"Progress is impossible without change, and those who cannot change their minds cannot change anything."

-GEORGE BERNARD SHAW

‘Tis the Season. There’s just something about the holidays that makes it difficult to dwell on things like "secular stagnation," or "structural unemployment," or even "American Express Statement Enclosed." Rather, it’s a time to consider the eggnog glass half full (and the way my wife makes eggnog—light on the egg, heavy on the nog--you definitely only need half a glass!).

For those readers who opened your special Christmas EVA edition, you received a tantalizing taste of the new book by my partner and dear friend Louis Gave: Too Different for Comfort. Even if you didn’t see that issue, it occurred to me that running some excerpts from Louis’ thought-stimulating creation is an ideal fit with this cheerful time of year. Louis does a laudable job of articulating the very substantial problems our planet faces right now while also highlighting numerous emerging solutions.

As you will read, one of the most exciting remedies for what ails the developed world (essentially, the US, Europe, and Japan) is a rapidly-accelerating trend, which Louis refers to as the "Robolution"; basically, the increasing role robots are already playing in wealthier societies. In fact, even in countries like China, robots are becoming quite common, displacing workers in what is still a low-cost venue (though China’s labor advantage is quickly diminishing).

For the aging industrialized nations, robots offer obvious and numerous advantages. As these machines become more advanced and flexible, they’re virtually certain to proliferate, performing functions right out of The Jetsons. This, in turn, could help mitigate the problems of a shrinking workforce relative to a growing retiree population.

As with all automation breakthroughs, however, there are winners and losers, beyond the obvious example of a worker whose occupation becomes "robotized". Other casualties, as Louis notes, are government tax policies which are extremely ill-suited for a smaller and more mobile, labor force where capital is becoming increasingly hard to tax.

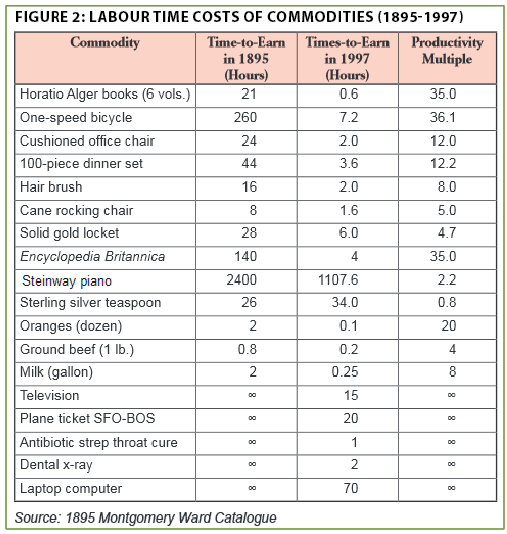

Yet, despite the hurdles posed by the Robolution, the benefits to society at-large far outweigh the costs. This outcome has been true of every mechanization breakthrough since the Industrial Revolution itself first gathered steam (pun intended) way back in the 1800s. The table Louis shows (pg. 5) of the dramatic reduction of hours worked in order to afford the necessities, and niceties, of life, makes the abundance, well, abundantly clear.

In Too Different for Comfort, Louis examines additional "mega-trends," such as the other revolution going on currently—in the US energy industry. Unquestionably, this boom also has many beneficial implications for our economy and has begun reshaping global dynamics that have been in place for the last 40 years. Yet, there are downsides to even what appears to be an unalloyed positive, such as less US dollars flowing out to the rest of the world. Since the greenback continues to be the planet’s reserve currency, past episodes of dramatic reductions in the US trade deficit have been consistently associated with financial and/or economic crises.

In my opinion, there are also implications for inflation and interest rates in Louis’ outlook. He specifically describes: "structurally accelerating deflation; an ability to produce more and more goods with ever fewer workers." Perhaps the forces he discusses, already underway, are among the reasons inflation continues to tumble around the world. And although US interest rates may spike higher on a near-term basis, it’s hard to see longer term yields returning to pre-crash levels, and staying there, with inflation so quiescent.

