“Facts do not cease to exist because they are ignored.”

-Aldous Huxley

POINTS TO PONDER

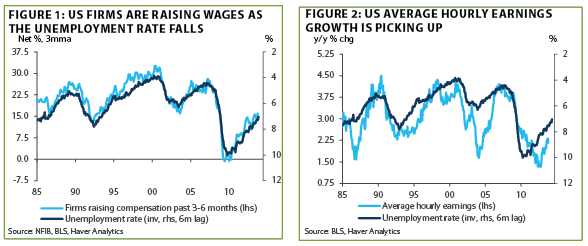

1. Compensation trends are definitely heading the right way for many US workers. While this is a welcome development for Main Street, it implies profit margin pressure for corporate America at a time when it is struggling mightily to generate revenue growth. (See Figures 1 and 2)

2. There was good news contained in a recent release by the National Federation of Independent Businesses. This organization, representing small businesses (the primary engine of job growth) is reporting an extraordinary seven point surge in positive expectations and, perhaps as a result, the most robust job creation intentions since 2007.

3. Although it’s certainly encouraging that the US budget deficit has fallen from 10% of GDP to 4%, this still represents nearly $700 billion of additional debt accumulated in the government’s most recent fiscal year. Of course, this amount has been tacked onto what is already a crushing national burden that now stands at the astounding level of $17 1/2 trillion (for a fascinating real-time look at our country’s ever-swelling indebtedness, please click on this link).

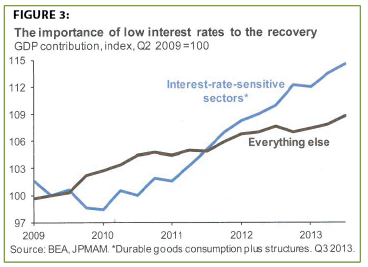

4. Past EVAs have commented on the degree to which the US economy has relied on lower interest rates to catalyze even the sluggish growth seen in this expansion. The following chart from J.P. Morgan makes this dependency abundantly clear. (See Figure 3)

5. In another indication of how hyped-up smaller investors are these days, TD Ameritrade has reported that its measure of client risk appetites has hit a record for the third consecutive month.

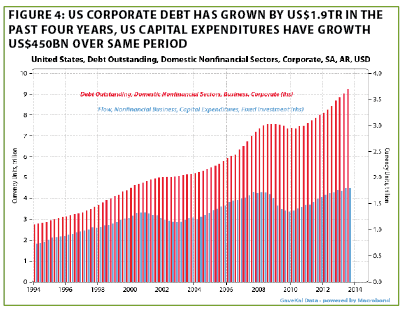

6. Vividly illustrating that financial engineering measures (higher dividends, stock buybacks, takeovers) in the US have taken precedence over long-term investing, corporate America has increased its debt load by $1.9 trillion, while capital expenditures have only risen by $450 billion. (See Figure 4)

7. The Financial Times has recently reported that Henry Ellenbogen, manager of T. Rowe Price’s New Horizon fund, one of the flagship small cap funds, is warning about overvaluation in his asset class of choice. Highlighting the unusual nature of his concerns, T. Rowe Price late last year elected to close the fund for only the fourth time since 1960. Subsequent to the three prior closures, shortly thereafter either the overall market declined or small caps lagged.

8. A constant refrain in the financial media is that the US economy is growing materially faster than Canada’s. Yet, in six of the last seven years, our northern neighbor’s economic expansion has exceeded America’s. Even recent data doesn’t provide conclusive evidence of superior US growth.

