By Wm. Kelly Sterling

As another challenging year ends, it is important to keep abreast of changes in the tax laws. This is especially true this year as we have a little more certainty about how new tax laws may impact you next year. This memo provides an overview of the major tax changes and tax planning opportunities. The summary below includes a synopsis of some provisions included in the Inflation Reduction Act, and a discussion of traditional year-end tax planning considerations.

Background

The Inflation Reduction Act (replacing the Build Back Better bill) was passed by Congress in the summer of 2022 and includes tax changes affecting tax years through 2032. Major components of the Act are focused on encouraging companies and individuals through tax credits to invest in “clean energy” technology (with additional credit amounts for these investments in low income communities). This act has little affect on the 2022 tax year. The affect on future years are mentioned below where relevant.

Individual Tax Provisions

Ordinary income tax rates

Tax rates will remain the same in 2022 and 2023, while tax brackets have been adjusted for inflation. The 37% rate will apply to income over $539,900 (single and head of household), and $647,850 (married filing jointly). These income limits will rise to $578,126 and $693,751, respectively, for the 2023 tax year. Please note that two single taxpayers living together may make $1,079,800 before becoming subject to the top rate, while married taxpayers will pay tax at the highest rate at $647,851 of income. The result is a significant “marriage penalty” for high income taxpayers.

Capital gains tax rates

The capital gains tax rate remains at 0% for taxpayers in the lowest two tax brackets, and 15% for taxpayers with income below $459,751 (single) and $517,201 (married). The capital gains tax rate increases to 20% if income exceeds these levels. These limits will increase to $492,301 and $553,851, respectively, for the 2023 tax year.

December 1, 2022

Capital gains may also be subject to the additional net investment income tax surcharge of 3.8% for high income taxpayers. Under current law, the 3.8% net investment income tax does not generally apply to flow-through income from an S corporation or from other pass- through entities if the individual owner is actively involved in the business.

As many of you know, Washington state has instituted a 7% capital gains tax on long-term capital gains above $250,000. The tax is imposed specifically on long-term gains from the sale or exchange of capital assets. There are a handful of assets that are excluded from this tax. Most notable are real estate, assets held in retirement accounts, and interests in qualified family-owned small businesses. The tax was supposed to take effect on January 1, 2022, with the first payments due on April 18, 2023, but the law is currently on hold as it proceeds through legal challenges. The State appealed a lower court ruling directly to the Washington Supreme Court. The case is expected to be heard in January 2023. The Department of Revenue still plans to collect taxes for 2022 if the Supreme Court reverses the lower court ruling. See the addendum with a recent status update on where this case stands.

Currently taxpayers who hold stock which qualifies as Qualified Small Business Stock may exclude 50%, 75%, or 100% of their gain depending on the date of purchase.

Personal exemptions are eliminated for tax years 2018 through 2025 under current law.

The child tax credit returns to $2,000 per eligible child for 2022. The credit may be reduced for joint filers with AGI greater than $400,000, and single and head of household filers with AGI greater than $200,000.

The standard deduction for 2022 is $12,950 for single taxpayers, $19,400 for head of household, and $25,900 for married taxpayers filing jointly. For taxpayers over age 65, the deduction is $14,700 if single, $21,150 for head of household, and $27,300 ($28,700 if both are over 65) if married filing jointly. Due to the high level of the standard deduction, many taxpayers will not itemize deductions in 2022. For 2023, the standard deduction increases to 13,850 ($15,700 if over 65) for single taxpayers, $20,800 ($22,650 if over 65) for head of household, and $27,700 ($29,200 or $30,700 if over 65) for married taxpayers filing jointly.

Under the Tax Cuts and Jobs Act the itemized deduction for state and local income and property taxes is limited to a total of $10,000.

Limits for certain retirement saving accounts are adjusted annually for inflation. Following are the 2022 and 2023 limits on retirement plan contributions:

IRA contributions: $6,000 in 2022 and increasing to $6,500 in 2023 ($7,000 for 2022 and $7,500 for 2023 if 50 or older)

December 1, 2022

SEP, Keogh, and other qualified employer-sponsored defined contribution plans:

$61,000 in 2022 increasing to $66,000 in 2023.

SIMPLE plan deferrals: $14,000 in 2022 and increasing to $15,500 in 2023 ($17,000 and

$19,000 respectively if 50 or older)

401(k) deferrals: $20,500 in 2022 and increasing to $22,500 in 2023 ($26,000 and $30,000 if 50 or older).

Qualified plug-in electric drive motor vehicle credit: Currently, taxpayers may receive a tax credit for the purchase of a qualified plug-in electric drive motor vehicle acquired after December 31, 2009. The credit is worth up to $7,500, depending on the vehicle’s battery capacity.

