Below are Evergreen Gavekal's Likes/Dislikes for December 17th, 2021.

Is it buy the dip time again? That question is likely on the minds of millions of investors as 2021 races to a close. As noted in this week’s main EVA section, for a multitude of stocks the dip is more like a cliff-dive. Consequently, it’s tempting to buy aggressively into this sudden shake-out which undoubtedly is being magnified by tax-loss selling.

On the other hand, there is another source of selling which is far more concerning. In this case, it relates to insiders who have bailing out of their own companies at a record-breaking clip. Per Wharton accounting professor Daniel Taylor in the Wall Street Journal this week: “What you’re seeing is unprecedented”. Ominously, he further noted that the waves of insider liquidations remind him of what was seen in early 2000. Lest you forget what characterized that era, it was the beginning of the wrenching tech crash that would leave the Nasdaq down nearly 80% by the time the selling burned itself out almost three years later.

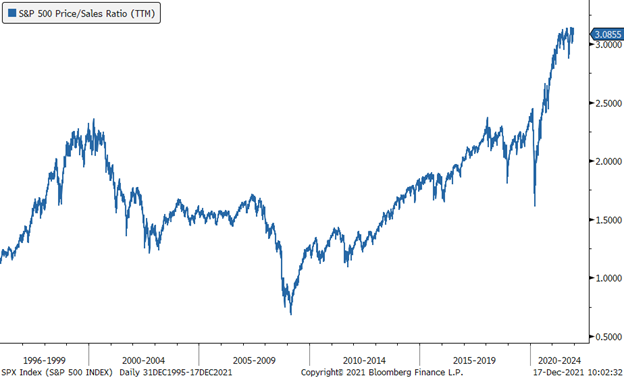

Because I’ve often conveyed my belief that there are many similarities between today’s stock market and that of roughly 22 years ago, that last part got my attention. Another parallel is that we are seeing widespread carnage while the S&P 500 index remains essentially unscathed. One more similarity is that valuations are equally astronomical, actually even more so based on the price-to-sales ratio which is among the best metrics in forecasting future long-term returns.

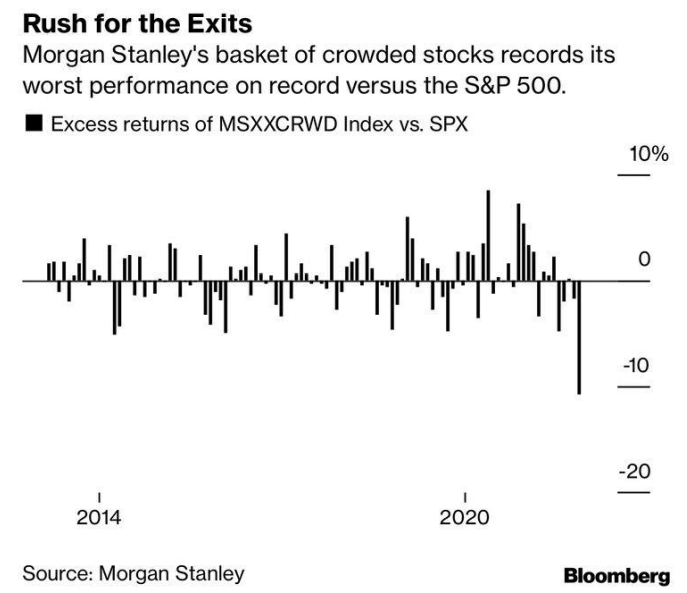

Another parallel with 2000, is that the average Nasdaq 100 stock is now down 17% , even though the index itself remains up over 20% for 2021. The gap between the average large cap “Naz” stock and the average itself is actually even wider than it was in 2000. As you can in the following chart, crowded, or overly popular stocks, are severely lagging the S&P 500. Snappy rallies are likely but the trend is no friend of these still silly-overpriced shares.

