"Everyone imagined that the passion for tulips would last forever, and that the wealthy from every part of the world would send to Holland, and pay whatever prices were asked for them."

-CHARLES MACKAY in his classic 1841 book, Extraordinary Popular Delusions and The Madness of Crowds

"There are no new eras, excesses are never permanent."

-Famed stock market technician BOB FARRELL

"Whenever I think of the past, it brings back so many memories."

-Comedian STEVEN WRIGHT

And now for something completely different… It’s time for a couple of firsts. The first “first” is that I’ve never before written an introduction to an introduction. The second is that I’ve never attempted to self-publish a book in real-time*.

Frankly, this entire effort may bomb for a number of reasons, all of which will be highly embarrassing to yours truly. For now, but subject to change at any time, I’ve decided to call my book “Bubble 3.0” with the not so catchy sub-title of “How central banks created the next financial crisis”. (Yes, another reason to hate sub-titles!) The basic idea, as you can readily surmise, is that we are going through the third iteration of an artificial asset inflation cycle that has reached highly dangerous levels, in my humble (and getting humbler) opinion.

Going forward, the outcome that would be the most humiliating to me would be if we are not, as I believe, involved in a bubble three-peat but, rather, merely a series of long-running bull markets in the major asset classes of stocks, bonds, and real estate. Further, in the event these all gently morph into mere corrections or mild bear markets, I will be wearing a four-egg omelet on my face.

While that scenario is possible, I remain convinced we are in the midst of something much more extreme. But for me to be proven right, this era must eventually need to be seen as the inglorious successor to Bubbles 1.0 (tech) and 2.0 (housing). Otherwise, I will be the first to concede I have been guilty of poor judgment and overreaction. Regular EVA readers are aware I’ve struck my neck out even further by referring to what we are going through presently as the Biggest Bubble Ever (BBE), an assertion I will do my best to defend in my new book. But, again, the proof will be in the unfolding—or unwinding—regardless of how convincing a case I make.

It is not lost on me that should I be right a lot of innocent people may suffer. My hope is that what lies ahead is a replay of October 1987, when financial market excesses were forcefully extinguished, almost overnight, without hurting the real economy. However, my overriding fear is that with so much leverage having been lathered on for many years, the odds don’t favor that outcome, much as I pray I’m wrong.

A key reason I am choosing to run this on an as-written basis is to get a jump on what I think might be the early stages of the deflation of the Biggest Bubble Ever. In my mind, what happened with Bitcoin and the other so-called crypto-currencies was a reflection of the intensity of the speculative mentality that has dominated recent years. However, I also feel the breathtaking Bitcoin boom and bust provides a sneak-preview of what is likely to follow – on a less extreme basis – for the Big Three: stocks, bonds and real estate, which, collectively, are trading at the highest levels in recorded history.

But the times, they are a changin’. No up-market in history has lasted longer than nine and a half years and this one will attain that age in a few more months—unless, that is, something comes along to trip up this incredibly powerful bull than has run so far, so fast, and for so long.

*However, I have written another book—mostly unrelated to financial markets—that is due to be published this spring; more on that to follow in an upcoming EVA.

Introduction

This book is, frankly, a foolish undertaking in several ways. The first ill-advised aspect is in challenging the wisdom of those central bankers whom the celebrated financial writer Jim Grant refers to as the planet’s “monetary mandarins”. After all, as I write this book—and am simultaneously publishing it in our firm’s on-line newsletter, the Evergreen Virtual Adviser—these lords of money look to have been victorious in coping with the aftermath of the Global Financial Crisis. (That none of them anticipated the cataclysm of a decade ago is another matter, though it does raise interesting questions about their current image of infallibility).

The second imprudent element is my overarching assumption that another financial disaster looms ahead. My only attempt to mitigate such recklessness is that I’m taking Warren Buffett’s advice about never combining a forecast and a date. Thus, I’m not saying when the invoice for ill-advised central bank policies will come due, just that a price will most certainly need to be paid.

