We are now past the halfway point of the year and, like every year, events have occurred that were either predictable, understandable in hindsight, or genuinely came out of the blue. In the following pages, I will review the more important developments thus far in 2023, and take a stab at assessing what they tell us about the investing future.

Surprise #1: China’s underwhelming reopening

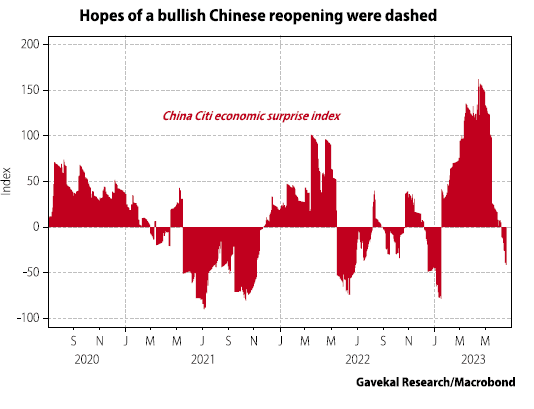

What happened?: After three years of “dynamic clearing” Covid policies, hopes were high that the abandonment of all pandemic restrictions in China would unleash the type of consumer demand seen in Western economies. And sure enough, as China reopened in December and January, Chinese equities rallied hard, as did related counters globally like mining and energy stocks. However, the rally fizzled faster than air coming out of a balloon shot down by a US$439,000 Sidewinder missile. Chinese economic data softened markedly and China’s equity markets rolled over hard.

Why did this happen? The simplest explanation is that Chinese growth remains overly reliant on the construction sector because real estate developers have a twin impact on growth. Firstly, as developers buy land, they provide local authorities with the capital necessary to engage in infrastructure spending. Secondly, after buying land, developers hire workers to put buildings on the land, further generating orders for numerous downstream industries including steel, cement and glass.

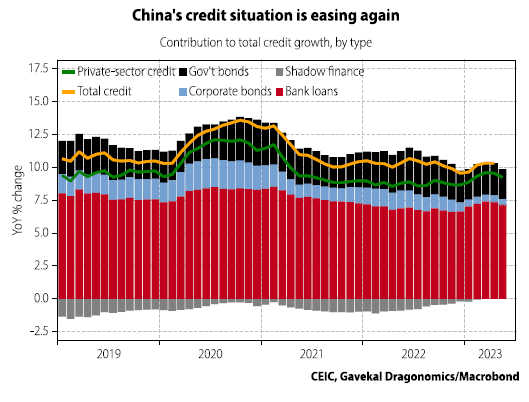

However, following years of Covid lockdowns and a real estate crackdown, the more aggressive real estate developers in China went bust, leaving more prudent property promoters as the survivors. And sure enough, the developers that survived are not rushing to buy land; at least, not as they did in the past. Simply put, animal spirits in the real estate industry have been crushed. And so even if banks are again willing/able to lend to developers, those who have access to bank loans are more likely to tap credit lines to buy back their own bonds at cents on the US dollar, rather than expand their balance sheets.

Another obvious explanation for China’s disappointing growth is that, unlike in the West, consumers were not paid to stay home. There were limited fiscal transfers and monetary easing in the 2020-22 Covid period. Instead, monetary stimulus and an easing in bank lending restrictions came after the reopening. Given policy lags and their economic impacts, perhaps Chinese growth was only ever likely to start surprising on the upside later in 2023?

