Click to view as PDF.

“Don’t you miss interest rates?”

- JIM GRANT, founder, Grant’s Interest Rate Observer

“The entire (financial) industry mindset is wrong here. And it’s a trap. When you promise something you can’t deliver, you structure your portfolio in ways that will kill you.”

- ERIC PETERS, author of the Weekend Notes newsletter read by investment managers controlling over $800 billion in assets.

SUMMARY

- In the 1800s, the Colt 45 pistol was known as “The Great Equalizer”. Today, the great equalizer might be interest rates—or the lack thereof. When rates are zero, the same amount of cash flow is produced on $10 million as on $10 thousand. When rates are negative—as they now are in so many countries—the greater the wealth, the greater the loss.

- Big government and big companies (or at least their senior management) are the big winners in a zero interest rate policy (ZIRP) environment. Heavily indebted governments can borrow for free—or even earn revenue—due to negative interest rate policies (NIRP). Large corporations use cheap debt to buy back stock and inflate stock options for insiders.

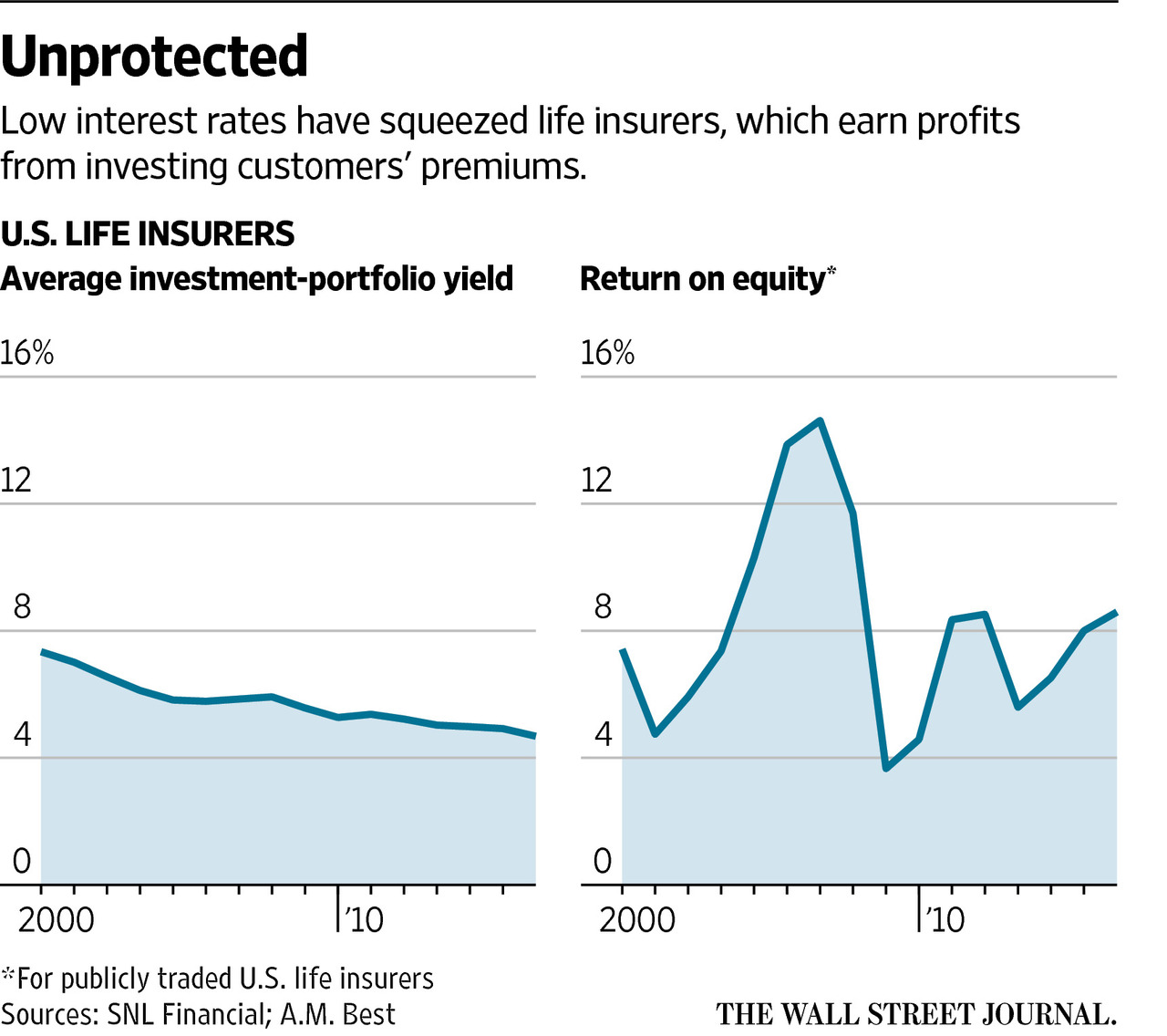

- The losers from ZIRP and NIRP are retired or soon-to-be-retired investors. Also, pension funds and insurance companies suffer based on their need to achieve returns high enough to fund their liabilities and contractual commitments. (4% is the new 8%!)

- Due to high current valuations, stocks and real estate can’t save the day for either retail or institutional investors. Formerly bubbly asset classes—like luxury condos, fine art, collector cars, small-cap stocks, and even commercial real estate—appear to be deflating or are poised to.

- Bear markets in MLPs (pipelines and other mid-stream assets), Canadian REITs and emerging market debt gave investors another shot at double digit yields. However, most investors appear to have missed the window based on heavy redemptions out of these depressed securities. (MLPs and many Canadian REITs are up 30% or more in the last six weeks.)

- $70 trillion in financial assets held by American investors is likely to produce 4% or less over the next five to ten years. This compares to a historic level of around 8%. The difference amounts to $2.7 trillion less of portfolio return for the US economy, with Baby Boomers being particularly disadvantaged.

- Many pension plans still assume 8%-type returns with little chance of achieving that due to NIRP and ZIRP. Insurance companies are imperiled as a result of the interest rate collapse and their guarantees on existing policies.

