen to believe that this isn’t likely to be the straw that breaks the camels back for the market, I do wonder if 9.6% more upside is worth sticking around to collect. Moreover, it’s what occurred after the Fed raised rates enough to slow the economy that is the big worry, as the next chart reveals.

FIGURE 3: S&P 500 PERFORMANCE DURING FEDERAL RESERVE TIGHTENING CYCLES

Note: Dates shown are the start of past Fed interest rate increasing cycles; bottom axis shows number of days of the tightening phase)

Source: Econometric Studios, Moody’s

While I continue to doubt the prevailing belief that the Fed itself will be the derailing force that breaks the market’s momentum, I do think there are some interesting factors at work. First, I’m not a fortuneteller but my guess is that this cycle doesn’t end with the fed funds rate anywhere near 12.6%, which has been the historical average finishing level. Second, most rate-hiking campaigns have started from a much higher level (5.9% average). Both suggest just how unusual of a position the Fed now finds itself. Lastly, and I’m being dead serious, this has to be the most anticipated rate hike in the history of mankind. During this wait-and-see period something unexpected happened. What occurred was a massive rally in the dollar versus most other major currencies. This effect, though unintended, may serve as a more drastic de facto rate increase. While some point to the oil decline as an offset to a stronger dollar, recent earnings seem to suggest the dollar is hurting more than oil is helping. Whether the Fed itself sees it this way as well could be evidenced by further postponing their intended rate hiking campaign into 2016.

It remains my belief (unlike Jeff Eulberg) that the Fed will in fact begin their tightening campaign. It will be designed as a steady climb of 25 basis points per quarter. This means we are looking at a few years before rates are normal. However, with the market at very lofty valuations by almost any metric, I find it hard to believe that we won’t see a serious decline from either weak economic data or some external shock in the not too distant future. When this happens, the Fed won’t have the necessary room to cut rates. That is when things will get interesting. The Fed will have to become even more creative and offer a new strategy to support the economy and the financial markets. If investors buy what the Fed is selling, this is likely a decent point for boosting equity exposure. On the other hand, if investors don’t take the bait, you will wish you had more on the sidelines, as a hedge against another surprising outcome.

Tyler Hay, CEO / email him

Tyler Hay, CEO / email him

Here We Go (Down) Again. Realizing the conventional wisdom has led them astray once more, investors are slowly waking up to the risks in emerging markets (EM). While capital has trickled out of select EM equity, bond, and currency markets over the last several years, a more broad-based and violent panic appears increasingly plausible over the coming quarters. This is due to the twin threats of China’s slowdown weighing on already oversupplied commodity markets and the Federal Reserve’s first tightening cycle in nine years that threatens to accelerate the still gradual reversal in Zero Interest Rate Policy/Quantitative Easing (ZIRP/QE) induced capital flows.

In decades past, such crises were regarded as non-events for the global economy. Relatively small countries with limited trade and financial linkages to the outside world could move through ebullient booms and agonizing busts like small children jumping on a Tempur-Pedic mattress. In other words, they were never able to generate enough force to tip the developed market wine glass. But considering how the financial linkages have grown in recent years, many investors, economists, and policymakers fail to realize how the abrupt decline in commodity prices, suffocating reversals in cross-border capital flows, and dramatic strengthening of the US dollar may serve as the catalyst for another global financial crisis.

Given the nature of this week’s Evergreen Exchange, I don’t have enough time to dig into the data or get into the idiosyncratic details of various countries with you here. But don’t worry, we will explore these themes thoroughly in future letters. For now, let’s review some of the flawed thinking that got us where we are today.

Narrative 1: Emerging Markets have “Decoupled” from Developed Markets. In the run-up to the global financial crisis, a number of economists argued that emerging markets like China, Brazil, India, and Russia had “Decoupled” from developed markets as a result of growing intra-emerging markets trade, rising middle class consumption, and investment projects designed to move those economies away from their traditional reliance on exports to the rich world.

