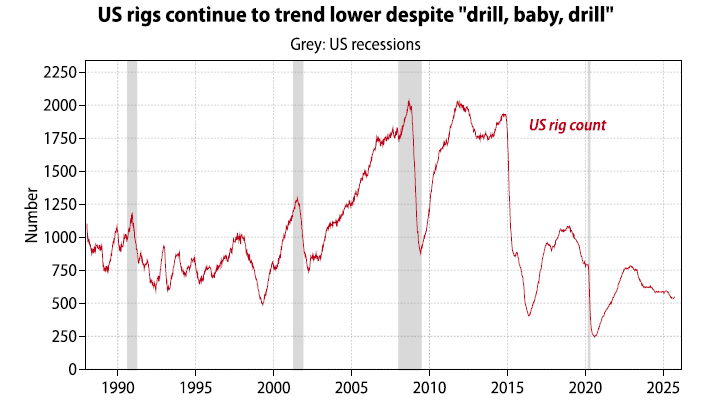

The American economist Thomas Sowell famously said that, in life, “there are no solutions, only trade-offs”. While this is undeniably true of most economic choices (i.e. tariffs typically benefit some producers and hurt most consumers), it seems especially true of energy-policy decisions. In recent years, Western policy makers have tended to impose ever increasing restrictions on the broader carbon industry in the name of fighting climate change. For example, through ESG requirements, funding to carbon producers became scarce and expensive. Hence, for all the talk of “drill, baby, drill”, the number of operating rigs in the US remains on a downward trend.

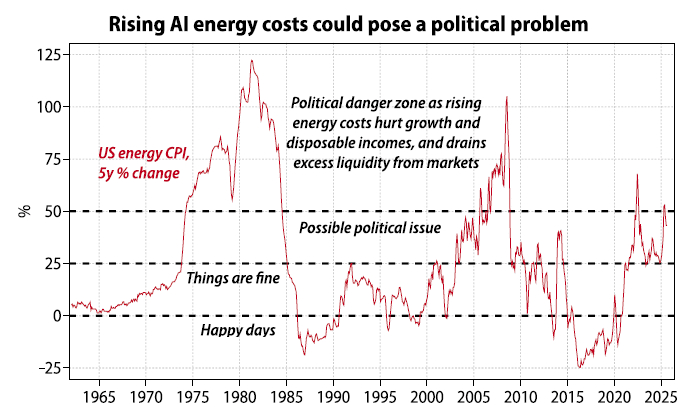

This policy choice by Western leaders of constraining energy production will be seen by most as either very courageous, or very short-sighted. On the latter point, recent political history tends to show that one of the surest ways for Western policy makers to lose the voting public’s confidence is to preside over a sharp rise in energy prices. This is what happened to Jimmy Carter, Valéry Giscard d’Estaing and Edward Heathin the 1970s. This political opprobrium makes sense for several reasons, including the fact that:

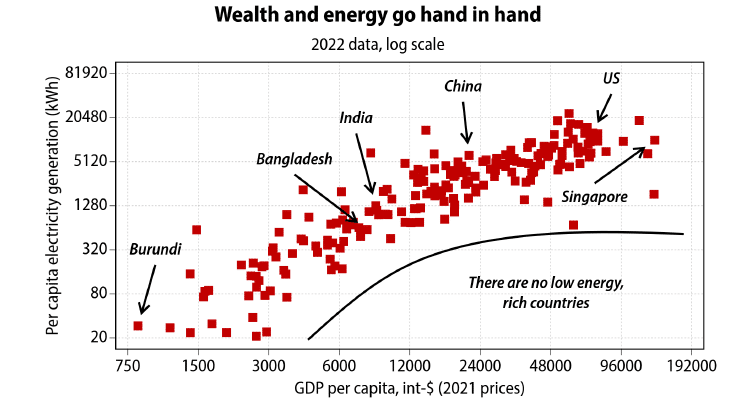

Suffice to say that given the importance of energy prices to our modern economies, it would be fair to assume that the first priority of any elected official taking office would be to drive energy prices lower; whether through foreign policy (signing long-term supply contracts with reliable producers), energy policy, industrial policy and even educational policy (encouraging the training of young engineers to work in the energy complex, whether nuclear, petroleum or renewable). But again, very surprisingly, the precise opposite seems to have occurred across the Western world in recent decades. Rather than encourage more production of energy, Western policymakers have instead opted to encourage less consumption of energy. But in a world in which economic activity is energy transformed, less energy production, and consumption, essentially means less prosperity. As of yet, there are no examples of a rich country with low energy intensity, as shown in the chart below.

There are two reasons to highlight this fact. First, in many countries, rising energy prices are becoming a genuine Damocles’ sword over policymakers’ heads (giletsjaunes riots in France). The second is that the rollout of artificial intelligence models is likely to spur sharply higher energy demand for the foreseeable future. And a combination of rising demand with constrained supply seems like a recipe for political upheavals.

