Saturday’s 11th-hour deal to suspend the US federal debt limit until 2025 will bring down the curtain on the political drama over the debt ceiling until after the 2024 election. But for investors, the story is far from over. The ripple-effects of the debt ceiling deal on financial markets and monetary policy are only just getting started.

These will affect markets in three phases.

Phase one: Relief. Financial markets will heave a heartfelt sigh of relief now the near-term possibility has been eliminated that the US government might miss payments or potentially default on its debt, which remains the world’s most important “risk free” asset. “Risk free,” of course, is a misnomer, as the brinksmanship over the debt ceiling reminds us. But following the deal, US treasuries will once again be considered as low risk as ever, at least in terms of default risk (inflation risk is another matter).

The market will also be relieved that the Treasury did not resort to dangerous expedients such as issuing US$1trn platinum coins and depositing them at the Federal Reserve. Superficially intriguing, this would have handed the Treasury a blank check, made modern monetary theory a reality, and destroyed the Fed’s independence on monetary policy (see Debt Ceiling Games). Instead, political compromise has imposed at least a marginal restraint on government spending growth. The US fiscal outlook cannot be described as healthy, but Saturday’s debt ceiling deal has made it marginally better, not worse.

All else equal, this relief should be positive for the US dollar and for US treasuries, especially at the short end of the curve. Last Friday, one-month T-bill yields traded as high as 6.02% on default fears. They should now normalize, converging with the Fed’s policy rate of 5-5.25%.

Phase 2: Treasury issuance drains liquidity. With the debt ceiling looming, the Treasury ran down its cash balances to just US$39bn, some US$540bn below its target of one week’s worth of its outflows (give or take US$100bn; outflows are volatile). With the debt ceiling now suspended, the Treasury will quickly issue debt, not just to make payments (which only move money around), but also to replenish its cash balances (which will drain liquidity from the private sector permanently—or at least until the next debt ceiling crisis).

The reduction in private-sector cash could put additional upward pressure on the US dollar and weigh on asset prices (see US Debt Ceiling Risks). Treasuries are likely to be especially affected by the combination of stepped-up issues and fewer dollars to buy them. This could also threaten banks. First, a sell-off in treasuries will add to unrealized losses on bank balance sheets, which could (i) scare off depositors, and (ii) force them to raise new capital. Second, the Treasury’s move to raise cash could suck deposits out of the banking system and deplete bank reserves, potentially creating liquidity problems (see How Does This Banking Crisis End?).

Phase 3: The end of quantitative tightening. After Congress increased the debt ceiling in August 2019, cash-raising by the Treasury drained liquidity to such an extent that the US financial system found itself facing a mini repo crisis the following month. Initially, the Fed responded by providing emergency loans on demand. But realizing it had gone too far with quantitative tightening, the Fed quickly found a permanent solution by pivoting to quantitative easing, so increasing the stock of bank reserves on a permanent basis.

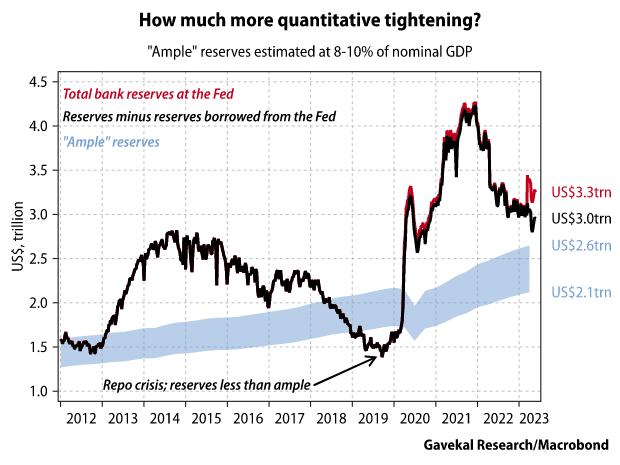

The experience was instructive. The stated aim of the Fed’s current program of QT is to reduce reserves to levels that are “just ample.” By implication, it wants to avoid running reserves down to levels that are less than ample, which would risk a repeat of the 2019 mini crisis.

It is hard to say where the line between ample and sub-ample lies. But the Fed is likely to target a level of reserves, adjusted for nominal growth, similar to the level that prevailed in late 2018 or early 2019, just before stresses appeared. Work by New York Fed staff suggests this means a level of reserves equal to 8-10% of nominal GDP (see Positioning For A Changing US Liquidity Environment).

Today, total reserves are some US$700bn above this range. If necessary, banks can borrow more reserves from the Fed, provided they have sufficient eligible collateral. However, reserves and collateral are unevenly distributed, so some banks may still get into trouble (see Time Is Running Out).

If the banking system shows no signs of liquidity stresses, the Fed will not need to start QE again. But it may still end QT. QT targets the level of non-borrowed reserves, which is now only about US$400bn above the desired range. If the US$540bn that the Treasury hoovers up to replenish its cash hoard comes mostly from bank reserves (rather than from the Fed’s reverse repo facility), reserves will fall into the desired range. Therefore, even without signs of stress, the Fed could well signal the end of quantitative tightening in the next few months, potentially at the Jackson Hole meeting in August.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.