In retrospect, that idea—that emerging markets could power through a developed market downturn unscathed—should have died in 2008. As our partners at GaveKal Research noted in February 2010, “the direction of economies around the world have moved in almost perfect unison.” Across the board, emerging markets fell into brutal recessions as a function of collapsing trade demand, plummeting commodity prices, and a global flight to safe-haven assets… all except China, which chose to embark on one of the largest credit booms in modern history.

Narrative 2: Now Emerging Markets Really are Safer than Developed Markets. In the immediate wake of the global financial crisis, emerging market (EM) economies staged an impressive comeback with the support of China’s credit-fueled investment boom driving a powerful commodity price recovery. In addition, massive fiscal stimulus in the USA, unprecedented monetary intervention by major central banks, and a tidal wave of financially-repressed foreign capital seeking higher rates of return further turbo-charged their post-crisis acceleration.

Rather than recognizing how dependent EMs remained on developed market capital flows and trade demand and/or unsustainable Chinese resource demand, many investors returned to an updated variant of that pesky decoupling idea. Conventional wisdom argued EMs were now less risky than the new “submerging” markets (the US, Japan and Europe), with smaller debt loads, rising consumption, far more favorable demographics, and overall brighter growth prospects.

This “Decoupling 2.0” narrative led to a multitude of bad decisions by investors, firms, and governments alike. According to the Bank for International Settlements, offshore US dollar-denominated credit grew from nearly $6 trillion in 2008 to well over $9 trillion in 2014, with roughly $4.5 trillion in the emerging markets. By another measure, the McKinsey Global Institute reports that total EM debt accounted for 47% of global debt growth from 2007 to 2013.

The enormous availability and low cost of cross-border, US dollar-denominated funding via bank loans and bond issuance-supported by mutual fund and ETF investments—continued to rise well beyond 2011. This was true even in countries that broadly decelerated amid missed reform windows, slipping global trade volume, falling commodity prices, widespread malinvestment, and increasingly toxic political climates. The entire scenario described above was beyond unsustainable. Further, the risks and failings were aggravated by the degree to which many fragile EMs have come to depend on foreign investment, relatively high commodity prices, or both of these factors, to avoid unmanageable capital flight. It should come as no surprise that the noose began to tighten, almost simultaneously, as China’s slowdown became more pronounced and the Federal Reserve began to tighten (and yes, tapering is tightening). While we have already seen substantial declines in a number of currency, equity, and fixed income markets over the last several years, the risk of rapid unraveling remains high.

Narrative 3: What Happens in Emerging Markets Stays in Emerging Markets. What happens next? While a small group of emerging markets like India and Mexico appear to offer reasonable valuations—in addition to the real prospect of pro-growth reforms—a number of catalysts are already on the horizon for a more violent, broad-based panic capable of bringing good markets down with the bad. The surging US dollar rally already in progress is a margin call on fragile emerging markets with $4.5 trillion in US dollar-denominated debt. Every seemingly isolated crisis that sparks risk-averse capital flight into the US dollar may, in turn, escalate the rising dollar/falling commodity pressure on the next round of countries until it squeezes even the United States into recession. And this would likely mean a global deflationary bust and a massive QE response from major central banks that seems silly to write on paper today.

While conventional wisdom—even within the Fed—continues to argue that small economies cannot possibly threaten the global financial system, it’s worth remembering that tiny, isolated Thailand almost brought down the US banking system in the late 1990s by triggering the disastrous Asian Crisis. That seizure pushed oil prices lower and the US dollar higher, which forced Russia to default on its sovereign debt. This finally blew a hole in the side of a massively leveraged hedge fund called Long Term Capital Management, sending shock waves around the world.