Another foolhardy feature of my project is alleging that the measures taken by entities such as America’s Federal Reserve, the European Central Bank, the Bank of Japan, the Bank of England, and, most remarkably as we will see, the Swiss National Bank, were indeed “ill-advised”. Yet, if the reader of this book doesn’t come to view them as such then I will have miserably failed in my efforts. And not for the first time in my career, I might add.

Readers should be aware that I’ve had a long-running and contentious relationship with bubbles. My life in the financial industry began in 1979 when Jimmy Carter was president and inflation was the scourge du jour. For those readers old enough to remember, I’m not referring to the persistent double-digit price rises we have seen in almost all asset values in recent years but rather of the CPI variety.

Back in the Carter era, it appeared as though the cost-of-living index was destined to continue rising at an accelerating rate, as it had done for most of the prior 15 years. That trend, coupled with the concomitant surge by interest rates to unprecedented levels (yields on short-term debt securities exceeded 20% in 1981 during the first year of Ronald Reagan’s presidency) proved to be a toxic combination for US stocks. But those unparalleled rates, engineered by then-Fed chairman Paul Volcker, produced the intended effect. For the first time in a generation, inflation began to crack—and crack hard. By August of 1982, with the Dow Jones trading at seven times its trailing twelve months earnings (versus over 20 as I write this text), the stage was set for the greatest bull market of all-time.

But come the fall of 1987, the market’s P/E ratio had tripled to over 20 and euphoria had replaced despondency among investors. Inflation was rising as were interest rates. Yet, those threats did little to dispel the market’s incessant march higher, even as computerized trading and a supposedly risk-mitigating strategy called portfolio insurance came to dominate activity (interestingly, similar forces are at work in early 2018).

The infamous crash of 1987 hit in October of that year, bringing US stock prices down 30% in just a few trading sessions. This was despite an economy growing at a rate three times as fast as the 2% snail’s pace that has characterized the current post-crisis expansion.

As rates on US treasuries crashed in the wake of the 1987 panic and the economy remained robust, stocks quickly regained their lost ground despite widespread fears of a replay of the Great Depression. In short order, lofty valuations were restored. However, the real action was occurring half-way around the world from Wall Street, in the land of the rising sun and even more rising asset prices.

It was during the late 1980s that the ground under the Imperial Palace in Tokyo was supposedly worth more than all the real estate in California. The main Japanese stock index—the Nikkei—was trading at a price/earnings (P/E) ratio of roughly 70. It was a bubble such as the world hadn’t seen since the late 1920s. The absurdity of the prices for Japanese stocks and property caused me, for the first time, to find myself in a bubble-busting state of mind.

Unfortunately, I had come to believe Japanese shares were ridiculously over-priced in 1988 when the Nikkei was trading at 20,000 (by the way, as recently as 2015, it was still trading at 20,000!). My belief caused me to urge my clients to sell their positions in some of Japan’s leading companies that I had bought for them in pre-euphoric times. Once this monstrous speculative frenzy climaxed, the Nikkei rose another 100%, topping out at roughly 40,000 and the aforementioned 70 times earnings. Suffice to say I sold a tad prematurely.

The reason I rehash this thirty-year old episode, besides being my initial encounter with an unadulterated bubble, was that it proved to be the pattern of my bubble-opposing efforts—being painfully and embarrassingly early in my predictions of the ultimate reckoning. Little did I know at the time that the world—which had largely been bubble-free since the late ‘20s, with a few minor exceptions—was destined to be caught up in a series of these strange phenomena over the next thirty years. And I was fated to repeatedly cast myself in the role of Dour Dave, Davie Downer, Doubting David, or any other denigrating characterization of my unwillingness to play along with the prevailing giddiness—always at great cost to my psyche and reputation.

Chapter 1

It seems appropriate to start the main body of this book with a basic question: What is a bubble anyway? Some wags have suggested that a bull market is one in which an investor is a participant while a bubble is one in which he or she isn’t invested. Despite its whimsical tone, I think there is a lot of truth in this simple saying. Over the years, and through serial bubble events, I’ve repeatedly witnessed the extreme logic contortions supposed market gurus go to in order to rationalize nonsensical valuations. Why? Because rampaging bull markets are good, if not great, for business—and bonuses—as discussed below.

