“In the middle of difficulty lies opportunity.”

-Albert Einstein

Peak Experience. With a business career rapidly approaching the 35-year mark, I’ve taken a number of work-related trips to some unusual, even exotic, locales. Last week, however, I traveled to what might have been my most unlikely business venue, one that probably strikes clients and readers as the ultimate boondoggle destination: Whistler, B.C.

Given that skiing is a favorite pastime of mine, and one that I rarely get to indulge in because my wife likes it even less than having her credit card rejected at Christmastime, skepticism about the business purpose of this sojourn is understandable. And because I always strive to be as honest with my readers as possible, I will admit that there definitely was some skiing involved. However, even that activity gave me a chance to gain valuable information, which I will share with you shortly.

In fact, “gave” is the key word or, more accurately, Gave. In this case, the pronunciation rhymes with “mauve” and I’m sure astute readers realize I’m referring to the Gave in GaveKal Research, whose incisive work I so frequently relay to all of you in these pages.

Louis Gave, the firm’s founder, has a winter residence up at Whistler, giving him the perfect lifestyle counterpoint to hot, humid, and humming Hong Kong, which he and his young family usually call home.

One of my main motivations for going up to Whistler at this hectic time of the year was the rare chance to meet with Louis’ father, Charles, who normally resides at the far removed longitudes of either Hong Kong or France. For those of you who regularly read John Mauldin’s wildly successful newsletter, you may recall that John refers to Charles as someone who, when he gets really revved up on a subject, comes across with the force and presence of God himself.

One night up at Whistler, my wife and I had a private dinner with Charles and his lovely wife Chantal. Frankly, though I had met him a couple of times before, I was still a bit intimidated. Besides his imposing persona, he also was a highly successful money manager in Europe before selling his $10 billion asset management in 1995 (that would be an extra zero above and beyond what Evergreen currently manages though we hope to add that digit over time).

Then, about 13 years ago, Louis, just 25 at the time, convinced Charles to join him in starting an investment firm in Asia. Though it seems like an obviously bright move now, you might remember that Asia had a few “issues” back in those days.

The truffle doesn’t grow far from the tree. It was the younger Gave’s view that Asia, and particularly China, would be the world’s growth engine in the decades ahead. But the crisis ravaging that region at the time was so severe that it drove Hong Kong housing prices down by 70% (and we think we had a tough housing market!). It took a brave contrarian to stake his future on Asia rising again, but we now know the wisdom of that decision.

It’s long been my opinion, having read just about every macro economic research source on the planet, that GaveKal’s big picture analysis of major financial trends is among the finest published anywhere. (Naturally, the folks at GaveKal don’t get all the calls right; after all, Charles only sounds like God, he’s not really supernatural as his wife can readily attest—particularly when he loses his wallet or his cell phone, which he does on a regular basis).

Moreover, GaveKal’s investment division has produced extraordinary results for its clients over the years, demonstrating the value of fusing intensive and unique research with a money management operation. Undercutting the widely held belief that markets are efficient and nearly impossible to outperform, both its Asia- and US-based strategies have dramatically beaten their respective benchmarks over the years.

Even more impressive, a fund GaveKal launched back in 2008 to capitalize on what it correctly foresaw as serious dislocations looming in Europe has rewarded the firm and its clients along the lines of what John Paulson did by shorting sub-prime mortgages. In other words, it wasn’t merely a home run; in fact, it wasn’t just a grand slam—it was multiple grand slams.

Therefore, the chance to spend time brainstorming with the two of them in a relaxed setting was definitely one of the highlights of my year. I don’t know whether it was the martini or Charles’ affable manner but I quickly overcame my intimidation. And it didn’t take long to find out how similar our market views are, especially that 2012 is likely to be a make-or-break year for Europe.

It’s his view that one of the incontinent Continent’s biggest challenges is a serious shortage of US dollars, a perception that is certainly affirmed by the Fed’s recent announcement to provide massive greenback-based loans to European central banks. More controversially, he believes the entire euro experiment is doomed to failure and that the sooner this reality is acknowledged the faster the financial markets will adjust and begin to stabilize.

Although others at GaveKal disagree with him and feel Europe will more closely integrate rather than break apart, considering his experience, and my own analysis, I lean toward his scenario. Charles adamantly believes that throwing off the shackles of a suffocating bureaucracy, along with an artificial and inflexible currency, will eventually be extremely bullish. While I don’t disagree with his long-term appraisal, I do worry about the carnage that might be done until we get to the “eventually” stage.

When I asked him where we should be over the next 6 to 12 months to protect our clients his simple answer was: “in dollars.” Consequently, he believes, consistent with Evergreen’s stance, that US multi-national blue chips will continue to outperform in the years ahead as they did in 2011. In fact, with almost no press, the large cap growth companies so long touted by both GaveKal and Evergreen have handily beaten the S&P 500 and even the perma-loved emerging markets over the last five years. (Additionally, since the market and economy peaked in 2007, US blue chip growth stocks have surpassed emerging markets by roughly 20%, once again confounding the consensus.)

Source: Evergreen Gavekal, Bloomberg

Source: Evergreen Gavekal, Bloomberg

In addition to my time sharing good food and adult beverages with Charles, I did spend a few hours on the slopes with Louis. For a 56-year-old grandfather with a balky back, that turned out to be quite an experience—as in near death!

