“The areas of consensus shift unbelievably fast; the bubbles of certainty are constantly exploding.”

- REM KOOLHAS, RENOWNED DUTCH ARCHITECT AND HARVARD UNIVERSITY PROFESSOR

SUMMARY

- While conventional wisdom suggests that US government bond yields have nowhere to go but up, we believe the economic fundamentals will continue to weigh on interest rates for the foreseeable future.

- Given their ability to appreciate during periods of market stress, US Treasury bonds (1) continue to play a critical role in any diversified portfolio, and (2) represent an actionable opportunity as the threat of risk aversion rises around the world.

- US Treasury bonds are one of our largest portfolio positions at Evergreen GaveKal based on the conviction that they can generate attractive capital gains in the event that the US economy slides toward recession and the global equity bear market intensifies.

- Should investors rush toward the safe haven of US Treasuries in the middle of a bear market, as we have consistently seen in times of panic, our plan would be to start rotating into other asset classes like equities and high yield bonds as falling prices lead to more attractive valuations.

THE CASE FOR US TREASURIES

The following commentary is from the Evergreen Investment Team:

Bond Bears Bewildered. We talk a lot about recognizing bubbles here at Evergreen. It’s part of our investment DNA.

While long-term investors hope to earn a healthy return on their savings by holding assets like stocks, bonds, currencies, commodities, or real estate over time, compounding capital is never a straightforward exercise. People are naturally emotional. Markets are inherently inefficient. And prices often lie.

When asset prices boom past their fundamental values, history tells us that busts are typically right around the corner. Either the cash-flows underpinning those assets will increase or prices will decrease, but investors who buy at bubbly valuations are almost always locking-in abysmal long-term returns.

It sounds simple enough. But while conventional wisdom often leads investors astray, it’s not always a matter of euphoria. Sometimes the consensus reacts to bubbles where there are none, which can do just as much damage to poorly positioned portfolios.

US Treasuries are the perfect example.

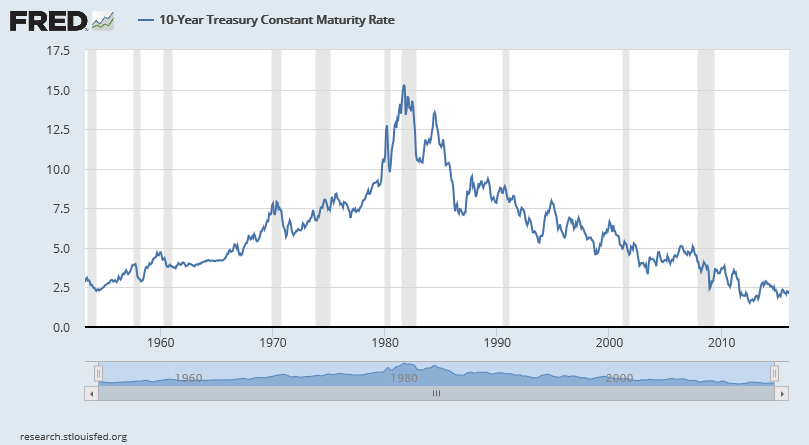

After thirty years of rising bond prices, falling inflation, and unchecked government spending, a popular view started to emerge that interest rates had nowhere to go but up after falling from nearly 16% in 1981 to less than 3% on the 10-year maturity T-note by December 2010.

“Americans have assumed the roller coaster only goes one way,” argued bond legend Bill Gross. “It’s been a great thrill as rates descended, but now we face an extended climb.”

10 YEAR US TREASURY BOND YIELDS (1962-PRESENT)

For a while that outlook seemed logical, even obvious, as it grew into conventional wisdom.

Some pundits argued that political dysfunction and ratings downgrades would lead bond market vigilantes to question the full faith and credit of the US government.

Others simply argued that bond yields would have to rise with US economic growth and inflation primed to reaccelerate after years of ultra-low interest rates and quantitative easing.

Either way, few investors expected “safe haven” yields to keep grinding lower—with the Evergreen investment team among the minority, as usual. Yet that is exactly what we’ve seen over the past few years.

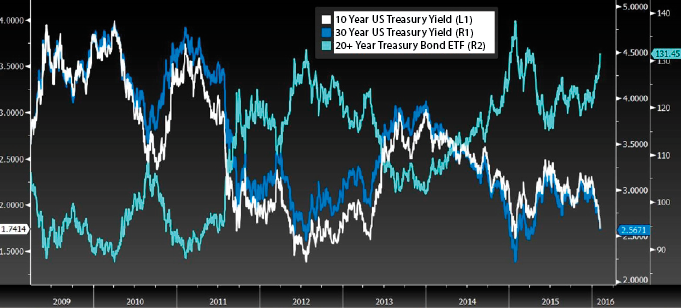

As you can see in the graph below, long-dated Treasury prices (as indicated by the 20+ Year Treasury Bond ETF) have risen by more than 40% since 2011 as yields have fallen below 2% and 3% on the 10-year and 30-year bonds, respectively.