This credit phases out for a manufacturer’s vehicles when at least 200,000 qualifying vehicles of that manufacturer have been sold for use in the United States. Both Tesla and General Motors have exceeded the limitation and the credit for purchase of a Tesla and General Motors is no longer available. Both Toyota and Ford were expected to cross the threshold at some point in 2022.

EV (Electric Vehicle) Clean Vehicle Tax Credits: The Inflation Reduction Act revises the Qualified Plug-in Vehicle Credit. The law eliminates the manufacturer unit threshold, but places other limitations on EV qualification, phases out the credit for high income earners, and places limits on vehicle cost. The new law also extends the credit to used vehicles. Here are the criteria to receive this credit beginning January 1, 2023:

If you bought your vehicle before August 16, 2022, when President Biden signed the act into law, all of the old rules apply. Electric vehicle qualifications for vehicles sold and taken possession of between August 16 and December 31, 2022, now require that the final assembly of qualifying vehicles be completed in North America.

Beginning January 1, 2023, the income threshold for those being able to receive tax credit is $150,000 for single filers, $225,000 for Head of Household filers, and $300,000 for married filing joint filers.

Under the new law, credits will only be allowed on vehicles costing less than $55,000 for EV cars, and $80,000 for pick-up trucks, vans, and SUVs.

The credit will continue to apply to hybrid plug-in electric vehicles if they meet the aforementioned criteria and are equipped with a battery over 7kWh.

Beginning in 2024, dealers can provide the credit at point of sale. Prior to that date, the credit is limited to the lesser of $7,500 or the income tax on the purchaser’s tax return.

There will be a Used EV tax credit limited to $4,000 on vehicles priced below $25,000. This credit includes an income thresholds cap of one half the thresholds for new EV purchases.

Clean Energy Tax Credits:

The residential energy efficient property credit. Prior to the Inflation Reduction Act this credit was set to expire on January 1, 2022. The credit was allowed for qualified solar electric property expenditures, and qualified solar water heating property expenditures placed in service after December 31, 2016. Taxpayers were able to claim a Residential Energy Efficient Property Tax Credit for 26% of the cost of eligible solar water heaters, solar electric property, fuel cell property, small wind energy property, and geothermal heat pump property.

Tax Credits for Switching to Green Energy

The Inflation Reduction Act extends the above credit for 2022 under the old rules and increases the credit for assets placed in service from 2023 through 2032. These credits are broken down into two categories:

Energy Efficient Home Improvement Credit. The previous $500 lifetime credit limit is now changed to a $1,200 annual limit through 2032. This change allows for home improvement planning combined with tax planning. Beginning in 2023, the credit will be equal to 30% of costs for all eligible home improvements. However, there are individual component credit limits for each year ranging from $150 to $2,000 (certain items can exceed the $1,200 annual credit limit). Please contact us with questions on qualifying improvements and their annual credit limitations. All taxpayers qualify for tax credits, and low- and middle-income consumers also qualify for rebates to reduce their up-front costs.

Residential Clean Energy Credit. The credit amount increases to 30% of the cost of eligible solar water heaters, solar electric property, fuel cell property, small wind energy property, and geothermal heat pump property.

The American Opportunity Credit is a $2,500 tax credit for qualified tuition and fees paid on behalf of a student who is enrolled on at least a half time basis. The credit is available for the first four years of the student’s post-secondary education. Qualified tuition and related expenses include course materials such as books, supplies and equipment needed for a course of study.

For 2022 and 2023, the credit phases out at modified AGI levels between $160,000 and $180,000 for joint filers, and between $80,000 and $90,000 for other taxpayers.

Current studies indicate that only 2% of phone calls to the Internal Revenue Service are answered. As a result, it is almost impossible to get issues resolved in a timely manner. The Inflation Reduction Act allocates almost $80B in funding to the IRS. $3B of these funds will go to taxpayer services; $45B will be allocated to enforcement; $27B will be spent on operations; and $5B will be spent on technology modernization.

The corporate tax rate continues at the 21% rate.

The Inflation Reduction Act alters the corporate tax rate for C corporations whose three-year average financial income is in excess of $1 billion by imposing a 15% minimum ‘book’ tax. It is estimated that only 150 companies will be subject to this tax.

Under the TCJA, the 2022 Section 179 deduction limit for capital purchases is $1,080,000, with the threshold for reducing the deduction up to $2,700,000 on capital purchases.

Expensing is permanently allowed for qualified real property, primarily leasehold improvements. This allows for immediate expensing of qualified improvements as in prior years.

Bonus depreciation for qualifying property under current law is 100% for property placed in service after September 27, 2017 and before January 1, 2023. It changes to 80% in 2023.

