“A man is only as good as his tools.”

― Emmert Wolf

I’m amazed by how many investors seem to fixate on the stock market, while many other asset classes comprise an equal or more significant portion of their overall wealth. News outlets fuel the hysteria by dissecting every microscopic piece of data as if it will help them predict future market movements. When I explain to people that I work in investments, they typically respond by asking: “Do you have a great stock tip?” The better questions to ask would be: “What type of fixed income should I be buying?” or “What alternative investments do you find compelling?”

If you examine the overall investment allocation for some of the most revered Endowment funds, equities are generally not the largest allocation in their portfolio. Fortunately, at Evergreen, we too aren’t solely reliant on the stock market to generate returns for clients. Our firm has strategically (and stubbornly) continued to build in-house income portfolios that use a wide range of securities, many of which come with subtleties and complexities that some of our competitors are reluctant to tackle. Additionally, through the formation of our private proprietary alternative investment funds, our firm can deploy capital into private markets in the form of equity or debt. Lately, the opportunities within private markets heavily favor investors with the skill to analyze these investments and the capital required to participate. We think it’s crucial in the current environment to construct portfolios that can deliver robust cash flow while also continuing to augment client portfolios with non-public market opportunities through access to private funds. We believe the return prospects of private credit and equity across many metrics look very compelling relative to the returns in public markets. While there are important considerations to weigh as you evaluate the opportunity set of asset classes, relying too heavily on the stock market is akin to fighting with one arm tied behind your back.

The current macroeconomic backdrop has already begun to present dislocations across a variety of asset classes, and the opportunities will likely only get more compelling. As you read on, hopefully what comes into view is the concept that using a more diverse toolset—private/public markets or equity/debt—delivers a more dynamic and consistent formula for forming one’s investment mix.

Commercial Real Estate/Workforce

The U.S. economy transformed in an astounding way because of the Covid-19 pandemic. Seemingly overnight, offices saw workforces thrust into a completely virtual environment. While few knew how long the pandemic would last, the common conclusion was that once it ended, we’d go back to living our lives the way we did before the pandemic. In many ways, this did happen; travel, restaurants, entertainment, and other industries saw people eagerly return to activities we all took for granted prior to Covid.

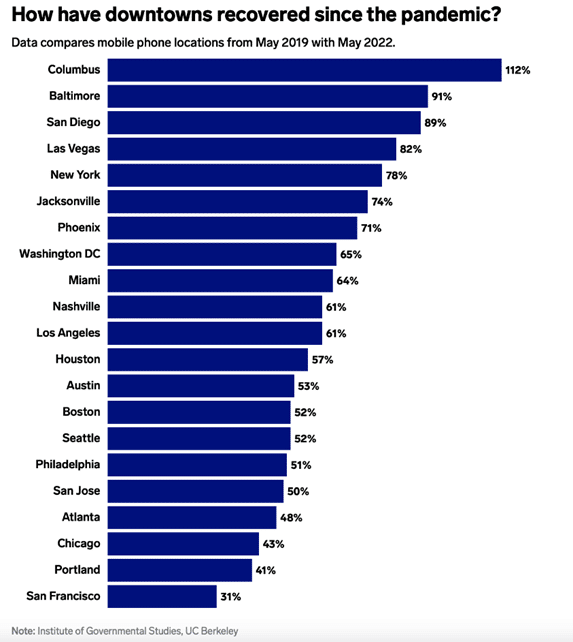

What was not widely anticipated was the potentially lasting damage set in motion for office real estate, retail, and subsequently downtown areas in many U.S. cities. Prior to the start of the pandemic, office occupancy rates were 95%. Today, with the effects of Covid largely diminished, office occupancy still hovers at a mere 46%. Unfortunately, the problems do not end there. The University of California Berkeley analyzed mobile usage across major cities in the U.S. and the results are staggering.

It could be argued that this “disappearance” was further exacerbated by companies relocating to more “business friendly” geographies – but even Austin and Nashville are feeling the pain. This makes one wonder if there are other forces at work.