To witness this process in action, you might go into the CNBC video archives and watch the parade of pundits on that station in late 2017 as they justified the mania in crypto-currencies. Even as the price of Bitcoin hit $20,000, there was an endless string of self-anointed experts who explained to the CNBC interviewers (some of whom were commendably skeptical) as to why and how the “cryptos” were likely to continue soaring.

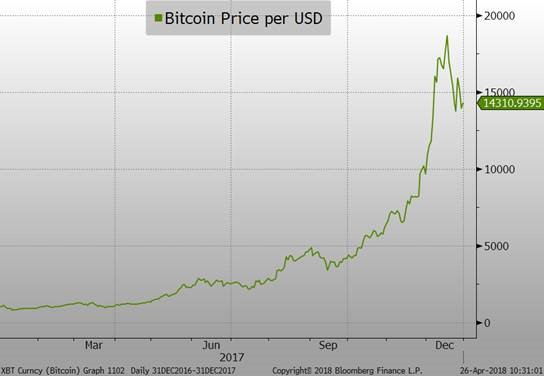

As prices on the cryptos went vertical in the fourth quarter of 2017, it was nearly impossible to read or watch any financial news story or show without being continually bombarded by articles or spots about Bitcoin and its less famous clones. The steeper the slope of the ascent, the more the investing public and the media raved about this remarkable phenomenon. And phenomenal it was, as you can see from the following chart.

Figure 1 Source: Bloomberg, Evergreen Gavekal (Jan. 1 - Dec. 31, 2017)

Source: Bloomberg, Evergreen Gavekal (Jan. 1 - Dec. 31, 2017)

The image above is crucial in answering the fundamental question about what constitutes a bubble. Based on almost 40 years of market experience—and far too many personal battles with these extreme manifestations of humanity’s avarice—it’s my conviction that the chart needs to look at least somewhat like Bitcoin’s to truly qualify as a full-blown (pun intended) bubble. In other words, at some point in the latter stages of the bull move in whatever, the price-line needs to literally go vertical in order to apply the “B” word.

Despite the increasing frequency of these over the last twenty years, (a topic for a future chapter) there are many who don’t believe in bubbles—or at least are unconvinced that they can be identified in real-time. To that point, a US Supreme Court justice once remarked that he couldn’t define pornography but he could recognize it if he saw it. In my opinion, that’s exactly the situation with bubbles. They defy a precise definition but when you see one you have to be truly bubble-oblivious to deny their existence.

The fact that so many do turn a blind—or least seriously visually-impaired—eye to them has, in my view, much to do with the incentives. As Warren Buffett’s long-time sidekick, Charlie Munger, has frequently quipped: “Show me the incentives and I’ll show you the results”.

Bluntly, for far too many involved in the financial markets, the inducements to pump up asset bubbles are immense and irresistible. The amount of money that flows from the heart of Wall Street through all the veins and arteries of the financial system—banks, brokers, ETFs, mutual funds—is, inarguably, astronomical.

Like croupiers at the world’s biggest craps game, these intermediaries (of which, admittedly, I am one) skim off astronomical amounts of riskless gains. After all, it’s not their capital on the line. Rather, it is the trillions of hard-earned money which, if you follow the trail far down enough, leads to ordinary folks, many of whom are retired or nearing retirement. In this era of central bank eradicated interest rates, these individuals are among the most vulnerable to being lured into stocks by the TINA argument: “There Is No Alternative”, or by the even more primal motivation: FOMO, “Fear of Missing Out”. One of my biggest concerns is that when this latest market bubble implodes, it is going to create enormous hardship for millions of older investors who have little chance of recouping their deep losses.