On a local note, but one that seems to reflect another nascent trend at the national level, the City of Seattle is considering a 60% leap in the minimum wage. If it does in fact become the law of the land, it will likely accelerate the Robolution. After all, dramatically higher wages, especially for routine functions, makes robots even more appealing to business owners (more to follow on this issue in an upcoming EVA).

Overall, Too Different for Comfort is an encouraging look at the future despite its somewhat cautionary title. The reality is that change is never comfortable. Yet, there should be no doubt that it is also absolutely essential.

TOO DIFFERENT FOR COMFORT

Louis-Vincent Gave

When Lord Salisbury, the first British prime minister of the 20th century, was asked by Queen Victoria to consider a reform, he famously replied: "Change? Your majesty, aren’t things bad enough as they are?"

Of course, it is in the nature of conservatives to look askance at change. But sometimes, change is thrust upon us; and in that regard, turn of the century periods tend to be particularly traumatic. Think of a man who fell asleep for 30 years in 1790. Our sloth would have woken up to a very different world in 1820 (France was no longer the dominant European power, Britain was rapidly expanding her global reach, Spain had become a has-been, the United States was experimenting with a new form of government...). The same is even truer for the man who fell asleep in 1890 and arose in 1920 to witness the end of the Austro-Hungarian, Chinese, Russian and Ottoman empires, the establishment of the USSR, the rise of Japan, the dominance of the United States. And the same is true today: someone who fell asleep in 1990 would likely be surprised to hear that Pentagon officials are now more worried about China (an economic and political basket case in 1990) than about the Soviet Union (which of course no longer exists); that Europe is going cap in hand to ask for loans from China, India and Brazil; that Iran may, after all, end up exercising ultimate political control over Iraq (remember that in 1990, Iran was left on its knees by the Iran-Iraq war). In short, beginning of centuries tend to be ‘revolutionary periods’, with societies, political systems, and established values all undergoing deep and profound changes.

Now contrary to what Lord Salisbury implied, not all change needs to be negative; after all, life is a whole lot more comfortable and less gruesome today than it was one century ago for almost anyone, bar perhaps a few British aristocrats or Russian landlords. However, change that is misdiagnosed, misunderstood or miscommunicated can be highly destructive. The entire History of the 20th century, with the rise of fascism, communism, large-scale genocides, unprecedented loss of human life in large-scale wars, etc... testifies to this unfortunate truth.

And this is where the study of economics comes in.

Most of us were taught in school that economics is the ‘dismal science’; the dour discipline necessary to master in order to allocate most efficiently the world’s scarce resources (whether labor, land, capital, or commodities). But in a world in which capital is increasingly human or, even more importantly, a world in which capital can ‘breed’ and become limitless rather than finite (for example, think of the information stored within the Amazon servers and how the more one shops there, the more information and thus ‘capital’ Amazon accumulates) such narrow-thinking makes no sense. Instead, economics is increasingly about reflecting on the changes reshaping the world, and how we can best adapt to them.

At least that is how we perceive things at GaveKal and why, in 2002, we moved our main office from London to Hong Kong, before opening a Beijing office in 2005. Indeed, a decade ago, the main change to the global system came from the ascension of China. And understanding this rise, and its global impact, was essential, we felt, to managing money efficiently. This was the task I decided to tackle in previous books such as Our Brave New World or A Roadmap For Troubling Times.

But now the China growth story is evolving, with massive ramifications across financial markets. Worse yet, this is happening at a time when the entire structure of production of most industrial countries is itself going through a highly disruptive accelerating rate of change. Indeed, over the past two years, one of the key GaveKal themes has been the rapid rise of automation and the growing obsolescence of the low-end workforce. Thi development which has probably helped trigger dramatic changes in our monetary systems – changes which themselves will also have deep ramifications (another key GaveKal theme, and source of debates, over recent years).

Re-reading the above paragraph, one might come to the same conclusion as Lord Salisbury – that change is something to be feared rather than embraced. That is not the thesis of this book, for some changes can be extremely positive. For example, the shale-gas revolution which started to bear fruit in the US following the 2008 crisis is undeniably a tremendously positive development. Also, the changes re-shaping the Chinese economy could unleash some extremely exciting and creative forces.

