"Consider the following simple, almost naïve question: Is it sustainable for an economy, which expands at a real growth rate of 2-3% per year, to provide a return (to investors) of say 10-15% per year?"

-Didier Sornette, world renowned mathematician.

Special message: This might be the only time you’ll ever receive an invitation to an event that begins by touting a conference held by another firm, but that’s exactly what I’m going to do. John Mauldin will be hosting, along with Altegris Financial, his annual Strategic Investment Conference (SIC), May 13 – 16, in San Diego. As veteran EVA readers know, this yearly assemblage of brilliant minds has been the source of a number of the more important insights conveyed in these pages over the years. The cost is $2,495, but for those signing up before March 14, a discount of $500 is available. In my opinion, this is money very well invested (not to mention a chance to spend some time in one of America’s loveliest cities).

The line-up at this year’s SIC will be impressive as usual, including the Crown Prince of Bonds (i.e., the man who, by most accounts, is in line to succeed Bill Gross as the new King of Bonds), Jeff Gundlach. In addition, Kyle Bass, David Rosenberg, and Newt Gingrich, will be speaking. Rounding out the headliners, and the other reason for this plug, will be two of my partners, Charles Gave and Anatole Kaletsky. The fact that they are sharing top billing with folks like Gundlach and Bass should underscore to EVA readers how highly regarded GaveKal is in the professional investment community.

For those of you who would rather stay close to the Seattle area (perhaps to bask in the continuing glow of the Seahawks’ Super Bowl blow out), Louis Gave, GaveKal’s founding partner, will be speaking at our Annual Market Outlook event on February 25. Moreover, the cost to attend is everyone’s favorite price: Free. Louis has graciously agreed to participate while he is in the Seattle area and provide some of his incisive views as to why Asian financial markets offer significant long-term investment appeal.

To further pique your interest, Grant Williams, author of Things That Make You Go Hmmm, one of the planet’s most popular financial newsletters, will also be presenting. In addition to his swelling stature as an economic and market scribe, Grant is becoming a very popular speaker at global investment conferences.

It’s no exaggeration to say that we are thrilled to have Louis and Grant attending our annual event and highly encourage you to sign up as soon as possible while there is still space available. Oh, yes, I will also be speaking, but please don’t let that keep you away!

Looking forward to seeing many of you on the 25th!

POINTS TO PONDER

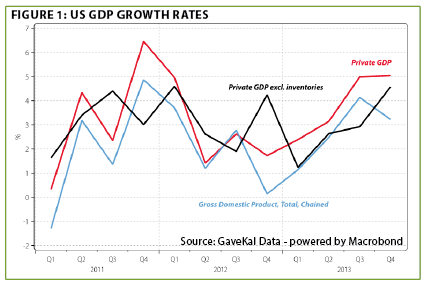

1. Recent US economic releases, including the last two jobs’ numbers, have disappointed the growth bulls. Yet, private sector GDP appears to have increased at a husky five percent clip for two straight quarters. (See Figure 1)

2. US energy demand has been contracting for years. Lately, though, a dramatic change appears to be underway. The US government’s Energy Information Agency (EIA) recently reported growth in America’s energy consumption exceeded China’s for the first time since 1999.

3. One fun factoid validating the belief that employed American workers are gaining the leverage to seek higher compensation is that Google searches "asking for a raise" are at a post-recession high.

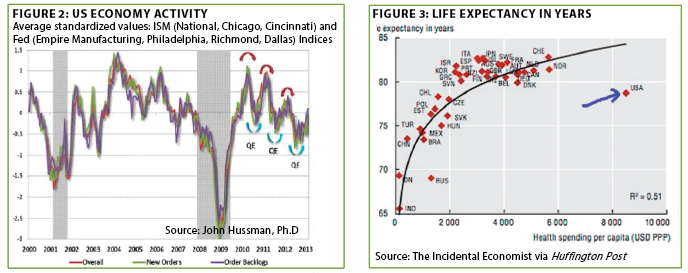

4. It’s becoming increasingly clear, even to many Fed officials, that the economic benefits—as opposed to stock market upside—from serial QEs (quantitative easings) are diminishing. Moreover, considering that this has been the feeblest post-war recovery, the return on the Fed’s $3.5 trillion dollar investment/experiment appears inadequate to justify the risks of the eventual reversal, including on stock prices. (See Figure 2 below, left)

