“Real estate cannot be lost or stolen, nor can it be carried away.”

–FRANKLIN D. ROOSEVELT

“There can be no other criterion, no other standard than gold. Yes, gold which never changes, which can be shaped into ingots, bars, coins, which has no nationality, and which is eternally and universally accepted as the unalterable fiduciary value par excellence.”

–CHARLES DE GAULLE

Well, that was an exciting week in the markets! All three major US indexes started down on Monday following renewed global trade concerns and overnight protests in Hong Kong. The slide worsened mid-afternoon as treasury yields continued their tumble. However, Tuesday was a much different story after the U.S. delayed several Chinese tariffs through December. The announcement sent indexes ripping higher across the board.

Not to be outdone, Wednesday saw the worst correction of the year after the closely-watched two-year/10-year treasury yield curve inverted for the first time since 2007. (Numerous portions of the yield curve have been “upside down” for months). This latest inversion sent the Dow down by 800 points (-3.05%), S&P lower by 85 points (-2.93%), and Nasdaq stumbling 242 points (-3.02%). Later in the day on Wednesday, former Fed-head Janet Yellen proclaimed, “Historically, [the yield curve inversion] has been a pretty good signal of a recession and I think that’s when markets pay attention to it. I would really urge that on this occasion it may be a less good signal.” The erstwhile US monetary chief’s words seemed to work magic, as stocks stabilized on Thursday following the release of strong retail-sales data. Then, today, equity prices are again soaring despite solvency concerns over American corporate icon GE and a bevy of bad earnings reports, including from bellwethers such as Cisco Systems.

The back-and-forth-and-back-again is enough to give even the most passionate ping pong fan vertigo. In fact, for context on the rarity of such whiplash, there have only been three other instances since 1952 in which the S&P fell 1% on a Monday and gained 1% on a Tuesday in back-to-back weeks.

In this week’s newsletter, Evergreen Gavekal’s partner Louis-Vincent Gave outlines why the recent market correction is likely different this time before providing his best bull case for real assets, high dividend stocks, and undervalued currencies. Please enjoy!

THE SURGE IN ANTI-FRAGILE ASSETS

By Louis-Vincent Gave

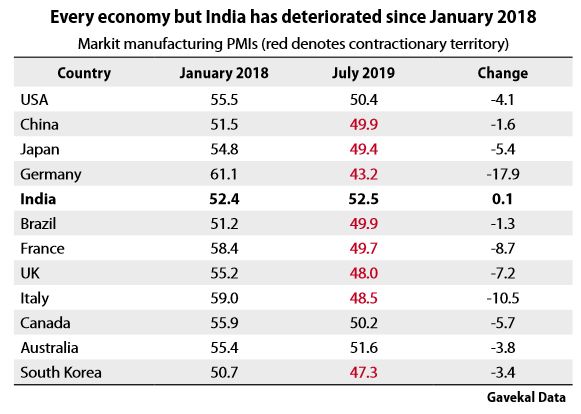

The nice thing about being a pessimist is that either you are proved correct, or you get a pleasant surprise. Unfortunately, there haven’t been many pleasant surprises recently. The table below shows major market readings for the Markit manufacturing PMI surveys in January 2018, when global equity markets were making their highs, and July 2019, which is the latest reading. The numbers are sobering and highlight some important facts.

The fingerprints of many culprits can be detected on this unfolding manufacturing slowdown:

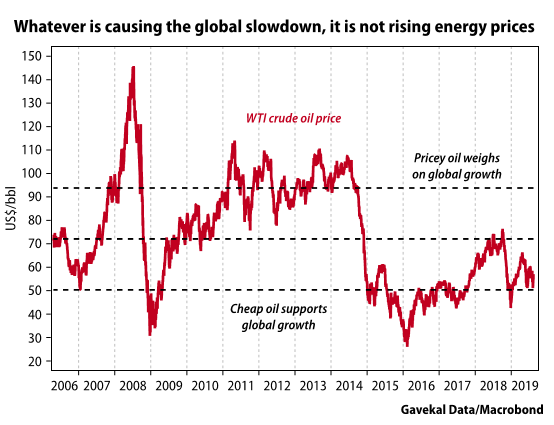

I could go on, but the point is that while there are lots of reasons for the current slowdown, they are not the usual ones. Typically, a downturn is triggered by either (i) a rise in energy prices, or (ii) a rise in interest rates. Neither can be blamed today. As I write, roughly a quarter (US$15.8trn) of the world’s outstanding stock of fixed income instruments is priced to deliver negative yields. Meanwhile, US natural gas prices stand below US$2.5/Btu, and the oil price is one standard deviation below its average for the past 10 years.