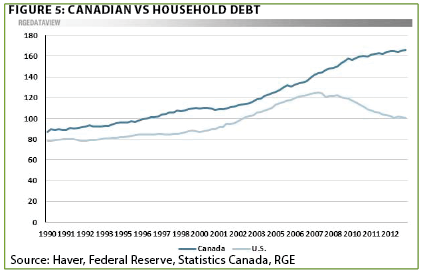

9. Although Canadian federal government debt is much lower than in the US (and Canada is projected to run a budget surplus next year), its consumers carry significantly more debt than do US households, a divergence that has widened in recent years. (See Figure 5)

10. In one of the more ironic news titles produced recently, The New York Times recently ran an article titled: “Puerto Rico Wants to Incur More Debt To Regain its Footing”. Its debt per capita is already unsustainably high, especially relative to per capita income that is about one-third of mainland US levels. It is hard to see how the tiny island can avoid a major restructuring (i.e., write-down) of its mammoth $70 billion debt load, which works out to over $18,000 per resident. This reality, in the current risk-on environment, didn’t stop the new issue from trading up sharply.

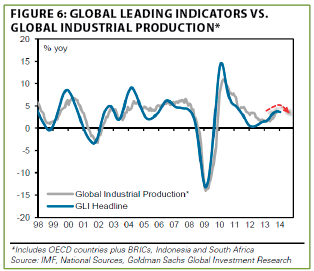

11. There’s no doubt brutal winter weather in much of the US negatively impacted the economy. This caused Goldman Sachs to lower its growth forecasts for the second time last month. Yet, even looking globally, where inclement weather hasn’t been much of a factor, industrial production looks soft. (See Figure 6)

12. Bulls on Europe are ubiquitous these days, in a radical reversal from 2011 and 2012. However, both the supply of money and its velocity are falling on the Continent currently. This is an unwelcome development with much of Europe already experiencing deflation when tax increases are backed out (which tend to hurt growth and raise the odds of even weaker prices).

13. Although the world is supposedly deleveraging, global debt continues to grow faster than GDP. The massive question is, with debt levels so elevated in the developed world, for how much longer?

14. Investors looking for attractive future stock returns should consider Asia. Since the 2007 peak, P/E, price-to-book value, enterprise-value-to-cash flow (EBITDA) and price-to-sales, ratios have all become far more attractive, as have dividend yields. On the other hand, return-on-equity (ROE) is much lower. However, this could mean profit margins have upside, unlike in the US. (See Figure 7)

15. Showing how far emerging stock markets have fallen in terms of investor preference, their cyclically adjusted P/E (CAPE) collectively was 37 in 2007 vs 27 for the S&P 500. Today, the US is nearly back to its 2007 zenith while the CAPE for the developing world is a mere 11.

The Three Ways. As many EVA readers are aware, late last month Evergreen hosted its Annual Outlook event in Bellevue with nearly 400 retail and institutional investors in attendance. Louis Gave and Grant Williams joined me in giving the formal presentations, and then we fielded numerous questions from the audience along with Jeff Eulberg and Tyler Hay.

At one point in the Q and A, Louis brought up one of GaveKal’s recurring themes—essentially, that there are three ways to make money in the financial markets. The first is to borrow short at low rates and invest, or lend, longer term. This is basically what banks have done for centuries. It is a model that has been co-opted by hedge funds and other non-banking institutions in recent years, a technique that is widely known as the infamous “carry-trade.”

There is a tendency with this approach to make attractive returns for extended periods, often enabled by easy Fed policies. Invariably, however, these strategies eventually blow up when something goes haywire (think Long-Term Capital Management). Consequently, sage investors like Warren Buffett have characterized the carry trade as picking up pennies in front of a steam roller.

Last summer’s rout in the high grade fixed-income market was yet another example of how those plying this trade, using leverage to goose otherwise low yields, periodically get steamrolled. (It should be noted that practitioners of this dark art have shifted their focus, and highly levered positions, to low-quality debt instruments where, undoubtedly, the next disaster lurks.)

Frankly, most retail investors don’t play this game unless they invest in funds that do utilize this financial version of Russian Roulette strategy. The second method, though, is much more relevant, especially given the prevailing environment.

According to Louis, “way” number two is momentum investing. In my view, this is the path that both institutional and retail market participants are increasingly taking. This go-with-the-flow method, facilitated by products like ETFs allows momentum followers to almost always find something that is “in the zone.” The rallying cry for this school of speculating thought is Jim Cramer’s hyperventilating shriek: “There’s always a bull market somewhere.”