But more on that in subsequent chapters. For now, let’s go back a few hundred years to the first documented bubble. As almost everyone has heard or read, the Tulip bubble mania—or Tulpenmanie, in Dutch—that gripped Holland in the early 17th century was the first well-publicized bubble, perhaps because by then the printing press had been invented. (Ironically, the invention of digital printing presses by present-day central bankers has played a starring role in Bubble 3.0.) Thus, the dissemination of its spectacular rise, and just as spectacular collapse, was easily documented and preserved. (While I have no proof whatsoever, I suspect bubbles go back as far as humans have engaged in trading activity.)

Figure 2

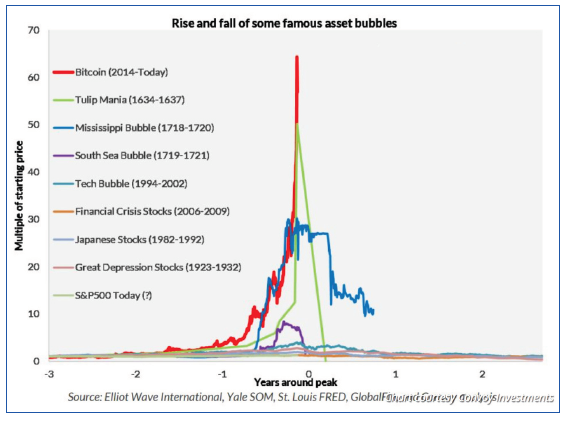

But even with the existence of newspapers, price data from over three hundred and fifty years ago is at least somewhat suspect. Putting that aspect aside, it is interesting—if not downright fascinating—to compare the purported price behavior of tulips back in 1636 and 1637 to that of Bitcoin in recent years.

Figure 3

As you can see in the chart above, what we witnessed recently with the cryptos was literally a once-in-a-three-and-a-half-century event. And there have been some whopper bubbles since then, such as the US stock market in the Roaring Twenties, the aforementioned mania in Japanese stocks and real estate in the late 1980s, and, of course, the tech bubble in the late 1990s. Consequently, what happened with Bitcoin deserves considerable “credit” in the annals of speculative orgies.

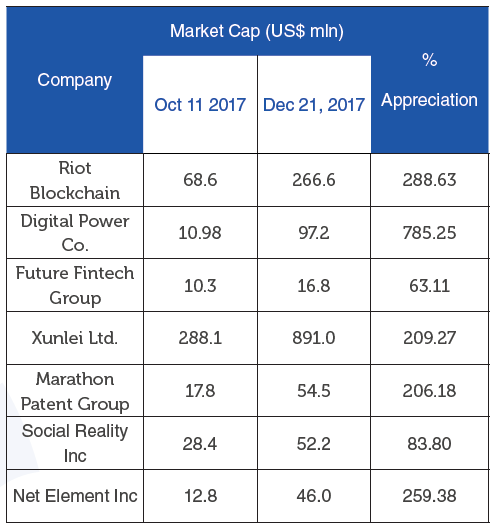

Some have dismissed the crypto-craze as a niche development that only involved a few tech nerds, some Russian hackers, and a limited number of gullible trend-followers. Yet, the reality is that well over $1 trillion was invested in the cryptos themselves, as well as in stocks that were allegedly linked to them and their more reputable underlying technology, Blockchain.

