When challenged over a shifting position, John Maynard Keynes famously replied “when the facts change, I change my mind. What do you do, sir?”. In theory, this sounds like sound advice. In practice, the challenge is knowing which facts matter, and which just provide noise. Even more challenging for investors is knowing what to do when new facts point in different, or even opposing, directions. With this in mind, the following eight trends are likely to reshape global markets for years to come:

The above list hopefully satisfies the always-worthwhile admonishment to “keep it simple, stupid”. Such developments seem obvious enough, as does the fact that any of the above trends would, by themselves, have a deep impact on asset price valuations. Together, they make for a very potent brew that will reshape financial markets for years to come. Specifically:

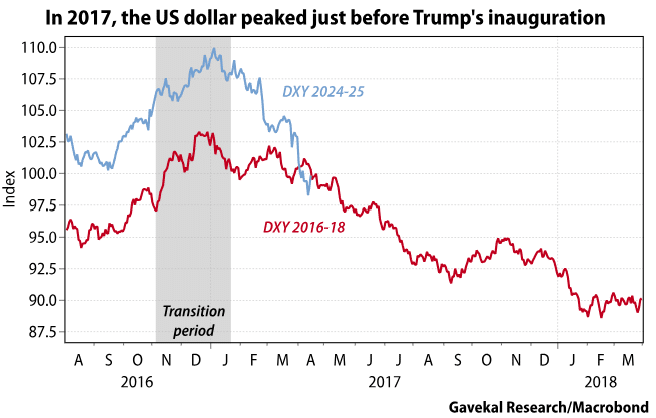

The aforementioned trends are bearish for the US dollar. For now, the DXY index seems to be tracking the patterns of the first Trump presidency. And yet the second Trump presidency is proving far less foreigner-friendly than the first. It thus seems likely that the dollar will remain under pressure.

The inability of treasuries to rally in the face of the past few weeks’ turmoil is an important tell. It seems that a mild US recession and massive equity losses are no longer enough to drive investors into US government bonds. This may be because of the stimulus coming from China and Europe. Or it may be because foreign investors are now trying to reduce their US exposure. Or it may simply be that the issuance and rollovers of US debt are too big for the market to readily digest.

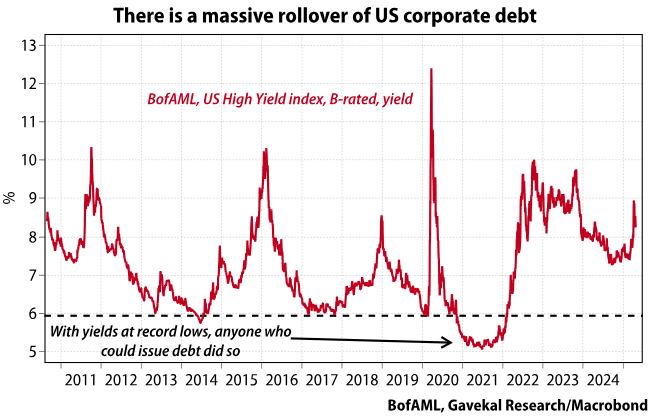

One of the big stories of the second half of 2025 is the record rollovers in US corporate debt. This is the echo of the late 2020 issuance boom that mostly went into share buybacks. Widening spreads are the Achilles’ heel of the US economy and of financial markets.

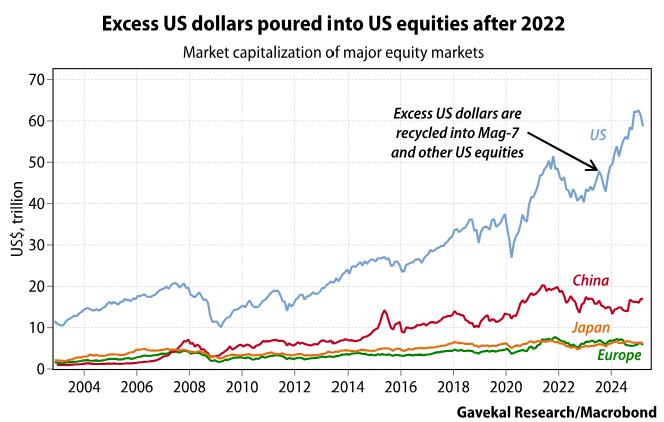

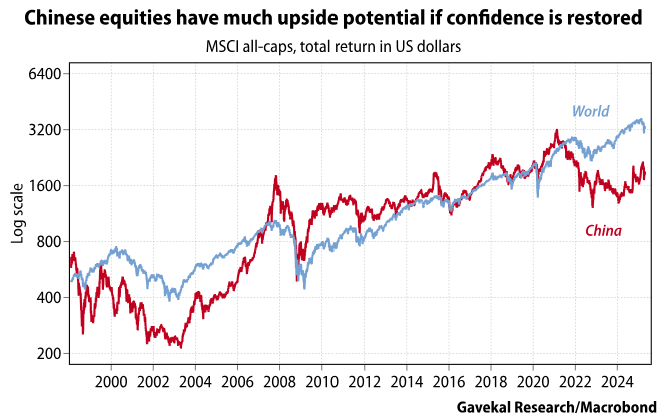

Between 2022 and early 2025, US equities added US$20trn in market capitalization, or more than the total value of greater China equities (see chart below). A key driver of this trend was foreign investors becoming less willing to recycle excess US dollars into treasuries after Russian assets were seized and President Joe Biden pursued an aggressive pro-cyclical fiscal policy. Meanwhile, in recent months the combination of China’s DeepSeek release and the Trump administration’s constant targeting of foreigners has meant that US equities are no longer the default destination for excess US dollars to be parked.