5. Numerous past EVAs have noted the immense waste and inefficiency in the US healthcare system, even prior to Obamacare. However, seeing it in graphic terms (literally) drives home just how much of an outlier the US is, with life expectancies below most other developed countries, despite the extra trillions of medical outlays. (See Figure 3 above, right)

6. Gifted money manager John Hussman recently revealed an important calculation. By adjusting the key "Shiller P/E" for the highest 10-year inflation-adjusted profits (on which Dr. Shiller’s famous ratio is based) in history, he has determined the current reading is 30. This compares, most unfavorably, with a post-war average of 19.

7. A prime reason the US stock market was so vulnerable coming into 2014 was exceptionally bullish sentiment. State Street’s institutional investor index hit a 4-year high of 114 in mid-January, just prior to a sharp sell-off.

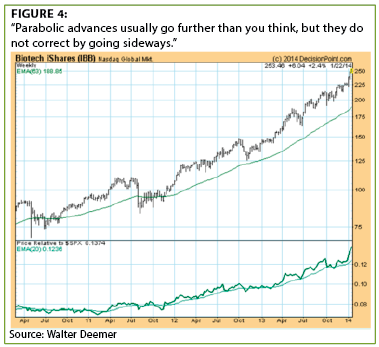

8. Many market pundits say that there is no bubble in stocks. Yet even ignoring the new-age Nifty Fifty issues like Netflix and Twitter (the latter having suddenly become a bit less nifty last week), the Biotech Index alone is ample evidence of speculative fervor run amok. In addition to tripling over the last 3 years, it is also trading at over 100 times trailing earnings. (See Figure 4)

9. Various EVAs in the second half of last year pointed out that with sentiment so bearish on bonds, a surprise rally was likely. A recent Bank of America Merrill survey found just 3% of institutional investors thought bonds would out-perform, right before January’s backtrack in yields on 10-year Treasury notes from 3.03% to 2.6%. Of course, as bond yields go down, prices go up, producing a sharp contrast to the stock market last month.

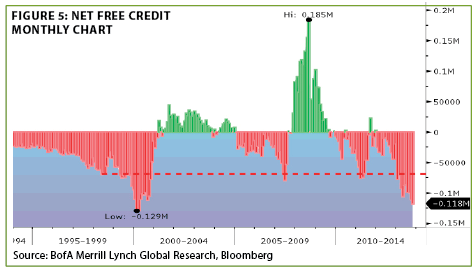

10. Net free credit balances are another indicator of extreme bullishness in the US stock market. Presently, these are at a deficit level virtually as severe as at the February 2000, peak of the biggest US stock bubble ever. (See Figure 5)

11. Illustrating that long beleaguered Europe is seeing pockets of reckless investing, payment in kind (PIK) bonds have resurfaced after a multi-year hiatus. Sales of this high-risk paper last year hit the loftiest level since prior to the global financial crisis.

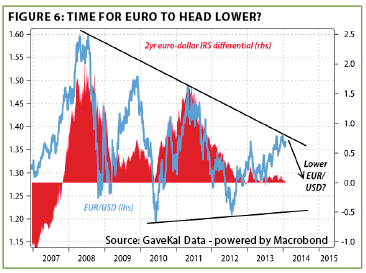

12. The euro has experienced a healthy rally over the last six months, similar to leaps seen repeatedly in recent years. The latest up-move, though, has lacked the power of past surges and may be petering out at its downwardly slopping long-term resistance. (See Figure 6)

13. Europe’s economy is broadly acknowledged to be turning a corner. However, a string of high profile earnings warnings from elite companies such as Shell, SAP, Unilever, and Deutsche Bank would seem to indicate it is far from a healthy environment.