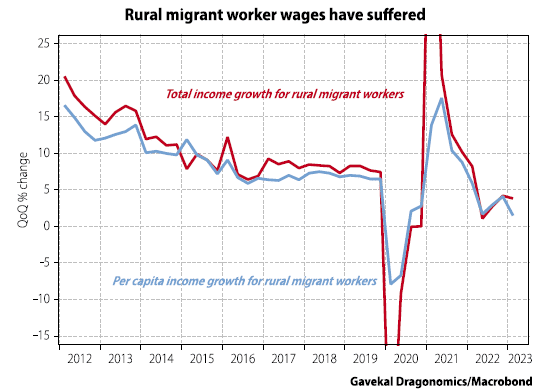

Yet another explanation lies in China’s labor market dynamics. In Western economies, Covid encouraged people to work from home and many workers have reluctantly gone back to jobs requiring a physical presence. To this day, restaurants, hospitals, stores and other client-facing businesses are struggling to fill vacancies. This worker shortage led to higher wages, which in turn fed into more consumption but also higher inflation. Yet in China— perhaps because of the Hukou registration system—labor market dynamics have been quite different. When Covid hit, many migrant workers left cities and returned to their home provinces. Then when Covid restrictions were lifted, rural migrant workers flooded back into cities. The first quarter of this year saw a record high 182mn migrant workers, a 10mn increase from4 Q22, or a 41.5mn increase from 1Q22. This marks the highest quarterly rise since data became available in 2012. Unsurprisingly, this sudden desire/need of migrant workers to find jobs has put downward pressure on wages, and so created a different dynamic then in Western labor markets (see first chart overleaf).

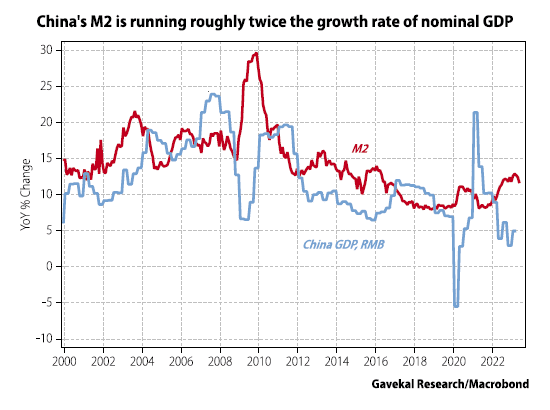

What happens next?: China today is one of the few major industrial economies where broad money growth (M2) is running at roughly twice the growth rate of nominal GDP.

If I invoke Irvin Fisher’s quantity-theory-of money-formulation of MV=PQ, the next question has to be: what happens to the “excess cash” pumped into the system? There are three possible answers to such a question:

1) Nothing happens: the cash stays in bank accounts as the velocity of money plummets. In this scenario, it seems likely that the People’s Bank of China will be compelled to keep slashing interest rates (perhaps to zero), even at the risk of further crushing commercial banks’ net interest margins (that are already hovering at record lows). This would mean a further rally in long-dated Chinese government bonds, though it would also likely keep the renminbi exchange rate under pressure. More importantly for the rest of the world, this scenario would mean that China would be right back to being a consequential deflationary force for the globe.

2) Asset prices are driven higher: a similar thing happened in western economies after the 2008-09 crisis. The view then was that excess housing built in Florida, Nevada, Arizona, Spain, Portugal, Vancouver and Sydney would remain empty for years, if not decades. Interest rates were collapsed to zero and excess money was pushed into the system. But, against the hopes of central bankers, this excess money did not jump start economic activity, but instead helped to bid up asset prices.

Chinese policymakers are clearly hoping to avoid this scenario for at a time of high youth unemployment and limited income growth for migrant workers, a further sharp rise in wealth inequality would go down with Chinese leaders like a high-altitude balloon over South Carolina.

3) Economic activity picks up: this would likely arise due to exports being strong, solid domestic consumption, a rebound in wage growth and, eventually, a real estate market that rediscovers its mojo.

Surprise #2: Silicon Valley Bank fails; the Nasdaq ends up being this year’s best performing market

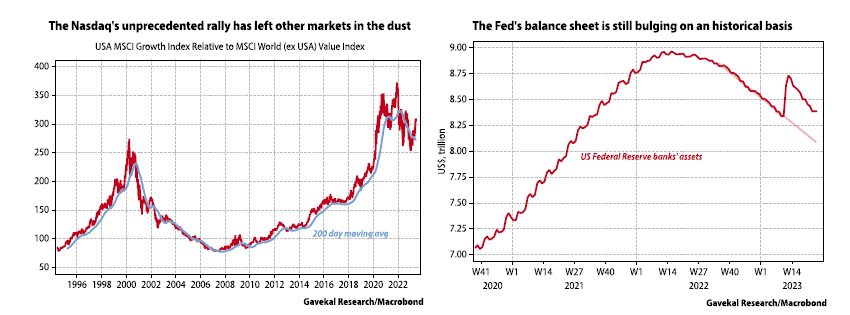

What happened? The failure of over-extended US regional banks was perhaps not a shocker in itself. After all, the business model of most banks is to borrow short and lend long. Thus, when yield curves invert, banks rarely thrive. The surprise factor has been that after the failure of SVB, Signature Bank, Silvergate Bank and First Republic Bank—which are all enmeshed in the greater tech, crypto, and biotech ecosystems—the Nasdaq has left other major markets in the dust. The renewed outperformance of US growth stocks in 2023 does not have a ready historical precedent (see left-hand chart below).