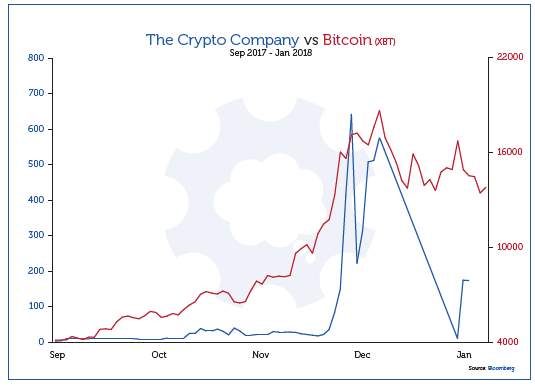

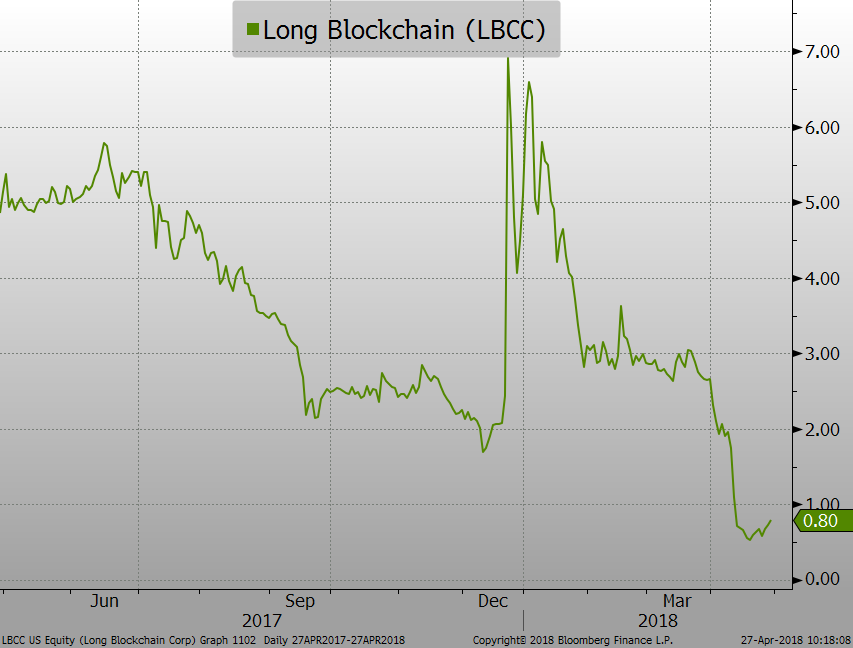

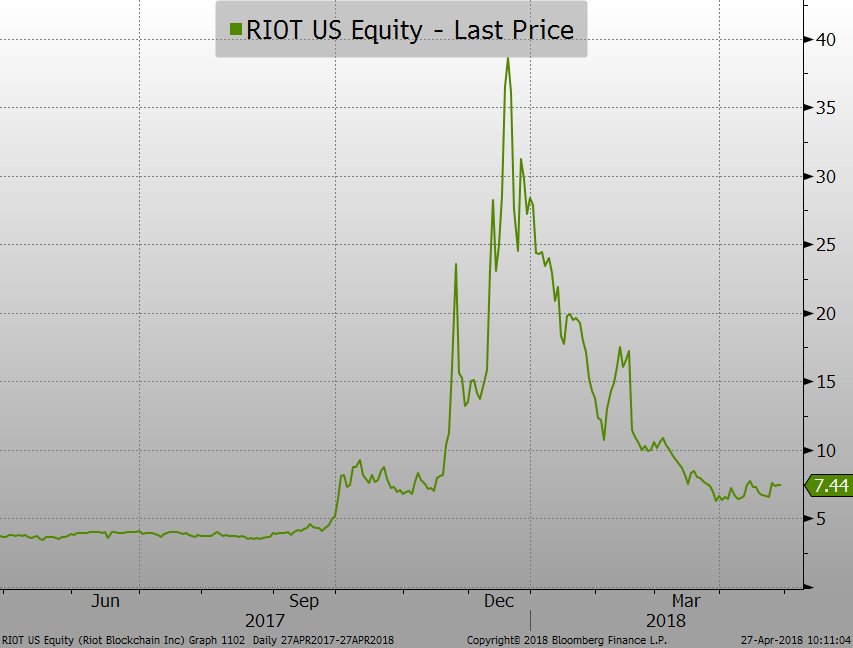

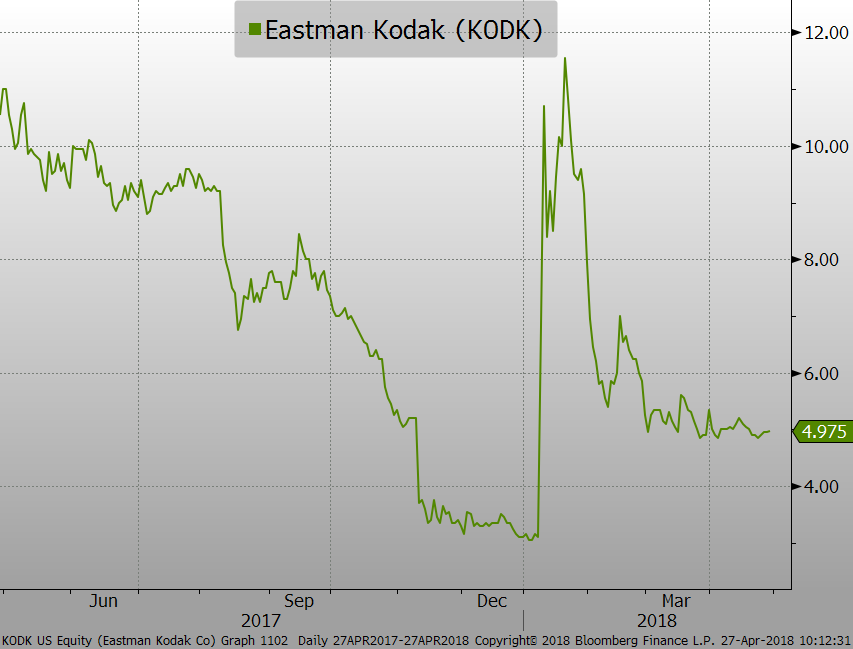

In a precise repeat of the dotcom insanity of twenty years ago, companies that previously had nothing to do with either Bitcoin or Blockchain saw their stock prices explode by simply changing their name to include some reference to either, or announcing their business model now included something related to them (as in the case of the formerly bankrupt Eastman Kodak). The charts below give you a tangible idea of how this absurdity played out as 2017 came to a close (the most humorous might be the former Long Island Iced Tea which tweaked its name to Long Blockchain).

Figure 4

Figure 5 Source: Bloomberg, Evergreen Gavekal (April 27, 2017 - April 27, 2018)

Source: Bloomberg, Evergreen Gavekal (April 27, 2017 - April 27, 2018)

Figure 6 Source: Bloomberg, Evergreen Gavekal (April 27, 2017 - April 27, 2018)

