On October 19th, the Wall Street Journal (WSJ) published an article by Eric Wallerstein entitled, “The Trusted 60-40 Investing Strategy Just Had Its Worst Year in Generations. Higher interest rates and inflation are upending millions of Americans’ retirement planning. Wall Street’s boilerplate mix of stocks and bonds isn’t cutting it anymore.” In short, the author proclaims that while many advisors have defaulted clients into a portfolio of 60% stocks and 40% bonds, it has now become passe. Is this true?

The recent evidence does appear quite damning for conventional wisdom in building retirement portfolios. In 2022, the 60/40 portfolio lost 17%; its worst year since 1937. The article goes on to point out that the outlook doesn’t appear much brighter. With rates still rising, the bond market isn’t offering much safety. He adds that another fundamental change is afoot: stock and bond prices typically move opposite each other, but recently they appear to be moving in unison.

I chose to examine this WSJ piece because it makes claims that I have seen circulated broadly in financial media and it is important for Evergreen clients to know where our firm and investment committee stand.

The definition of a balanced portfolio has changed over the years as low returns from bonds have coaxed more investors into stocks and made the composition of funds labeled “moderate risk” look more aggressive than in years past. Research shows that most Americans are too heavily weighted in stocks, including older investors who are drawing on their portfolios to pay bills and maintain their lifestyle. A Vanguard study even found that more than 20% of investors over age 85 have all their money in stocks.

Why would a person in (or nearing) retirement invest their accounts so aggressively? Charts abound showing how you can make 9% annualized by investing in all stocks for the long term. What these statistics leave out is the amount of people who realize their investments and true risk tolerance are misaligned, then rush from risk to safety at exactly the wrong time. I should note that I cannot think of a more dependable way to destroy wealth over time than to take on more risk than you can stomach only to sell when markets drop and then re-enter after the recovery is underway. It is better to err on the side of caution when assessing one’s own appetite for risk, as a mistake in those assumptions can be financially paralyzing.

Prospective clients often walk in the door of our office with an idea of what they would like their portfolio to earn over time. When they say, “I want to earn 9%”, the advisor will reply, “Does that also mean you’re willing to see your portfolio decline by 66%?” Nearly all clients reject this level of risk. Unfortunately, many financial advisors are happy to sell the idea of higher returns and brush over the risks associated with that. After all, the higher returns they promise, the happier the client will be…at first. Some advisors will nudge clients into these higher risk levels by using this cute accounting trick that obscures market volatility:

Over the past 50 years, the worst year for stocks was 2008, when the S&P 500 declined 37%. Firms often tell clients they are looking carefully at history and quote -37% as the worst-case scenario. As it turns out, by looking only at the calendar year of 2008, a part of the decline that started in 2007 and the tail end which continued into 2009 are eliminated. Admittedly, no one likes losing money, but down -37% is a lot more palatable than down -66%, which was the true market decline from the peak in 2007 to the bottom in 2009.

Stock-heavy portfolios make sense for investors who are not drawing income from their investments and can stomach the ups-and-downs of the market. Yet, many investors mistakenly stretch for higher returns, particularly in times of benevolent market conditions. While stocks can improve the expected return of a portfolio, there are additional ways to enhance overall return while also increasing diversification, something we will discuss later in this piece.

It is true that “balanced” is the most ubiquitous portfolio recommendation on Earth, and the reasoning for this is sound. By combining stocks with bonds, using history as a guide, it has smoothed out portfolio volatility. The returns between stocks and bonds have been inversely correlated as we’ve pointed out. More recently, we’ve seen instances where both stocks and bonds have been declining in unison. Many investors were left holding a losing hand in 2022, which serves as the crux of the argument against the 60/40 portfolio in the aforementioned WSJ article. A closer examination of the fine print tells a different story about 2022 and balanced portfolios. This discrepancy is due to the factors which impact bonds and are far less visible than those factors impacting stocks.

