Over the past four years, we’ve published a popular series highlighting a handful of Initial Public Offerings (IPOs) for investors to watch. The most recent installment, which was published in February of this year, shared a mindboggling statistic: that companies listed on US exchanges rose so rapidly in 2021 that the tally of IPOs hit an annual record just six months into the year. It also pointed out that after a red-hot 2021, the first month of 2022 was anything but stellar for shares of newly public listings.

In recent years, IPOs have typically emerged from a short-list of promising unicorns, which are defined as private, VC-backed companies valued over $1 billion. Globally, there are currently over 1,200 unicorns with a combined valuation of $4.2 trillion.

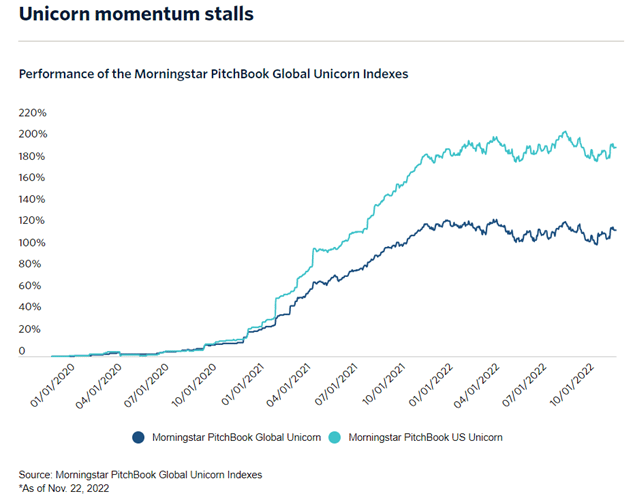

As we enter the final month of 2022 and turn the page to a new year, it’s worth evaluating how unicorns have fared during a volatile year in both public and private markets.

Hint: some of the statistics might surprise you.

It’s no secret that the past few months have been challenging for the broader tech space. Two headline stories that have filled up newsfeeds lately are rolling workforce reductions and the blowup of cryptocurrency exchange FTX. On top of that, stories of Tiger Global’s demise, Twitter’s volatile takeover, and hefty valuation haircuts paints the picture that once high-flying growth companies are in distress. However, despite all the negative news, looking closer at the data tells a different story.

*As of November 22, 2022

2. In the United States, new unicorn creation is back to pre-Covid levels, minting roughly 13 new unicorns per month in the 2nd half of 2022. Although this is down from an average of 50 per month in 2021, the sustained creation of newly minted unicorns in the face of uncertain economic conditions is a good sign that innovation and growth is pushing forward despite headwinds.

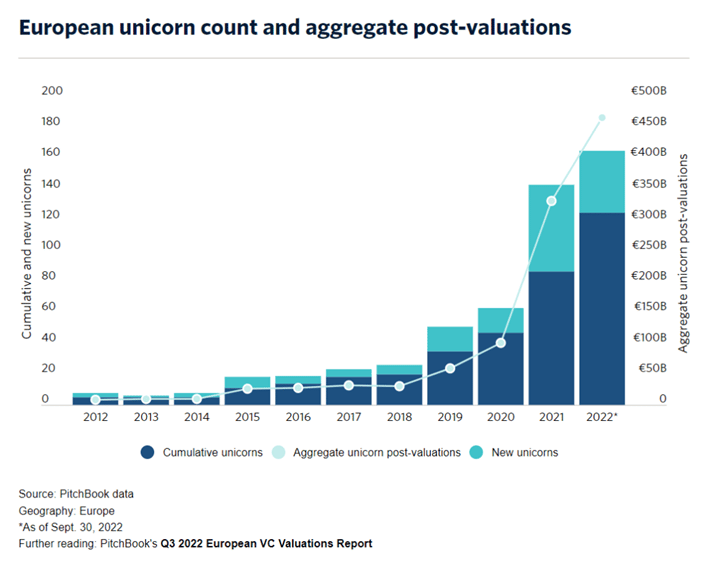

3. Across the pond in Europe, in the first three quarters of 2022, 40 European companies achieved a €1 billion-plus valuation which was similar to levels in 2021. Despite a slowdown in unicorn creation during the third quarter of 2022, the value of Europe's unicorns rose significantly from last year with an aggregate unicorn post-money valuation of €466.2 billion, up 40.7% from the end of 2021.

The relatively strong performance of unicorns throughout 2022 can be attributed to several factors including that many unicorns entered the market downturn with plenty of cash on hand to avoid the repricing that public market companies were unable to avoid. Hefty cash balances mixed with cost restructures to extend runway have and will buy time for market conditions to improve.

However, as many of these companies are forced to raise capital in 2023, one of the main risks is that, despite plenty of dry powder, traditional VCs may not have enough money to sustain such lofty unicorn valuations without the help of crossover investors. According to PitchBook:

“Crossover investors, such as mutual funds and hedge funds, have been a driving force behind the unicorn phenomenon, but many have pulled back from late-stage deals in recent months… If crossover investors believe that VC returns will remain depressed—and there are better deals to be found elsewhere—their retreat from the sector may prove durable. The effect could be severe. For all their mountains of dry powder, traditional VC firms simply don't have enough money to sustain the valuations of the largest companies.”

Currently, roughly 25% of global unicorns are valued between $1.0 and $1.2 billion. As such, a handful of unicorns could be on the cusp of losing their moniker if they are forced to raise capital at a lower valuation than in previous rounds.

However, while its possible that unicorns could become a rarer breed in the coming year, many later stage companies have built extremely strong businesses that are often entrenched into the fiber of everyday work and life. As such, despite the negative headlines, the unicorn breed isn’t likely to face an extinction event anytime soon - it just might be harder to attain and maintain the aspirational moniker until the cycle turns over.

Is it time to thin the unicorn herd? | PitchBook

European unicorn creation holds steady | PitchBook

Michael Johnston

Tech Contributor

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.