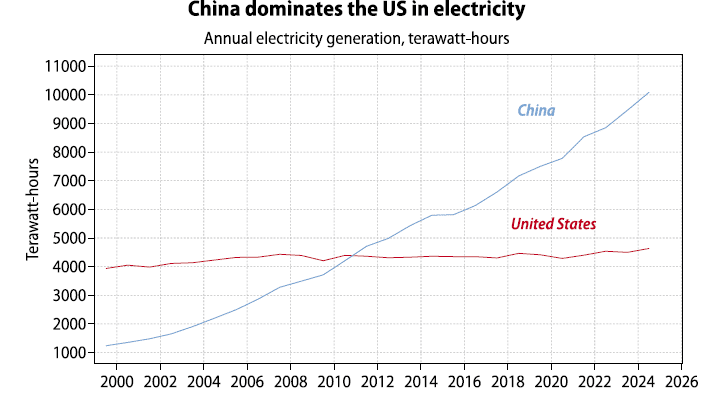

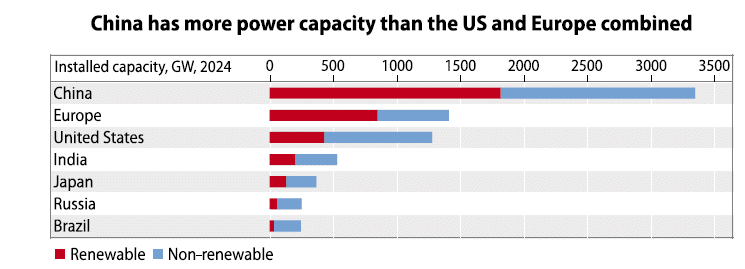

All of which brings us back to the quandary at the heart of the AI roll-out: whether the constraint on AI solutions will be access to computing power, or instead the access to electricity. As things stand, the US still holds a clear advantage in growing—and rolling out—computing power. In electricity generation, however, China has surged ahead: 20 years ago it produced about half as much electricity as the US; today, it generates more than twice as much. This means that China now produces more electricity than the US and Europe combined.

Hence, if access to cheap electricity does become the main constraint to the AI rollout (admittedly a massive “if”), Western policymakers will face the following options:

Of these four options, the last would seem to be the smartest political choice. But it brings us back to Sowell’s point made at the outset of this report and the policy choices that must be embraced to achieve the end goal of lower energy prices (possibly the only path towards maintaining AI dominance and avoiding a political backlash). So how will Western policymakers—especially those in the US—ensure that electricity prices stop rising, and hopefully roll over?

One option would be to push for a marked increase in oil and gas production from Venezuela or Iran—ideally both. Despite their vast proven reserves, the nature of their regimes deters investors from committing the capital needed to optimize output, and so put downward pressure on global energy prices. The temptation to encourage regime change must thus be strong, although it should be noted that the US-led regime change in Iraq in 2003 was associated with oil prices later surging rather than collapsing.

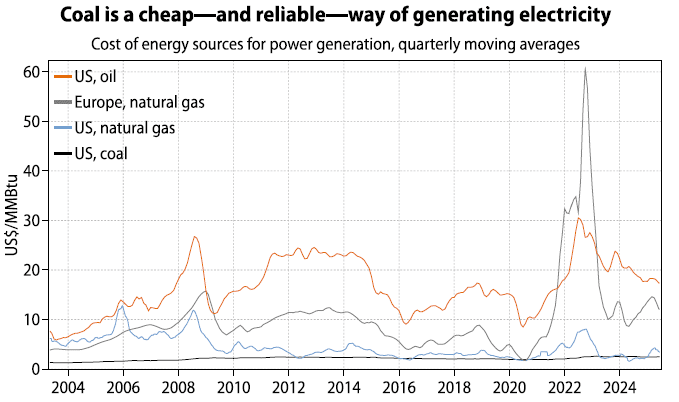

A second, safer bet would be for the US to re-embrace coal, still the cheapest source of electricity (see chart below). After all, coal is relatively easy to mine, transport and burn, and coal plants can be built quickly at competitive costs. In recent days the US Energy Department has moved to delay the decommissioning of existing old coal power plants.

All of this brings us to Trump’s recent United Nations speech, in which he essentially called climate change a hoax and berated those leaders who fell for it as essentially condemning their economies to atrophy and eventual death. This felt like a pretty strong signal that the US would have no qualms burning a lot of coal if that meant keeping its leadership in AI, crypto-currencies and all things energy intensive.

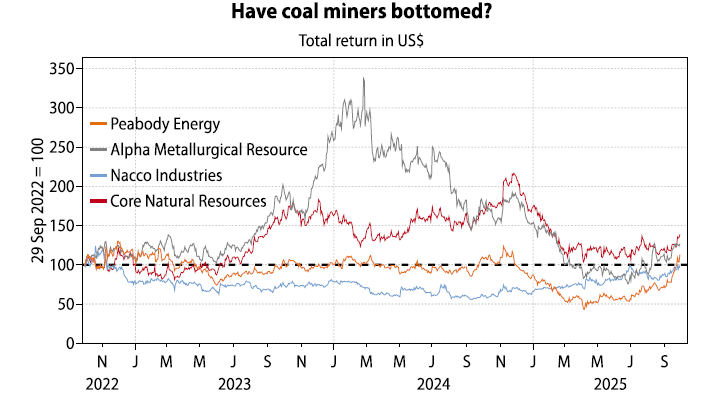

Interestingly, however, most US coal names are trading at roughly their level of three years ago. Sure, they have rebounded from their lows of 12 months ago. However, with an administration that very obviously does not carry any water for the Green lobby, with a demand outlook for electricity that keeps on being revised higher, and with oil and natural gas production in the US seemingly plateauing, one might think that coal names would be a little more popular. Of course, anyone with an ESG mandate cannot really start to look in the direction of coal miners. But then, at least in the US, ESG is also rapidly losing steam.

DISCLOSURE: Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.