Source: Bloomberg, Evergreen Gavekal (April 27, 2017 - April 27, 2018)

Figure 7 Source: Bloomberg, Evergreen Gavekal (April 27, 2017 - April 27, 2018)

Source: Bloomberg, Evergreen Gavekal (April 27, 2017 - April 27, 2018)

Figure 8

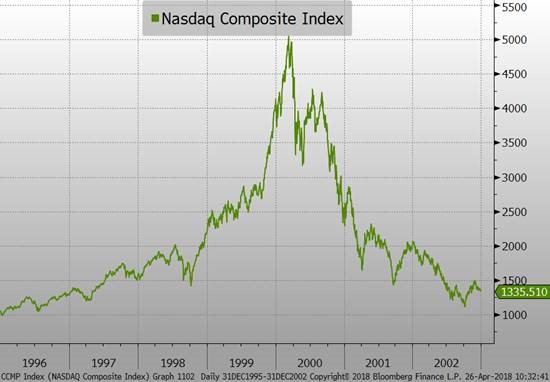

You can clearly see in Figure 1 that as last year came to an end so did the bodacious Bitcoin bubble. Like almost all that have preceded it, there have been some powerful counter-trend rallies, giving the pragmatic holders (likely an oxymoron when it comes to this “asset class”) several graceful exit points. However, the psychology with these types of moonshot moves is that true believers can never seem to realize the jig is up…at least not until the price falls 80% or so and then flat-lines. Please see a classic case in point. (It’s safe to say that when 2003 rolled around, tech investors were as scarce as Seattle SuperSonics fans are these days.)

