Duplication does not equal diversification

After most workouts, I make my way to the steam room at the local athletic club. Recently, I found myself sweating away as I listened to two guys talking about the concept of diversification. One guy says to the other, “do you worry the stock market is too pricey and it could crash?” The other guy replies, “I used to worry, but my broker told me that my portfolio is extremely diversified since my portfolio has 50 companies in it.”

Investors, like this gentleman, often confuse portfolio diversification as diversifying within an asset class instead of diversifying across asset classes. Given the backdrop of a stock market that’s looking expensive across a number of valuation metrics, it’s a critical inflection point to revisit the value and methodology of what makes a truly diverse portfolio.

Owning 50 stocks or an ETF helps to mitigate the impact of a single company failing, but it does not protect against the broader equity market. In normal conditions, stocks exhibit correlations around 0.9, and during a market crisis, that correlation often approaches 1.0. In plain terms, when the stock market crashes, nearly all stocks decline together.

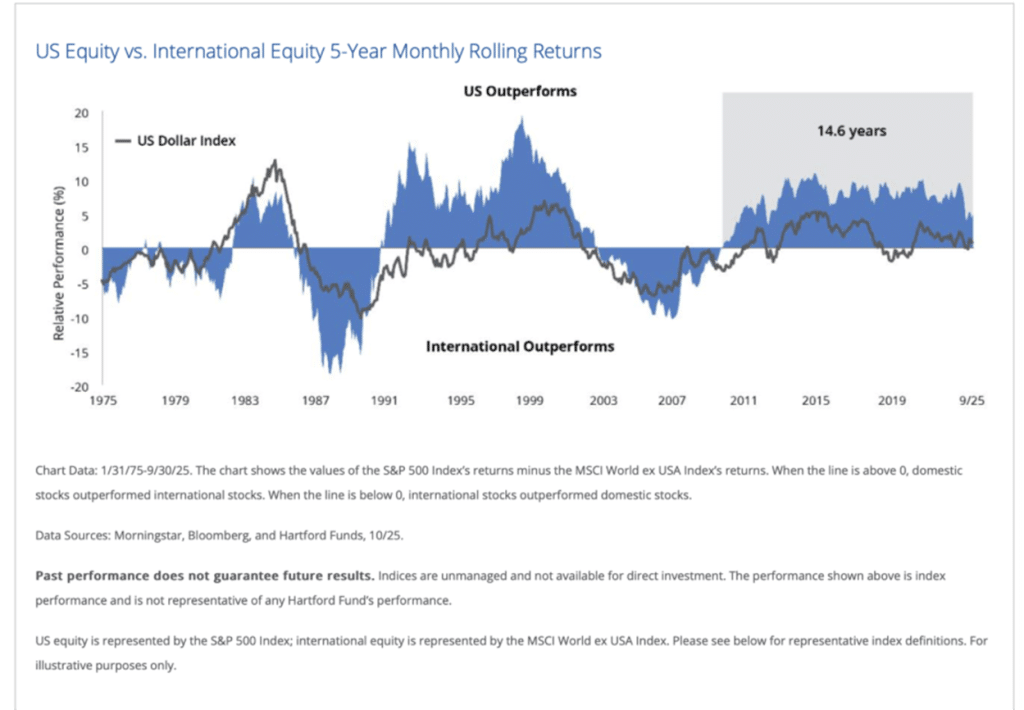

Additionally, prudent investors who are seeking robust diversification will also include utilizing different geographies when constructing a portfolio. For nearly 15 years, as the chart below shows, the US has dramatically outpaced foreign markets, but that trend has now begun to reverse.

Adding to the complexity, investors today have access to more investment options than at any point in history—public markets, ETFs, factor strategies, private credit, private equity, venture capital, real estate platforms, structured products, digital assets, and more. While this expanded menu creates opportunity, it also introduces complexity. It has become harder and increasingly critical for investors to distinguish between true diversification and mere duplication. Many new investments behave similarly beneath the surface, even if they appear different on paper. As a result, constructing an intentionally diversified portfolio now requires deeper analysis, clearer objectives, and a more disciplined understanding of how each asset class contributes to—or overlaps with—existing exposures.

Takeaway: When you buy stocks, you are speculating. You are betting that the future economy will be stronger than it is today. (Given that the stock market typically rises 74% of the time in a 12-month period, and declines only 26% of the time, the odds are in your favor.1) But stock appreciation is not a certainty. If a company consistently fails to deliver results, investors will eventually lose optimism and sell the stock, driving it lower. Alternatively, there are systemic economic shocks that can hit the market (i.e., DOT-COM, Financial Crisis, Covid), which cause the entire system to go into seizure. In these periods, all speculation stops, and both good and bad companies are equally impacted.