VIVA LA ROBOLUTION

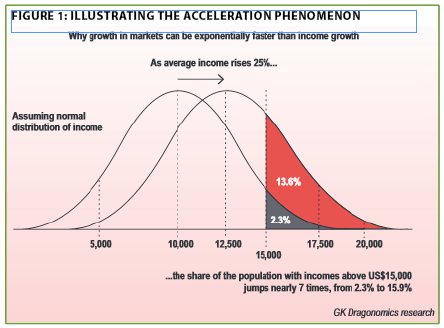

In the early 20th century the French economist Albert Aftalion developed the concept of ‘Acceleration’. Aftralion explained that most socio-economic variables are distributed according to the ‘normal’ law, the famous bell-shaped curve, affectionately also called the boiler hat. This is especially true of income. In a normally functioning society (i.e., not North Korea), income tends to be distributed according to a Gaussian pattern, with a large percentage of the population making close to the average level of earnings. In a normal country there will be few people with a very low income and few with a very high income. At both ends of the curve (the tails), one finds a very small population in percentage terms. This Gaussian distribution of income matters greatly for, when it comes to the buying of certain goods and services, the historical evidence suggests the existence of thresholds. For example, if the average income in a country is below US$1,000, nobody owns a television when the income moves above US$1,000, then almost everybody buys one. For a cell-phone, the required income level seems to be around US$2,000. For a car, the critical level seems to be US$10,000/year. For foreign travel, it is US$15,000. For university education, US$20,000. For financial products, US $30,000 and so on.

In 1998, only a few million Chinese were registered cell phone owners. By 2008, 650 million people in China were yelling into their receivers while going to the movies, riding the train, lounging in the park. In the course of ten years, two things happened: firstly, the GDP per capita rose from US$817 in 1998 to US$3,405 in 2008. Secondly, the price of using a cell-phone collapsed. This twin effect, incomes moving to the right and prices moving to the left, led to an explosion in demand far beyond the correspondent growth in income. It is this double 'Acceleration phenomenon' which makes 'deflationary-booms' possible.

Now any new technology typically goes through an initial phase where price points are so high that only a few early adopters can afford the new revolutionary product. This was the case for autos, for air conditioning units, for televisions, for cell phones and personal computers... And up until now, it has definitely been the case for most high-end manufacturing robots. However, the question investors should ask themselves is whether we have no reached a tipping point? And it's not just about the US$10,000 robots that Foxconn claims it will be producing by next year. Nor it is Bill Gates' recent forecast that new generation robots may become as ubiquitous and have as transformative an effect on our economies and our lifestyles as the personal computer. Instead, it's about everything we see about us: from Paris' driver-less metro railtrains, to Panasonic's fully automated plasma screen plants in Osaka. Everywhere we care to look it is hard to avoid the conclusion that an increasing number of jobs are being replaced by machines and smart software. Even the rabbi's matchmaking duties are now being replaced by Match.com's algorithms (or, in the rabbi's case, www.jdate.com)

But as with the PC revolution of the 1990s, it's not all about price. Indeed, the first generation of industrial robots did relatively simple, yet repetitive, tasks on production lines where labor was expensive and fault-tolerance was low. Such machines brought precision to Japanese car factories and Taiwanese wafer fabrication plants, allowing lean production with minimum wastage. What they did not do was fundamentally change the nature of industrial automation which over the last 200 years has grown increasingly capital intensive and sophisticated. Until now, that is. Indeed, to even the most casual of observers, the obvious conclusion has to be that robots are becoming sufficiently smart and affordable to change the way manual tasks are undertaken in both developed and developing economies. New generation robots can be programmed to undertake complex tasks that allow easy replacement of physical labor; and can then be reprogrammed to do different tasks.

In a move reminiscent of General Motor's purchase of the Los Angeles, San Diego, and Baltimore tramways in the 1950s, Amazon spent US$775million in 2012 on Kiva Systems, a supply chain robot maker. Clearly, Amazon's goal was to not only move one step above the competition in terms of supply-chain efficiency, but also ensure that the competition stayed one step behind. Or take Foxconn, with over 1 million employees, the company is on record as wanting to effectively replace 300,000 workers with robots over the next three years. Already, the company’s highly secretive new Chongqing plant is reportedly experimenting with robot-run production lines.