The key to understanding the link from Thailand’s devaluation in 1997 to the near collapse of the US financial system is simple, but underappreciated: Herding behavior… the dark side of the greed-driven growth/yield-chasing that created this mess over the last seven years. If the last three decades have taught us anything about cross-border capital flows and financial contagion, it’s that herding behavior—especially among fund managers and ETF investors—can amplify distress in small economies (with limited trade and financial linkages) into legitimate threats to the entire system. And, according to a recent study by the IMF’s Gaston Gelos and Hiroko Oura, the asset classes which display the strongest vulnerability to manager herding today are—you guessed it—emerging market bonds and emerging market stocks. In this case, all the conditions are right for a stampede towards the exits.

The risk of a LTCM-style blowback is very real in a world where, until recently, China has artificially supported commodity demand, central banks have suppressed the cost of capital for the longest time on record, and a herd of largely passive investors has overstayed its welcome in emerging markets. We don’t need to see a sudden financial shock to push the global financial system over the edge. We just need to see a very predictable (and self-reinforcing) spike in the US dollar (USD). That’s it. The dominos are all lined up and the US dollar breeze is turning into a gale force wind as the Fed signals that it could hike its target for the federal funds rate as soon September 2015.

I’m not saying that increasingly fragile emerging markets will be the cause of the next global financial crisis; but the Federal Reserve’s cavalier attitude and stark refusal to extend life-lines to fragile EMs underscores the real possibility that Ms. Yellen may soon lose control.

I know it’s hard to miss out on returns when it appears that the big risks, like a disorderly Grexit, have receded for the time being. I know it’s painful to suffer through meager yields in a ZIRP/Negative Interest Rate Policy (NIRP) world. But in a world where everything is expensive, where liquidity can evaporate in a single trading session, and where correlations between traditionally uncorrelated asset classes can break down without warning, our best defenses against the rising risk of a macro accident are: (1) diversification, (2) cash, (3) knowledge, and (4) the discipline to act on that knowledge rather than emotion. Eventually, defensively postured portfolios will yield enormous dividends as investors who keep their powder dry will have the opportunity to buy valuable assets at prices close to those seen during the global financial crisis.

Worth Wray, Chief Economist / email him

Worth Wray, Chief Economist / email him

"Better" doesn’t equal good. I’ve sat in countless meetings with both clients (current and prospective) and other industry professionals who tend to believe interest rates will inevitably move higher. In my opinion, this is the single most common market misperception.

In 2010, The New York Times published an article titled, Interest Rates Have Nowhere to Go but Up. Despite five years of perpetually lower global interest rates, there’s still a pervasive belief that higher interest rates will prevail. What’s unique about this misperception—compared to typical misperceptions exposed half a decade later—is that neither side of the argument believes they were wrong.

At the time, the investment chief of the world’s largest bond fund, Mohammed El-Erian of Pimco, warned investors “…get out of treasuries, they are very, very expensive.” Even the Oracle of Omaha, Warren Buffett, was sounding the alarm when he said he “…couldn’t imagine the rationale for adding bonds to portfolios.” Bond bears believed that equities had better return potential since the economy was recovering from the financial crisis, equity valuations appeared reasonable, and the Federal Reserve was ending its $1.25 trillion emergency asset purchase plan. In essence, the foundation for higher interest rates was now in place. Pimco founder Bill Gross said, “Americans have assumed the roller coaster goes one way. It’s been a great thrill as rates descended, but now we face an extended climb.”

Oddly, the reason no one feels wrong in this debate is because both markets have exceeded average annual rates of return since 2010. As we well know, over this time period, US equities have been on a meteoric rise with the S&P 500 returning over 14% annually. However, clients and investors are often shocked when I mention that long-term treasury bonds, as measured by the ETF TLT, have returned over 9% per year in that same time period.

Concerns related to bond prices, due to strong economic growth and rising inflation, never materialized. As we’ve mentioned many times in the past, since 2010, US GDP has increased by an average of 2.2% per year, generating the weakest economic recovery in history. Inflation remained subdued and never threatened to get out of hand. In fact, the risk of deflation has led the Federal Reserve to step back in to support the market repeatedly during this recovery.