- Interest rates are now the lowest since at least the Middle Ages and probably back to when King Tut was a pharaoh not just a museum exhibit.

- Despite—or because of—NIRP and ZIRP, economic activity around the world continues to disappoint. This is likely to get worse as boomers, the largest global population cohort, become fully cognizant of their compromised income condition.

- There will be more opportunities to secure high returns—such as was the case with MLPs, Canadian REITs, and emerging market debt recently—for those investors who are prepared and have the courage to buy into panics.

THE GREAT EQUALIZER

By David Hay, Chief Investment Officer

It was often said back in the Wild West days of the 1800s that God made men but Sam Colt made them equal. This was, of course, in reference to his iconic pistol, the Colt 45, with the ironic name of The Peacemaker (The Widowmaker would have been more appropriate). It also became known as the Great Equalizer because whether you were a wispy five-footer or a brawny six-footer, this lethal six-shooter rendered you equals in a gunfight.

In today’s bizarre investment world, where so many things are upside down, the Great Equalizer is interest rates—or, more accurately, the lack thereof. If interest rates are zero, holding $10 million in cash is no advantage, from an income generation standpoint, than having a mere $10 thousand. If rates are negative—as they are in Japan out to 10 years in their government bond market—the man or woman with $10 million loses more!

Or think about it from the standpoint of a government. The more indebted it is, the more it makes. Again, Japan is the perfect case study. It has by far the greatest amount of government debt relative to the size of its economy than any other developed country. For years, it has been assumed Japan had dug itself into an inescapable fiscal debt hole with no way out. But now what was literally a massive liability has turned into a major asset. Those trillions of IOUs are currently generating positive cash flow! Debt trap avoided; problem solved. Who knew it would be such a painless solution?

Based on the foregoing, and so many almost incomprehensible developments, it’s clear the planet’s financial system has truly arrived in a land that Lewis Carroll might have created. However, I’m sure Mr. Carroll never had the investment scene, circa 2016, on his mind when he wrote lines such as “Why, sometimes I’ve believed six impossible things before breakfast,” as the Queen said to Alice in Through the Looking-Glass. Yet, these days, the impossible things just keep adding up.

