Weighing your Social Security benefit options can get complicated, quickly. The most common questions we hear at Evergreen are about timing: should I take my benefits as early as possible to avoid withdrawing funds from my investment portfolio (thereby giving them extra time to grow)? Or should I wait as long as possible to take Social Security to maximize the dollar amount of my benefit?

Personal factors make these questions even more difficult to navigate. An ideal claiming strategy is based on countless individual variables: your planned retirement age; clues about your own longevity based on other family members' life expectancies; your investment portfolio's size and asset allocation; the details of your spouse's situation, if applicable. Nevertheless, there is some general wisdom to consider as you weigh your choices.

Understanding Your benefits

What am I eligible for?

Personal Benefits

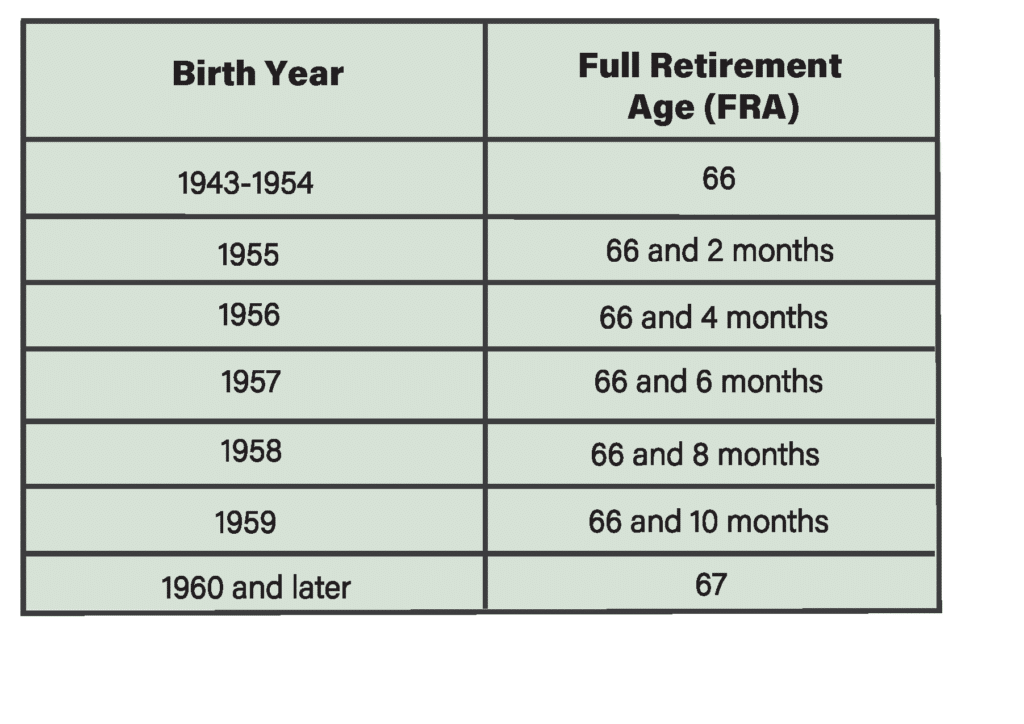

To claim Social Security based on your own work record you need 40 quarters of credits, which equals 10 years of work. Your benefit is calculated by the average highest 35 years of earnings adjusted for inflation. You can start claiming as early as age 62 and as late as age 70. Your Full Retirement Age (FRA) depends on your birth year (see chart below). For each year you claim before FRA, your benefit will be decreased by 6.00% to 6.25% each year depending on your birth year. If you wait until age 70 your benefits grow by 8% per year. If your FRA is 66 then claiming at age 62 will produce 75% of your FRA benefit and if you wait until 70 you will receive 132% of your FRA benefit. [1]

Spousal Benefits

If you do not have enough work credits, you can qualify for spousal or ex-spousal benefits based on your spouse's work record. You are eligible for half of your spouse's benefit and up to half of their FRA amount. If your spouse delays taking Social Security until age 70, you do not receive half of the maximum amount, only the FRA figure. To be eligible you must be married for at least one year and your spouse must be taking benefits (unless they have filed and suspended before April 2016). If you have 40 credits of work and are eligible for spousal benefits you will take the highest of the two options available. Previously, couples could utilize the deemed filing strategy where a spouse could take their spousal benefit while allowing their personal benefit to grow, then switch to their personal benefit later. This strategy was phased out in 2015. [2]

Ex-Spousal Benefits

If you were married for 10 years and have not remarried you are also eligible to take ex-spousal benefits. You must be divorced for two years before filing and your ex must also be taking benefits. Similar to spousal benefits, you will have the option of your personal benefit and half of your ex's benefit, whichever is larger.