Figure 9 Source: Bloomberg, Evergreen Gavekal (Dec. 31, 1995 - Dec. 31, 2002)

Source: Bloomberg, Evergreen Gavekal (Dec. 31, 1995 - Dec. 31, 2002)

But let’s go back in time again, though not quite as far as 380 years, courtesy of the incomparable Jim Grant. If you’ve never read one of his regular missives—Grant’s Interest Rate Observer—or heard him speak, you have missed one of the 21st century’s (and, for that matter, the 20th century’s) most accomplished financial wordsmiths. In his February 2018 issue, Jim wrote a captivating overview of a less well-known—and another long, long-ago—speculative frenzy, the Mississippi Bubble.

The primary architect of that initially intoxicating, but ultimately unhappy, affair was a Scotsman by the name of John Law. Mr. Law was born a few decades after the Tulip Bulb mania and his subsequent actions seemed to indicate he learned much from that episode. His hurried relocation to France was precipitated by being the winner of a lethal duel (presaging the fate of Aaron Burr a century later who had the same exile experience after fatally shooting the now resurgently popular Alexander Hamilton).

But Law is now famous—or infamous—for skills well beyond those of a steady-handed marksman or his other latent talent, gambling. Perhaps it was his tendency to turn a quick buck—or franc—that led him to devise his “System”, a means of solving the chronic debt problems of the French monarchy. Just as US president Richard Nixon would do some 250 years later, Law came up with a plan to ditch that barbarous relic known as gold and replace it with something much less restrictive: paper money.

As Jim Grant retells it, the “System” was based on, in Law’s own words: “An abundance of money which would lower the interest rate to 2%...reducing the financing costs of the debts and public offices, etc, relieve the King.” Previously the then-reigning majesty’s treasury was subject to the indignity of borrowing at 8%. Thus, a quartering of the interest cost could be theoretically realized.

Now, pay special attention to this part, again quoting Law himself: “It would enrich traders who would then be able to borrow at a lower interest rate and give employment to the people.” Does that sound familiar? Let’s compare Law’s words to the following quote from former Fed Chairman Ben Bernanke in his now legendary November 2010, Op-Ed article for the Washington Post in which he described the alleged benefits of his upcoming “System”, officially known as Quantitative Easing:

“The FOMC (Federal Open Market Committee) intends to buy an additional $600 billion of longer-term Treasury securities by mid-2011 and will continue to reinvest repayments of principal on its holdings of securities, as it has been doing since August.

This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate this additional action. Easier financial conditions will promote economic growth…Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”

Ah, the virtuous circle. That’s exactly what Mr. Law promised the French monarchy and, for a time, in basketball parlance, he swished it. Law quickly became a hero of both aristocrats and common folks. In the process he also became very, very rich—always a nifty side benefit. Per Jim Grant, as one of Mr. Law’s biographers noted with exquisite irony, he was a “twenty-first century banker in the eighteenth century”.

Essential to his “System” back in 1715 was setting up a bank. But not just any bank. It needed to be one with some serious gravitas, like having its notes or debt convertible into gold. It also needed a grand name—the Royal Bank. As Jim Grant observes, it became France’s first central bank.

If you are wondering what could go wrong with a bank whose obligations could be exchanged into gold, just wait a bit. Once the bank was officially the King’s own, it issued notes backed by…you guessed it: royal edict. In other words, it was fiat money. Accordingly, notes could be issued at will, at least by regal whim or inclination. And the King was very much inclined. Once thus structured, the Royal Bank increased the supply of said notes somewhat—like by 400% in 18 months. Again, anticipating those to follow in his crafty footsteps, Law required the Royal Bank notes to be accepted for transactions. Then he made it illegal to hold gold and jewelry, beating Franklin Roosevelt to the punch on the gold possession ban by over 200 years.