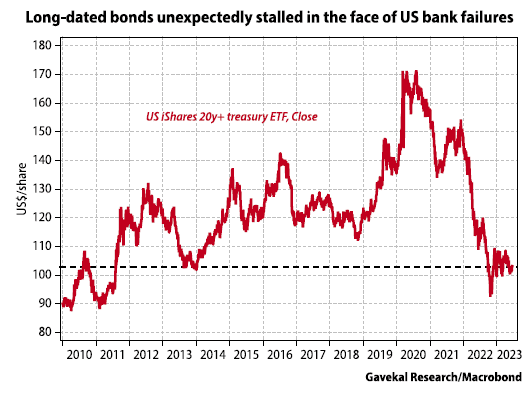

Why did this happen? As always, success has many fathers. Firstly, the launch of Chat GPT rekindled interest in all things software related (see Questions Raised by the AI Surge). Secondly, as banks hit the wall in the US, the Federal Reserve started to again expand its balance sheet (see the right-hand chart on the previous page and Why There Will Be No US Recession). Even if most of this excess liquidity has, in recent weeks, been reabsorbed, the Fed’s balance sheet still stands above where it was when SVB hit the wall, and is much bigger than it would have otherwise been. Thirdly, and perhaps most importantly, long-dated treasuries did not rally in the face of US bank failures, which is unusual as bank failures typically mark the start of a stampede towards “safe investments”. This “dog that did not bark” outcome raises doubts about investors allocating big parts of their portfolios to OECD government bonds (all the more so, as they have basically delivered no returns for a decade).

With that in mind, imagine a nation like Singapore, the United Arab Emirates, Norway which is enjoying large current account surpluses, healthy central bank reserves and a sovereign wealth fund whose long term returns have handily beaten those of long-dated US treasuries (which, given the above chart, is not that challenging a bar to clear).

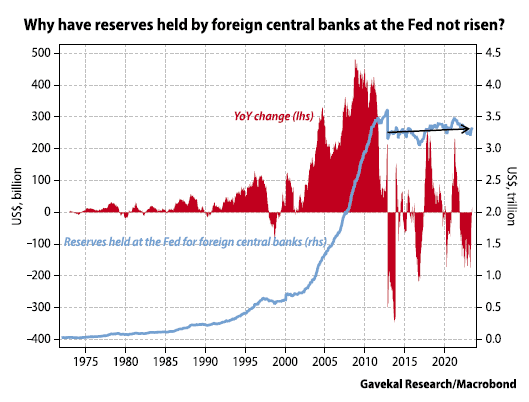

Historically, a sizable share of such countries’ foreign exchange reserves would have been kept in US treasuries. But is this still the case today? In spite of US current account deficits of about US$900 a year, reserves held at the Fed for foreign central banks have basically flat-lined for a decade (see chart overleaf and A Smoking Gun). Perhaps we have reached the point when foreign central banks no longer feel the need to keep huge holdings of treasuries? Perhaps they fear confiscation, as befell Russia, Venezuela and Iran, or like China they are being prudent. If they can now buy oil and other commodities in their own currency (whether renminbi, Indian rupees, Thai baht, Korean won or Japanese yen) perhaps they can hold less US dollar reserves.

If that is the case, it makes sense for central banks to turn over the cash that used to be in US treasuries to sovereign wealth funds for deployment in assets with a better long-term return profile. From there, the sovereign wealth funds

which have had billions land in their laps, would likely be tempted—at least in the short term—to follow the path blazed by the Swiss National Bank, and simply buy the world’s largest, and most liquid stocks.

What happens next? Despite the US economy having defied recession fears and having near full employment, its budget deficit continues to blow out (should a recession materialize, this situation will clearly worsen). And as the Federal government goes back to spending monies committed in the Inflation Reduction Act and a pre-election budget, it will need to borrow. If the Fed keeps shrinking its balance sheet, these monies will have to come out of the private sector, which will “crowd out” private actors, denting returns on most assets other than US dollar cash. Alternatively, the Fed could find a way to accommodate the upcoming increase in US government debt. In this scenario, the US dollar will weakens and asset prices should rally meaningfully. The answer to this question is likely to determine performance for the rest of the

year (see The Effect Of A Loose Fiscal, Tight Money Combination).

