Introduction

It’s easy to forget how quickly technology has advanced over the last 15-20 years.

In 2006, a small Silicon Valley startup named Tesla Motors started producing a luxury EV that could go more than 200 miles on a single charge. That same year, Amazon launched Amazon Web Services (AWS) giving life to “the cloud”. In 2007, Apple released the iPhone and Netflix released its online streaming platform. In 2010, 4G/LTE networks ushered in an era for mobile application development that has given rise to some of the most valuable and widely used companies in the world.

During the same window, the United States entered a 17-month bear market between October 2007 and March 2009 that saw the S&P decline by nearly 50%. Now known as The Great Recession, the economy experienced a major contraction in almost every asset class, most notably real estate and equities.

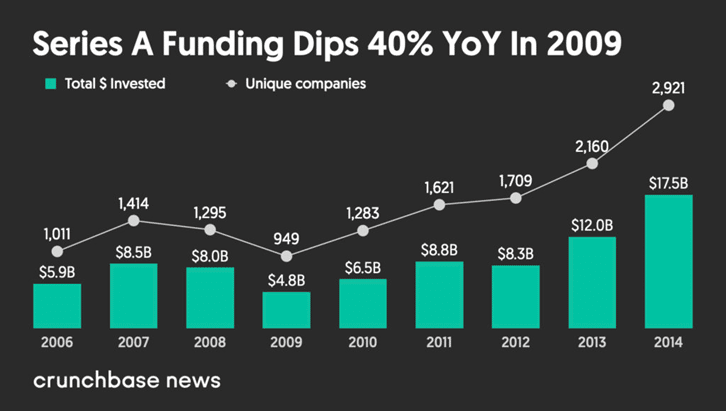

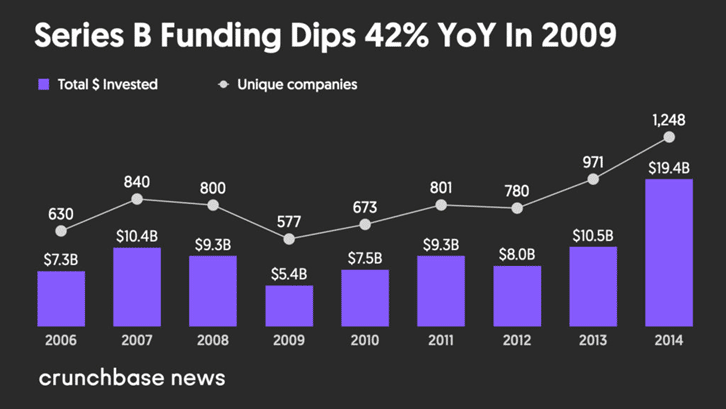

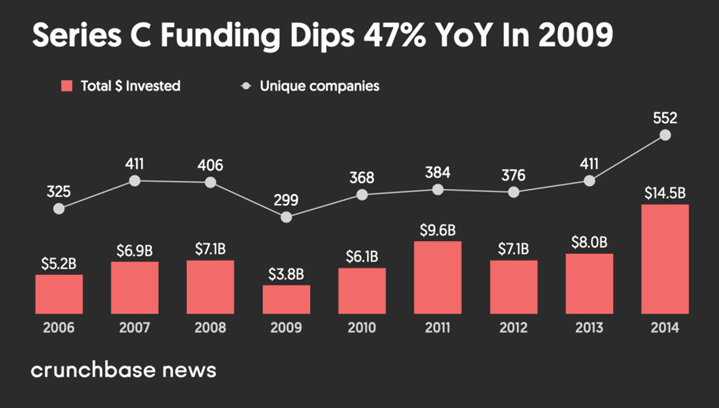

It also slowed down the pace of investment into burgeoning private technology companies, some of which were still clawing their way out of the dotcom bubble from a few years earlier. The macro environment between 2007-2009 led to less deal flow for private companies, as Series A, B, and C funding dipped more than 40% year-over-year in 2009 (see charts below).

If you’re familiar with the Venture Capital space in any capacity, you’ve likely heard of Andreessen Horowitz, also known as a16z. The firm was founded by Silicon Valley legends Marc Andreessen and Ben Horowitz, who are widely considered to be among the most successful venture investors of all time. Over the years, the firm that bears their name has successfully invested in and exited from companies such as Airbnb, Facebook, Groupon, Lyft, Coinbase, Slack, Instagram, Skype, Roblox, Robinhood, and Oculus, among many others. With such an incredible hit rate, you’d think they spent decades investing and perfecting their craft. However, you might be surprised to find out that Andreessen Horowitz was founded in July of 2009, making the firm just over thirteen years old.

At its founding, Marc and Ben raised a $300 million fund during a period where markets were reeling, uncertainty was palpable, and funding in private companies not only “dipped” but jumped off a cliff. Hindsight is always 20/20, but an environment that looked like anything but a sure thing turned out to be the best possible time in history to invest in early-stage tech. Today, just thirteen years later, a16z manages over $28 billion in assets.

Fortunately, I have the opportunity to sit on the Board of Directors for an early-stage, venture backed technology company with the first partner to join Andreessen Horowitz without the last name Andreessen or Horowitz. As such, I have a unique vantage into the thought process and strategy behind what has made a16z among the most respected venture investors on the planet.

While today’s economic environment is swirling with uncertainty, one thing that’s clear is that there remain ample opportunities to invest within private markets for the following reasons:

While nobody has a crystal ball to predict exactly what the macro environment holds, if we can learn something from this founding story of a16z, it’s that periods of economic and market dislocation can be tremendous buying opportunities for savvy investors. Private markets – which are more difficult to access than public markets for most investors – are one alternative asset class that could come out of this cycle with incredible long-term prospects.

If you’re an Evergreen Gavekal client that is interested in learning more about private market opportunities, please reach out to your wealth consultant.

Michael Johnston

Tech Contributor

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.