Yet Law’s ambitions went beyond the Royal Bank. He needed a narrative, a sexy story to get speculative juices really flowing. He got that with the Mississippi Company, which he established to acquire and possess the trading rights to France’s vast holdings in what would eventually be the United States, representing nearly half of the future superpower’s landmass. The Mississippi Company also secured a tobacco monopoly, trading monopolies, taxing power, and the royal mint. And you thought Google had a fantastic business model! Shortly thereafter, it managed to acquire all of France’s national debt, which he offered to refinance at just 3% (ironically, about what US government obligations presently yield).

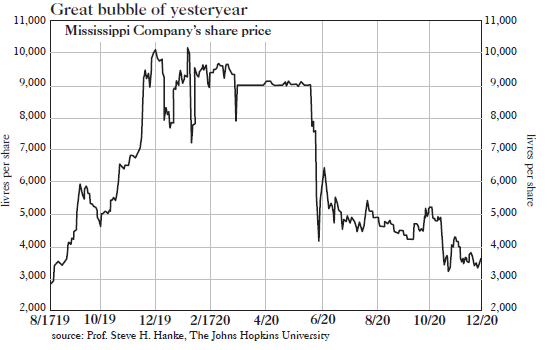

Law also issued shares in his Magical Money Machine, the first 3M, if you will. After initially trading sideways, they began a spectacular ascent in 1719, as shown in this chart Mr. Grant included with his newsletter.

Figure 10

The Royal Bank offered loans at just 2% for those wanting to buy its shares, not unlike today’s Fed encouraging the use of what was, not long ago, nearly free margin money (though, admittedly, to buy shares in the S&P, not in the Fed itself).

Law’s grand scheme predictably produced a raging bull market not only in France but throughout Europe. As Jim recounts, land prices quadrupled and the Mississippi Company’s stock price soared to 50 times earnings (though a far cry from some of today’s outlandish P/Es). The French economy boomed to a degree that puts our present pathetic expansion to shame.

However, one of Law’s former cronies, Richard Cantillon, suspected something was rotten and not just in Denmark. Cantillon believed that eventually all of the fake money would lead to cost-of-living inflation. By early 1720, it wasn’t just asset prices that were rapidly rising. Consumer prices were going—to use a 20th century colloquialism—postal, as well.

But there was another problem, per Jim, which today’s central bankers only seem to dimly perceive: “It was all very well for the bank to buy assets in a rising market. But to whom would it sell in a falling one?” Suffice to say what happened in France in 1720 was a debt crunch followed by uncontrolled inflation and a currency crisis. The Royal Bank printed money to frantically buy shares in the Mississippi Company, in a vain effort to support the share price. This caused the money supply to explode and the franc to implode. In short order, Mr. Law was out of a job. Not long after, Law was literally wanted by the law. He fled into exile and although once among the wealthiest men in Europe, he died (sorry) dead broke in Venice in 1729.

Of course, such events could never play out in the modern world, not with central bankers in control who so presciently saw the dangers of the tech and housing bubbles, right? As Jim notes, despite all their computers and on-staff PhDs, entities like the Fed may soon find out how tough it is to raise rates enough to combat mounting inflationary pressures without puncturing the series of asset bubbles they’ve blown over the last decade.

Maybe we’ll get lucky and more bubbles will collapse in on themselves like the cryptos without causing systemic damage. But since I believe we are in the midst of the Biggest Bubble Ever (BBE) across the major asset classes of stocks, bonds, and real estate—with evidence to back up that contention to be presented in future chapters—I’m taking the Cantillon approach.

Reportedly, he made a fortune shorting shares in the Mississippi Company and loading up on gold. Since John Law’s company is no longer around to short, I’ll have to make do with US small caps instead. Since they trade at over 80 times earnings, including the one-third of them that lose money, they’re not a bad substitute. And holding a generous amount of the barbarous relic—along with other hard assets like energy securities—might save skeptically-minded investors from the ravages of the latest central bank experimentations with printing press prosperity.

David Hay

Chief Investment Officer

To contact Dave, email:

dhay@evergreengavekal.com

OUR CURRENT LIKES AND DISLIKES

Changes highlighted in bold.

LIKE

NEUTRAL

DISLIKE

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.