Living to write about it. Years ago, Louis had told me he was on the Duke ski team in college but what he neglected to mention was that he’d also been a member of the elite French Alpine battalion. These are the guys who flit around mountains in all-white camouflage with machine guns strapped to their backs. Needless to say, his idea of fun runs and mine were just a tad different.

Amazingly, I managed to survive a couple of adventures down sheer faces with rocks all around and in snow conditions that were not exactly ideal. For some strange reason, called self-preservation, I decided to ski with Charles and Chantal after lunch, definitely much more my speed (literally).

But between heart-thumping runs with Louis in the morning, I was able to pick his brain during those rare times when we—ok, I—stopped to catch my breath. When I brought up that I felt Germany should do all it could to protect Spain and Italy, he disagreed. He wasn’t impressed by my point that Italy, despite its abundant problems, is actually running a primary budget surplus (meaning that before interest costs it is in the black). Louis countered that their deficit is set to explode as it falls into recession. Essentially, he feels the Italian government is insolvent.

Due to the fact that GaveKal is headquartered in Hong Kong, and has extensive operations in Beijing, the folks there naturally have very strong opinions about what’s transpiring in China presently. Many EVA readers have no doubt seen that there is mounting concern that China may experience an economic hard landing, potentially magnified by a bursting real estate bubble even worse than what the US has endured. Louis and his team disagree.

While they have few doubts that China is slowing and that property prices are clearly cracking, they definitely don’t see a doomsday scenario unfolding. They believe China’s GDP growth will slow to the 7% to 8% range but that it has the resources to manage a gradual cooling of its formerly “en fuego” property market. The fact that Hong Kong property prices plunged by more than two-thirds during the Asian crisis and yet nary a bank failed is pretty convincing evidence that China can avoid the horrific chain reaction we saw when our property bubble popped back in 2008.

They also feel that rising domestic consumption and much more efficient use of capital will help cushion the drag from softening exports and falling real estate values. The bottom line is that they see China slowing but not collapsing.

Beyond investments, the three of us also had some interesting and encouraging discussions about ways in which our two firms can work collaboratively. While very exciting, that’s a topic for another EVA.

Then, before I knew it, our short time together was over and we embarked on the long drive back to Seattle, giving me a chance to process the information I had acquired from these two gifted men.

The road ahead. As many Evergreen clients know, whenever we go on extended driving trips, Mindy takes the wheel allowing me to read research and, occasionally, serve as navigator. On that latter score, I had an epiphany on this trip that I suspect quite a few of you might benefit from: Google Maps.

Thanks to my tech savvy—and Apple-smitten—eldest son, I’ve learned how to use the Google Map App not just for directions but also to select routes based on the lightest traffic flows. Driving up to Whistler through Vancouver has always been a nightmare but thanks to the Map App I was able to find a highway that was all in green (meaning light traffic) and avoid the usual red zones (basically bumper-to-bumper). As the young folks used to say: WAY COOL!

Wouldn’t it be great if one of Google’s app-sters could come up with something that would give us a reliable red, yellow, green road map for the financial markets? Somehow, I’m not expecting to see that coming to an iPhone near you (or me) anytime soon. Therefore, relying on old-fashioned economic research, decades of experience, common sense, invaluable contacts such as GaveKal, and perhaps a bit of technical analysis seems to me the best hope for dealing with these crazy times.

Based on the extensive reading and thinking I’ve done both on the way back from Whistler and over the Holidays, I’ve come up with a few thoughts I’ll summarize in bullet point form:

For more on what we see unfolding in 2012, next month we will be issuing our usual annual forecasts as well as reviewing how well—or poorly—we called 2011.

In the meantime, all of us at Evergreen Capital want to wish our clients and readers a most happy, prosperous, and, especially, healthy New Year! We’ll do what we can to help with the second part!!

David Hay

Chief Investment Officer

To contact Dave, email:

dhay@evergreengavekal.com

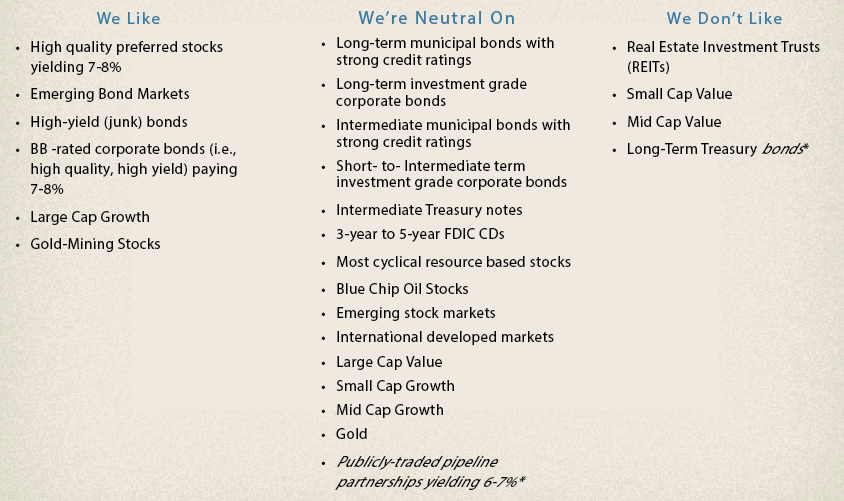

OUR CURRENT LIKES AND DISLIKES

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.