Survival Benefits

Starting at age 60 (50 if disabled), you may be eligible for 100% of a deceased spouse's FRA benefit. You are eligible for these benefits at any age if you are caring for a child under 16. Ex-spouses are also able to collect these benefits. Unlike spousal benefits, you can start with survivor benefits at age 60 and switch to your own benefit in the future.

What is my Full Retirement Age (FRA)?

Your FRA depends on your birth year. This age has gradually increased over time and may rise again in the coming years.

How do I find out my benefits?

You can find your benefit estimate at www.ssa.gov. Here you will see your estimated retirement benefit at 62, FRA, and 70, as well as disability and family benefits. It will also list your date of birth, Social Security number, and earnings record. If this information is not accurate and up to date, reach out to the Social Security Administration as soon as possible to make sure this is corrected. This document is updated each January, we recommend reviewing it annually.

How is my benefit taxed?

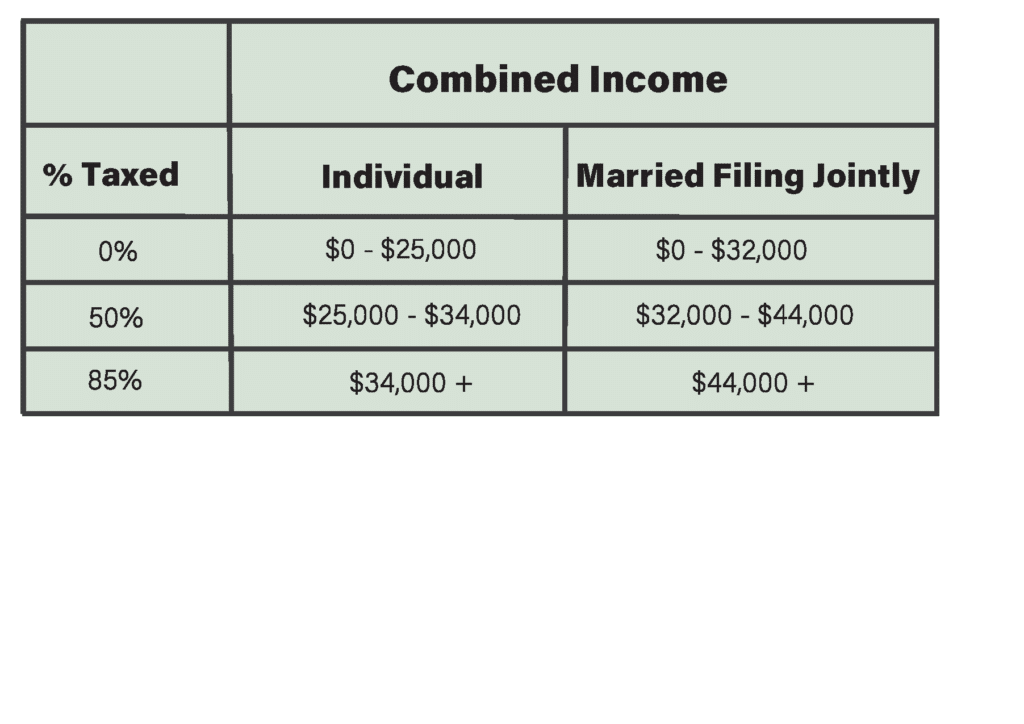

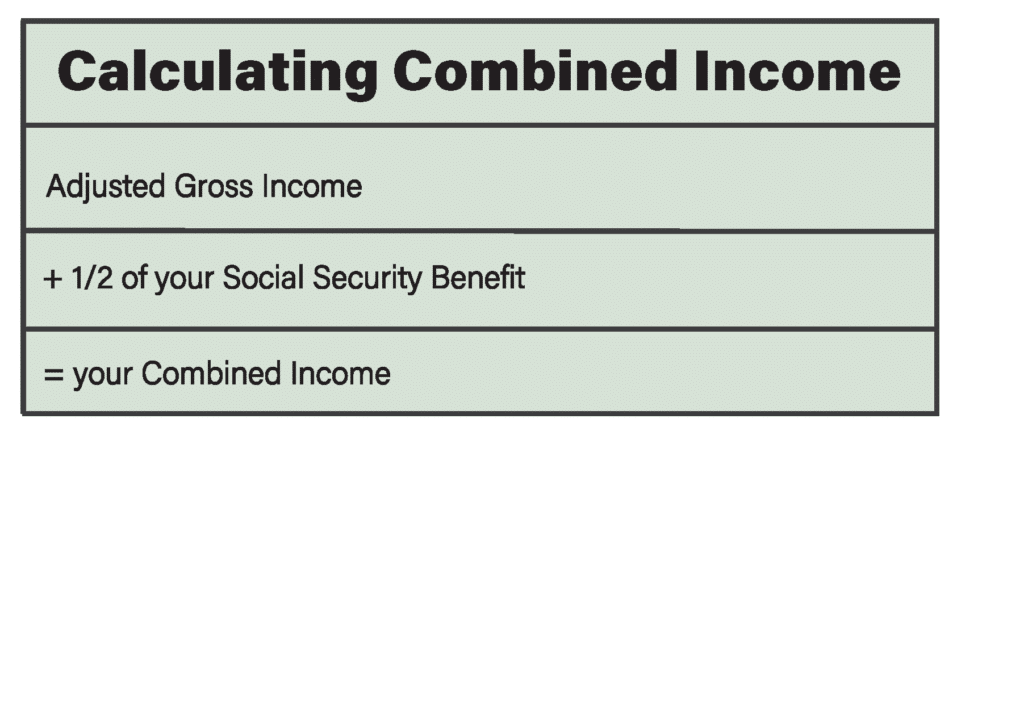

At a maximum, you will pay taxes on 85% of your benefits [3]. The Social Security Administration will take into account your combined income which is different than your adjusted gross income (AGI).

When To Take Social Security?

Break-Even

Should you take your benefit early or delay it? There are many factors to review when determining the best time to take Social Security. To understand how to maximize your lifetime income, first, consider the break-even point, which is the age you must live to in order to receive more benefits from Social Security by delaying your benefit. The exact age varies based on your birth year, but it is generally late 70s-early 80s. We generally recommend delaying until 70 but there are other factors to consider.

Considerations

Health/Life Expectancy

If you live past 81, you will receive the largest benefit by waiting until age 70. If you don't expect to live past 77, it may make sense to claim as early as 62. In the U.S., the average life expectancy for men is 73.5 years and 79.3 years for women [4]. While it is impossible to predict, unless there are underlying health issues or family history, we believe it is prudent to plan for longevity.