14. Despite a firming renminbi (the Chinese currency) and sharply escalating wages, China’s exports continue to expand, up 13% in 2013 over 2012. Strongly suggesting that this improvement was more than a function of dubious accounting, its foreign currency reserves expanded by a whopping $500 billion last year alone, bringing its total trove of these assets to approximately $3.7 trillion.

15. Unquestionably, emerging nations face an array of problems once again. However, at least on a price-to-book value basis, their stock markets are nearing the panic lows of early 2009. (See Figure 7)

The cringe factor. My career in the financial industry, incredible as it seems at least to me, will hit the 35-year mark next month. To some, this is akin to having spent three-and-a-half decades working for Caesar’s Palace, or some other gaming company, but maybe not quite as respectable.

There’s little doubt millions of retail investors consider investing in the stock market tantamount to a fling at a Las Vegas crap table, and with worse odds (at times like now, though, when prices are soaring, that thought doesn’t seem to be too much of an inhibiting factor). Actually, given how rigged the investment game is these days, at least when it comes to short-term trading against algorithm-driven computers, transacting in nanoseconds, they’ve got a very valid point.

But, the good news is that there’s a powerful case to be made, that for those who don’t need to be "benchmark slaves," they can swing the odds in their favor. In other words, investors who don’t feel compelled to tie their fortunes to an index, like the S&P 500 when it has gone postal, can actually profit from the silliness, if not madness, of crowds.

Fortunately, there are several available tricks of the contrarian trade, somewhat like card counting at blackjack in the days of a hand-held deck (which is reputedly how Bill Gross made his initial grubstake). A disciplined and determined application of these tactics can tilt the odds in a longer-term investor’s favor. One of those is to pay close attention to extreme sentiment readings regarding the various investable asset classes, as is often communicated in this newsletter. Of course, this doesn’t always work, at least not immediately, anymore than does doubling down with 11 against the dealer’s 6 when the card-counter knows there are mostly face-cards left in the deck. But it certainly helps skew the odds the right way.

Another odds-shifting technique my team and I have noticed over the years pertains to our clients’ reactions to certain purchases and sells. The more negative the response we receive, the more likely we are making a shrewd long-term investment move. At this point, I should hurriedly note that most of our clients stay out of the armchair quarterback role quite admirably. Yet, as in any situation involving hundreds of human beings—and, especially, their money—there are bound to be a number who just have to give their investment manager a piece of their mind.

One of the most extreme examples of this situation occurred back during the giddiest days of the tech mania. An unusually large percentage of clients would call to complain when they would see confirmations coming through showing even partial sales of stocks like Qualcomm or Nortel (the latter of which could now be accurately renamed No-tel, as it is no longer among the living).

At around the same time, in the wake of the devastating Asian crisis, I can recall clients becoming borderline apoplectic if they saw a buy slip pass their way on something like the Korea Fund. In fairness, as is often the case, for awhile their negativity was justified; longer-term, though, the nuked Asian markets rose by several hundred percent. Meanwhile, the retail investors’ number one asset class of choice, tech stocks, proceeded to vaporize nearly 80%.

The relevant case-in-point today involves US small cap stocks and, more particularly, a hedge we hold for our clients currently. The Evergreen investment team recently agreed that we should absolutely be adding to this position right now but, just as absolutely, we concluded that doing so would likely enflame a significant percentage of our client base.

In other words, we literally cringe when we think of how clients will react when they see us adding to this holding. Which likely means…well, you fill in the blank.

The Great Pull Forward. For my money, and I have a lot bet accordingly, being short small-cap stocks over the next two years will likely provide considerable protection against seemingly reasonably priced longs like, ironically, US large-cap technology stocks. Regardless of blue chip tech’s fair valuation currently, they are unlikely to dodge the coming carnage. However, in a radical reversal versus fourteen years ago, these now appear to be respectable refuges of comparative value.

Of course, the reason that investors don’t like something is almost always because it has been going down (and, conversely, they consistently fall head-over-heels for another something because it has been going up). This doesn’t apply, as we all know, just to US small cap stocks, though they are the most egregious example. It also pertains to the American stock market as a whole. (I should disclose that the Evergreen investment team decided to add to our anti-small-cap position, despite the "cringe factor.")