Although institutions should be above such herding behavior, the evidence of the last 15 years strongly suggests that, increasingly, they are not. These institutions instead obsess over benchmark adherence and getting fired for tracking errors. As a result, the so-called smart money frequently is swallowed up by dumb manias.

It could be sheer coincidence that there have only been five 40% or greater market declines in the last 90—two of which have occurred since 2000. Or, more plausibly in my view, there is a connection between the greatly increased inclination for investors to chase performance with a herding mentality, causing markets to soar far beyond fundamental value, before imploding. (Fed policies that are either bubble-blind or outright bubble-inflating have also likely played a starring role in this tragicomedy of errors.)

But perhaps the most timely and urgent issue is how this latest exercise in crowd-investing, which is leading to some very crowded trades indeed, is going to evolve—or, more likely, devolve.

Only fools rush in—and then out. One of the biggest problems with momentum investing is knowing when to gracefully dismount from the bull in a long rising market. It’s equally difficult to quit hibernating with the bears when prices have been in an extended slide. Buffett recently relayed to his shareholders a quote from the late, great Barton Biggs on the first part of this dilemma: “A bull market is like sex. It feels best just before it ends.” (It’s fair to say the inverse is true right before the mauling stops in bear markets.)

With apologies to our PG readers, I think that is a perfect, if somewhat risque, way to describe the quandary momentum investors face. The current ecstatic state of the US stock market is a prime case study. Last year saw $277 billion of inflows into domestic equity funds, not far below the ultimate bubble year of 2000, the exact inverse of the gushing outflows that occurred in late 2008 and early 2009. (Can you say sell low, buy high?)

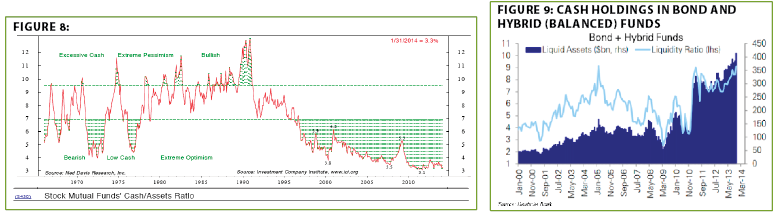

It is Evergreen’s view that institutional investors are aware of the late-stage and dangerous nature of this advance. But their collective fears of lagging behind the market are keeping them invested. As you can see, cash levels in stock funds are extremely low, although not as miniscule as in the late 1990s. This stands in marked contrast to the hefty liquidity held by bond and balanced funds. (See Figures 8 and 9)

We further believe that there is also some hubris involved. It’s highly probable that entities such as hedge funds are convinced they can get out ahead of the next selling frenzy. Not unreasonably, they expect the retail investor to play his and her usual role of bag-holder. However, it’s also likely that only the nimblest and luckiest institutions will be able to escape once the fire breaks out, as everyone else scrambles for the exit.

Many slower moving institutions, especially large traditional funds, will be faced with a choice of selling at greatly reduced prices, that may well go lower, or sit it out until the next up-cycle. Momentum is a fickle creature, and at some point it shifts from the best friend to the worst enemy of the “long-only” set. That’s when the old golf saying, “long and wrong” will ring true once again.

Another venerable epigram, in this case courtesy of Wall Street is that, “traders drive Chevrolets while investors drive Cadillacs.” These days, that should probably be updated to Priuses and Teslas, but you get the idea. By definition, traders are momentum players and only the most dexterous earn superior returns. Certainly, when it comes to retail investors there is overwhelming evidence that as they have become more short-term focused, trying to chase the always elusive “bull market somewhere” rainbow, their long-term returns have suffered mightily.

There must be a better way and, fortunately, there is…

Reversions don’t have to be mean. Ok, Alfred Hitchcock I’m not. I’m sure none of you are surprised to learn that Evergreen feels there really is only one way to earn superior gains over a full market cycle and that is by sticking to Louis’ third, and final, path to profits: return-to-the-mean investing.

That can sound a little esoteric to those not well-versed in “Wall Streetese,” but it’s really a simple concept: Asset prices have an inevitable tendency to return to long-term equilibrium.