Bonds are unusual financial creatures and the market for them is larger than most individual investors realize. The global credit market is roughly three times the size of the global equity market and is incredibly diverse. There are US government bonds, foreign government bonds, investment grade bonds (stable companies), junk bonds (less stable companies), short-term bonds, medium-term bonds, long-term bonds, bonds with fixed rates, bonds with floating rates, bonds that go from fixed to floating rates… It sounds like Dr. Seuss meets Wall Street as I list the dizzying assortment of bond options. Even more confusing is how they behave. If the economy is strong, you can assume with reasonable certainty that your stock portfolio will increase in value. Bonds are more nuanced. Bonds that appear similar when held side-by-side often are not and will perform differently in reaction to the economic environment and monetary policy. Take for example, the Treasury bonds below.

| Bond A | Bond B | |

| Borrower | U.S. Government | U.S. Government |

| Term | 1 Year | 20 Years |

| Return 12/31/21-10/25/23 | +1% | -44% |

Bond A is a 1-year government treasury and Bond B is a 20- year government treasury. The borrower is the same (the US government) and the only difference is one bond will expire in one year and the other will expire in 20 years. From 12/31/2021 to today, Bond A returned a total of 1%—not great, but when you consider that Bond B lost 44%, it’s not so bad!

The reason for this massive performance discrepancy is the effect of changes in interest rates. As a direct result of the Fed’s unprecedented hiking campaign, bonds with longer maturity dates have been decimated. Short-term bonds saw far brighter days in the face of this rise in interest rates, a welcomed change from their status just a few years earlier.

Fortunately, at Evergreen, we build our portfolios in-house, which allows us to be nimble, adjusting our holdings based on such changing market factors. However, not all advisors actively manage portfolios in-house. It is much more work and applying more resources to an asset class that’s typically consider far less sexy (bonds) may seem like a fool’s errand. Part of the appeal of the 60/40 portfolio for many advisors is that in its most static form, it’s supposed to act like an autopilot form of investing. If you failed to be nimble and just purchased the off-the-shelf Bloomberg Aggregate Bond Index, as many investors did, you have watched the “safe” portion of portfolio fall significantly.

We have established that not all 60/40 portfolios are created equal and actively managing the bond side of the portfolio has advantages over a static approach. Next, let’s explore why stocks and bonds have changed from being inversely correlated to correlated, and whether we expect that to be the norm going forward.

The Federal Reserve kept rates low following the Great Financial Crisis hoping to aid in the market’s recovery. The reasoning is that low interest rates encourage borrowers and discourage savers. Rates were kept low far longer than many observers thought prudent, as they warned of a dangerous side effect: inflation.

Inflation didn’t arrive as expected, as the Covid-19 crisis triggered the inflationary environment that many had warned would come eventually. The combination of broken supply chains and unprecedented direct government stimulus finally ignited the kindling and started a wildfire for prices. The Federal Reserve has since found itself like a firefighter trying to squelch the flames of inflation by heaping buckets of rate hikes upon the economy. These rate hikes have a restrictive effect on economic activity, as anyone who’s in the market for a mortgage can attest. Eventually, as the effects of higher rates began to ripple throughout the economy, bond prices faced a sudden reckoning as demonstrated above with Bonds A and B. Said simply, the Fed knowingly and expressly pursued a campaign despite the risk of significant collateral damage.

Already, longer term bond holders have been punched in the gut. Borrowers of debt who failed to manage their liabilities appropriately have been devastated and, in some cases, wiped out (i.e. Silicon Valley Bank/First Republic Bank.) Today, we find our situation juxtaposed to where we were just a few years ago when interest rates appeared to be permanently at near zero. The knee jerk reaction by investors has been to rejoice in the fact that simply sitting on money markets seems like a free lunch. With the 10-Year treasury recently touching 5%, it is plausible that the increasing strain on the economy could tip us into a recession, but it also means we are likely approaching the end of Fed hikes. If this happens, it will mean that the Fed’s rate hiking campaign will soon give way to yet another easing cycle, once again changing the required playbook for successfully investing in bonds. Investors who are riding high on short-term bonds or money market funds could find themselves awash in liquidity with far less favorable places to deploy it than should they act today.

Historically, when the Shiller P/E (a metric that attempts to determine whether stocks are cheap versus expensive) reaches its present readings, future stock returns have been 2.6% annually over the next 10 years. There are other metrics that redundantly sing the same tune, suggesting that stocks are expensive. Shifting to bonds may have seemed like a viable option but many investors have been burned. Neither of these points are meant to suggest abandoning those asset classes entirely. In fact, we think there are good values to be found in both stocks and bonds, if you shop selectively and strategically. Which begs another question...are these the only areas to invest capital?