Bond Dilemmas

Most investors understand that one very easy way to mitigate their exposure to the stock market is to own bonds, but there are two big reasons why bonds are currently being neglected. First, the stock market is enjoying the longest bull run on record, which has the tendency to lull even the most cautious of investors to sleep. Investors forget that markets don’t always go up. Second, many investors who own a mix of stocks and bonds have seen their stocks go up in value far more than bonds. For one or another of the above-mentioned reasons, I suspect that many investors have portfolios that are excessively riskier than they should be. Thus, investors should be systematically pruning their stock gains to avoid a portfolio that’s too equity heavy due to market appreciation.

Using bonds to offset market risk is hardly cutting-edge advice. But it’s worth noting that it’s not exactly an elementary exercise for investors. Not all bonds offer the protection investors are looking for. Lower quality bonds (higher yield), don’t provide much protection from the stock market as they have between a .6 and .8 correlation, meaning they tend to move in the same direction. Savvy bond investors know that Treasury bonds and highly graded corporate bonds have a correlation closer to zero. Speaking in plain English again, this generally means high quality bonds tend to be much less affected by what’s happening in the stock market. In fact, in times of extreme crisis treasury bonds have historically appreciated in value while the stock market crashed.

Takeaway: Buying bonds is not a new way to protect your portfolio. If anything, it’s so old that people sometimes overlook it. It is a fundamentally important portfolio strategy that has become a rusty tool for many investors. It is also a strategy that gets over simplified. Many investors think that all bonds offer the same characteristics and therefore if they own “bonds” their portfolio is safely invested. That’s a gross miscalculation that may leave many investors who thought they were protected unpleasantly surprised.

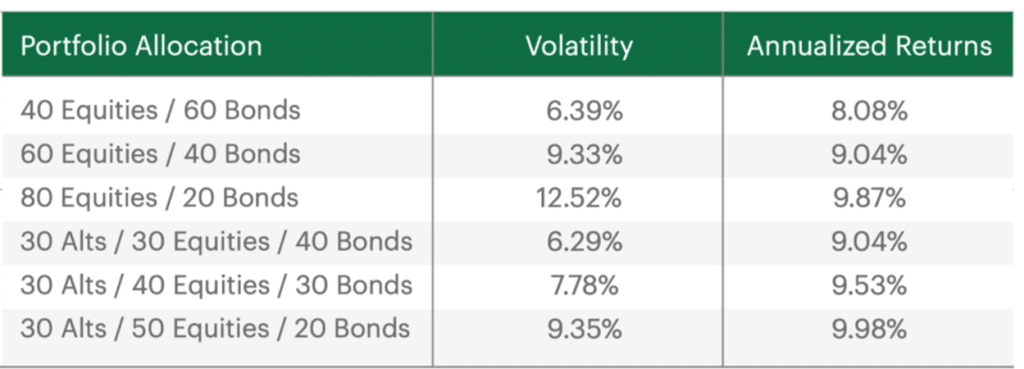

60/40 portfolio is not dead, but it can be enhanced

In August, Larry Fink, CEO of Blackrock, said in an interview that “the classic 60% stock/40% bonds portfolio may no longer fully represent true diversification.” He went on to say that a mix of 50% stocks, 30% bonds and 20% private investments is better way for qualified investors to build portfolios for the future. He elaborated about the opportunities in alternative assets by saying, “They’re in private markets, locked behind the high walls, with gates that open only for the wealthiest or largest market participants.”

While I wholeheartedly echo Fink’s sentiments, I want to add some critical commentary regarding the practical use of private investments before I proceed. Public markets (stocks and bonds) are very useful as cornerstones to build an adequate portfolio, but if you want to truly diversify, you need to consider a wider range of investments. In particular, certain investors can benefit by adding Private Real Estate, Private Credit, and Venture Capital to their mix.

Public markets are dominated by big, market-wide forces—interest rates, economic headlines, investor sentiment, geopolitical news—so most stocks tend to move together. It’s like the ocean: when the tide shifts, everything rises or falls with it. The surges of greed and fear that sweep through public markets routinely drive prices well past the boundaries of mathematical expectation. Private assets behave very differently. Their returns are driven far more by the specific company or project: the management team, the strategy, the execution, the pricing power. Think of them as individual swimming pools—each one rises and falls based on its own plumbing, not the ocean’s tides. In other words, public markets are mostly about macro risk, while private markets are about idiosyncratic, asset-specific risk. That’s also why adding private assets to a portfolio introduces new sources of return that aren’t entirely concerned about what the S&P did on any given Tuesday. Thus, by nature, private markets offer a diversification away from the larger economic forces into smaller more outcome-based investments.

Takeaway: Owning a well-constructed portfolio with the right amount and properly selected bonds will offer adequate portfolio stabilization. Certain clients should seek to actively capture the benefits typically reserved for larger investments groups, by investing in alternative asset classes.