Back in 2010, many investors got this call wrong because they thought it was inevitable the economy would recover and interest rates would normalize. But today, despite years of repeated economic disappointments, we’re back to the point where it seems everyone believes that interest rates have nowhere to go but up and that bonds have leprosy. In order to get this call right five years ago, we advised paying close attention to economic data—as opposed to the actions and comments of the Federal Reserve board. This is the same advice we’re giving today. And, if you’ve been paying attention, the economic data hasn’t been stellar.

When I study today’s markets, attempting to forecast current investor misconceptions, I am still drawn to the interest rate argument in the US. (Although this time around, I don’t think there is much of a chance that down the road both sides will be debating how right they were about rates.) Currently, there are many similarities to what we saw in 2010: A hoard of bond bears are repeating the same tired and lazy rhetoric on interest rates, the Federal Reserve is seemingly on the verge of raising short-term interest rates, and the consumer is near its most confident levels in decades. However, what’s different than five years ago—and what I believe will be the most obvious misperception of the next half-decade—is the nearly universal conviction US stocks appear to remain “the cleanest shirt in the laundry”.

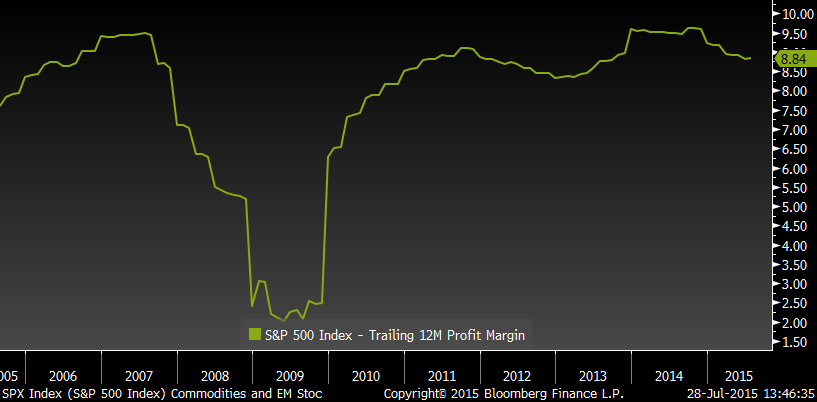

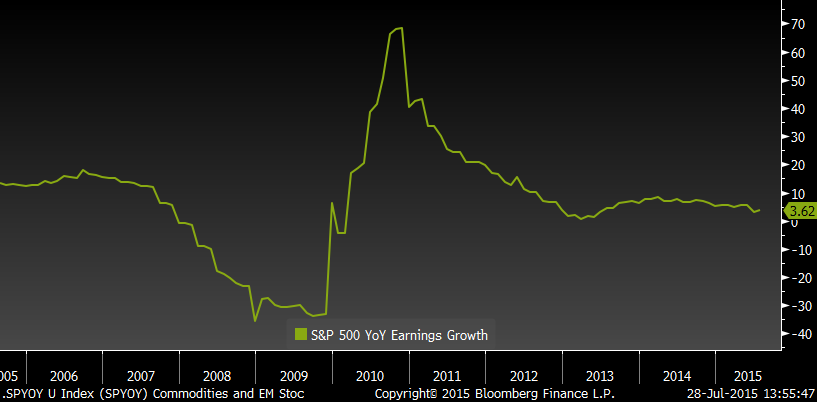

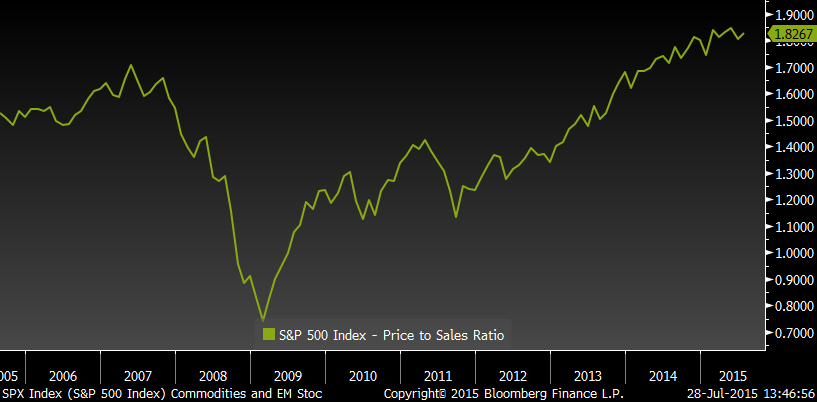

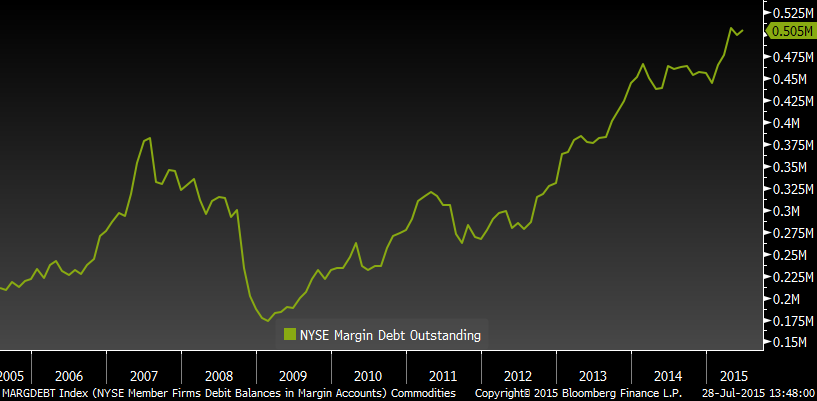

In this case, though, the initial positive view on US shares was founded on strong fundamental analysis. As mentioned earlier, in 2010 we agreed that US equities looked attractive relative to other global markets. Earnings appeared depressed and primed to skyrocket, and we felt the return potential of the US far exceeded any other market. Fast forward to today and we have profit margins at peak levels, earnings rolling over, a dramatic increase in margin debt, and valuations stretched on nearly every metric.