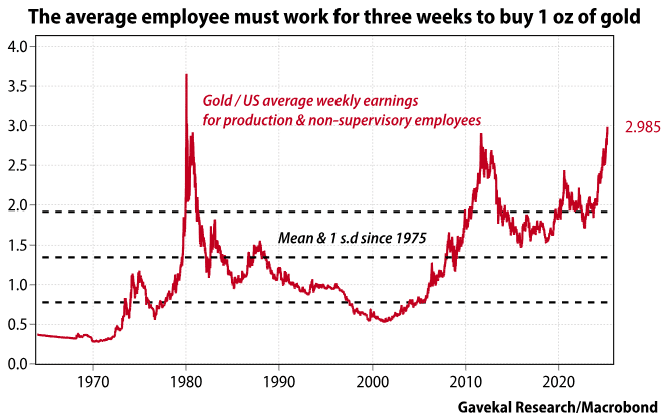

Almost all of the aforementioned trends are bullish for gold. The folding of the US security umbrella means that foreign central banks are now more likely to recycle excess savings into gold than into US treasuries or Magnificent-Seven stocks. The effect of fiscal and monetary policy stimulus being pursued in China and the European Union is also supportive of gold. The only issue with gold is that it is getting expensive.

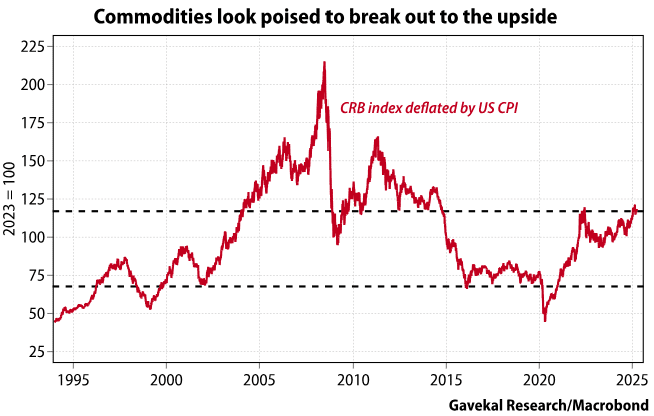

Most of the aforementioned trends—from the weaker US dollar to fiscal and monetary policy stimulus in China and Europe—are bullish for commodities. Most bullish of all should be the folding of the US security umbrella. In a more uncertain world, most countries and businesses should feel compelled to build up inventories of strategic commodities. As it turns out, commodities do look like they might be about to break out.

A major trend unfolding this year has been the repatriation of capital from the US back into Europe by large pension funds, private banks and other capital allocators. For now, these flows have mostly affected exchange rates, with the Swiss franc, euro, Swedish krona and British pound all strengthening. Will this capital now be redeployed into European equities? This is highly likely, especially given the domestic fiscal stimulus now being lined up. Perhaps it has even started.

On the one hand, the stronger euro should be a tailwind for fixed income instruments across the old continent. On the other hand, the fiscal stimulus is a major headwind to overcome. For now, a steeper yield curve seems to be the path of least resistance.

While Chinese companies are as globally competitive as they have ever been, consumer and business confidence remains in the doldrums. As such, China’s massive trade surpluses are still not being recycled into domestic assets. If/when this changes, the past year’s outperformance of Chinese equities will become turbocharged.

Most issuers are priced to fail. Most will; some will not. With China’s government stepping on the fiscal and monetary policy gas, this space offers an acute asymmetric risk-reward profile. At the very least, investors should ponder how to best position for the “brrrrr” sound the Chinese printer is set to make.

LatAm assets should benefit greatly from capital being repatriated by local pension funds and high-net-worth individuals. More importantly, the broader region should enjoy a rerating as it will surely benefit most from the reshoring of US foreign policy, and the rollout of “Fortress America”.

Financials seem to be outperforming in almost every major market. This may be a reflection of steeper yield curves. Or perhaps the fact that banks and insurance companies should witness great productivity gains through the application of artificial intelligence. Or maybe it is simply a consequence of improving net interest margins.

An entire generation of investors has been brought up with the experience/belief that dips in technology stocks are to be bought. But what if it is not the case this time around?

This feels like a pivotal year, with dramatic shifts in a number of political, geopolitical and economic forces. This situation is opening up attractive risk-reward opportunities in numerous asset classes. In light of the above, the trends that now seem to be unfolding in financial markets make sense. They also reiterate a long-held Gavekal belief that money managers are not paid to forecast, but to adapt.

DISCLOSURE: Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.