But, as we’ve written several times before, smart investing is simple but far from easy. And one of the aspects that makes it so hard is that every cycle is different and prices can dramatically over-shoot mean, or fair, value. When it comes to the stock market, there are also myriad ways to measure what is a reasonable level for stocks to trade. Many of them can seem conflicting, leaving investors to conclude that there simply is no right answer. Yet, if you are willing to ignore the short-term, where anything can and probably will happen, that is definitely not reality.

There are a series of valuation methods that have been proven over the last 125 years or so to very accurately predict long-term returns. Some are fairly complicated and subject to almost endless debate, like the Cyclically Adjusted P/E (for which, despite its controversy, we still have an affinity). However, as Jeff Eulberg noted in last week’s EVA, the most straightforward is the very basic price-to-sales ratio. This is simply the market value of the S&P 500 divided by total revenues.

Currently, this metric stands at nearly 1.7 to 1. Even using just the timeframe since 1990, and thereby excluding the much lower price-to-sales ratios that were the norm for the prior post-WWII period*, the mean is 1.4 to 1. This would imply an 18% “mean reversion.” That doesn’t sound too bad, I realize, but it ignores the aforementioned overshoot phenomenon. The market regularly trades far below the mid-point.

*While I haven’t seen price-to-sales data going back to 1900, I’m quite certain it would further shift the mean much lower, making the current level even more inflated.

For example, in 2009, the S&P 500 traded down to 0.6 times revenues (as it also did in 1987 and 1990). But let’s be generous and assume that the low of about 1.2 to 1 seen in 2003 is the next trough. That would be a much scarier 30% decline, and would officially qualify as a true bear market. Since these deep dives tend to happen every four to five years, a 30%-off sale on US stocks is certainly within the realm of possibilities, if not probabilities.

Beyond the challenges of being a momentum player and knowing when to shift gears, there is also the difficulty of being a fully committed long-term investor in the late innings of a bull market. If the buy-and-hold investor doesn’t begin to raise cash and reduce exposure, he or she doesn’t have any buying power for when the next reversion, and then some, occurs. In fact, if that investor is a fund, the odds are they will be facing mass redemptions, forcing them to sell rather than buy when prices are at bargain levels.

That’s why Evergreen tries very hard, including at times like right now when momentum investing is totally in-vogue, to systematically sell when prices are well above the long-term mean. This gives us the ability to be buyers when the eventual downside overshoot occurs. Over a full up/down cycle, this has been rewarding for our clients even though it’s been a very long time since we’ve seen enough undervaluation to be aggressive buyers. That caution has been a handicap for the last two years but, according to a highly informed source, this won’t always be the case, as you will soon read.

With my concerns so elevated, I’m reading even more extensively about what the best and brightest are saying, and how they justify their viewpoints. At this critical juncture, I believe that their opinions on where the markets are headed will lead to the distinction of prophetic or the shame of foolish in the years ahead. An individual who I believe will get the ultimate designation of prophet is one of the new members of the Fed body that sets monetary policy, Dick Fisher.

For those EVA readers who feel I am being too negative on US stocks right now, I’d suggest you reflect on the following excerpt from a speech he gave earlier this week (it’s worth noting that he is the lone senior Fed official who has actually managed money):

“I fear that we are feeding imbalances similar to those that played a role in the run-up to the financial crisis. With its massive asset purchases, the Fed is distorting financial markets and creating incentives for managers and market players to take increasing risk, some of which will end in tears. There are increasing signs quantitative easing has overstayed its welcome: Market distortions and acting on bad incentives are becoming more pervasive.”

There you have it. If you think Mr. Fisher’s warnings are diametrically opposed to the usual sugary pablum put out by the strategists at big Wall Street firms, you get a gold star. If you also believe that, in the fullness of time, his concerns will enter the same pantheon of prescience accorded to those who anticipated the housing meltdown, I’m with you. Come to think of it, Dick Fisher saw that one coming, too. Maybe it’s good idea to listen to him.

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Evergreen Capital Management LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.