Ski Area Boundary: No ski patrol or avalanche control beyond this point

Avid skiers have undoubtedly seen signs marking the entry for skiers looking to leave controlled mountain confines in search of better skiing conditions. Likewise, investors who are looking to leave traditional asset classes behind in search of better conditions will need greater expertise while navigating the terrain. If you’re wondering why any investor would be willing to undertake these risks, look no further than some of the largest, most sophisticated endowment and pension funds. They’ve been investing in private markets for decades. A survey by the National Association of College and University Business Officers (NACUBO)2 shows that of endowments managing over $5 billion in assets, over 50% of their investments were made in alternative asset classes.

The government realizes that the average investor has been shut out of these markets. In August, an executive order was issued instructing the Department of Labor to reduce the regulatory barriers for investor’s 401k into private markets. While it’s still early in the implementation, it’s clear that investors are likely to get more chances to ski out of bounds sooner rather than later.

It is true that private markets can unlock better risk adjusted returns for investors, just like skiing out of bounds can lead to skiing untouched powder, but there are risks. Not every skier can navigate the obstacles that come with entering the backcountry. Further, the conditions are unpredictable as there is no ski patrol to check for avalanches or to mark cliffs or other hazards. The same is true in private markets. Private investing comes with obstacles that most individuals need help navigating.

Access is the first hurdle: private funds require large commitments, multi-year lockups, and diversification across many strategies and vintages. Top-tier managers are often invite-only and prefer investors with scale, established relationships, and consistent capital. An elite advisor opens these doors, provides institutional access, and manages the operational complexities like capital calls and K-1s.

The second obstacle is the specialized expertise required to evaluate these opportunities. Each type of private investment—venture, private credit, real estate, buyouts—has its own structure, risks, and underwriting needs. Each category of private investment—venture capital, private credit, real estate, buyouts—demands a different underwriting skill set and understanding of unique risk drivers. Evaluating managers, reading complex agreements, modeling cash flows, and assessing idiosyncratic risk all require deep experience. These two factors—access rooted in scale, and expertise rooted in specialization—make private investing substantially more demanding than public markets.

Takeaway: When appropriate for investors, the inclusion of private asset classes can help achieve better risk-adjusted returns. Investors need significant financial capital and expertise to play in this arena. The scale and scope of firms with this expertise can integrate alternatives into client portfolios.

Being diversified means being different

True diversification comes from owning assets that behave differently—not simply holding more varieties of stocks. Bonds, private credit, private real estate, private equity, and other alternative asset classes each have distinct economic drivers, cash-flow characteristics, and sensitivity to differing market forces. High-quality bonds often provide stability and income when equity markets face pressure, acting as a counterweight during periods of recession or falling growth expectations. Private credit delivers contractual interest payments that are far less sensitive to daily market sentiment, with returns tied primarily to borrower fundamentals rather than broad equity movements. Real estate is influenced by localized supply–demand dynamics, rental income, cap-rate movements, and long-term demographic trends—drivers that frequently diverge from public market cycles. Private equity and venture capital capture company-specific value creation—operational improvements, revenue growth, innovation—meaning their return paths tend to be more idiosyncratic than market-beta driven. It’s fair to note that as more capital is invested in this once off limit asset class returns could compress, making manager selection in this space even more critical.

Because these asset classes move to their own rhythms, adding them to a portfolio introduces new sources of return and reduces dependence on the rise and fall of public equities alone. The result is a more balanced portfolio that tends to experience smoother performance, smaller drawdowns during periods of market stress, and faster recovery because not every component is exposed to the same vulnerabilities. This multi-engine approach doesn’t just improve risk-adjusted returns, it improves the investor’s experience. Portfolios with broader diversification tend to generate more consistent outcomes, allowing investors to stay invested, remain disciplined, and avoid emotionally driven decisions in volatile periods. Expanding beyond equities into bonds and alternatives ultimately creates a portfolio that is more resilient, more stable through different market regimes, and better positioned to deliver durable long-term results.

Takeaway: Investors tend to think that diversification comes from owning stock in many different companies. While this is certainly a step in the right direction, true diversification comes from owning different types of investments, not just more investments within an asset class. Investment in bonds is a significant step to smoothing out the volatility within a portfolio, but it may be wise to expand the types of investments used even further.

Conclusion

As a firm, we believe our clients have benefited greatly from the disciplined application of true diversification through many different market cycles. Over the decades, we have developed deep knowledge and experience in using fixed income to reduce volatility, generate cash flow, and provide stability when markets are disrupted. That foundation remains essential.

At the same time, we recognize that the investment landscape has evolved, and we continue to allocate significant firm resources to expanding the range of asset classes available to clients for whom these strategies are appropriate. This includes thoughtful access to alternative investments and other non-traditional sources of return that can further strengthen portfolio resilience.

By understanding and embracing the full breadth of diversification—across public markets, private markets, and varying sources of risk and return—we aim to help our clients navigate the inevitable cycles of financial markets with greater confidence, consistency, and long-term success.

DISCLOSURE: Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.