As hard as zero interest rates are to believe—after all, this means US investors in cash, for example, have been losing money net of inflation for some seven years—negative interest rates take the absurdity to an entirely new level. It’s not just Japan that is employing a negative interest rate policy (NIRP). Per recent EVAs, nearly 40% of the so-called “rich” world is using some form of NIRP.

The theory behind such radical monetary measures is that eliminating, or even inverting, interest rates is a sure-fire way to stimulate over-indebted economies. This is because the normal adrenaline boost of cutting rates no longer works when rates approach zero. The kissing cousin of zero interest rate policy (ZIRP) and NIRP is another acronym: QE, the now legendary quantitative easing. QE has been used for years to circumvent the limitation on central bank effectiveness at the “zero bound” for interest rates. In reality, we’ve now had years and years of QE experimentation in the desperate attempt to fend off the drags of too much debt and too little growth.

A question that is fair to ask at this point is: How well has it been working?

Big government, big companies: big winners. Warren Buffett’s sidekick in multi-billion dollar wealth accumulation is Charlie Munger. One of Mr. Munger’s pithier truisms is “Show me the incentives and I will show you the outcome." When it comes to the inverted world of ZIRPs and QEs, that epigram is particularly relevant. Consequently, for heavily indebted governments—who are strongly incented to grind interest rates to nothing, or less—the outcome is glorious, with Japan being the poster government in this regard.

For stock option-laden corporate executives, zero and negative interest rates are also wonderful. They allow senior management teams to issue debt at negligible costs and use the proceeds to buy back their own stock, pushing its price up and enhancing the value of said stock options. One of the realities of the stock option game is that, once vested, these are typically exercised and sold. In other words, insiders generally take the money and run. So unusual is an “exercise and hold” that they are actually considered to be insider purchase transactions.

The point is, the beneficiaries of stock option largesse rarely stay around for the very long-term (another vexing point for outside shareholders is that during bear markets, new options are often issued at lower prices). The problem is, with such a strong incentive to produce short-term stock appreciation, management teams tend to become most indiscriminate as to the price at which they retire their shares.

Late in a bull market and economic up-cycle, such as now, companies have a well-documented tendency to overpay for these repurchases. As Mr. Buffett himself has noted, this process destroys—rather than builds—shareholder wealth.

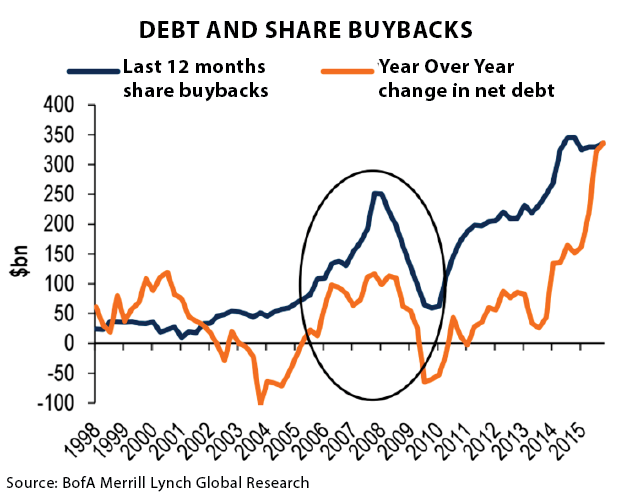

In case you think buy-backs are just an interesting footnote, you should consider the importance of these to the stock market’s rise since 2009. Over that timeframe, more than $2 trillion has been expended by firms to acquire their own shares, according to HSBC in a recent report on this subject. As you can see in the chart below, share buy-backs and the debt issuance to finance them, have gone hand-in-hand over the last two bull markets. Clearly, we are in a much more dangerous zone now than we were even in 2007.

Schwab’s chief investment strategist, Liz Ann Sonders, was quoted by Business Insider as saying: “There’s no question that by far corporate buybacks have been the source of most of the buying in the stock market. On a cumulative basis there has not been a dollar added to the US stock market since the end of the financial crisis by retail investors and pension funds.”

With that as a segue, let’s reflect on the incentives and outcomes for both retail investors and pension funds due to the phenomena of ZIRP/NIRP/QE.