FIGURE 4: S&P 500 PROFIT MARGINS

FIGURE 5: S&P 500 EARNINGS GROWTH YEAR-OVER-YEAR

FIGURE 6: S&P 500 PRICE TO SALES RATIO

FIGURE 7: NYSE MARGIN DEBT OUTSTANDING

Source: Evergreen GaveKal, Bloomberg

Further, the current environment is much different in the US compared to other markets globally. The Fed may be poised to finally hike interest rates after ending its quantitative easing program last October (though I have my doubts.) The US dollar has appreciated an incredible 32% from its lows in 2011, and is now a major headwind for US corporations selling goods overseas. Finally, and most importantly, US equity valuations are at a significant premium to most global markets and offer significantly lower future growth.

In the early part of this decade, earnings growth and depressed valuations led the markets higher. Then, adding fuel to the fire, the rapid expansion of index funds led to an unwavering and rampant herd-mentality charge into US stocks. It’s true, this current misperception grew out well-informed investing principles. But if we study the landscape of US equities today, we don’t find depressed market valuations and earnings growth potential. Instead, we see an expensive broad market with significant challenges to move higher.

Today, like interest rates over the last five years, market participants appear to believe US equities have nowhere to go but up. Yet, like the belief in higher interest rates, the current faith in US equity prices does not appear to be based on fundamental analysis. Rather, it seems to be based, as is so often the case, on what has happened not what will happen. In other words, the belief that the US market is superior to all others is mostly based on the fact that it has been the shooting star. But you know what eventually happens to those.

Jeff Eulberg, Director of Wealth Management / email him

Jeff Eulberg, Director of Wealth Management / email him

OUR CURRENT LIKES AND DISLIKES

Changes are noted in bold.