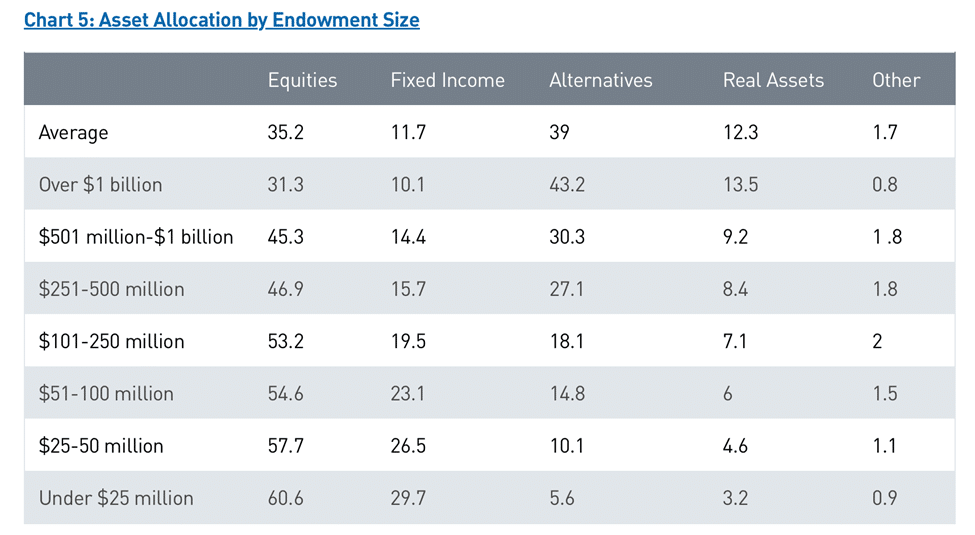

We think one viable opportunity lies in the typically unexplored universe of alternatives assets. The average retail investor has very little, if any, of their assets allocated to private markets/alternative investments. Private market investing is a mysterious and decidedly opaque region of the financial system that feels out of reach to the investing public. Contrast this with the body of professional investors, such as large pension funds and endowments, that have significant portions of their portfolio in alternatives. A PNC study found that for Endowments over $1 billion they had more of their capital invested in alternatives than stocks and bonds combined, allocating 43% of their total asset base.

Contrast this with endowments under $25 million that invested only 5.6% of their assets in alternatives on average. In this same study, larger endowments outperformed smaller ones by 1.3% per year over a 10-year period. This doesn’t sound like much but, for an investor with $2,000,000, this incremental 1.3% over 30 years will equate to approximately one million additional dollars. Larger investors know that by investing in private markets they can possibly unlock greater value than if they only invested in publicly accessible stocks and bonds.

*Alternative investments are a financial asset that does not fit into the conventional equity/income/cash categories. Examples of “alternatives” include, but are not limited to, private equity (and debt) or venture capital, hedge funds and real estate.

Admittedly, there are certain benefits to investing in public markets. They provide the highest levels of liquidity, meaning you can sell either a stock or bond at nearly a moment’s notice to come up with cash. Public market investments are also highly regulated and transparent. These companies are required to make regular filings where they disclose droves of relevant information for an investor to interpret. But remember, the access to public companies is just that, public. There are limited, if any, barriers to entry and everyone can research and subsequently invest in any and all aspects of the public markets.

Alternative investments have exactly the opposite characteristics. Some of the top private funds have minimums of $10,000,000 to invest in a single fund, making them anything but accessible for most investors. Often, even if an investor meets the minimum, the best-in-class funds are oversubscribed, meaning there’s more willing investors than there is room in the fund. Therefore, to gain access, you not only need money but, often times, it requires a relationship. In addition to issues with access, there are also issues with liquidity. The typical fund has a lifetime of 10 years, which triggers reluctance among investors not accustomed to such a structure. Also, due to regulatory guidelines, there are significant restrictions on how these funds can advertise their investments, making them not only expensive and hard to access but difficult to find in the first place. Many investments in the world of alternatives require a significant amount of due diligence as well as breadth of expertise within the varying asset classes, including but not limited to Private Equity, Venture Capital, Real Estate and Private Credit. Even for those investors who can navigate these complexities, there’s an additional consideration referred to as vintage risk. While Napa Valley is home to many of the best wineries in America, some vintages are better than others. Similarly, it is critical for alternative investors to not only diversify among the types of private investments but also the timing in which they invest.