Spousal Benefits

If you are married, it is important to coordinate with your spouse to understand who will file for which benefit and when. If one is claiming a spousal or ex-spousal benefit the person with the higher earnings record also needs to be taking benefits. To secure the highest benefit for the surviving spouse, the individual with the largest earning record should delay until age 70. We recommend reviewing the break-even for combined benefits to determine the optimal filing strategy.

Solvency of Social Security

Many individuals choose to take Social Security early, as there is fear these benefits will go away. According to the Social Security Board of Trustees, reserves are expected to be depleted by 2035 and taxes will be able to pay 75% of scheduled benefits [5]. Recommendations that would allow for full payment for the next 75 years include reducing benefits by 13% or increasing payroll tax from 12.4% to 14.4%. It is likely a combination of increasing taxes, pushing back FRA, and lowering benefits for younger generations will be utilized to continue to fund the program.

Financial Plan

It is important to review the context of your plan to understand the implications on your cash flow. If you are working past your FRA or have other income sources such as pensions or rental income, it may make sense to defer. For others that have a lower life expectancy, claiming early is a better approach. If you are a current Evergreen client, reach out to your wealth consultant to run a Social Security optimization. If you are not a current client and are interested in learning more, click here to take our client compatibility survey and speak to a wealth consultant.

[1] https://www.ssa.gov/benefits/retirement/planner/delayret.html

[2] https://www.ssa.gov/benefits/retirement/planner/claiming.html

[3] https://www.ssa.gov/benefits/retirement/planner/taxes.html

[4] https://www.cdc.gov/nchs/products/databriefs/db456.htm

[5] https://www.ssa.gov/policy/docs/ssb/v70n3/v70n3p111.html

Katie Vercio, CFP®

Senior Financial Planner

To contact Katie, email:

kvercio@evergreengavekal.com

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.