"The typical secular bear market has multiple cyclical phases—and there will be more of these cycles before the current secular bear is over."

-Ed Easterling, author of the highly regarded investment book, Unexpected Returns

SPECIAL ANNOUNCEMENT: For some of our readers, now may be a good time to book a trip. United Airlines chose to join the long list of airlines devaluing their currency airline miles starting February 1, 2014. To learn more see: http://thepointsguy.com/2013/11/uniteds-newest-customer-unfriendly-campaign-increase-the-cost-of-award-tickets

The loneliness of the long distance rower. Approaching 60 years old and 35 years in the investment business is both a blessing and a curse. Prior experiences with periods of extreme bullishness, and the overvaluation that almost always goes with it, give old codgers like me the endurance to row against the current. Yet, they also make it virtually impossible to enjoy the late stages of a cyclical bull market.

The reason I italicized "cyclical" is that it is a vitally important word. There are many who believe that this is the wrong term, including my esteemed partner at GaveKal, Anatole Kaletsky. He, and other experts, believe we have entered into a new secular (aka, long-term) bull market. This is much more than an intellectual exercise, because the correct adjective has enormous investment implications.

In this month’s guest EVA, once again courtesy of John Mauldin and his Outside the Box weekly newsletter, one of my absolute must-reads, we are showcasing a recent essay by Ed Easterling. Thanks to John, I have read Ed’s work for nearly a decade. As is the case with so many of the market strategists I admire, Ed gave ample warnings of the last bear market well in advance of its ferocious phase.

As you will soon see, Ed believes, as does the Evergreen investment team, that we’re late in a bull market, albeit a very powerful one, within what is still an overall bearish episode which began in early 2000. He also postulates that being a "rower"—meaning, in this case, a money manager who seeks to protect their clients’ portfolios during times of elevated risk—is essential right now. Conversely, if we truly are mid-way through a secular bull market, such as was the case from the early 1980s to the late 1990s, then being a "sailor" (i.e., just riding with the prevailing bullish winds) is the preferred approach.

Considering that the market has risen by roughly 194% over the last 5 years, and has made a new all-time high, it’s reasonable to consider that this is the real deal; the Second Coming of the great bull market that ran from 1982 to early 2000. Certainly, a replay of that glorious romp is possible. However, given that by a variety of measures, the typical stock is more expensive than it has ever been in the past, such a conclusion seems improbable. Moreover, when the main driving force of the last few years—the Fed—is clearly shifting both gears and key personnel, there’s another reason to question that happy belief.

But, while the last 5 years look great on paper—like when participants look at their 401k statements this month—retail investors are "too often tempted to focus on immediate returns," in Ed’s words. Many investors might, for example, be lured in to shifting from their beleaguered emerging market funds, which appeared so lucrative a few years ago, into their gone-ballistic US equity funds.

From personal experience over the last three and a half decades, I know how all-too-true the words "tempted to focus on immediate returns" are. In fact, years ago, Evergreen coined a term for this: The Tyranny of the Temporary. In essence, this means that what has happened in the markets in recent years dominates investor thinking and behavior, leading them to extrapolate past returns into the future. In a long-running bull market, that works, but in a secular bear market, it is disastrous.

Even the 1980s had that mostly forgotten (though not by me) event: The Crash of 1987. Should something similar, or even less traumatic, lurk over the horizon these days, the kind of balanced and loss-mitigating portfolio construction Ed is advocating in his essay becomes a life-saver (and every good rower or sailor should have one of those!).

Ed also points out that in this era of big up-moves and equally severe retrenchments, an investor who is merely coasting on the market’s mercurial winds makes little progress, even if, at times, the sailor pulls well ahead of the rower. As a result, someone who simply bought a S&P 500 ETF two years ago has probably outperformed most professional money managers (and certainly nearly every hedge fund). The test will come, though, in the next downturn: How much of that gain will they actually retain?

We realize we aren’t the most unbiased source in this regard, since nearly all of the portfolios we manage are of the balanced variety, and they include many of the risk-reduction securities Ed highlights at the top of page 5. Yet, it is this highly diversified and heavily cash-flow-oriented approach that has earned our long-time clients higher-than-market returns with less risk over the last nearly 15 years.

While rowing is a lot more work than sailing, we agree with Ed that in unpredictable seas, which are in our "marketological" forecast, the paddle is more reliable than the sail.

