This introduction to the latest chapter of Bubble 3.0 gives me the opportunity to highlight one of my most important and repeatedly emphasized topics: Wrong cycle investing. By that, I’m referring to the recurring tendency of most investors to buy high and sell low.

We all know we shouldn’t do that, but our very nature works against wise investment decisions. As discussed in more detail in this chapter, humans have evolved to do things like move with a pack. It’s great when it comes to fighting wooly mammoths but not so hot when it comes to making money in the financial markets. In fact, it’s downright devastating.

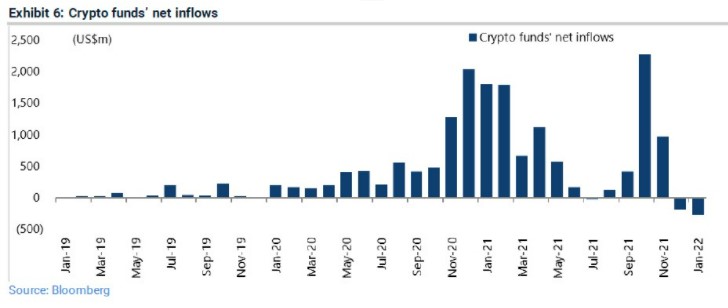

A classic and recent case in point is Bitcoin. Whenever its price is rocketing, I get a flurry of emails and calls from clients about investing in it; but when it’s crashing, which it frequently does, the silence is deafening. The following chart illustrates this phenomenon with far more precision. As you can see, when the leading crypto is going vertical, the same thing happens with inflows. In other words, money chases performance, as it almost always does. The more extreme and highly publicized the up-move, the greater the influx of capital. And, inevitably, the more severe the resulting losses.

Chart of Bitcoin's Price

Most Inflows Tend to go into Bitcoin

However, the main topic of this chapter is how corporations behave in this regard. For a sneak preview, it’s exactly the same story. Companies buy their own shares hand-over-fist when they’re high and rising. Then, during a crisis – like the Covid Crash of March 2020 — the repurchase activity almost vaporizes. The same scenario played out during the Global Financial Crisis (GFC). The following chart, pulled from the main body of this chapter, illustrates that reality.

Accordingly, as prices were ripping higher last year, publicly traded Corporate America was gluttonous when it came to buybacks. Here’s a relevant Wall Street Journal headline from December:

Back in March 2020, when their shares were being pummeled, repurchases were mostly MIA. In fact, it was actually worse than that: a long list of formerly active buyers, at much higher prices, were forced to be sellers of stock at bombed-out prices to shore up their balance sheets. Frankly, the energy sector, which I’ve so often endorsed, was one of the worst offenders in that regard. (Fortunately, it has learned its lesson and is rapidly paying down debt today even as it also aggressively buys back shares; however, it is doing so at still very-depressed valuations.)

With Ukraine appropriately dominating the news cycle, the topic of buyback abuses has fallen off the radar for most financial commentators. It’s my conviction, though, that in the fullness of time, it will be shocking how much shareholder wealth has been squandered by senior management teams on overpriced and, often, over-leveraged repurchases.

DISCLOSURE: This material has been distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, are subject to change, and reflect the personal opinions of David Hay (an employee of Evergreen Gavekal) as of the date of this publication. This publication does not necessarily reflect the views of Evergreen’s Investment Committee as a whole. All investment decisions for Evergreen clients are made by the Evergreen Investment Committee. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed, and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this letter have been selected to illustrate the author’s investment approach and/or market outlook and are not intended to represent Evergreen’s performance or be an indicator for how Evergreen or its clients have performed or may perform in the future. Each security discussed in this letter has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in the aggregate, may only represent a small percentage of a Evergreen’s client holdings. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. Before making an investment decision, the reader should do their own research and/or consult with their financial advisor. Past performance is no guarantee of future results. All investments involve risk, including the loss of principal.