The slow boil. It’s probably axiomatic to say that every environmental shift produces winners and losers. That is almost certainly the case with our current extraordinary experiment in monetary stimulus. Sometimes, though, like a frog being slowly boiled, it takes awhile for the losers to realize they are in the soup.

American investors now own nearly $70 trillion of financial assets. Unquestionably, the value of this stash has been greatly inflated by the frenetic efforts of central banks worldwide. Accordingly, superficially one could argue that the US investor class has been a winner due to ZIRP, et al. But, like with the frog, who at first just feels a comfortable warmth, I wonder if there isn’t a nasty surprise brewing.

Getting back to the “Great Equalizer” opening, I’m sure many EVA readers were thinking as they read it: “Who needs to hold cash? I can put my nest egg in stocks or apartment buildings.” That’s a great rebuttal and, in fact, shifting from cash to stocks and income producing real estate was a brilliant thing to do—seven years ago. Or even five years ago. But about three years ago, the wisdom of that became less sound as prices left the range of undervaluation—and even fair value—and entered at least the minor bubble zone.

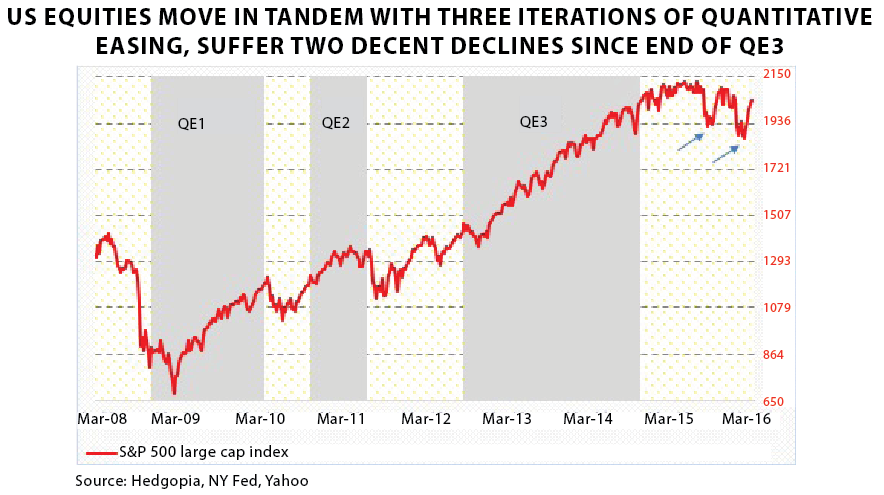

With apologies for some redundancy, the chart below, from my friend Paban Pandey and his excellent Hedgeopia blog, vividly illustrates how utterly dependent this bull market has been on the Fed and its three prior QEs.

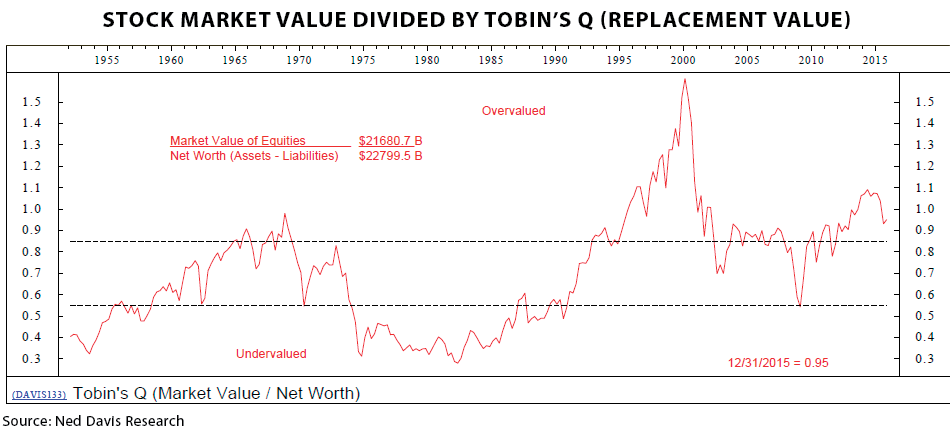

Numerous (countless?) past EVAs have demonstrated the ensuing overvaluation of the US stock market caused by repetitive QEs based on our favorite tape measure of the price-to-sales ratio (which, by the way, remains scary high). Therefore, I thought it would be refreshing to use a different metric, the well-known Tobin’s Q. This compares the total market value of US shares to their estimated replacement cost. As you can see below, it remains at one of the highest levels ever, excluding the last hockey stick phase of the great late ‘90s tech bubble. (I should note that this comes from Ned Davis Research and they have moved back to cautiously constructive on the market outlook despite major long-term concerns about valuations.)