HALF & HALF: WHY ROWING WORKS

By Ed Easterling

So you’re in line at Starbucks. The guy in front of you orders a drink that takes longer to explain than it does to consume. You want a drip…with room in the cup for milk. Then YOU take longer to decide whether it’ll be cream, half and half, or some watered-down version of the natural product from cows. Decisions, decisions…

This article addresses two key questions for investors today: why do secular stock market cycles matter and how can you adjust your investment approach to enhance returns? The primary answer to the first question is that the expected secular environment should drive your investment approach. The investment approach that was successful in the 1980s and 1990s was not successful in the 1970s nor over the past fourteen years. Therefore, an insightful perspective about the current secular bear will determine whether you have the right portfolio for investment success over the next decade and longer.

Now, assume for a moment that you must pick one of two investment portfolios. The first is designed to return all of the upside—and all of the downside—of the stock market. The second is structured to provide one-half of the upside and one-half of the downside.Which would you pick? Which of the two would you have preferred to have over the past fourteen years, since January 2000? (Note: the S&P 500 Index is up 23% over that period.) In a secular bull market, the first portfolio—with all of the ups and downs—will be most successful. In a secular bear market, however, the second portfolio of half and half is essential. More about this shortly—and the insights may surprise you!

SECULAR STOCK MARKET CYCLES

Why should anyone take the time to assess the secular environment when investors are so focused on next quarter’s (or month’s!) account statement?

Steven Covey writes in Seven Habits of Highly Successful People:

Once a woodcutter strained to saw down a tree. A young man who was watching asked "What are you doing?"

"Are you blind?" the woodcutter replied. "I’m cutting down this tree."

The young man was unabashed. "You look exhausted! Take a break. Sharpen your saw."

The woodcutter explained to the young man that he had been sawing for hours and did not have time to take a break.

The young man pushed back… "If you sharpen the saw, you would cut down the tree much faster."

The woodcutter said "I don’t have time to sharpen the saw. Don’t you see I’m too busy?"

Too often, we are so focused on the task at hand that we lose sight of taking the actions that are necessary to best achieve our goal. With investments, the goal is to achieve successful returns over time. We should not be distracted by a focus on this week or month; we need successful returns over our investment horizons—which often extend for a decade or two…or more.

And this is where Starbucks, Covey, and secular cycle strategies converge. Investors are too often tempted to focus on immediate returns. In periods of secular bull markets, that’s fine. But today, in a secular bear market, reach for the half and half. Take the time to assess the goal, as Covey emphasizes, and sharpen your investment strategy.

DON'T ACCEPT BREAKEVEN

Over the past 14 years since 2000, investors have repeatedly learned the lesson of falling back to, or recovering up to, breakeven in the market. While there’s no better feeling than coming from behind to breakeven, it’s a very bad feeling to watch a gain wither to a loss. But investors did not need to experience the same rollercoaster performance in their investment portfolios that the overall market traversed.

Some portfolios—generally it’s the ones that are indexed to the market using exchange traded funds (ETFs) or mutual funds—have "participated" in the market’s ups and downs. That’s fine; such simple participation is what those funds are designed for. And that works great in secular bull markets like those of the 1980s and 1990s. But it does not work well in secular bear markets like today’s.

To illustrate, assume that the market drops by 40% and then recovers by surging 67%. An investor with $1,000 will decline to $600 and then recover to $1,000. So if you take the full cream option—all that the market gives—the illustrated cycle provides a breakeven outcome.

Chapter 10 of Unexpected Returns: Understanding Secular Stock Market Cycles (which has just been published in most eBook formats like Kindle, iPad, and Nook) contrasts the concept of a more actively managed and diversified approach to the more passive, buy and hold approach to investing. The chapter explores the concepts with the boatman’s analogy of "rowing" versus "sailing."

Sailing is analogous to the passive investment approach of buy-and-hold—the use of ETFs and certain mutual funds to get what the market provides. Rowing, on the other hand, seeks to capitalize on skill and active management. Rowing uses diversification, investment selection, and investment skill to limit the downside while accepting limits on the upside. When the stock market plunges, portfolios built by rowing generally experience only a fraction of the losses suffered by those dependent on sailing. The expectation, however, should be that the "rowing" portfolios will also experience (only) a fraction of the gains.

The investment industry analyzes such fractional performance by assessing the so-called down-capture and up-capture of securities or portfolios. In other words, when the stock market declines, down-capture is the percentage of the decline that is reflected in your portfolio. If your portfolio declines ten percent when the market drops twenty percent, then your portfolio has a down-capture of fifty percent. Likewise, for market gains, upcapture is the relative percentage of your gains to the market’s gains.