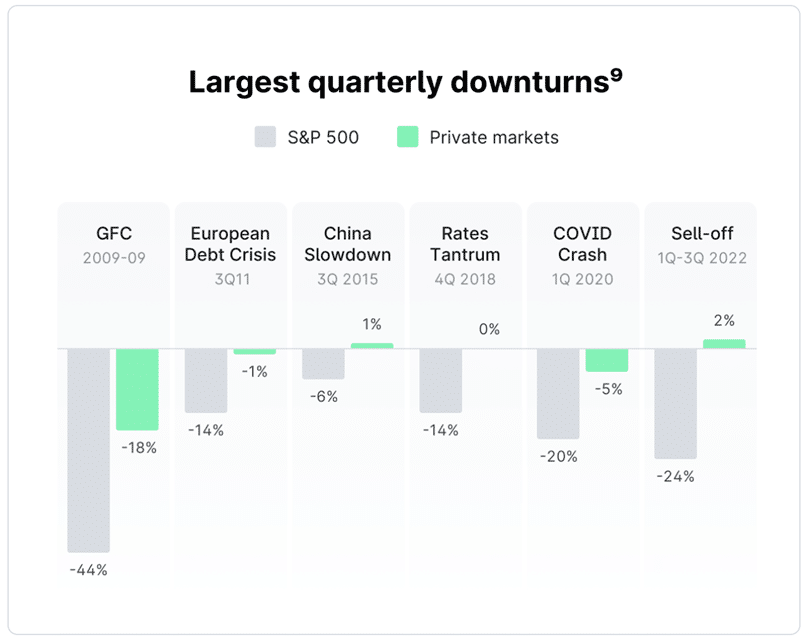

Private market returns have behaved differently than the stock market. Generally speaking, if you invest in stocks and the economy tips into a recession, it’s likely that your basket of stocks will also decline along with it. Private markets have much more idiosyncratic risk, meaning you’re betting more on the outcome of a specific company than the economy as a whole. This plays a valuable role for an investor looking to diversify their portfolio away from economic fluctuations. While a portion of your wealth may ebb and flow along with the economy, another portion will be tied to the performance of specific business outcomes. Maybe that sounds risky? Consider this chart from Yieldstreet. In the past five stock downturns, private markets have outperformed the S&P 500 by an average of 18% per decline. The idea that alternative investments are just speculative bets to be made while the sun is shining is not supported by stubborn facts.

Source: Yieldstreet. As of 1/26/2023.

9. Past performance is not indicative of future results. The chart represents the largest quarterly drawdowns in the S&P 500 since 1/1/2008. “Private markets” represents an equally weighted (33.3%) blended index across Private Real Estate, Private Equity and Private Credit. Private Real Estate consists of the NCREIF Property Index (33.3%), Private Equity consists of the Preqin Private Equity index (33.3%), and Private Credit consists of the Preqin Private Debt Index (16.65%) and Cliffwater Direct Lending Index (16.65%). It is not possible to invest directly in an index of private market assets. Unless otherwise noted, financial indices assume reinvestment of dividends. All indices are unmanaged.

Investing in private markets is certainly not appropriate for all investors. When it is appropriate, there are hurdles related to access, complexity, and liquidity. We expect that in the decades ahead the issue of access will abate first. The issue of complexity and liquidity, however, are inherent in these types of investments and will likely be the source of greater risk adjusted returns.

Most people should not invest in stocks alone. The role of a balanced portfolio is not dead and remains a critical tool for many investors. The dismal performance of this strategy of late has highlighted important aspects of the investment process that seemed to have been forgotten until now.

The role of bonds is not insignificant to most investors. They represent a sizeable portion of many individuals’ portfolios. Yet, so often, the stock portion of investors’ portfolios command an overwhelming amount of the investment headlines. We believe the ability to create dynamically shaped bond portfolios versus simply buying off-the-shelf products is a critical value add versus the “set it and forget it” mindset used by many of our peers in the wealth management industry.

An active approach has played a valuable role in our investment success over the years. In some instances, being strategic about the bonds to own is only the first step in maximizing a portfolio’s potential. When it is appropriate, expanding the asset class universe beyond public markets can provide improved diversification as well as help drive better returns. To do this, clients must be willing to evolve their prior thinking and educate themselves on these lesser-understood asset classes. We believe that the marriage of a dynamically evolving investment process that can stretch across the widest range of asset classes has the best chance of helping investors achieve their investment goals. This is why we continue to pursue such a course on behalf of our clients.

Tyler Hay

Chief Executive Officer

DISCLOSURE: Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.