Frankly, it doesn’t matter whether you use price-to-sales ratios, the Shiller cyclically-adjusted P/E ratio (based on normalizing earnings over a business cycle), market-value-to-GDP (once Buffett’s favorite guidepost), or John Hussman’s twist on the latter (which supposedly has shown the best ability to predict future long-term market returns). They all convey the same message: Returns from US stocks over the next five to ten years are almost a lock to be extremely disappointing.

By the way, the optimist's refuge of a reasonable P/E based on forward earnings continues to crumble as future earnings projections melt. The original estimate for 2015 was $136 per share for the S&P 500; it now looks like it will come in around $100. Kind of a big miss, don’t you think? But that $136 number was widely used back in 2014 to assure investors the market was cheap on forward earnings. Estimates have become more realistic lately but forecasts remain for an improbable 15% pop in second half 2016 profits and an equally unlikely 13.6% rise for 2017. So buyer beware, once again, of the siren song of “cheap on forward earnings”.

It’s always trickier, at least for me, to determine if real estate if overpriced. Logically, you would think that’s the case after so many years of miniscule interest rates. Lending credence to that theory, one of the most skilled real estate investors I know—who is still a whirling dervish at nearly 80—is telling me that he is able to sell apartment buildings at 2% type “cap rates” (basically, offering the buyer a mere 2% cash flow return on their purchase price). As a result of bids like this, he is methodically selling off major portions of his property empire.

Additionally, media stories are proliferating about rising inventories of unsold luxury homes and condos in cities such as New York, San Francisco and, even, once thermo-nuclear London. Prices have also clearly begun to contract. There are a growing number of reports of early trouble signs with commercial real estate (the Wall Street Journal ran a front page story titled “US Commercial-Property Sales Plunge” two days ago, noting that hotel values have fallen 10% year-over-year). Even in our formerly en fuego local Bellevue office building market, vacancies have more than doubled in the last year to a lofty 12%—and with more supply coming online soon.

The truth is, whether you’re talking high-end art, collector cars or rare antiques, the message is the same—prices got way too high due to exceptionally lax monetary policies around the world and they are now cracking. This is notwithstanding the recent robust rally in many oversold “risk-on” investment sectors/asset classes.

Therefore, here’s the problem with QE helium: it doesn’t change the intrinsic rate of return from stocks or real estate; it just brings it forward by a few years. Ultimately (as in right now or even a few years ago), prices rise so high that future returns become either negligible or negative. Call it Zero Investment Return Policy or Negative Investment Return Policy—your choice. You can even use the same ZIRP and NIRP acronyms!

Now, let’s think about what all this means to pension plans and those most vested in them: baby boomers like me.

Tired but not retired? One of my greatest apprehensions is of the day when millions of boomers wake up and realize they’ve been had. As John Mauldin recently wrote, in a top-notch piece called “ZIRP and NIRP: Killing Retirement As We Know It”, the concept known as retirement is a relatively recent development. It was only in the post-WWII years that the luxury to retire became commonplace even in advanced economies, at least in terms of enjoying twenty or thirty years of work-free living.

But now there is a wicked collision occurring between extended longevity and the spreading disappearance of investment returns. For decades, individuals who were approaching retirement would become increasingly risk-averse and rely more heavily on safe securities like CDs and fairly short-term high grade bonds to generate the income they needed. Yet, as we all are painfully aware, these vehicles might still be safe but they certainly aren’t income-producing.

Since this condition prevailed in most rich countries for years, retirees, and those soon to join their ranks, have swallowed hard and moved into higher risk and (at least theoretically) higher return areas. There is little doubt stocks, junk bonds, and emerging market debt were big beneficiaries of this shift—for awhile.