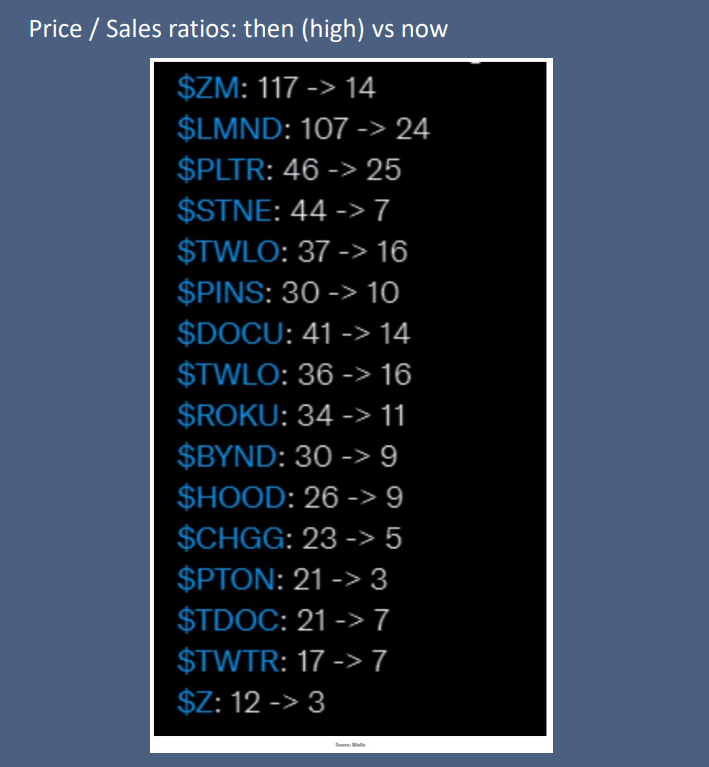

Another vivid illustration of how much damage has been done to most of the ludicrously inflated growth names, please check out the below image. Per earlier EVAs, 10 times sales (note, revenues, not earnings) is considered to be the bubblezone. That most of the below hit over 20 times sales, with a couple beyond 100 times, speaks to just how maniacal the speculative excesses became earlier this year. It’s truly been one for the record books.

So, we’ve got cracking growth stocks--at least of the non-mega-cap variety, like Microsoft (and even mighty MSFT has been sliding lately)--unparalleled insider selling, and valuations that are far into the danger zone. Maybe this isn’t the dip to buy, after all.

However, it might not be quite as open and shut as that. For one thing, insiders may be unusually motivated to sell right now because of potentially much higher capital gains tax rates next year. As Professor Taylor pointed out, senior management types selling immense blocks of stocks could save as much as $8 million on sales of $100 million of highly appreciated shares. Based on how freely options have been granted in recent years, combined with the spectacular up-moves in tech stocks, at least until recently, $100 million insider sales are not that uncommon. Therefore, perhaps the insider selling frenzy isn’t quite as concerning. But I wouldn’t totally blow it off, either.

What is much more of a source of comfort is what I have long referred to as a two-tier market. As I’ve noted before, the recent twin fears of the Fed going on a tightening warpath and the potential for another round of global lock-downs due to Omicron has triggered a sharp correction in a wide array of stocks that track the economy. Because I’m not particularly worried about either the Fed or Omicron, I continue to recommend accelerated accumulation of cyclical sectors, with energy still at the top of the list.

From recent research I’ve seen, I’m more convinced than ever that we are in the Third Energy Crisis of the last fifty years, with the shortages we’ve seen in recent months likely to become more acute next year. This is another reason why I believe inflation is likely to be stickier in 2022 than the consensus assumes.

On a related note, I see no reason to be a buyer of long-term US high-grade bonds like Treasuries. This is despite the fact that sentiment is highly bearish on them right now (as regular EVA readers know, I hate being aligned with the majority); accordingly, they may rally short-term, but I continue to view them as certificates of confiscation. Overseas bond look much more attractive, in many cases, particularly in countries that are running significant trade surpluses.

Positioning Recommendations

LIKE

- Large-cap growth. (Some of the Teflon mega-cap issues have begun to crack of late. The better risk/reward ratios, however, can be found in large-cap names that aren’t in the mega category.)