Rather than bore EVA readers with more valuation measures that demonstrates how spendy US shares are these days (using those measures that have actually demonstrated their predictive power over many decades and countless market cycles), I thought I’d shift gears in this EVA. Instead, please allow me to briefly discuss a concept I’ll call "pulling forward."

In my bizarre mind, this might be the ultimate theme—the most important concept to grasp—a contention that is always hazardous to put forward. Let me be unmistakably clear here: We believe that far too much of what appears to be the extraordinary prosperity of the last thirty years is really a multi-trillion dollar case of pulling forward.

Now, that is no doubt raising some questions in your mind, kind of like how it was possible that the Denver Broncos could have been favored to win the Super Bowl. (Hey, despite my hard-earned right to be perpetually bearish on Seattle sports teams, I called that one right, even if I did barely miss on my MVP call). But I digress…

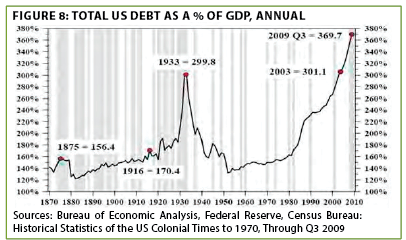

Pulling forward is essentially what leverage allows us to do. We can borrow now in order to consume things that we would normally have to defer until tomorrow (and deferring isn’t a popular state of mind in America these days). Yes, I know I’ve run this chart (top of next page) at least twice before, but it’s one of those graphics that is portentous in the extreme. (See Figure 8)

Unless you are visually challenged, or permanently bullishly disposed, it’s hard to look at this chart and not realize that the fundamental underpinnings of the glorious asset price ascension I’ve seen over almost the entirety of my career is almost certainly the ultimate case of pulling forward. In other words, we’ve used a massive increase in debt to create an illusion of prosperity that we, mostly erroneously, attribute to our highly evolved economic skills. The only problem is, as evidenced by the last two wicked bear markets, these moments of societal self-congratulation tend to be fleeting at best, and devastating at worst.

Why ask why—or how? Fortunately for the human race, hope springs eternal and, presently, there is abounding hope that this time is different. (Why is it that those words always remind me of when the nuns in my first grade class used to rap my knuckles with the metal edge of a ruler?)

There is a pervasive contemporary belief that the concept of payback, otherwise known as mean reversion or, in the context of this EVA edition, unwinding decades of "premature gratification syndrome", is as antiquated as the belief that Puerto Rico will ever be able to repay its debts in full. (We might add that Europe, Japan, and the US are in pretty much the same leaky boat.)

According to the bull case, we don’t need to be concerned about any of the otherwise nagging concerns listed below:

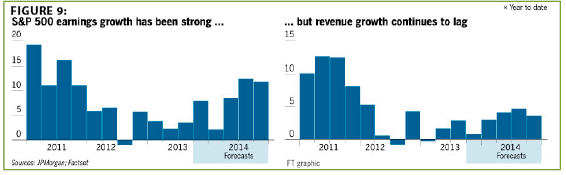

1. How corporate profits can continue to grow at a rate much faster than revenues (taken out far enough this means that revenues and profits will ultimately converge, an absurdity that even Jim Cramer would have a hard time believing).

2. How the US can continue to promulgate policies which, on a daily basis, create ever more "takers" and, similarly, an increasing deficiency of makers.

3. How asset prices can escalate at a rate much faster than the growth in the overall economy.

4. How debt levels in rich countries can stall out and not cause a reduction in the future growth rate (i.e., after decades of debt growing faster than GDP, can we expect prior expansion rates to continue once we’ve hit the "debt wall"?).

Let me be the first to admit that these are niggling and trivial questions in the context of a raging bull that would put Jake LaMotta to shame. But, as we have very unpopularly put forth—a bit prematurely, I might add—bull markets don’t last forever. Once they end, the excesses of their late stages are revealed with the mercilessness of the matador’s sword, applying the coup de gráce.