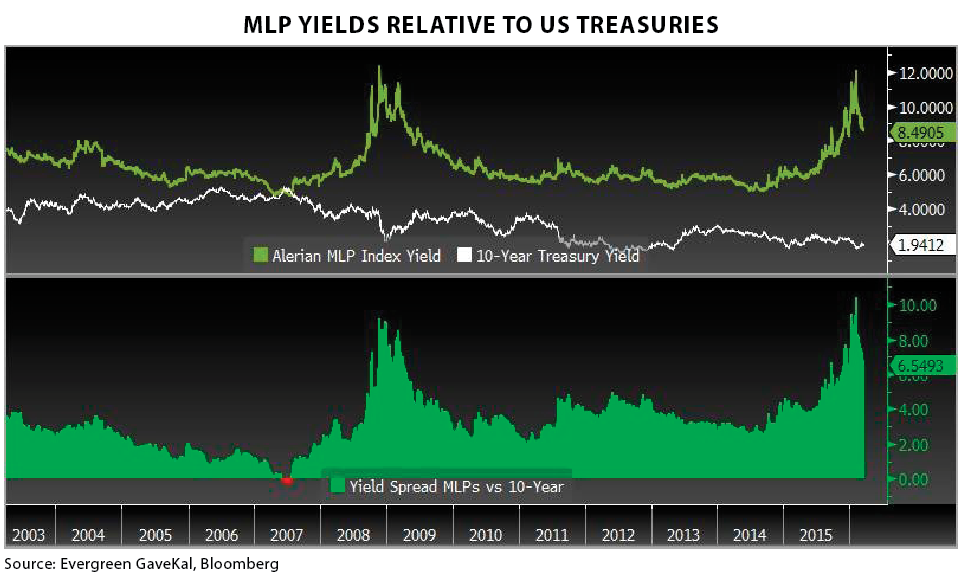

However, since the fateful summer of 2014—when Evergreen believes the top was put in for our latest uptrend in most financial instruments—junk and developing country bonds have been pounded, despite a vigorous snap back since early February. And retail investors have been doing what they do best when prices decline sharply—as in, panic. Thus, as yields have risen materially they have been selling hand over clenched fist. So instead of looking at this as exactly the opening they needed, income-starved boomers have been bailing. This same dynamic has played out with MLPs and a number of leading Canadian REITs, as documented (too?) frequently in these pages. As highlighted on the next page, MLPs were recently yielding 800 basis points (8%) more than the 10 year Treasury.

We all know the market has rallied over 10% from its February 10th low. But not many are aware that MLPs have vaulted almost 30% and several of the most depressed Canadian REITs are up 30% to 50%. Unfortunately, it appears as though few were buying them when they were at 60%-off type prices and with double digit yields. Based on the massive outflows occurring from high yield and emerging market funds, the same is almost certainly true with those, as well.

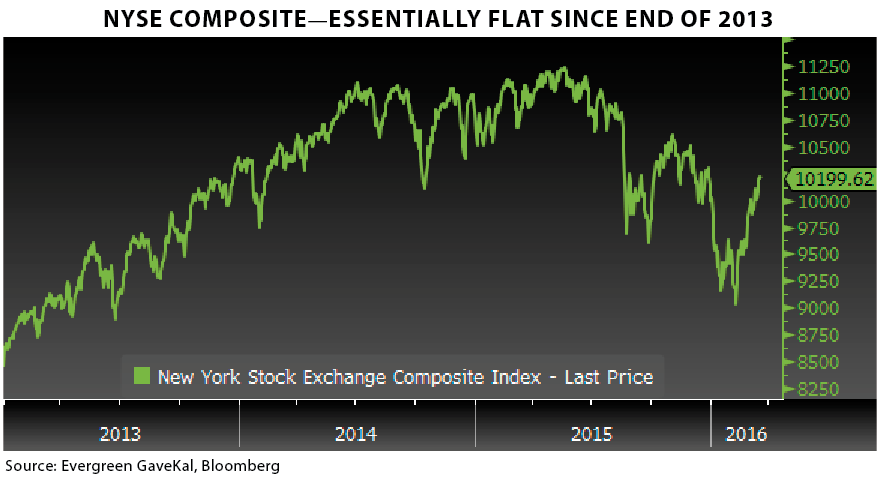

This pattern of buying when feeling forced to and then panicking when prices correct is precisely the opposite of what an investor who hopes to be able to live on his or her portfolio must do in the Alice In Wonderland world of today. The fact of the matter is that buy-and-hold hasn’t worked for the last couple of years and, with the stock market, for the last decade and a half. Remember that the S&P has returned less than 4% since the start of this century/millennium. And that’s with valuations presently at near record levels.