- Certain international developed markets, especially Japan (Use the recent pull-back for adding to or initiating position in ETFs like EWJ. The Japanese market should be a beneficiary of overseas investors pulling capital out of China.)

- Publicly traded pipeline partnerships, i.e., MLPs and other mid-stream energy securities. (Buy on weakness! They look poised for their usual late December, January rally.)

- Gold-mining stocks (Ditto!)

- Gold (The miners appear far more undervalued at this point.)

- Silver (It has more snap-back potential than gold currently.)

- Select international blue chip oil stocks (Again, it’s time to be a buyer for long-term, contrarian investors.)

- Short-term investment grade corporate bonds (1-4 year maturities; favor shorter maturities due to rising inflation risks because of the likelihood that the Fed and the Treasury are over-stimulating the US economy.)

- Emerging market (EM) bonds in local currency (focusing on stronger countries, particularly in Asia)

- Large-cap value (Use Omicron-driven weakness to accelerate accumulation especially in more cyclical companies.)

- High-dividend equities with safe distributions (These, too, have been hit; thus, add selectively though they lack the rebound potential of more aggressive issues, outside of economically-sensitive areas.)

- Most cyclical resource-based stocks (Buy more aggressively.)

- BB-rated corporate bonds (Buy more selectively after a spectacular rally and favor shorter maturities.)

- Canadian REITs (Avoid office issues for now.)

- South Korean Equities (S. Korea remains one of my favorite markets.)

- Certain “Virus Victim” equities such as refiners, homebuilders, and select retail stocks (Certain retailers look extremely attractive right now, especially one that is based in Seattle with a famously generous return policy.)

- Investment-grade floating rate corporate bonds (Despite a vigorous rally this year, there remains decent long-term value in this bond market niche.)

- The higher quality mortgage REITs (Previously, we had recommended profit-taking; use recent weakness for re-accumulation.)

- Floating rate bank loans (Although GDP growth this quarter came in much slower than Q2, this should be a pause not a reversal. Thus, the still healthy US economy reduces default risks and the floating-rate structure of bank loans mitigates inflation risks.)

- Copper producers. (The largest US copper producer has declined about 7.1% recently, creating an attractive entry, or further accumulation, point.)

- A relatively new sector recommendation is healthcare stocks. Many have corrected and are trading at alluringly attractive valuations, often with lush dividend yields. (Use the recent weakness in some pharma names to accumulate; however, be selective as some have experienced strong rallies recently.)

- For those looking to for downside hedges, one of my personal favorite shorts is the Indian stock market. Its valuation looks indefensibly inflated.

NEUTRAL

- Uranium and uranium producers (There are better opportunities elsewhere for now.)

- Renewable Yield Cos (Based on the hefty rally that has occurred with this group in recent months, justifying our buy rating on them earlier this year, we are downgrading them to neutral; some profit-taking is reasonable despite bright long-term prospects.)

- A wide range of high-income securities, including preferred stocks (Preferred stocks look less attractive with prices up, yields down, and inflation risks on the rise. As with bonds, we prefer the floating-rate variety.)

- Intermediate-term investment-grade corporate bonds, yielding approximately 2.25% (Now rated neutral due to our increasing inflation concerns and the paucity of attractive yields; they have been under pressure lately due to rising rates overseas and escalating inflation concerns.)

- Mid-cap value

- Emerging stock markets; however, a number of Asian developing markets look undervalued (Caveat investor: These are much less bargain-rich than they were a year ago. China is an exception; its market has been crushed creating interesting value plays for brave investors. However, it’s continuing war on its best companies is a large and legitimate concern. Further, I would note key Chinese equities are breaking multi-year support.)

- US-based Real Estate Investment Trusts (REITs) (It is critical to be highly selective with this sector; however, the reopening of the US economy, despite recent challenges, should relieve pressure on some of the most impaired sub-sectors of the REIT universe—unless they are exposed to cities and/or states that are seeing significant population and business outflows.)

- Cash

- Canadian dollar-denominated short-term bonds (The recent yield spike makes these even more interesting—literally.)