Very soon, large-scale robotic adoption and production by firms such as Amazon or Foxconn will fundamentally change the competitive dynamics of their entire industries. But just as IBM and Cisco dominated the first phase of the computing and internet cycle, the early winners of the robotic revolution will likely be the makers of core infrastructure. Which means that, for now, investable options in this potentially high-growth sector remain dominated by robot producers, a group of companies whose performance can now be tracked through an ETF (ROBO.US). Incidentally, what are ETFs but another sign of the unfolding Robolution, with algorithms and programs replacing money managers in the investment decisions? (My note: Now, let’s not get carried away, Louis!)

Having said all this, there is little doubt that the listed robotics sector remains very much a niche market today; but then, so was the internet in 1995 and 1996. Meanwhile, the robotics’ industry growth potential offers a compelling risk-reward proposition–especially at current depressed valuations. With robotic adoption benefitting from technological advancements, and indirectly from inexorably rising labor costs in large manufacturing economies, the current market leading suppliers should benefit. Building an early position in these stocks provides optionality–especially if, as seems possible, robots really do end up taking over the world. Or, at the very least, taking over jobs that, until recently, were being filled by Chinese, Vietnamese, Mexican or Polish workers.

WILL THE ROBOLUTION END UP EATING ITS OWN CHILDREN?

Most people know the quip of Henry Ford pointing to his new machines and asking Walter Reuther "How will you get union dues from them?", only for the UAW leader to reply: "How will you get them to buy your cars?"

Back then, the challenge was not as much the machine’s threat to industrial workers as much as the rapid industrialization of agriculture. As mentioned before, at the turn of the 19th century, roughly half of the workforce of most countries with a European population (whether England, France, the US, Australia...) worked in farming. Within a generation, this ratio had broadly fallen to 10% or thereabouts. And that 10% produced multiples of the foodstuffs that their forefathers has produced.

This massive gain in productivity, itself a direct result of the mechanization of agriculture (along with improvements in seeds, fertilizers, overall farming knowledge, etc...) had many beneficial effects, not least of which was the ability to work a lot fewer hours to feed one’s family. The table below, derived from the Montgomery Ward catalog, reviews the number of hours the average US worker needed to work, in order to purchase everyday items. In 1895, twelve oranges cost two hours of work. By 1997, the cost of these same oranges was down to six minutes.

If nothing else, this illustrates the profoundly deflationary nature of capitalism. Fundamentally, capitalism is about making more with less. And if possible, much much more with much much less. And given the Robolution, we may well have entered a period of structurally accelerating deflation; an ability to produce more and more goods and services with ever fewer workers.

In his research, Professor Brynjolfsson shows that 65% of American workers occupy jobs whose basic tasks can be classified as information processing. This is frightening as it leaves open a lot of jobs that could be replaced by machines and/or software. It is this new reality that raises major headaches for policymakers.

The first big policy issue is faced by central banks which have given themselves the dual task of fighting both deflation and the rise in unemployment. But what if higher unemployment and the fall in prices are a structural phenomenon that has little to do with the cycle? For example, if tomorrow Samsung is able to fully automate its production line and deliver to our doors a smartphone without the intervention of a single worker (save the lorry driver bringing the parcel) and, as a result, the price of a phone halves? Or what if, thanks to ever-improving robots, heart surgeons are able to operate on ten times as many patients as they are today, thereby collapsing the cost of the average heart surgery? Should we bemoan such deflation? Should we lobby our policymakers to do something about these collapsing costs? And what could they do? Order surgeons to use leeches to treat heart problems and electronic contract manufacturers to go back to using child labor? And does putting the cost of capital at zero, and printing a lot of money (the remedies so far espoused by most central banks in their bid to fight deflation) really help the laid-off Samsung worker, or now-unemployed nurse, find a job? Or does the zero cost of capital instead accelerate the trend of replacing labor with capital? After all, if we make capital free, and labor expensive (through increases in regulations, increases in benefits etc...), should we be surprised that companies replace labor with capital?