Beginning in 2018, individual taxpayers may be entitled to a deduction of up to 20% of their qualified business income from partnerships, S Corporations, LLC’s, and sole proprietorships. For 2022, if taxable income exceeds $340,100 for a married couple filing jointly, or $170,050 for all other taxpayers, the deduction may be limited based on whether the taxpayer is engaged in a service-type trade or business (such as law, accounting, health or consulting), the amount of W-2 wages paid by the business, and/or the unadjusted basis of machinery and equipment held by the trade or business. The limitations are phased in for joint filers with taxable income between $340,100 and $440,100 and for all other taxpayers with taxable income between $170,500 and $220,500.

Year end and other tax considerations moving forward

Year’s end signals your last chance to balance the timing of income and deductions for tax purposes between the current and the upcoming year to your maximum advantage. This is especially important considering the pending changes. Historically, the best year-end tax planning strategy has been to follow the time-honored approach of deferring income and accelerating expenses to minimize current year taxes.

Taxpayers should consider whether they hold substantial basis within their aggregate pre-tax IRA accounts (Traditional, SEP, and SIMPLE combined) and if they could be converted to Roth IRAs at little or no tax cost.

When considering changes to charitable giving, Donor Advised Funds are a popular option. These funds allow for a deduction upfront when a donation is made to the fund and then allows the donor to make grants to charities from the fund in subsequent years. Also, for taxpayers who are over 70 1/2, there is a benefit from giving up to $100,000 of IRA withdrawals directly to charities. This strategy allows them to reduce the taxable amount of their required distributions, and reduce their IRMMA adjustment, while still being allowed the full standard deduction for the tax year.

Lastly, here are several other year-end tax planning considerations –

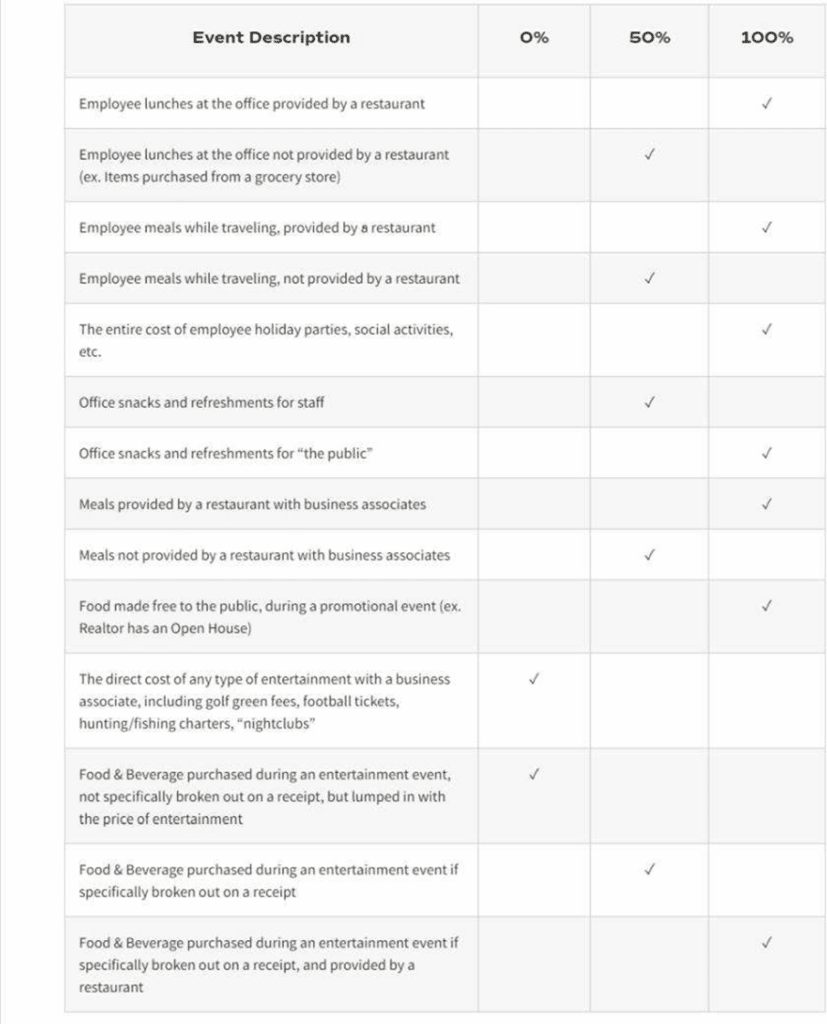

As part of COVID relief packages, meals and beverages purchased from restaurants in 2022 are 100% deductible rather than only 50% deductible. (We have included a table with the rules for the meals deduction at the end of our memorandum.) The deduction reverts to 50% in 2023.

Exhibit A- Table of Rules for Deductible Meals

Washington Capital Gains Tax

Background

Litigation

Compliance Activity

Legislature

If you have any questions about what steps you may take before year-end to save tax, please do not hesitate to contact our office.

Wm. Kelly Sterling

CPA, ESK Owner

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.