Even more vexing is the fact that apartment rentals have their lowest vacancies since the mid-1980s and industrial real estate has proved quite durable. To put in perspective the damage that’s been done in office, simply look at the office market REIT index, which is down nearly 60% from its peak in 2019. Is the office the first shoe to drop or is it facing unique structural headwinds all its’ own, or does the truth lie somewhere in the middle?

When forming an investment thesis, it’s important to look both at past lessons learned while also being willing to imagine new possibilities in the future. Office buildings and downtown areas have been hammered as vacancies remain at staggering levels. It’s become so bad that some office buildings have begun converting into condos or apartments. A resourceful idea, no doubt, but if you talk to real estate insiders, they will tell you this is far more costly than you might think. Offices, for example, are designed to have a couple of bathroom locations per floor that are shared by many users. Apartments or condos require far more decentralized plumbing. Retrofitting a building from office to residential sounds good in theory but is much more difficult in reality.

Another consideration for office is the eventual equilibrium for workplace behavior. More and more CEOs have come out (Jamie Dimon of JP Morgan, Elon Musk of Tesla/Twitter, Andy Jassy of Amazon, etc.) mandating that employees return to work, but it seems that employees are reluctant to comply. So why don’t CEOs just fire disobedient employees? For one, the unemployment level is extremely low, placing the bargaining power in the hands of the job seekers. In addition, skilled employees who are capable of working from home will likely end up at a more benevolent employer. Lastly, there is probably some truth to the fact that a portion of jobs can in fact be done remotely. Unemployment is cyclical though, and there will be a time where the balance of power swings back to companies and it will be interesting to see if employers push harder and more broadly for a return to office or if society is accepting this as the new normal.

I do wonder how long the novelty of working from home will last for workers. Yes, it’s nice to take a Zoom meeting wearing whatever clothing items can’t be seen on your camera, but there are drawbacks. People are social creatures, and many (not all) enjoy at least some of their co-workers. Remote work has distractions like pets, children, loud roommates, nagging spouses (not mine, of course), etc. I think office investors must underwrite for the fact that, while vacancies are likely to improve from these anemic levels, we may never see the same five-day 9am-5pm work schedule that was once considered standard. Where this ultimately settles will be a deciding factor in the amount of office space businesses will require. Even if future occupancy is permanently lowered by say 20-30%, does this directly correlate to a 20-30% reduction in office sizes? I’m not so sure.

Lastly, ripple effects on downtown areas cannot be ignored. As office buildings remain empty, surrounding businesses struggle. The times of businesses betting that being centrally located near office buildings was worth the associated rent premium has ceased, at least for the time being. In turn, this means less tax revenue for these cities, reducing the ability to fund quality societal services. This creates a vicious cycle where businesses begin to shun downtown areas that aren’t clean or perceived as safe. Does this cycle eventually reverse if workers gradually creep back to “normal” levels? I would think yes. As I mentioned earlier, history can provide some clues as to what may lie ahead, but it’s not clear whether we’ve seen a permanent change in certain behaviors or if they are simply prolonged (albeit temporary) deviations from past norms.

Busted Banking

The failures of Silicon Valley Bank (SVB) and First Republic Bank (FRB) quickly thereafter undoubtedly created flashbacks to the days of the Great Financial Crisis. The resulting effects were similar. Equity and debt holders were wiped out. Depositors were made whole and bigger banks gobbled up the assets of the failed institutions. These were not small banks that failed; both had market caps north of $40 billion at their peak. It is also worth noting that they failed less because they had made bad loans but rather more as a result of poor investment decisions with their deposits. The whole situation was made worse by the fact that information moves so quickly. It used to be that as word of mouth began to circulate, troubled bank depositors would literally run to the bank hoping to be the first in line to get their money out. Now, as word spreads on the internet at warp speed, and orders to withdraw money are simply a few clicks of a mouse, banks can falter in the blink of an eye.

Silicon Valley Bank played a vital role in the tech banking eco-system. SVB had 50% of US VC-backed startups as their customers, which amounts to 65,000 startups! Besides being a holder of assets, they also played a huge role in lending capital to these startups. Given their proximity and familiarity in Silicon Valley, they thought (and probably accurately so) that they had greater insights than larger banks and thus were more equipped to make creative loans to their customers. In many cases, young startups turned to debt financing over equity because it avoids the dilutive effect of more shareholders. The void of their absence is already being felt. Large institutions are not nimble enough to enter this space. Does JP Morgan or Wells Fargo really want to perform the necessary due diligence to lend even a thriving startup capital? I’m guessing not, because these loans require a lot of work and won’t move the needle for a bank of its size.