History is quite clear that societies can only pull forward affluence for so long until the realization unceremoniously sets in that there was only so much wealth to accelerate. Once that epiphany occurs, the adjustment process is both swift and painful, much like the bull fighter’s final thrust.

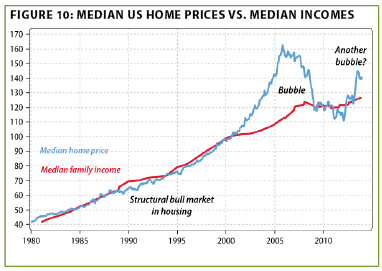

For a real life example that should still poignantly resonate in the minds of investors worldwide, consider what happened with housing a decade ago. After years of largely tracking median family income, home prices dramatically detached from that crucial fundamental factor (after all, one needs cash flow to make mortgage payments, a reality that both regulators and lenders blithely ignored).

This breakaway lasted for several years, emboldening the real estate bulls to proclaim a new era. But, as the great Bob Farrell has said, there are no new eras—excesses are never permanent. The housing market had pulled forward years of price appreciation into the period from 2001 to 2006—aided and abetted by the Fed’s overly loose monetary policies and chronic bubble blindness—and the puncturing of this mania nearly detonated the global financial system.

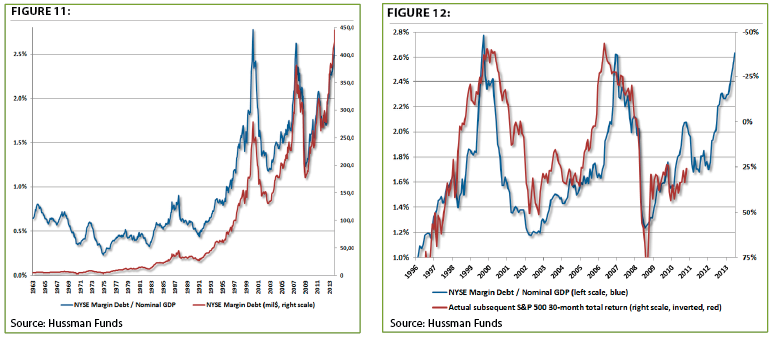

In case you believe we’re not going to repeat past blunders, and that pulling forward is all behind us, please consider the following chart on margin debt. As you can readily see, at least those of you who don’t have your perma-bull blinders on, borrowings to buy stocks have had a rather notable spike over the last few years. Besides the obvious warning signal given by such a vertical occurrence, as John Hussman has demonstrated, past incidents of such nearly straight-up moves in margin debt have led to extremely negative future returns. Once again, however, this time could be different (ouch!).

This EVA began with a quote from one of my new heroes, Didier Sornette. Thus, I thought I would leave you with this excerpt from his extraordinary essay, The Illusion of the Perpetual Money Machine: "Unsustainable situations are often caused by misaligned incentives…To get out of this Catch 22 situation, a major overhaul of the incentive systems of our societies should be the priority."

Sadly, at this time, our systemic incentives are heavily biased toward pulling forward, whether it is the Fed trying to recreate the ghost of bubbles past, or corporate America accelerating a future decade of normal earnings growth into a few vertiginous years of over-the-top profitability.

It’s great fun while it lasts, but have we collectively forgotten that all good, especially too good, things come to an end? I haven’t, which could be a big reason why I sleep as well these days as John Fox (the coach who believed that if he stopped Marshawn Lynch he could win his first Super Bowl). If he was a regular EVA reader, he might have been a bit more attentive to the $11 million a year all-purpose offensive threat who nearly claimed this year’s Super Bowl MVP honors, and who certainly thwarted Denver’s best laid defensive plans.

Serendipitously or not, the Seahawks kept Percy Harvin in reserve until the ultimate, as far as football is concerned, moment of truth. Unlike most of America today, the Seattle coaching staff resisted the temptation to pull him forward before he was ready. Maybe that’s a key reason why the perpetually lowly Seahawks are now, as incredible as it seems, world champions.

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Evergreen Capital Management LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.