US TREASURY BOND ETF PRICE VERSUS YIELDS

Source: Evergreen Gavekal, Bloomberg

While interest rates have jumped periodically, they have always fallen back down to earth (some would say to lower earth). And today—even in the face of Fed tightening—the long-term downtrend remains intact.

How Low Can Interest Rates Fall? Looking ahead, we see a number of reasons why the downtrend in US Treasury rates can continue despite the conventional wisdom that rates must explode higher.

(1) The US economy is struggling under a massive debt load with total debt now exceeding 350% of GDP.

While high debt is one of the primary sources of economic and financial market instability in the world today, it is also widely misunderstood by bond market vigilantes with overactive imaginations.

Over the course of the last century, we’ve learned that a sovereign government with an active printing press and a dominant reserve currency can carry excessive debts for decades. But carrying that growing debt burden comes at the expense of economic growth, inflation, and productivity.

While central banks can try to jump-start growth and inflation in such an environment, we’re quickly learning that you can’t fix a debt problem with more debt. Despite temporary pops in the economic data, all that debt just weighs more heavily on growth and drags the economy closer to deflation over time.

That’s the trap we’re in today and it’s why US government bond yields continue to fall. But it’s still nowhere as bad as what we’re seeing in the Eurozone (with debt over 460% of GDP) or Japan (with total debt over 660% of GDP). And, contrary to conventional “wisdom”, instead of these towering debt levels causing rates to spike, bond yields in Japan and much of Europe are far lower than in the US, as noted below.

(2) Our population is aging rapidly with a growing share of capital owners reaching retirement age.

While the long-term impact of weak demographics is still up for debate in an economy experiencing rapid technological change, we do know that aging capital owners tend to become more risk averse in retirement.

Again, the United States—which accepts roughly 1 million immigrants each year—is not going over the same sharp demographic cliff we’re seeing in places like Japan, China, or Europe. However, shifting risk tolerance is certainly adding to the downward pressures on government bond yields.

(3) The introduction of negative interest rates is creating more room for government yields to fall.

With much of the European Union (EU) and Japan now operating under negative interest rate policies (and the Fed signaling that it may join them at some point in the coming years), we’re watching something shocking and new in the world of finance.

Investors are paying premiums (rather than demanding premiums) to get their hands on supposedly “risk free” government bonds and yield curves are going sub-zero even in at-risk government bond markets. We’re not just talking about Japan, Germany, or the Netherlands, but governments with obvious debt problems like France, Italy, and Spain.

That’s insane and it seems Janet Yellen and her colleagues at the Fed are not far from joining the party.