Surprise #3: Peace between Iran and Saudi Arabia

What happened? The broader Middle East has been griped by proxy wars, pinning the Saudi-Sunni regime against the Iranian-Shia regime. In conflicts that gripped Yemen, Syria, Lebanon and Iraq, armies or militias tended to be supported by Iran on one side, and Saudi Arabia on the other. That was until a few months ago, when Chinese president Xi Jinping—in a role reminiscent of Jimmy Carter’s in 1978 Camp David accords—convinced both Saudi and Iran to look together to a more prosperous future (see Peace Breaks Out).

Why did this happen? Maybe both countries are simply weary of war? Or perhaps both Saudi Arabia and Iran have seen the destruction, loss of life and economic disaster triggered by the Ukraine war and come to realize the high costs of conflict. Maybe a Saudi Arabia which feels less protected by the US is more open to compromises? Maybe Iran has by now become so dependent on China that it had little choice but to agree to a deal negotiated by China’s diplomatic service? Again, success has many fathers and, in this case, the underlying reason for the unfolding peace deal doesn’t matter nearly as much as the fact that a peace deal has been agreed.

What it means? Maybe my French bias is showing, but for 70 years, France and Germany went at each other’s throats, wreaking havoc across Europe. Once Germany and France made a genuine peace and looked forward to a prosperous Europe together, what followed became known as “Les Trente Glorieuses”—a 30 peace dividend that delivered uninterrupted growth, rising infrastructure spending and increasing disposable income.

Could the same now occur across the Middle East? After all, barely a week now goes by without some new large infrastructure plan or free trade deals being announced This breakout of peace across the region should, if nothing

else, give “Ricardian growth” in the region a significant boost.

But the deal is important beyond the borders of the Middle East. Imagine being a policymaker in China, India, Japan, South Korea, or Thailand which are all vulnerable to an energy price surge. Historically, such surges have arisen from wars in the Middle East, whether Yom Kippur, Iran-Iraq, or Iraq’s invasion of Kuwait. Hence, oil importers fretted that “proxy wars” between Iran and Saudi Arabia could morph into a full scale war that caused crude prices to shoot up past US$200 a barrel. It thus made sense to keep a large stock of US dollars and as much oil as one could afford in strategic reserves.

With that risk having seemingly been taken off the table, inventories of both oil and dollars can be run down. Perhaps this explains why energy prices have been on the softer side all year.

Surprise #4: the weakness in food prices

What happened? Following Russia’s invasion of Ukraine, investors worried that the export of soft commodities from Ukraine, and Russia, would be severely hampered. Given Ukraine’s role as a global “bread basket”, it is easy to

understand why, in the face of all-out war, prices for most soft commodities, but especially wheat, shot up. Interestingly, however, wheat prices have halved since their March 2021 highs and now stand some 12% below their pre-invasion levels. And, up until the rally of recent weeks, almost all soft commodity prices were below their pre-invasion levels.

Why did this happen?: the simplest explanation is that in spite of the unfolding war, Russia and Ukraine have, together, continued to deliver roughly 55-60mn metric tons of wheat into the export market (see right hand chart above). The much dreaded supply shock thus never fully materialized. This, of course, leaves the rest of the world with an underlying vulnerability; the fact that a collapse in Russian and Ukrainian wheat exports did not occur in the past 18 months does not mean that it can’t happen. In fact, the blowing of the Kakhovka dam could indicate that the Ukrainian war is entering into a new phase where the belligerents target each other’s key infrastructure.

What it means? The rollover in food prices, combined with soft energy prices, have helped keep inflation in check globally, but especially in emerging economies where food makes up a bigger share of inflation baskets. From there, it is easy to conclude that a rebound in food prices—whether due to reduced exports from Russia/Ukraine; poor harvests in Asia arising from El Niño; droughts in the US mid-West and Canadian forest fires—could upend the consensus surrounding falling inflation. In that respect, gaining exposure to beaten-up soft commodities might be an interesting portfolio hedge.

