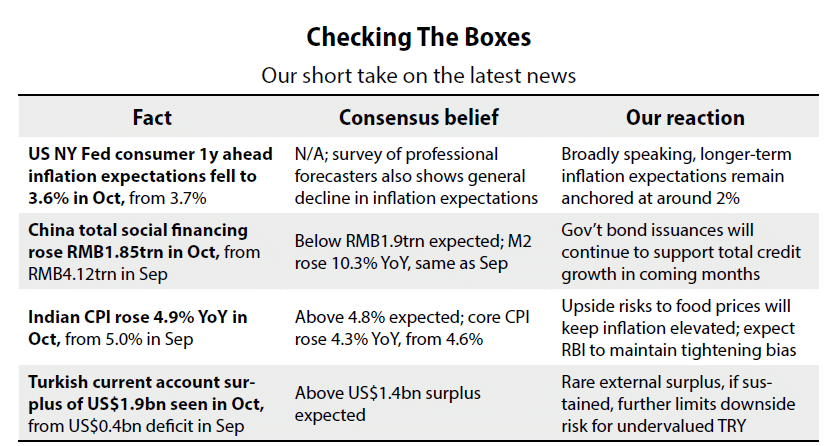

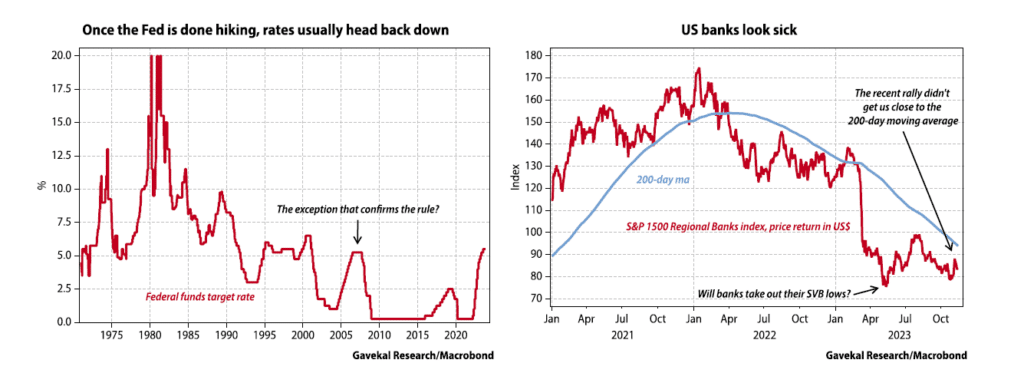

A little under a month ago, various Federal Reserve governors started to signal that the US central bank might have reached its terminal destination in this hiking cycle. Of course, such statements were replete with caveats that short rates would stay “higher for longer”, even as history shows that, aside from 2006-07, once the Fed is done, it has usually been a matter of months before interest rates have been cut again. In this regard, rate hikes resemble tequila shots: one never knows when one’s had enough until one’s had too much.

Conceptually, there are three main reasons that could lead the Fed to stop hiking interest rates.

1) Most obviously, Fed policymakers are starting to believe that the rise of US interest rates across the curve will prove sufficient to slow down the US economy over the coming months, and could even push it into a recession. We can call this the “recession threat” clause.

2) As the long end of the US bond market has melted down in recent months, US bank shares—especially those of regional banks—have again begun to look sick (see right-hand chart overleaf). For a few weeks, it looked as if bank stocks would take out their spring lows. Clearly, losses on bond holdings—even if held to maturity—are leaving banks more fragile, even as losses on credit cards, auto loans and commercial real estate are starting to perk up. We can call this the “bank crisis threat”.

3) As interest rates rise, the US government’s funding cost is becoming an issue, in and of itself. This is partly down to budget deficits running far above where they should be at such a stage of the cycle (about 8% of GDP). But, as with other OECD governments, it is also due to the US having failed to extend the duration of its debt when interest rates were low and now finding itself having to roll over at least US$1trn, if not more, every single quarter in the coming two years. Hence, interest expenses are shooting up. We can call this the “government funding need” issue.

© Gavekal Ltd. Redistribution prohibited without prior consent. This report has been prepared by Gavekal mainly for distribution to market professionals and institutional investors. It should not be considered as investment advice or a recommendation to purchase any particular security, strategy or investment product. References to specific securities and issuers are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Since the Fed’s signaling turned dovish, the markets have latched on to the first possibility—namely, that the Fed is motivated by the growing odds of an economic slowdown, or perhaps even a US recession. Cyclicals of all stripes have been taken to the woodshed (especially energy stocks and metal miners), staples have rallied a little but the real stars, once again, have been mega-cap US tech stocks. The idea underlying these moves is clear enough: in a world without growth, long-bond yields should fall (and they did pull back in recent weeks) making stretched valuations less relevant. Moreover, in a world with limited growth, the warm comfort of Microsoft, Apple, Meta and others is a safe bet on which to fall back. And in fairness, if the world really is set to experience a slowdown, owning the Magnificent Seven may well be the path to salvation. However, as every movie buff knows, at the end of the Magnificent Seven movie, only three of the heroes actually survive.

Such an observation leads me to run the following scenario analysis:

Option 1: neither the US, nor the world, experiences a recession in 2024. In this scenario, cyclicals offer compelling value and have a very attractive embedded stream of returns for years to come.

Option 2: the Fed is not on hold due to recession fears, but because certain US banks, or other financial intermediaries, are in an increasingly precarious situation. If this is the case, the Fed will likely have to cut interest rates, and engineer a steep yield curve, to help banks recapitalize. In this scenario, the US dollar would most likely roll over (high US interest rates are, at this stage, one of the key drivers of US dollar outperformance). This would not be bad for the “Mag-7” per se, but it would be much better for all US-dollar-sensitive assets such as commodities, emerging markets, US industrials and makers of capital goods.

Option 3: the real looming problem is runaway US government funding costs which, in time, should mean that the Fed ends up following the Bank of Japan down the slippery slope of yield curve controls. In this “going Turkish” scenario, the US dollar would (like the yen before it) become the main variable of adjustment (see Turning Turkish). Almost all asset prices would most likely rise, with the main question being which assets rise the most. The answer is likely to be non-US-dollar assets.

All this says that there are many ways to invest for the Fed pause. For now, it seems that the market has embraced a knee-jerk reaction of simply returning to the past decade’s big winners. But if the Fed really is done raising rates, is buying broadly expensive stocks in an expensive currency really the path to future riches? Perhaps some of the recently forgotten assets like Latin American local-currency debt, emerging market equities, industrials and commodities will end up offering more bang for one’s buck—provided, of course, that the world does not spin into a recession in the coming quarters.

DISCLOSURE: Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.