More poignantly is this trend a thread to the current structure of most Western welfare states? Indeed, most developed countries put together their current fiscal structures in the period between the Great Depression and the oil shocks of the 1970s. And the rules which most governments (at least, the successful ones!) seemed to work under were that:

In those days, the economy was organized along vertical lines, around key industrial consortiums, whether GM, P&G, IBM or Citibank for the US, Mitsubishi & Sony for Japan, Renault and Credit Agricole for France, etc... Most of the value-added accrued to a few key, large, companies, typically managed by friends, or even government appointees and technocrats. In this pyramidal eco-structure, taxing the very wide working-base made all the sense in the world. After all, as Mark Twain once said: "Tax the poor people; there is just a lot more of them."

But then labor became flexible (the 300,000 or so Frenchmen living in London attest to this – as do the rosters of the Chelsea football and Toulon rugby squads) and now, for a lot of activities, labor may even be becoming superfluous. Surely this raises the question of whether maintaining high taxes on labor (i.e., income taxes, payroll taxes, etc...) to fund welfare states still makes sense?

The problem here is obvious enough: in a world in which labor is harder to pin down, capital only becomes much freer (as the numbers of rich, older, French folks living in Brussels can attest). And this trend towards freer capital may also be going into hyper-drive. Indeed, once a company makes the switch to the ‘platform company’ business model (for more on this, please see our book Our Brave New World), as they focus more on design and on sales than on labour-intensive manufacturing, the more and more companies start to domicile their research and marketing activities in countries with low marginal tax rates (Ireland, Luxembourg and Switzerland yesterday, Hong Kong, Canada and Portugal tomorrow?) Companies do this both for their shareholders and for their employees(which increasingly are one and the same).

The reality is that, in a world in which both labor and capital become ever more decentralized and in which the more productive talent will want to work, or at least be taxed, in low tax environments, the modern welfare states will be hard pressed to prevent a structural downturn in tax receipts. Let’s not beat around the bush: in the new world forming in front of our very eyes, income and capital gains taxes will become increasingly voluntary and governments will have to get their pound of flesh elsewhere. So will this trigger a change in the welfare-state? Or a change in the taxation method?

Looking back though the history of modern nations, one finds that the first industrial revolution gave birth to the modern nation-states and the idea of citizenship. At the time, governments basically provided subjects, who had little say in the matter anyway, a modicum of regalian functions (police, army, judges). Following the second industrial revolution, governments started to branch out from their regalian functions and provided citizens with income redistribution, education, pensions, healthcare, unemployment insurance, etc. In a society where everything was based on industrial mass production, mass distribution, mass consumption, mass education, mass media, mass recreation, mass entertainment, and weapons of mass destruction, a system of mass taxation made sense. But today, in the midst of a rapidly accelerating third industrial revolution, centred around the ability to store, transmit and analyse information ever faster at a collapsing cost; a society characterized by a growing diversity in lifestyles (what Alvin Toffler called ‘subcults’), fluid organizations that are prone to rapid change (Toffler called them ‘adhocracies’), and in which workers are less proletarians than loosely-affiliated ‘cognitarians’; with an economic system in which mass customisation offers the possibility of cheap, personalised production catering to small niches and in which ‘prosumers’ can increasingly fill their own needs through the miracle of 3D printing, does mass taxation to deliver uniform state services really still make sense?

In our ‘third wave’ world in which platform companies, prosumers and cognitarians operate, taxes will increasingly become voluntary. This implies that governments will have to compete with each other to provide the best services at the lowest possible costs to attract the world’s best platform companies, and their workers. Over time, this should mean that governments which provide the most efficient Regalian functions, and at the lowest possible costs (Hong Kong? Singapore? Luxembourg?) stand to survive in their current structures. Either that or, like the US, governments will have to trap their citizens through global taxation; i.e., take away their right to vote with their feet (this can be done on citizens who have an emotional attachment to their countries – it is much harder to do on corporations who are, by nature, far more mercenary). So on the assumption that non-US Western governments shy away from locking their populations behind the high walls of global taxation, the pound of flesh will have to be found elsewhere. In our view, this will have to be done through:

