“The Fed’s dual mandate is that of arsonist and fire brigade.” - Jim Grant.

It is my belief, based on years of observation, that if you want to know the truth about government agencies and their actions, listen to retired officials from those entities. Once they have escaped the group-think environment, and are also freed from the straight-jacket of political correctness, they become far more candid… and accurate.

The Federal Reserve is a classic case in point. Numerous former senior Fed members have been blunt in their criticisms of key policies once they have left the Marriner Eccles Building. This includes condemning its biggest initiative, the repetitive quantitative easing (QE) cycles over the last 13 years that have done so much to elevate asset prices and so little to promote real economic growth. (Once again, for an inside take on this, with abundant quotes from many of the Fed officials who supported, often reluctantly, QEs 1, 2, and 3, please read Christopher Leonard’s great book, The Lords of Easy Money. It has the appropriate sub-title: How the Federal Reserve Broke the US Economy.)

The comments this week by the former president of the NY Fed, Bill Dudley, are what have created my personal “Aha!” moment. In addition to once heading the most powerful of all the Fed’s districts — partially due to its proximity to Wall Street — Mr. Dudley was also a Vice-Chairman of the even more omnipotent Federal Open Market Committee (FOMC). It is that group which actually sets Fed polices and controls short-term interest rates. Actually, in the QE era, it has also exerted enormous sway over long-term interest rates. (This is because the Fed has used the trillions of fake money it has fabricated to buy treasury bonds and government-guaranteed mortgages; this effort has pushed rates well below where they would have been exclusive of the Fed’s constant interventions.)

My epiphany relates to the Fed’s conundrum that I, and many others, have recognized: How can the Fed possibly raise rates enough to catch up to inflation? Being old enough to vividly remember the inflationary 1970s, I can also recall that the much-derided Fed of that era under then-Chairman Arthur Burns managed to get rates up around the CPI level in fairly short order. Admittedly, he rarely pushed them above inflation but at least if price increases were running at 8% he would jack the fed funds up in that vicinity.

Now, can you imagine our current Fed raising rates that much? Neither can I--actually, not even close. But even before my Bill Dudley-induced wake-up-and-smell-the-espresso event this week, it was dawning on me that the Fed doesn’t need to use its interest rate weapons to slay inflation. It just needs to seriously wound the financial markets. (By the way, it will soon also be engaged in only its second- ever double-tightening: selling bonds, the opposite of QE, known as Quantitative Tightening, and hiking rates.)

One of my daily must-reads is The Closing Print authored by Jones Trading’s Chief Market Strategist, Mike O’Rourke. He did such a perfect job of summarizing Mr. Dudley’s comments that I thought I would just run an excerpt of his note from yesterday:

“President Bullard's indication of how far the FOMC is behind the curve dovetails perfectly into former NY Fed President Dudley's Bloomberg Opinion piece yesterday. The title of the piece says it all, ‘If Stocks Don't Fall, the Fed Needs to Force Them.’ The focus of Dudley's piece is the easy financial conditions environment, the need for those conditions to tighten to rein in inflation, and that a key aspect of tightening is lower equity prices and higher bond yields. Dudley explains with a candor that exceeds that of any former Fed official we have witnessed, that ‘Investors should pay closer attention to what Powell has said: Financial conditions need to tighten. If this doesn't happen on its own (which seems unlikely), the Fed will have to shock markets to achieve the desired response. This would mean hiking the federal funds rate considerably higher than currently anticipated. One way or another, to get inflation under control, the Fed will need to push bond yields higher and stock prices lower.’ It is amazing how liberating abandoning the trappings of office can be. Dudley is correct that the FOMC's actions to date have done little to tighten financial conditions. As we noted above, as of a few weeks ago, the Fed was still adding accommodation.

