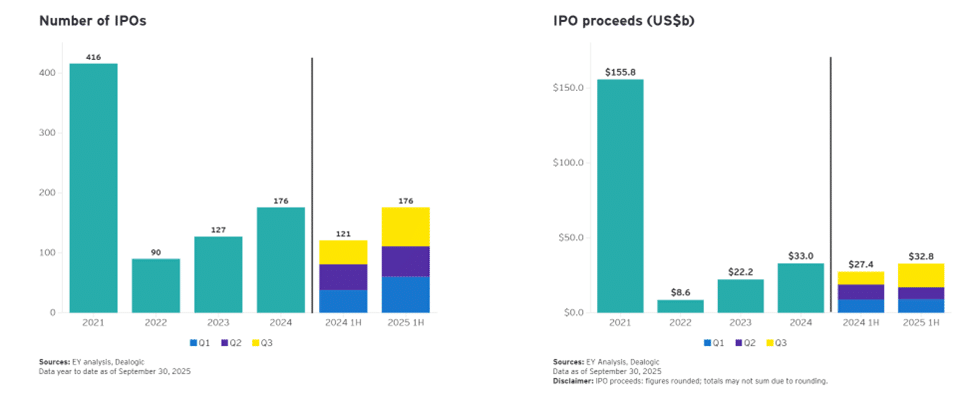

The third quarter of 2025 marked the most active period for U.S. IPOs since 2021. During the quarter, 65 U.S. companies went public, raising $15.7 billion—up meaningfully from the 40 IPOs that raised $8.6 billion in the third quarter of 2024. Momentum was driven by 23 offerings that raised $100 million or more, including five deals exceeding $1 billion in proceeds.

This resurgence has renewed investor optimism that the IPO market may be entering a sustained recovery after falling sharply from its 2021 peak. Improved deal execution, stronger aftermarket performance, and greater valuation discipline have contributed to a more constructive environment for issuers and investors alike.

Looking ahead, the IPO pipeline for 2026 includes several notable private companies that could make their public market debuts. Among the most closely watched are OpenAI and SpaceX, both of which have attracted significant attention due to valuation expectations that would place them among the world’s most valuable publicly traded companies.

A healthy IPO pipeline is essential to the broader capital ecosystem: it allows private market investors to achieve liquidity and recycle capital into innovation, while providing public market investors access to high-growth businesses that have increasingly remained private for longer. Several factors suggest that 2026 could see continued momentum in IPO activity, building on progress from 2025:

While risks remain—particularly for technology companies with high exposure to the AI trade—investors are increasingly focused on a new cohort of potential public offerings in 2026. Successful execution of these IPOs could represent a meaningful inflection point for a market that has remained constrained for several years.

Below are several notable IPOs to watch in 2026. This list is not an endorsement of any company, but rather a framework for monitoring where investor appetite and potential market leadership may emerge as the IPO window continues to open.1

IPOs to Watch in 2026

Company: OpenAI

Primary Business Offering: OpenAI is an artificial intelligence research and product company focused on developing advanced AI systems, particularly large language models (LLMs) and other frontier AI technologies such as ChatGPT.

Year founded: 2015

Headquarters: San Francisco, California

Reason it’s worth watching: OpenAI is reportedly preparing for a new funding round in 2026, including a possible IPO. Recent reporting from The Wall Street Journal suggests the company’s latest financing discussions could imply a valuation of $830 billion, while other reports point to targets as high as $1 trillion. Despite this investor enthusiasm, CEO Sam Altman has publicly stated that he is “0% excited” about becoming the CEO of a public company. Whether market demand and capital requirements ultimately outweigh Altman’s reluctance to pursue an IPO in 2026 remains a key question that investors will be watching.

Company: Anthropic

Primary Business Offering: Similar to OpenAI, Anthropic is an artificial intelligence research and product company. It’s best known for its flagship AI assistant, Claude, which competes directly with models developed by OpenAI and Google.

Year founded: 2021

Headquarters: San Francisco, California

Reason it’s worth watching: Anthropic is reportedly exploring its own IPO as it competes for AI supremacy against OpenAI and others. Investor sentiment around the AI trade has been skittish of late, so it will be interesting to watch whether Anthropic taps public markets to continue fueling its ambitions. A decision to access public markets would signal confidence in the durability of AI demand and its own competitive positioning, while opting to remain private and continue raising capital could reflect a preference to further scale compute, infrastructure, and enterprise adoption before subjecting the business to public market scrutiny and volatility.

Company: SpaceX

Primary Business Offering: SpaceX is an American space technology company that designs, manufactures and launches advanced rockets and spacecraft. The company has made numerous advancements in rocket propulsion, reusable launch vehicle, human spaceflight, and satellite constellation technology since its founding.

Year founded: 2002

Headquarters: SpaceX is now headquartered in the city of Starbase, Texas, after Musk moved the company from its previous headquarters in Hawthorne, California.

Reason it’s worth watching: SpaceX is widely expected to pursue one of the largest IPOs in history. While Elon Musk had previously dismissed IPO speculation, he has since acknowledged that reports of a potential 2026 offering are “accurate.” Multiple media outlets have indicated that the company could seek to raise more than $30 billion at an implied valuation of approximately $1.5 trillion. These reports follow earlier coverage by The Wall Street Journal suggesting SpaceX was initiating a secondary share sale at an $800 billion valuation—claims Musk later described as “not accurate.” If SpaceX ultimately proceeds with a public listing, it would represent a landmark event for both the IPO market and the broader technology sector.

Company: Databricks

Primary Business Offering: Databricks is a data and AI company that simplifies data architectures by unifying information, analytics, and AI workloads into one common platform.

Year founded: 2013

Headquarters: San Francisco, California

Reason it’s worth watching: Databricks has appeared on our annual “IPOs to Watch” list for multiple years, yet the company remains private. In its most recent funding round, Databricks raised more than $4 billion at a $134 billion valuation. Alongside the announcement, the company disclosed that it surpassed a $4.8 billion revenue run rate in the third quarter, representing growth of more than 55% year over year, and generated positive cash flow over the past 12 months. With a substantial capital base and strong financial profile, it will be worth monitoring whether Databricks ultimately pivots toward the public markets or continues scaling privately—particularly if companies like OpenAI and Anthropic complete successful IPOs in 2026.

DISCLOSURE: Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.