Surprise #5: Weak Asian currencies, strong Latam currencies

What happened?: The diverging performance of Asian and Latin American currencies this year has been pronounced. The Colombian peso, which usually correlates to oil prices, has risen by 23.9%; the Mexican peso by 20.8%; the Brazilian real by 17.2%; the Chilean peso by 12%. At the same time, the yen has fallen-7.7%, the Malaysian ringgit -3.3%, the renminbi -2.5%; the Korean won and Taiwanese dollar are basically flat; the Singapore dollar—in spite of huge capital inflows and a soaring domestic real estate market which saw the Singaporean government impose a 60% stamp duty on foreigners looking to buy properties—has only gained 1.8%.

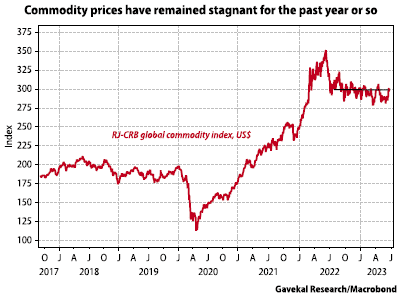

Anyone shown the left-hand chart above after being away at sea for six months would likely conclude that an epic surge in commodity prices had hurt commodity-importing Asia and boosted commodity-exporting Latin America. Yet, in reality, commodity prices have essentially gone nowhere in the last year as shown in the right-hand chart above.

Why did this happen? In Latin America, five countries have “credible’ central banks: Brazil, Mexico, Chile, Colombia and Peru. When inflation first arose in 2021, these central banks were not taken in by arguments asserting price rises to be “transitory”. They hiked aggressively and real rates shot up.

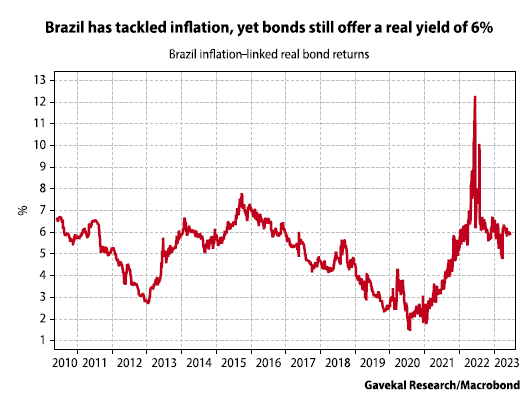

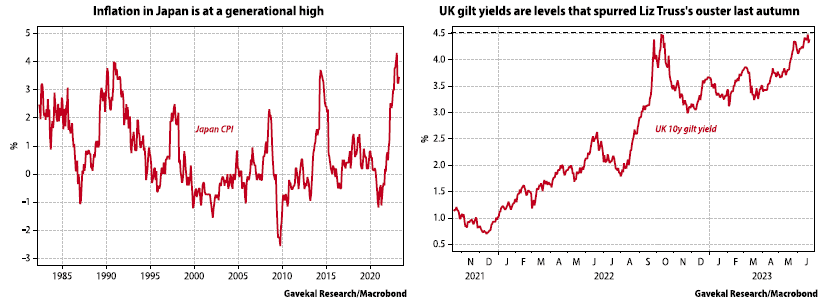

To a large extent, real rates across Latin America are still high, and thus are likely attracting foreign capital. Imagine being a Japanese private saver. On the one hand, the Bank of Japan is promising to continue yield curve control policies that de facto transform Japanese government bonds into certificates of confiscation. On the other hand, Brazilian inflation-linked bonds still offer real yields of 6% (see chart overleaf). In these conditions, should we be surprised that the yen is weak and the Brazilian real is strong?

Of course, the interest rate differential is not reason for the outperformance of Latin American currencies. Other factors include China’s disappointing post-Covid economic recovery, geopolitical fears surrounding Taiwan Straights and “friend-shoring/near-shoring” trends that benefit countries like Mexico (see The View From Taiwan).

Why it matters?: A long held Gavekal view is that long, structural, and sustainable equity bull markets often evolve as “triple-merit scenarios”. Such phases see an economy benefit from a rising exchange rate, falling real interest rates and, from there, rising asset prices. Despite investors presently being focused on artificial intelligence, it seems that such a scenario may be unfolding across Latin America. Who can remember a time when Brazilian government bonds outperformed US treasuries by more than 50%, and this while the Fed tightened and the US dollar rose? The bond markets seem to be sending a fairly clear, and powerful message as to where the next broad bull market will take place (see An EM Decoupling Of Sorts).

The above list of 2023 surprises is hardly exhaustive. I could have mentioned:

I will conclude with a rapid SWOT analysis of the global investment environment following the above 2023 developments.

Conclusion: a SWOT analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.