These failures shook the confidence in regional banks and given the writing on the wall, one would expect many depositors to continue fleeing regional banks in search of banks considered “too big to fail.” Unfortunately, the outflow of deposits may not prove to be the biggest obstacle for regional banks. According to Goldman Sachs, more than half of the $2.9 trillion in commercial mortgages will have to be renegotiated by the end of 2025. Estimates suggest as much as 70% of all commercial real estate debt will come due in the next five years. This is a massive issue for small/regional banks who are on the hook for nearly 2/3 of these loans. Stronger subsegments in commercial real estate, such as multi-family and industrial real estate, have displayed much stronger fundamentals than office and retail, which have already taken a beating. As these loans are refinanced at massively higher interest rates, these banks will face significant challenges. It also seems overly optimistic, as this massive refinancing wave occurs, that other segments of the commercial real estate market won’t come under pressure.

More questions abound as we think through further reverberations. Will the government decide to prop up regional institutions? Will it allow them to go bust and let the bigger banks gobble them up like we saw with SVB and FRB? How much consolidation can regulators stomach? What would a further hallowing out of these banks mean to the economy as a whole? Few can agree on how this should or will play out, but most would agree that the impact of how it does will have significant consequences to the economy.

Debt costs between now and the end of 2025 are going to be a tough pill to swallow, even for performing properties, as few people expected rates to get to these levels so quickly. This means many will be forced to raise additional equity or forfeit properties to lenders. Institutions (i.e., Private Equity) with ample capital stand to make a killing as this slow-motion train wreck continues to unfold. At some point, the office real estate market will become cheap enough to coax even cautious investors off the sidelines, but in our view that’s unlikely to play out in the near-term. It will not be for the faint of heart. In order to buy into weakness, you have to buy when the outlook is stormy. Once the clouds have cleared, the bargains will be long gone. We see this as an undoubted tailwind for elite Private Equity companies, which served as a key investment driver for the launch of our most recent private investment fund.

Deficit Disorder

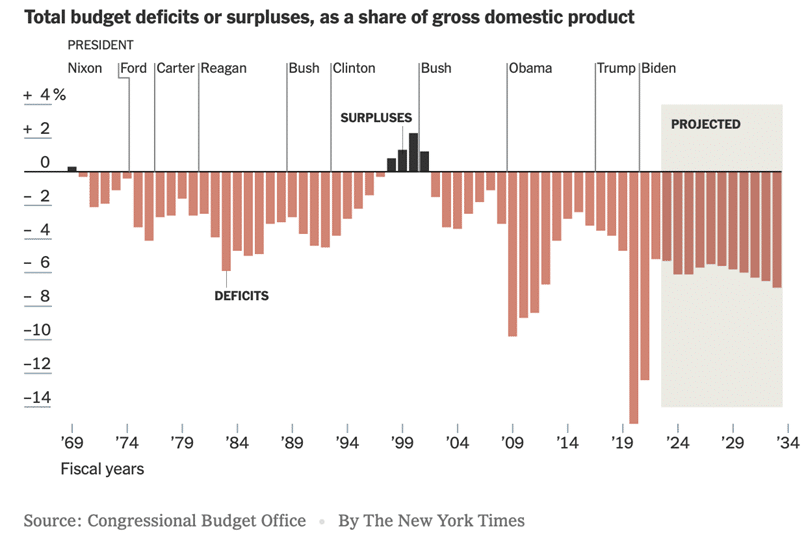

At the time of writing this, the U.S. national debt totaled $31.9 trillion. If you want to go through a sobering exercise of seeing our nation’s debt, go up every second of the day, there’s a website that continuously shows this (https://www.usdebtclock.org). $31.9 trillion is a number that seems so large it’s almost too hard to put into perspective. So, here’s another way to look at our nation’s debt: Let’s convert our national debt situation to that of an American family. Think of a family who makes $71k in income, spends $90k, forcing $19k onto a credit card each year with an already accumulated debt balance of $447k. Not good!

