Private market investments were the exclusive domain of institutions and ultra-high-net-worth investors for decades. These asset classes are characterized by limited disclosure, high minimum investment thresholds, and long lock-up periods, which have historically made them opaque and difficult for retail investors to access. However, private markets have grown dramatically and have become an increasingly important component of diversified modern portfolios for qualified investors*. The number of private companies has ballooned by 43% over recent decades, while the number of public companies has declined by 35%. In other words, a growing share of economic growth and investment opportunity now resides in private ventures. As such, an investment strategy encompassing public and private assets should be considered table stakes.

Large institutions, like pension funds and endowments, have been paving the way for several decades. Since the early 2000s, public pension plans in the U.S. have sharply increased allocations to “alternative” investments from just 14% of portfolios in 2001 to nearly 40% by 2021. This massive reallocation reflects a fundamental belief that private assets can enhance returns and provide diversification beyond what traditional stocks and bonds offer. Private market assets under management are projected to keep expanding rapidly – Bain & Company forecasts private markets will grow more than twice as fast as public markets, potentially reaching $60–$65 trillion in AUM by 2032.

Why Institutions Love Private Assets

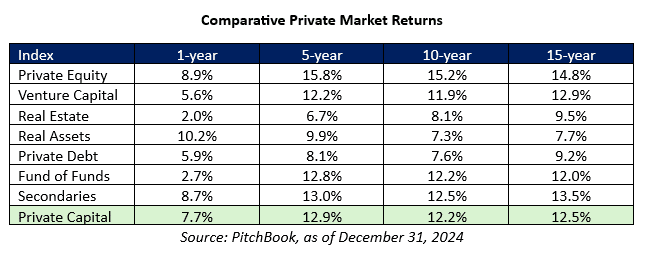

Within private markets, there are a broad spectrum of asset classes and strategies — each with its own risk/return profile. The long-term performance of many of these strategies has often exceeded that of traditional public market investments, particularly when measured over multi-year periods.

Institutional investors, such as large pensions, sovereign wealth funds, and university endowments, have long favored private markets for several compelling reasons:

While the door to private markets has cracked open slightly in recent years, thanks to the emergence of interval funds, non-traded REITs, and online platforms, the most compelling private opportunities are still difficult for retail investors to access. High-performing private equity funds, top-tier venture capital vehicles, and specialized real asset strategies are still mostly reserved for institutional capital or ultra-wealthy individuals.

In addition to access challenges, private market investments often come with structural nuances that require deeper analysis: long lock-up periods, irregular cash flows, complex fee structures, and legal documents that are difficult to interpret. Without proper guidance, retail investors can find themselves in investments that don’t align with their risk tolerance, liquidity needs, or long-term goals.

Given the complexity, opacity, and variability of private market opportunities, retail investors stand to benefit significantly by working with a trusted partner that can guide them through the private investment landscape. By partnering with an experienced advisor, individuals can gain exposure to high-quality private market opportunities that were once out of reach, while ensuring those investments are thoughtfully integrated into a long-term strategy. In today’s evolving financial landscape, access is no longer the only challenge; making smart, well-informed decisions about where and how to allocate in the private market is what separates successful investors from the rest.

Evergreen Gavekal offers exclusive alternative investment opportunities for clients through our Evergreen Ventures division . If you’re a client interested in learning more about our private investment opportunities, please get in touch with your wealth consultant.

*Investing in alternative investments often requires being an Accredited Investor and/or a Qualified Purchaser.

DISCLOSURE: Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.