Consider this math: Americans now have $70 trillion in financial assets—an all-time high. However, if this enormous sum earns 4% per year instead of an assumed 8%, the shortfall is about $2.7 trillion per year of income. Please realize that even the 8% was a gross number from which inflation, taxes, and investment expenses needed to be deducted. The net number was around 4%, the safe withdrawal amount you have likely heard about so often. Now the gross number might be closer to 4% with the net in the same neighborhood as your local bank savings account—roughly zippo.

If you think I’m too pessimistic, consider a portfolio of 60% stocks and 40% ten-year treasury bonds. Assume the stocks return 4%, which is higher than what some of the most respected forecasters of future equity gains are using. The treasuries yield 2%. The combined would be around 3 ½%, once again before taxes, inflation, expenses. Yes, you can goose that a bit with investment grade corporate bonds, but not by much.

Over the last couple of years we’ve seen some low and even negative returns. And I can tell you from hundreds of conversations that older investors are already feeling squeezed. Factoring in how many boomers are, and will be, moving into the “living on portfolio income” category, the economic implications of a $2 ½ trillion income shortfall among this massive population cohort are sobering.

If you’re thinking: “I’m safe. I’ve got a nice pension and annuities to boot”, you might want to think again.

Great Expectations/Not So Great Realities. Pension plans around the world are waking up to the specter of ZIRP and NIRP being with us for years to come. It’s a financial crisis of the first order for both public and private plans and I mean no hyperbole. Citigroup just reported that government retirement plans are unfunded or underfunded by $78 trillion. This compares to “only” $44 trillion in debt. Accordingly, the Citi piece comments that total global sovereign debt may be three times larger than generally believed. The same report also estimated that private plans in the US and the UK are short by half a trillion, which almost sounds like a rounding error in comparison.

Most of these plans rely on gains and income from investments to offset a significant portion of their liabilities. This is why interest rates gone AWOL is so problematic for them. CALPERS, the gigantic California public employees’ retirement plan, just lowered its return assumption from 7.75% to 7.5%. Achieving this minor reduction was a political battle. Yet, how are they going to earn even 7.5% with interest rates as low they are and stock prices as high as they are? Public pension officials—and, of course, politicians--are in complete denial about this throughout the US, not just in California. They know contributions need to be dramatically increased but they aren’t willing to put through the tax increases and/or service cut-backs to fund them.

Insurance companies are also under the gun. On Monday of this week the Wall Street Journal ran a feature article with the headline “Low Rates Sting Insurers” and the sub-title of “Industry makes consumers pay for long period of weak investment returns”. The “consumer pay” is reduced benefits on long-term care policies and lower returns on life insurance contracts. With annuities, you can bet that the long-running trend toward lower yields will continue with an increasing amount of the monthly “income” being a return of the owners’ capital.

Gavekal’s Charles Gave has long been concerned about major failures in the life insurance industry due to its inability to earn enough return to cover the guaranteed rates in contracts sold years ago when interest rates actually existed. It’s highly probable that some insurance companies are venturing into high-risk areas in an attempt to get returns that at least match their commitments. It’s well documented that pension plans have been doing this, often greatly increasing stock or hedge fund exposure. This is almost certain to lead to blow-ups, possibly of a mega-nature.