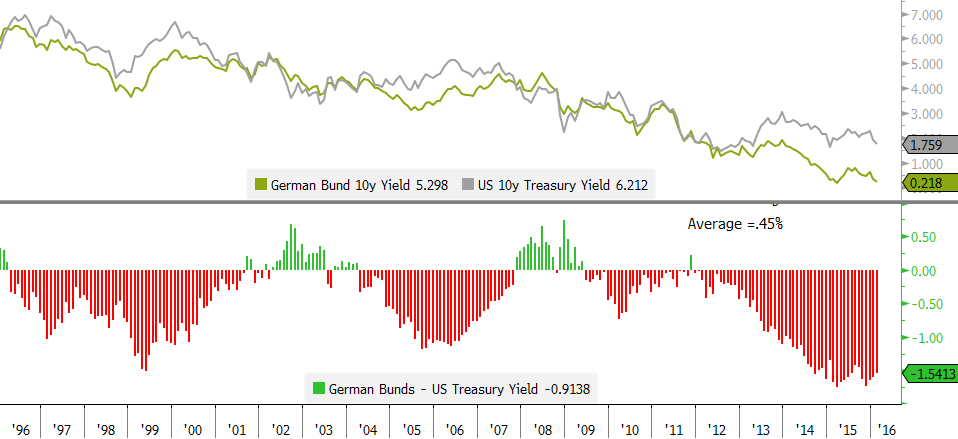

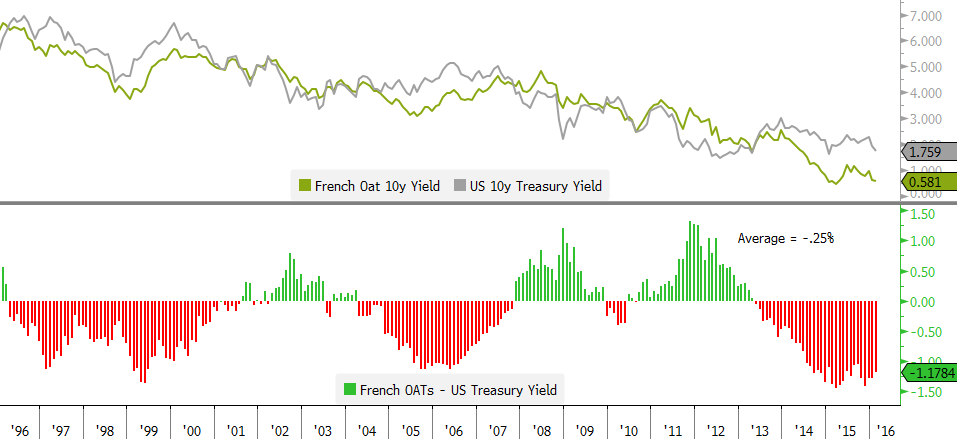

Just to keep things in perspective, it’s worth noting that the 10-Year US Treasury yield is now trading at one of the widest spreads versus 10-Year German bunds and 10-Year French OATs since the euro’s introduction in 1999. Should US rates fall to match current levels in Germany or France, we would be looking at a sub-1% US Treasury yield with 10% or greater price gains.

10 YEAR GERMAN BUND—10 YEAR US TREASURY YIELD SPREAD Source: Evergreen Gavekal, Bloomberg

Source: Evergreen Gavekal, Bloomberg

10 YEAR FRENCH OATS—10 YEAR US TREASURY YIELD SPREAD Source: Evergreen Gavekal, Bloomberg

Source: Evergreen Gavekal, Bloomberg

Not only do falling foreign bond yields and sinking yield curves around the world send a powerful message to US Treasury investors that rates can go lower with the help of central banks, but these policies are also setting the stage for a future flight to safety (as we explain below).

(4) The divergence between major central banks is already triggering serious instability in the United States and abroad.

As you’ve no doubt heard by now, the divergence between central bank policy in the United States and our massively indebted trading partners in Europe in Japan has fueled a significant rise in the US dollar over the past several years. This, in turn, has contributed to an outright collapse in commodity prices and a general deterioration in global financial conditions.

While the Bank of Japan and the European Central Bank have tried to address deflation risks with additional asset purchases and negative interest rates over the past couple years, such moves have only served to drive the US dollar higher. Should they press even harder in the coming months to keep their strengthening currencies relatively weak against the dollar, it threatens to unleash a serious wave of global risk aversion by destabilizing China and a host of other emerging markets.

On the flip side, a weaker US dollar, driven by deteriorating US economic activity and a potentially dovish turn in Fed policy, could lead to sharp rises in both the yen and the euro. That may seem like a better outcome for global stability, but we cannot be so sure given the poor quality of Europe’s banks or the banana republic level of debts owed by Japan’s government. To the extent that currency strength leads to a return of outright deflation and a deterioration in economic activity, it’s easy to see how a sharp fall in the US dollar could usher in a different kind of crisis.

If the rising risk of a US recession isn’t enough to push US Treasury rates to all-time lows, a shock out of Europe, Japan, China, or the emerging markets certainly could.

All this may sound bleak, but that’s the world we live in. And until the underlying debt burdens shake out, it’s very likely these forces will continue to favor US government bonds.

Am I Diversified? As we remind our clients on a regular basis, US Treasuries play a critical role in any diversified portfolio. While cash and corporate bonds can dampen the impact of equity losses, US government bonds are the only true safe haven capable of generating strong capital gains during periods of market stress.

For the time being, think of it as an insurance policy with a negative premium. It pays you a modest sum to protect against extreme events as long as the nominal yield (currently 1.81%) is greater than the year-over-year inflation rate (currently 0.70%). That will change if and when the Fed moves to a negative interest rate policy, but the fundamentals are clearly on your side today.

This is an important point that many retail investors have neglected over the last several years. While shoring up their portfolios against an imminent bond bear market, few investors realized that they were concentrating their portfolios into a one way bet on accelerating inflation and rising earnings in an environment where equity prices had already outstripped their own fundamentals.

That’s tantamount to cancelling your property insurance with a forest fire already burning just a few miles down the road.

Just ask yourself, am I diversified? Am I insured against a major sell-off in the equity market? If not, we suggest visiting with your financial advisor and reassessing your risk tolerance. With markets experiencing a sharp short-squeeze over the last week, this may prove an opportune time to get defensive, embrace the diversifying power of US Treasuries, and prepare for another big leg down in the equity market (Evergreen continues to see an investable rally point at around 1600 on the S&P.)

At this point in the market cycle, we believe that cash, gold, long-dated Treasury bonds, high-grade corporate bonds, and beaten-up energy/MLPs are the only asset classes deserving of large allocations, but that will change as prices fall. Should investors rush toward the safe haven of US Treasuries in the middle of a bear market as we have consistently seen in times of panic, our plan would be to start rotating into other asset classes like equities and high yield bonds as falling prices lead to more attractive valuations.

If past is any guide, prices are likely to overshoot as much on the downside as they did on the upside. And for truly long-term investors—who are willing to be greedy when others are fearful—that will be exceedingly good news.

OUR LIKES AND DISLIKES.

No changes this week.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.