This leaves investors in a quandary. On one hand, they might conclude that the recent macro data—not just weak PMIs, but weak copper prices, inverted yield curves, weak industrial production numbers and falling trade—indicate that the world economy is heading into a significant global slowdown or a recession, even though the usual cyclical brakes of a higher cost of money and more expensive oil are not operating. In short, “this time is different.” On the other hand, investors could conclude that the low level of interest rates and cheap energy will combine, as they always have in the past, to put a floor under global growth.

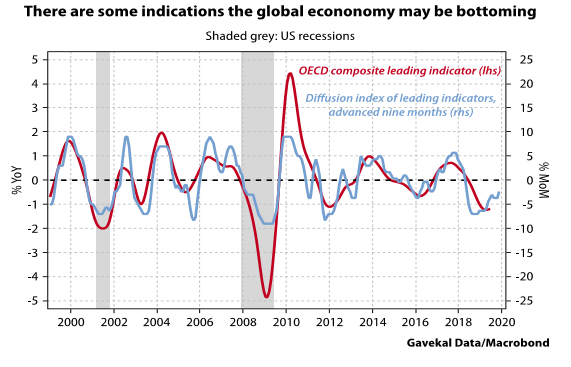

The second possibility should not be dismissed out of hand. The OECD leading indicators seem to be forming a bottom, and Gavekal’s own diffusion index of the OECD leading indicators highlights that some OECD economies have already bottomed and may now be improving.

Yet, it really may be different this time, for a host of reasons.

1) The global political situation

When the global economy fell apart in 2008, world leaders promptly got together and worked to reestablish the trust, and the hope for the future, that had been shattered by the Lehman Brothers bankruptcy. The G20 held its first summit, and China launched a twin monetary and fiscal policy stimulus which brought an end to the global recession.

Then in 2015-16, when global growth again hit the skids, world leaders came together in Shanghai. The resulting “Shanghai consensus”, combined with yet more stimulus from China, ensured a rebound in global growth.

Fast forward to today and the political situation has changed. Instead of global coordination, we have the US trying to contain Chinese growth. China, meanwhile, is visibly trying to derail the US equity bull market.

At the same time, on the Old Continent, the European Union clearly wants Britain to faceplant following Brexit, while the new Boris Johnson government would also likely be quite happy if a new economic crisis engulfed the eurozone. As it turns out, such a crisis may be around the corner with a possible election in Italy likely to lead to a much more confrontational government in Rome.

I could go on, but in the interest of brevity I will simply highlight that the last two major global slowdowns—in 2008 and 2015—came to an end thanks to massive Chinese stimulus. Today, the global economy is slowing again. But China’s leaders, miffed at being branded bad global citizens when they have spent the last decade keeping the global growth train on its rails and not devaluing their currency, are being vocal about their warnings of further economic pain to come. So here we are facing a slowdown, and Chinese policymakers are angry and unlikely to do much to help.

2) The high cost of free money

As long ago as 2011, Charles made the argument that while it made sense to collapse interest rates during a crisis, the goal should be to return interest rates to a neutral level relatively quickly. Otherwise, low interest rates would not only ensure a lack of productive investment (financial speculation being more rewarding at low rates), but would also increase social tensions between the owners of assets and workers.

Fast forward to today, and the obvious conclusion after a decade of zero and negative interest rate policies is that the countries which went down the path of outrageously low interest rates have essentially sacrificed their entire financial industries. Across the eurozone, Scandinavia, Japan, in all the NIRP countries banks are flat on their backs, pension fund managers are having sleepless nights wondering how they will meet their future obligations, and insurance companies, more often than not, are living off their equity capital. And without a healthy financial industry, it is challenging for growth to get traction.

3) Asset Valuations

In recent years, all sorts of records have been set.

Undeniably, it has been a good decade for asset-owners. But at the same time, it has been a rough 10 years for workers and anyone who doesn’t own assets, hence Donald Trump’s election, the French Gilets Jaunes and Hong Kong’s protest movement.