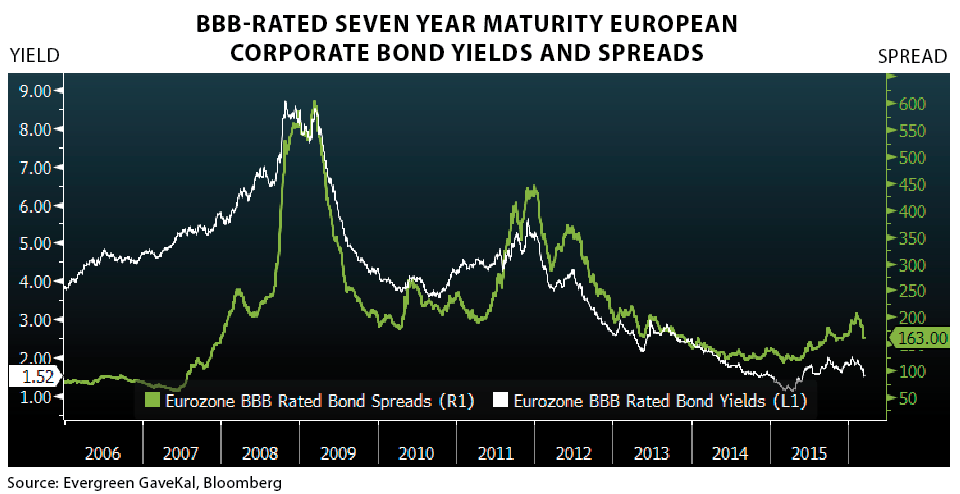

Eurozone insurance stocks soared two weeks ago when the European Central Bank (ECB) announced the latest radical remedy to persistently deficient growth and below target inflation—printing money to buy corporate bonds. Per the following charts, this immediately brought the yield premium paid on seven-year BBB-rated corporate debt in Europe versus government borrowing rates (i.e., the credit spread) down from 2% (200 basis points) to 1.63% (163 basis points). This nudged the actual yields lower to 1 1/2%, illustrating that seven year government bond rates in Europe overall are slightly negative.

Despite the immediate positive reaction, we question the rationale. Rates of 1 1/2% on corporate bonds make it that much harder for eurozone insurers to meet their contractual obligations (the same is true for private-sector pension plans; public plans in Europe tend to be “pay as you go”, aka, unfunded).

This raises a question about the overall effectiveness of interest rates around the world at levels lower than they have been in at least 600 years (i.e., back to the Middle Ages, if not back to when King Tut was a pharaoh instead of just a museum exhibit). Yes, this avalanche of cheap money pumped up asset prices around the world, at least for a time. But, as mentioned above, many of these are breaking down. Even the Energizer Bunny known as the US stock market has gone nowhere since late 2013 as measured by the NYSE composite (a broader index than the S&P 500).

Yet, economies, including the US, continue to disappoint. The central banks never seem to ask themselves if it’s their policies that are restraining growth rather than catalyzing it (such as by flattening yield curves* and clobbering bank profits, thereby making them less inclined to lend). Instead, they attempt ever more extreme monetary tricks, creating little economic activity but a growing number of distortions and systemic risks. Let’s face it: if ZIRP and NIRP were effective economic propellants, Europe and Japan would be booming right now. (Similarly, if these were the path to high stock market P/Es, these regions wouldn’t be trading at substantial discounts to US stocks, as they are; rates this low reflect economic sclerosis, leading to lower P/Es.)

Governments—who are now increasingly being paid to borrow money—feel no need to institute growth-boosting reforms like reducing regulatory strangleholds or incentive-killing tax structures. And, per the foregoing, retired or retiring investors are at huge risk of having their golden years seriously tarnished. The shortfall in their investment income is likely to be another big drag on global growth—the last thing the planet needs right now.

As my one of my intellectual heroes, Charles Gave, pointed out this week in his essay “The Fed’s Price Keeping Operations” , history shows that governments and central banks can manipulate market prices for awhile but not indefinitely. When the failure point is reached, markets can shock on the downside. Ironically, that’s the good news… for those who are prepared.

The only solution for investors in this Through the Looking Glass world is to be both patient and brave. Patient, when market prices are clearly overvalued and excessively influenced by absurd monetary policies, and then brave when the inevitable price plunges occur. The opportunities provided by the collapse in MLPs, Canadian REITs and gold mining shares in recent years are prime examples. Trust me, there will be more, many more. And they will provide a fleeting chance to offset “The Great Equalizer”, otherwise known as the abolition of interest rates.

OUR LIKES AND DISLIKES.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.