During choppy, volatile, secular bear markets, most investors want little or none of the declines, but they want much or all of the gains. Beat the market! Other than for the luckiest of the market timers (which usually enjoy such success for fairly short periods of time), such a strategy is not realistic over most investment horizons. There is a more realistic expectation, however, that does fit with many risk-managed and actively managed portfolios.

USE THE HALF & HALF

Returning to the previous illustration, a portfolio structured to limit downside risk while participating in the upside would have fared better than breakeven. Although most investors seek somewhat less than half of the downside while achieving somewhat more than half of the upside, let’s assume that you have a half and half portfolio—50% downcapture and 50% up-capture. As the market falls 40%, your portfolio declines 20%—from $100 to $80. Then as the market recovers 67%, your portfolio rises by just over 33%. Your $80 increases to almost $107. So while the market portfolio gyrated from $100 to $60 and back to $100, your portfolio progression was $100, $80, and then $107.

Even better, consider the impact across multiple short-term cycles. The typical secular bear market has multiple cyclical phases—and there will be more of these cycles before the current secular bear is over. The effect of multiple cycles on the "rowing" portfolio is cumulatively compounding gains while the result for the "sailing" portfolio is recurring breakeven. The second cycle (using the same assumptions) drives the "rowing" portfolio from $107 to $85 and then to $114. The score after the third cycle: Mr. Market = $100 and your portfolio = $121. Three cycles of breakeven for the market still results in breakeven—you can’t make up for it with volume.

Of course, skeptics will respond that there’s often a difference between theoretical illustrations and empirical experience. Further, the S&P 500 Index has, at least at this point, increased 23% from the start of this secular bear in 2000. Yet the disproportionate impact of losses over gains is a formidable power.

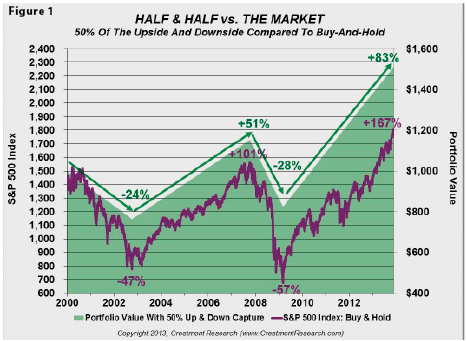

As reflected in Figure 1, the S&P 500 Index started this secular bear market at 1469 and then took an early dive, ending 47% lower at 777 in October 2002. Five years later, the S&P 500 Index peaked at 1,565—up 101% from its low. By March 2009 the S&P 500 had sunk by 57% to 667. Now, four and a half years later, we are up 167% to 1,805. Cumulatively, the buy-and-hold portfolio (excluding dividends and transaction costs) is up 23% over the 14-year investment period.

For the alternative approach, let’s divide the percentage moves in half and apply them to your portfolio: -23.6%, +50.7%, -28.4%, and +83.5%. Your initial investment of $1,000 declined to $764 in less than two years. With half of the market’s gains, your portfolio climbed to $1,152 five years later. Then, applying just half of the subsequent market decline, your gain sank to a loss of $825. Ouch!... a gain yields to a loss. Note, however, that while the market found its bottom below its 2002 trough, your portfolio is nicely above its previous dip. For now, accept that consolation prize.

Then, with just half of the market’s gains over the past five years, your portfolio again advances to new highs. Over the secular bear cycle-to-date, the market is up 23%, compounding at a modest 1.5% annually. Yet your portfolio is up 51%, providing twice the compounded gain. With dividends and other income from your "rowing" portfolio, you have solid real (inflation-adjusted) returns.

Some people will focus on a shorter-term view, given the current economic, financial, and political uncertainties. They will reject a horizon of fourteen years and say that one cycle is not enough to benefit from a more hedged and diversified approach.

Interestingly, it doesn’t take numerous cycles to realize the benefit of the more hedged "rowing" approach. In the first cycle in Figure 1 (the early 2000s), market followers ended up 6.5%, while the rowing crew lapped them at 15.2%. In the most recent cycle, which includes 167% market gains since the bottom in 2009, buy-and-hold boosted portfolios by 15.4% while the harder working "rowing" investors currently lead with 31.4%.

The hedged "rowing" portfolio not only worked over the past fourteen years, it was successful over the course of the previous secular bear market from 1966 to 1981. After that sixteen years of secular bear, the S&P 500 Index portfolio showed gains of 33%, while the "rowing" portfolio had delivered 44%.