- One- to two-year Treasury notes

- Traditionally “safe” sectors such as Staples and Utilities (Most utilities have had healthy price bumps lately; consequently, they are less appealing.)

- Virus Victors (I.E, those companies that have benefitted from global lockdowns and now sport premium valuations. Many have retreated significantly of late; Clorox, for example, remains down materially from its peak.)

- Small-cap value (This style has corrected 9% of late; however, it has held up considerably better than its growth-oriented peer—see below.)

- European banks (Shifting these back to neutral due to improving vaccination prospects on the Continent. Still-prevailing negative interest rates in Europe are very hard on bank profitability.)

DISLIKE

- Intermediate-term Treasury bonds (They have rallied lately due to pervasive negative sentiment—in other words, they were oversold—and Omicron-driven growth fears; longer-term, all distant maturity treasury bonds look decidedly unattractive.)

- Small-cap growth (Since late-February, around the time of our negative call on this style, it is now down 13 ½%; in fact, it has swooned by that amount in just the past month (down almost 13% since 11/8).

- Removing the short recommendation on small cap due to its recent correction. Small cap growth, however, continues to look vulnerable, especially should there be an oversold rally soon.

- As a relatively new tactical recommendation related to the above bullet, investors seeking to reduce equity exposure might want to buy an inverse small-cap ETF. One of these offers twice the upside—and downside—of the small cap index; i.e., should small caps fall 10%. (After the recent correction, this position is slightly positive.)

- Long-term treasury bonds (These are in the dislike category due to both Evergreen’s and Gavekal’s rising conviction in a looming burst of inflation; despite a now faltering rally over the last few months, long-treasuries remain down 4.5% on a total return basis this year.)

- Long-term investment grade corporate bonds (These are viewed negatively because of the narrow yield gap, or spread, between corporate debt and treasuries combined with our escalating inflation fears. However, there are a smattering of long-term issues that still offer attractive yields. Long-term corporate bonds have had a negative total return of -1.5% for the year.)

- Most municipal bonds (Munis have bounced a bit lately but we remain negatively disposed to longer issues.)

- US dollar (The dollar has rallied recently, pushing it up roughly 7.2% for the year. This is despite the fact that the US is running a trillion-dollar trade deficit and the Fed continues to fabricate money at over a $1 trillion annualized rate. Thus, the dollar’s long-term outlook appears very challenging and it remains overvalued versus many currencies, especially those in Asia.)

- Many semiconductor tech stocks (Semis have held up comparatively well during the shakeout; many of these names look extremely pricey and hence vulnerable.)

- Mid-cap growth

- Lower-rated junk bonds (For the first time ever, junk bonds “provide”, on average, a yield below inflation; thus, their other moniker, high yield, no longer applies. In my view, the lowest rated junk bonds offer the worst/risk reward.)

- Green energy stocks (Note, this refers to equities not the Renewable Yield Cos; most of the former had explosive up-moves in 2020 and into this year; lately, though, many green energy plays have been hit hard, especially the dodgiest issues like Lordstown Motors and Nikola. The recent new EV truck maker Rivian looks ludicrously overvalued; justifying that negativity, it has lost about 45% from its recent peak, down another 10% this week.)

- SPACs (Special Purpose Acquisition Companies, which are structured to greatly favor insiders and disadvantage retail investors. The SPAC ETF has fallen 36% from its February highs, justifying our negative stance on this highly speculative slice of the market.)

- Most new issues (Earlier this year, the IPO market was as frothy as I’ve seen it other than the giddiest days of the dot.com era; there are also signs the new-issue craze is fading, even though some recent IPOs have had explosive moves…if you were able to attain shares at the initial offering price, which every few are. Be very careful about chasing these in the secondary market.)

- Despite a disastrous February, most of the popular Reddit/WallStreetBets stocks still have material downside. (As noted above, my repeated bearish views on these lottery tickets have been vindicated, at least for now. For those that care, I would sell or short AMC into today’s Spiderman-driven rally.)

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.