On top of that, consider the Fed’s interest rate hikes are expected to triple interest costs paid by the government over the next 10 years. Something has to give. Higher taxes on individuals and corporations, which is always a popular choice for voters. Less spending or reforms to existing program promises, which is not a popular platform to run on. Or, continue to kick the can down the road and use up what’s left of our strong credit on the global stage.

Regardless of which scenario plays out, this has to be considered one of the greatest long-term challenges for the American economy and I tend to hope and believe that Winston Churchill was right when he said: “Americans can always be trusted to do the right thing, once all other possibilities have been exhausted.” While some may not find this too reassuring—and I don’t blame them—we are always considering that not all stories have good endings when we construct our client portfolios. To give readers some semblance of hope, I’ve included some steps outlined by the CBO here (https://www.cbo.gov/publication/58981) that could begin reversing the course of the deficit, though none of them come without pain.

In my opinion, until the American people recognize this as a problem and demand that something be done, this threat will persist. By the way, I do not view this as a partisan problem. The chart included below shows there’s plenty of blame to go around for how we got here, and it will take both parties to help get us out.

Interesting Rates of change

It wasn’t that long ago when many were making the case that owning stocks over bonds made sense on the basis that bond yields were flat out unattractive. A period that was no doubt unpleasant for retirees and savers who had become accustomed to earning 4% safe return on their bond portfolios. How quickly we’ve gone from operating in a world where fixed income had seemingly no allure to the environment, and now we now find ourselves here. In pursuing a policy meant to stem the tide of inflation once thought to be “transitory,” the Fed has been hiking interest rates aggressively. As discussed above, there has and will continue to be significant collateral damage done to the economy. Bond holders who misplayed their hand by holding long maturities took it squarely on the chin as bonds registered their worst year in recorded history. To be fair, it wasn’t just amateurs who got this bet wrong. Many investment professionals including those in charge of SVB, FRB, and others doubted the Fed’s conviction, mispositioned their investments, and subsequently suffered catastrophic losses. However, as the saying goes, “one man’s trash in another man’s treasure.”

Investors, who were long-starved for yield but remained disciplined and didn’t make those mistakes, now find themselves in the cat bird seat. Fortunately, this is exactly the position many of our clients find themselves in as well. Today, you can buy certain investment grade government bonds that will pay you 5.75% for the next 10 years. Even a safer 5-year treasury pays nearly 4.0%, a far cry from the near zero yields investors have grappled with for the last decade. This poses a crucial question as to where we are with yields? If inflation has peaked, and there is some data pointing in this direction, the Fed has likely reached the end of their tightening cycle and the smart play is to lock in yield for an extended period of time. Those who believe we have not yet seen a high in yields would be wise to continue owning shorter-term bonds and recycling them into higher and higher future yields.

For so long, lazy investment managers slapped clients into brainless bond funds because there wasn’t much difference between bonds with differing characteristics. Essentially, all bonds paid near-zero no matter the maturity. Unless you were willing to brazenly wade into the world of junk bonds, it was impossible to find yield. Today, we feel vindicated in our conviction for refusing to pack it in and just buy bond funds. Our continued commitment to our proprietary in-house bond strategies means that, unlike bond funds, we can build nimble, dynamic, and tax advantaged bond portfolios to both protect and take advantage of market dislocations.

Conclusion

It’s in our DNA to believe that investing is and should be about much more than just predicting the direction of the stock market or which stock is superior to the next. Whether that’s through the utilization of our income strategies or allocating capital to our proprietary platform of private funds. We have invested considerable time, resources, and capital to build an expertise in asset classes outside of just stocks. We believe this has and will continue to give us a competitive edge over other firms. I can count on one hand the firms I’ve heard of in our industry who are committed to this same endeavor. Far more often, management of other firms mock us for continuing to spend the time and effort necessary to maintain a robust in-house investment team. When the stock market is going straight up and it’s easy to make money, those comments cut deeper than they do at present. Instead, today we find ourselves acquiring clients who are once again realizing that investing in stocks is part of but not all that a client should want in a firm.

Tyler Hay

Chief Executive Officer

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.