Keep in mind that there are many ways to structure a "rowing" portfolio. It is beyond the scope of Unexpected Returns and Crestmont Research to develop or present specific alternatives. Nonetheless, rowing-based portfolios often consider—and include when attractively valued—a variety of components, including but not limited to: specialized stock market investments (e.g., actively-managed, high-dividend, covered calls, long/short equity, actively-rebalanced, preferred stocks, etc.), specialized bond investments (e.g., actively-managed, convertible bonds, inflation-protected securities, principal-protected notes, etc.), alternative investments (e.g., master limited partnerships, royalty trusts, REITS, commodity funds/advisors, private equity, hedge funds, timber, etc.), annuities, variable life, and others.

Clearly, some people will be skeptical about structuring portfolios to achieve (or improve upon) fifty percent up and down capture. Others will be looking for this article to present proof of a system that will lock in those results; it does not. But many others will relate today’s discussion to their own or their advisor’s experience. For the last group, this discussion intends to reinforce that good performance is not coincidence; rather it is the product of applying skill to portfolios that historically relied solely upon risk for return.

HOW IT WORKS

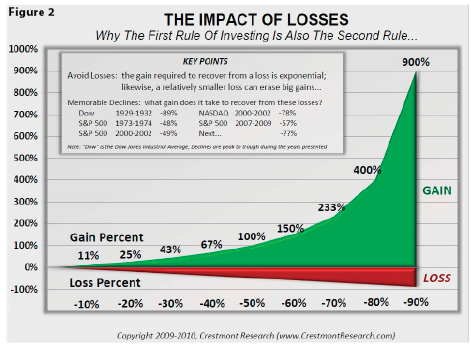

Market portfolios are outperformed by hedged portfolios in secular bear markets because of the disproportionate impact of losses in relation to the gains required to recover losses. Most significantly, as the magnitude of the loss increases, the required recovery gain exponentially increases.

In secular bull markets, on the other hand, gains significantly overpower losses. So although cyclical swings deliver the occasional "correction," the recoveries far exceed the losses. The result is that above-average returns from sailing cumulatively exceed those from hedged rowing. In secular bear markets, however, gains across the secular period are cumulatively fairly modest or nonexistent. The result is that losses during secular bears well overpower the gains. Hedge portfolios mitigate some of the negative effects and enable investors to cumulatively succeed.

Figure 2 presents graphically the dynamic of offsetting gains and losses. As the losses increase, the required gain to reach breakeven exponentially increases. To illustrate the half and half effect within hedged portfolios, note that the required gain for a 20% loss is 25% and the required gain for a 40% loss is 67%. Those two points are chosen because 20% is half of 40%, consistent with the earlier "half and half" illustrations. Note that you will see the same effect with 10% and 20% or with 30% and 60%, etc.

While the market investor needs 67% to recover from his 40% loss, the hedged investor only needs 25% to recover from one-half of the 40% loss (i.e., 20%). Yet when the hedged investor receives half of the market’s recovery, 33% from the near 67% surge, the hedged investor has exceeded the required 25% recovery return. As a result, the hedged investor achieves a net gain across the cycle.

So the gains from a hedged portfolio are not coincidental to the recent five years, fourteen years, or the secular bear market of the 1960s and ‘70s. The gains occur whenever overall market gains are muted—in every secular bear market.

The current secular bear market has quite a way to go. The normalized price/earnings ratio (P/E) for the overall market is relatively high. The past fourteen years worked off the bubble levels from the late 1990s, but the P/E has not declined to levels that are required to drive a secular bull market. A more detailed discussion and dramatic graphics can be found in an article titled "Nightmare on Wall Street" at www.CrestmontResearch.com.

YIELDING TO TEMPTATION

For some people, looking back fourteen years seems like an eternity. Needless to say, those same people are the most skeptical about analyzing a century of secular stock market cycles. They are also the most susceptible after the past five years to Siren’s call to overweight equities today. Yet a market that has run up substantially is more susceptible to correction or decline than it was before its surge. The trend is not always your friend. One of the documented weaknesses of human nature in investors is the tendency to ride winners despite their waning fundamentals (and sell some losers despite their newly attractive fundamentals).

Isn’t it ironic—in a Gary Larson Far Side kind of way—that the investor sticking his neck out may not be the tortoise-like rowing investor after all?! So although the temptation to follow the momentum of 2013 might drive an overweighting of equities, this may be just the time to consider leaning away from passive buy-and-hold strategies in the market. We may soon be approaching the start of the next cycle—from the top.

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Evergreen Capital Management LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.