By Will Denyer

The Federal Reserve is on a mission to put the inflation genie back in the bottle. With both trailing inflation and forward inflation expectations running above policymakers’ comfort zone, the Fed will continue to tighten aggressively, most likely raising interest rates by 75bp, or possibly even 100bp, this Wednesday. [Editor's note: the Fed announced its decision to hike interest rates by 0.75 percentage points for the second consecutive time on Wednesday.] The question is: what will happen if the Fed succeeds in its mission, and more to the point—how will it define success? What if inflation expectations fall back to target but trailing inflation measures remain elevated? Is the Fed more backward-looking or forward-looking?

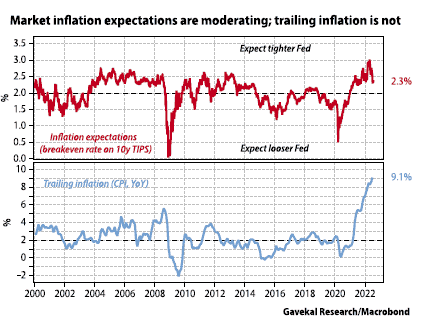

These are questions the Fed may have to face soon. Market-based measures of inflation expectations have already moderated in response to Fed tightening and guidance. The breakeven inflation rate on 10-year Treasury inflation-protected securities has fallen from 3% three months ago to 2.3%—not so far above the Fed’s target of 2% (see the upper chart overleaf). But trailing inflation measures continue to trend up. In June, the US consumer price index was up 9.1% year-on-year, and up an annualized 11% over the previous three months. It is therefore likely that inflation expectations will normalize sooner than trailing inflation. If they do, how will the Fed react?

Before 2020, it was clear the Fed prioritized the inflation outlook. It maintained a forward-looking inflation target of 2%, regardless of past inflation misses. But the 2020 revisions to the Fed’s policy approach effectively split the target into two: (i) trailing inflation that averages 2% over some unspecified time, and (ii) inflation expectations that are well-anchored around 2%.

Currently, trailing inflation is running hot. And by all conceivably-relevant look-back periods, trailing inflation has either risen to the Fed’s average 2% target or has overshot it (see the lower chart overleaf). Therefore, today both trailing inflation and forward inflation expectations call for tightening.

Both measured inflation and inflation expectations influence the Fed’s policy decisions. But if they send different signals, today’s Fed is likely to give inflation expectations at least as much weight as trailing inflation, and probably more. This assertion is based on a number of observations:

1) Fed chairman Jay Powell has repeatedly stated that the “ultimate goal” of monetary policy is well-anchored inflation expectations. The Fed’s average 2% target for trailing inflation is merely a means to that end (see This Is Not Arthur Burns’ Fed). This puts the emphasis on inflation expectations.

2) Trailing inflation can be noisy. Prices are affected by transient factors which can be misleading (in 2021 the Fed put too much emphasis on the transience of inflation drivers; see Fighting The Fed Over Wages). In theory, long-term inflation expectations should be less noisy.

3) Inflation expectations have proved a useful guide to Fed policy in the past. In 2013, after the 10-year breakeven inflation rate rose to the high end of its normal range (around 2.5%), then-chairman Ben Bernanke started talking about tapering quantitative easing, even though trailing inflation was still on target. In 2021, after the 10-year breakeven rate again rose to 2.5%, the Fed immediately started to talk seriously about tapering.

4) The Fed actually has three statutory mandates from congress: “maximum employment, stable prices and moderate long-term interest rates.” The maximum employment goal is effectively irrelevant as a policy consideration because it suggests the Fed should always be as loose as possible within the limitations of its inflation goals. The “moderate long-term interest rates” mandate gets less attention, in part because what constitutes a “moderate” rate of interest is ever-changing and difficult to quantify. Still, it is safe to assume that policymakers want to keep interest rates at levels they think promote economic growth and employment (and at which the government can fund itself). And it is inflation expectations,

rather than trailing inflation, that directly affect market interest rates.

5) The Fed’s average 2% inflation goal is not symmetrical. The Fed’s new policy framework explicitly commits it to run inflation hot after it misses its target to the downside, but it does not clearly commit the Fed to run inflation cold after an upside miss. Challenged on this in January, Powell declared: “There’s nothing in our framework about having inflation run below 2%… What we’re trying to do is… keep inflation expectations well anchored at 2%. That’s always the ultimate goal.” In other words, the only reason the Fed would intentionally run inflation cold after a miss to the upside would be if it was deemed necessary to reanchor long-term inflation expectations back down at 2%.

The Fed would like to see measured inflation cool from present levels, if only because this would reinforce the recent moderation in inflation expectations. However, if inflation expectations fall back to target or below—and show signs of staying there—the Fed may well ease up on the brakes, even if trailing inflation is still elevated. Given how fast this cycle is progressing, this may become a live issue for the Fed over the coming months.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.