By Tan Kai Xian

On Tuesday, as the S&P 500 sold off so abruptly, the Vix index, derived from the implied volatility on S&P 500 options, climbed from 23.87 to 27.27. This illustrates the utility of exposure to Vix futures as a hedge for US equity portfolios. As the S&P 500 fell -4.3%, an index of mid-term (fourth to seventh month) futures on the Vix rose 4.5%. To take an extreme example: as the S&P 500 has fallen -16.2% (dividends included) year to date, a 50:50 portfolio comprising the S&P 500 and mid-term Vix futures is down just -2.9%, with greatly reduced volatility. That is a performance that trounces equity portfolios hedged 50:50 with either US treasuries, Tips, or gold.

All very well, you might object, but this year has been unusually volatile for US equities. What is there to say the Vix will continue to offer a superior hedge going forward?

As it happens there are three related reasons

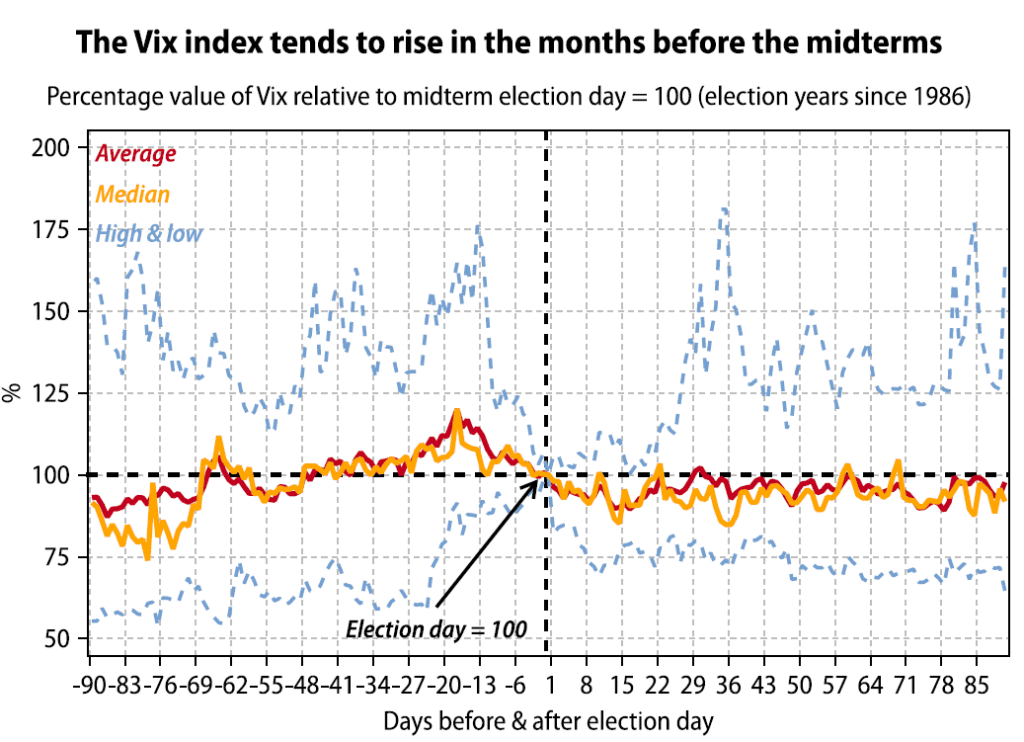

1. The US midterm elections on November 8. With a little less than eight weeks to go, the results remain uncertain, although at this stage prediction markets are pricing in the Republicans to take control of the House of Representatives, while the Democrats retain the Senate. Whatever the outcome, history shows that the Vix tends to rise over the two months preceding both midterm and presidential elections (see the chart overleaf). Years without elections show no such pattern over the same months, which suggests the relationship could be significant—and that the Vix is a viable hedge for electoral uncertainty.

2. The US fiscal trajectory. Whatever the outcome of the midterms, the US budget deficit is likely to contract over the next year or two. Admittedly, the midterm results will affect the pace of that contraction. If the Republicans do take the House, passing spending bills will be tough. But even if the Democrats retain control of Congress, barring a deep recession the deficit should still be smaller than during the years of Covid.

A smaller budget deficit implies relatively less public-sector capital allocation aimed at promoting stability, which, all else equal, implies a greater degree of economic—and market—volatility (see Beware TheTriple Tightening).

3. Broader economic conditions. The US budget balance relative to GDP is one component of Gavekal’s broader US volatility regime diffusion index. The other two are the growth rate of US TMS3 money supply relative to GDP and the US current account balance as a percentage of GDP. The first two are measures of the public sector’s involvement in capital allocation. The third gauges the influence of foreign investors, who tend to be relatively price-sensitive (see A New Phase For US Volatility). Currently all three components are indicating volatile conditions relative to their 20-year medians, which means the volatility regime diffusion index is at a maximum +3 reading for the first time since 2007. This points to an increased probability of spikes in the Vix.

In addition, the elevated risk of a US recession (see Navigating A USRecession), points to an uncertain outlook for US equities and therefore to increased demand for portfolio protection. In sum, then, there are solid reasons for US equity investors to continue to favor exposure to mid-term US Vix futures as their preferred hedge in the near term run-up to the US midterm elections in November, and quite possibly beyond, depending on the evolution of the US volatility regime.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.