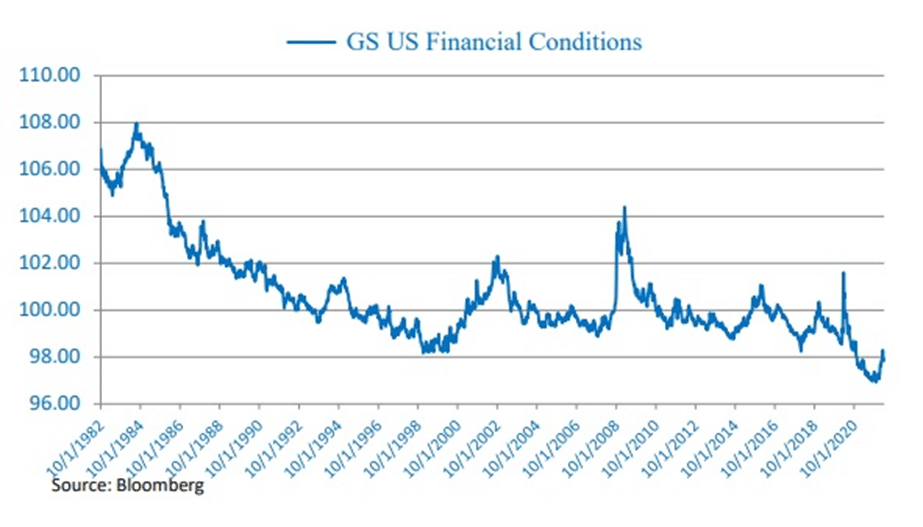

Dudley indicates that the incredible resilience of both the stock and bond market create a reflexive dynamic where the more resilient markets remain, the more tightening that will become necessary. Although the Goldman Sachs Financial Conditions index has risen from its all-time low of December 31st, 2021, it still remains below its pre-pandemic trough registered during the Technology Bubble in December of 1999 (chart below). There has already been a significant amount of pain over the past 6-12 months among the more speculative stocks, but in the 2000-2002 bust many of those names dropped more than 90%. Even young Amazon shares declined 95% from 1999-2001. We believe it is the Fed's lack of credibility fueling the reflexive dynamic that Dudley fears, but the quicker the Fed convinces the market that it is serious, the quicker financial conditions will tighten to an appropriate level.”

If you’re wondering why a stock market correction, that could easily evolve (devolve?) into an actual crash, would help in the fight against inflation, consider 2008 and 2020. In both of those instances, deflation became at least a brief threat. The 2008 example is particularly relevant because inflation and commodities, including crude, were uncomfortably high right before the market turmoil of that year. In fact, oil actually touched $140 a barrel in 2008. Adjusted for inflation, that’s almost double where it is today.

Yet, by early 2009, as markets kept circling the drain, “de” replaced the “in” when it came to inflation. This near-death-experience for the financial system prompted, of course, the launch of the very first QE. Is a serious bear market guaranteed to happen again? There’s no such thing as certainty when it comes to stock and real estate prices but I do think there are couple of particularly vital sentences above, to wit: “Investors should pay closer attention to what Powell has said: Financial conditions need to tighten. If this doesn't happen on its own (which seems unlikely), the Fed will have to shock markets to achieve the desired response.”

My personal twist on this is that I believe both the economy and inflation will prove more resilient to Mr. Powell’s own sudden epiphany — his desire to be the second coming of Paul Volcker. Ironically, this comes after years of him acting like the Anti-Volcker. The stock and property markets — especially, office buildings, in the latter case — are a much different story.

My suggestion is that you re-read Mike O’Rourke and Bill Dudley’s comments, at least once, if not twice. This may be the best investment advice you get this year.

LIKE

The category of two- to five-year maturity BB-rated corporate bonds is worth focusing on now, in my view. The yields on these have vaulted close to what I think could be the “new normal” inflation rate of 4% to 5% (once the global supply chain opens up again; sadly, I don’t see that happening anytime soon). This an area where doing some serious research can pay off by targeting those companies that are likely to be jumped up to investment-grade (BBB-rated or higher) by the rating agencies. This creates an automatic price increase that can serve to offset the downward pressure from rising rates.

NEUTRAL

Note the addition of utility stocks to this section. Actually, giving them a neutral rating is a tad on the generous side considering their low yields and expensive valuations, especially in a rising interest rate environment. However, utilities have broken out to a new multi-year high which precludes a negative rating based on my methodology. Be on alert, though, should they go much higher and be ready to start a dollar-cost-averaging disposal campaign if you have much exposure to this sector. You will likely be reading a more direct “take profits” message from me soon in this regard

DISLIKE

Due to both the rally by growth stocks since mid-March — which has, admittedly, partially reversed — and the market concerns expressed in the main section of this EVA PR, I think small- and mid-cap growth positions should be reduced. In fact, I’d suggest a major reduction for those heavily exposed to these areas. Of course, the best time to have done so was last year when I was repeatedly cautioning about the Crazy Over-Priced Stocks (COPS), many of which fall into the mid- and small-cap growth styles. A very long list of those have been absolutely pummeled, but I think there is more pummeling on the horizon (note what’s happened to two of my picks-not-to-click, AMC Entertainment and GameStop, of late).

DISCLOSURE: This material has been distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, are subject to change, and reflect the personal opinions of David Hay (an employee of Evergreen Gavekal) as of the date of this publication. This publication does not necessarily reflect the views of Evergreen’s Investment Committee as a whole. All investment decisions for Evergreen clients are made by the Evergreen Investment Committee. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed, and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this letter have been selected to illustrate the author’s investment approach and/or market outlook and are not intended to represent Evergreen’s performance or be an indicator for how Evergreen or its clients have performed or may perform in the future. Each security discussed in this letter has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in the aggregate, may only represent a small percentage of a Evergreen’s client holdings. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. Before making an investment decision, the reader should do their own research and/or consult with their financial advisor. Past performance is no guarantee of future results. All investments involve risk, including the loss of principal.