By Louis Vincent-Gave

Given the Ukraine war, political upheaval in France, the looming arrest of a former US president, and worrisome bank failures, it would be easy to conclude that the world is going to hell in a handbasket. Yet, amid the bad news, recent weeks have seen two encouraging developments. The first is the restart of diplomatic relations between Iran and Saudi Arabia, which could help end the murderous proxy conflict in Yemen. A related development is this week’s visit by Syria’s president Bashar al Assad to the United Arab Emirates (Assad has long been supported by Iran, while the UAE is close to Saudi). One could conclude that after 20 years of turmoil, peace is breaking out across the Middle East. If so, this will have important investment consequences.

Impact #1: energy prices.

I have been an energy bull on the basis that as China reopens, stretched oil producers will struggle to satisfy demand. Yet in recent months, energy prices have fallen and energy stocks have struggled. On Monday, WTI crude prices briefly fell to US$67 a barrel on fears that banking woes may cause a US recession and hit oil demand. Such price signals could also point to a disappointing Chinese recovery, although this is not borne out by the latest data. It could also be down to a structural shift in the global energy environment, as big energy buyers like India and China can now buy energy at a discount from a sanctioned Russia. Or perhaps weak oil prices stem from final demand globally being impacted by the growth in electric and hybrid vehicles.

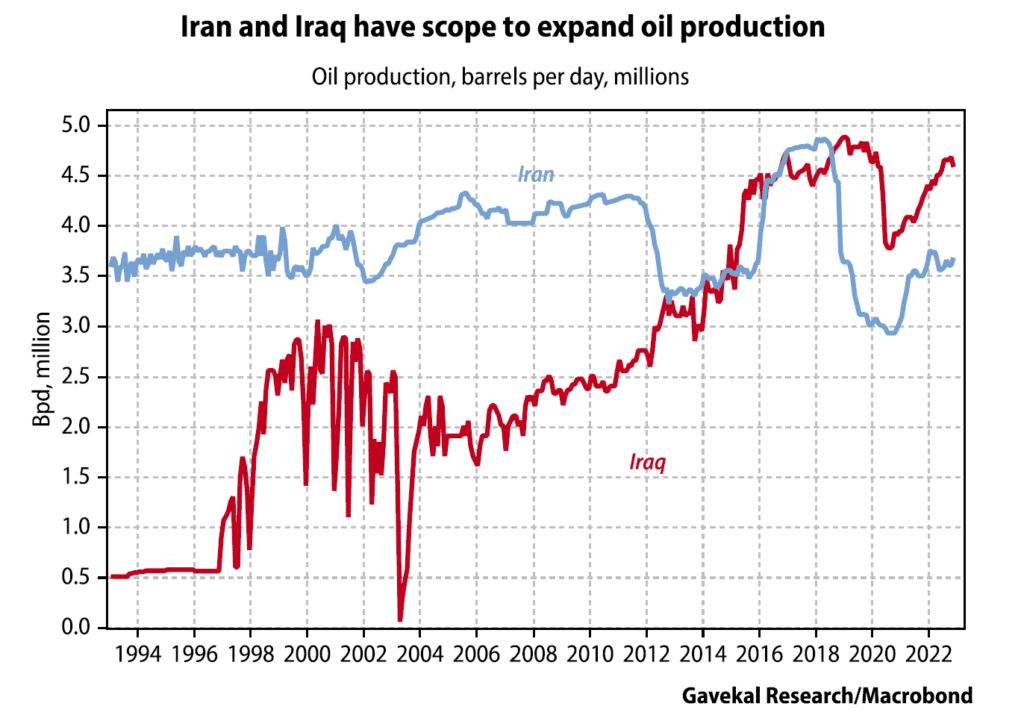

But perhaps the simplest explanation is that as peace breaks out in the Middle East, part of the geopolitical risk premium is being taken out. After all, the broader Middle East has been deeply unsettled since the US invaded Iraq in 2003. Iraq itself has been devastated and became the stage for a proxy war against Iran. This matters because Iraq is one of the world’s big low-cost oil producers—as is Iran. So an outbreak of peace across the Middle East could see more capital spending in both countries and thus more crude production eventuating from them.

Impact #2: arms makers

Saudi Arabia, Qatar and the UAE have been eager clients of the Western death merchants, mostly because they feared Iranian expansionism. Yet in recent years, disruptive weapons like drones have made warfare asymmetric as conventional military hardware is left vulnerable to sudden destruction. Perhaps this realization was a factor in peace breaking out. Whatever the reason, more peace should mean less defense spending; and less defense spending means that Middle Eastern nations will have less need for Western currency.

Impact #3: US-Saudi relations

In February 1945, President Franklin D. Roosevelt met with King Abdulaziz Ibn Saud on a US destroyer in the Red Sea and struck a deal. In return for ending its dependency on Britain, the US guaranteed the Saudi regime’s safety, and the Saud family guaranteed the US access to Saudi oil—most importantly, that oil would be priced in US dollars. As a result, Saudi stayed safe and the US dollar was guaranteed to remain the world’s reserve currency, if for no other reason than that all oil trades were priced in dollars (that was until the US forced Russia to sell its oil in Indian rupees, Chinese renminbi, Thai baht, Emirati dirhams, etc). But how much will Saudi need US security guarantees if peace negotiations make it more secure in its immediate neighborhood? If so, Riyadh may feel less need to constantly recycle large current account surpluses into Western assets.

On this last point, Saudi crown prince Mohammed bin Salman has not been shy in presenting ambitious development goals for his country, which he wants to see act as a guiding light across the Middle East. Clearly, fostering a peaceful backdrop is key to any long-term development goal that allows most Saudi savings to be redeployed domestically. The fact that investments in Western markets are turning out to be duds—like last year’s record loss on US treasuries and the Saudi National Bank’s Credit Suisse stake wipeout— will only further encourage such domestic use of excess capital.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.