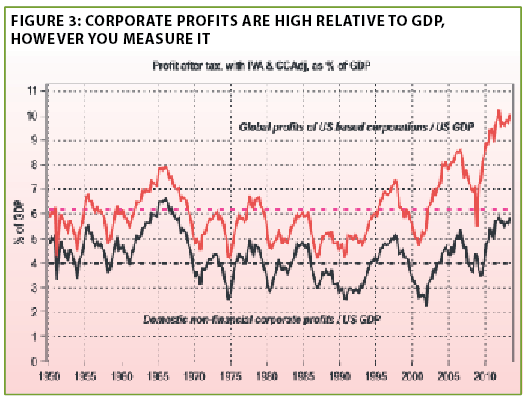

Beyond the neutral impact of inheritance tax, high death duties may also make sense from a social stability standpoint. Indeed, in a world in which, thanks to the Robolution, the returns on capital rise exponentially (look, for example at the chart below, showing how far US profits relative to GDP, stand above their long term mean (admittedly, part of the boom in profits is linked to the fact that US companies have been so efficient at harvesting profits abroad – a phenomenon we discussed in Our Brave New World, but even stripped of their foreign profits, US domestic profits relative to GDP stands at close to all time highs). So while the returns on physical labor collapse, the societal risk inherently becomes that too much capital becomes too concentrated in just a few hands. This is all the more so since a) capital starts to ‘breed’ (as reviewed above) while b) capital increasingly becomes untaxable. In such a world, pushing for high inheritance taxes to avoid a ‘latifundalization’* of our economies, in which too much wealth is concentrated in too few hands, may well make sense.

Unfortunately, however, in no Western democracies have we seen a move towards scrapping income and capital-gains taxes, to be replaced by sales, real estate and inheritance taxes. And so we are stuck in a situation where, even five years after the recession, the tax receipts of almost every Western government fall far short of their spending habits – a situation bound to get worse as Western countries age, blowing pension obligations and social security costs through the roof. And thus, to square the circle, central banks have been forced to transform themselves into the financing arms of their countries’ budget deficits; even if the consequences of adopting zero interest rate policies are ultimately self-defeating.

*My note: i.e., Similar to the extreme disparity between the rich and the poor that has unfortunately typefied much of Latin and South America.

CONCLUSION

Putting it all together, it would be easy to embrace Lord Salisbury’s negativity on change. Indeed, with Western policymakers following the same trail blazed by Japan in the past two decades (Zero Interest Rate Policy (ZIRP), keeping dead companies on life support, refusal to restructure bust banks...), and marveling that the results are turning out to be broadly the same, one might be tempted to become despondent. However, there are also reasons to be optimistic. Look at it this way: an investor who, in 1989 had been told what a disaster zone the Japanese financial markets would turn out to be over the following twenty years would likely have concluded that the world was doomed. After all, in 1989, Tokyo was the shining city on the hill, with the grounds of the imperial palace worth more than California. These were the days when most teenagers believed that, if they did not learn Japanese, they would never find a job (I once went to a 1980s themed party where one of my friends had a yellow SONY Walkman in which he was playing Japanese language tapes – genius!). Of course, what our Japan-bear in 1989 could not have foreseen was the way the internet would change our way of working, saving, playing and consuming. It would have also been tough to predict that China would become a global powerhouse (let’s not forget that, in 1989, Deng Xiao Ping was ordering Li Peng to gun down students). Or that the 1990s would witness the collapse of the ‘Evil Empire’ and the harvesting of a decade-long ‘peace dividend’...

So today, even as policymakers, at least in the West, seem to be doing their best to repeat the Japanese experiences, we must not forget that a number of productivity-enhancing trends are unfolding. Some are starting in Japan (the Robolution), some in the US (shale), others in China (cheap machinery, renminbi financing...) and each has the potential to reap attractive rewards for investors. Together, these trends may yet make for a potent mix.

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Evergreen Capital Management LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.