This gap between the haves and the have-nots raises the question whether the next downturn can be dealt with by pushing asset prices even higher, and whether pushing real estate prices any higher wouldn’t be self-defeating. Perhaps we have reached the point where low interest rates force future retirees to increase their savings, and where high real estate prices force young people either to postpone the start of their adult lives—getting married, buying a house, having children—or to massively tighten their belts in the hope of getting a foot on an increasingly steep housing ladder?

4) The end of a monetary era?

Today’s weak growth raises the specter of the end of a cycle—not so much an economic cycle, but a cycle in which monetary policy could be counted on to boost growth. With interest rates already in negative territory across large parts of the industrialized world, real rates below 1% in every developed market, and further gains in asset prices potentially counter-productive for both mass consumption and political harmony, the era of central banks’ ability to fine-tune economic outcomes may be coming to an end.

If so, and if we really are heading into an economic slowdown, to be effective, any policy response will have to be fiscal rather than monetary. So, what type of fiscal policy response are we most likely to see?

Given the rhetoric across most Western countries, investors might expect a sharp rise in infrastructure spending. In Canada, Justin Trudeau was elected on a platform of infrastructure investment, as was Trump in the US. And in the UK, Boris Johnson definitely appears keen on grand projects. However, recent years have shown that boosting infrastructure spending, while popular in principle, turns out to be a daunting task in practice. Between the rise of environmental lobbies, the “not in my backyard” mentality of home-owners (who often have had to leverage up to the eyeballs in order to buy), and the difficulty of getting municipal and regional authorities on board, it turns out that few “shovel-ready” projects turn out to be remotely shovel-ready at all.

Instead, the path of least resistance for government spending is to continue funding entitlement spending, and especially entitlement spending that caters to the middle class (education, healthcare etc.). Clearly this was the path being taken by the potential presidential candidates in the most recent Democratic Party debate in the US. But in turn, this raises the question whether or not entitlement spending is really growth inducing.

Investment conclusions

Putting all this together, it would seem that:

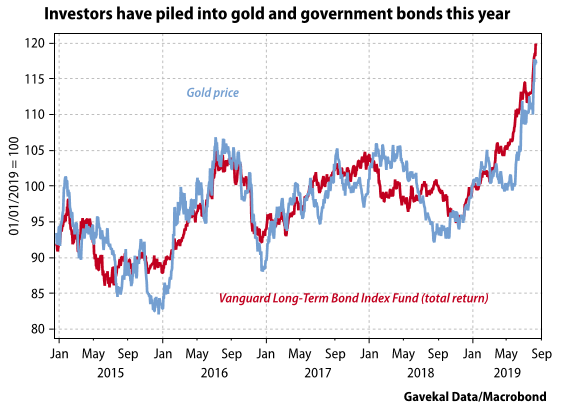

Against this challenging backdrop, investors have piled into “anti-fragile” and safe haven assets, typically government bonds and precious metals.

Government bonds are the natural destination for a world in which growth continues to collapse, but less so if growth rebounds or if governments embark on massive fiscal stimulus. On the other hand, in a scenario of higher government spending funded by central bank generosity, what increasingly looks like the start of a new gold bull market makes plenty of sense.

Beyond precious metals, another logical destination for investors should be real assets—real estate, REITs, high dividend-paying stocks and commodity producers—in countries with undervalued currencies. Currency undervaluation will cushion domestic producers against the global slowdown, which may explain why Canada and Australia have maintained PMIs above 50. Moreover, starting with an undervalued currency reduces the immediate risk of a currency collapse linked to an inappropriate fiscal policy. You don’t get hurt too badly falling out of a ground floor window.

In this sense, there are a number of currencies that appear undervalued today, and most have the Queen’s head on their banknotes. Whether looking at the UK, Canada, Australia or New Zealand, the old Commonwealth appears to be as good a place as any to deploy capital in the current environment. Beyond the English-speaking world, Sweden, Mexico and a number of emerging markets have currencies trading between one or two standard deviations from their historical purchasing power parities. They may not be far enough away to guarantee immediate outsized returns on local currency assets. But they could perhaps provide some shelter at a time when most assets are priced for perfection and the global macro environment is looking ever more tough.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.