“Recent geopolitical developments have led me to raise my probabilities of trade and other types of wars, such as capital wars, cyber wars (and possibly even shooting wars).”

-RAY DALIO, famed investor and founder of Bridgewater Associates

The Trump Trade Tirade, Part II. The original idea for this week’s EVA was to compile a list of “winners” and “losers” should the escalating trade war play out fully. Bloomberg published a similarly devised list on April 4th after China fired back at Trump’s proposal for $50 billion in tariffs. But what started as a research project worthy of consideration, quickly turned into a painstaking realization: there are no real “winners” in a trade war of this magnitude. The global economy loses.

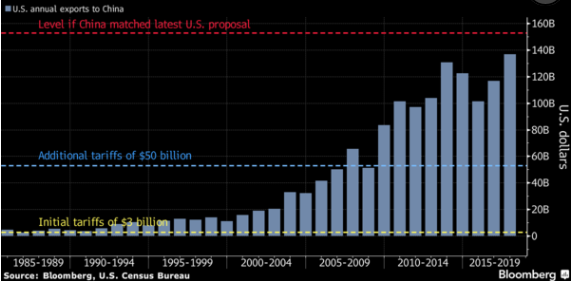

Nevertheless, last Friday, President Trump upped the ante by ordering the United States Trade Representative (USTR) to consider an addition $100 billion in tariffs on imports from China – which would make up a total of $150 billion for those keeping track. Given that the US only exports about $140 billion worth of goods to China annually, the accumulation of Trump-based threats represents a greater sum than China could even consider targeting in direct tit-for-tat tariffs, as the following chart shows:

Source: Bloomberg, US Census Bureau

Source: Bloomberg, US Census Bureau

The S&P responded by closing out last week 1.4% lower than where it started on April 2nd, while the Cboe (Chicago Board Options Exchange) Volatility index spiked above 20 – or nearly double its level for the past year. But, as has become increasingly common with back-and-forth rhetoric between the world’s two largest economies, this week was a completely different story. Stocks surged Tuesday following conciliatory remarks from Chinese President Xi Jinping and President Trump has been notably absent from escalating the conflict via the Twittersphere.

As noted in our March 16th EVA on trade, Trump is keen on resolving two things: reducing bilateral trade deficits and limiting China’s access to IP and technology. Anything short of this will be seen as a failure in his eyes, and our belief is he will not stop pressing towards at least the appearance of a major victory on both fronts. The hope is that cooler heads will prevail, and that back-channel dialogue will result in a deal for the short- and long-term benefit of the global economy.

However, those seeking certainty, resolution or a return to consistently low volatility in the near-term will likely be disappointed. While China has seemingly taken the moral high-ground in these trade disputes, they have plenty of political and economic weapons in their arsenal to bring equal or greater pressure to bear should trade negotiations fall through or tensions ramp up again. Some of these include China further devaluing its currency, selling off its huge stash of US Treasuries, blocking mergers by US multinationals, or subjecting US firms to regulatory harassment. While any use of these tactics would undermine their credibility as a responsible global actor, the mere threat of unleashing these non-tariff retaliatory tools should give Washington pause on ratcheting up trade threats. Of course, cooler heads don’t always prevail.

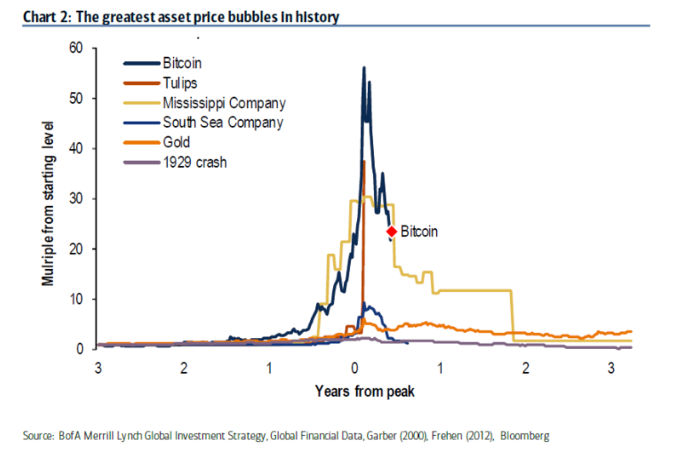

Should I Invest in Bitcoin, Part II. Speaking of cooler heads, remember Bitcoin-mania? You know, the mother of all bubbles that created such a frenzy people even took on credit card debt to invest in the speculative coin. Well, the hype-machine’s hyperbolic run quickly deflated after reaching nearly $20,000. As of today, the price of Bitcoin has cratered to $8,000, falling in step with some of the other biggest bubbles in history:

The question worth asking after this massive run-up and subsequent fall from grace is whether investing in Bitcoin is worth re-considering at these depressed levels?

The short answer is simply, no. We still believe Bitcoin is extremely expensive, volatile, and subject to risk that could result in a lack of liquidity. However, in the midst of the bubble, I had the chance to sit down with a couple of industry experts – one a savvy investor and one a front-line developer – who provided some interesting insight into cryptocurrencies.

The first thing I learned was that many intimately associated with the space believed the massive run was mostly fueled by uninformed “investors” who were interested in turning a quick profit and that a deep correction was inevitable. The cause of the run-up was that demand sharply spiked due to FOMO (fear of missing out) and was not driven by fundamentals or actual value. It doesn’t take a PhD to understand this was happening, but it’s worth noting given the parallels to other bubbles in more traditional markets – specifically, equity markets.

The second thing I learned was that several alt-coins (“alternative coins” not including Bitcoin) are preferred in developer communities. Specifically, Ethereum and Ripple provide more practical applications leveraging blockchain technology that address real-world problems. While we would not necessarily recommend investing in either at this point, we do believe they have more long-term value and provide a better alternative for those interested in the space.

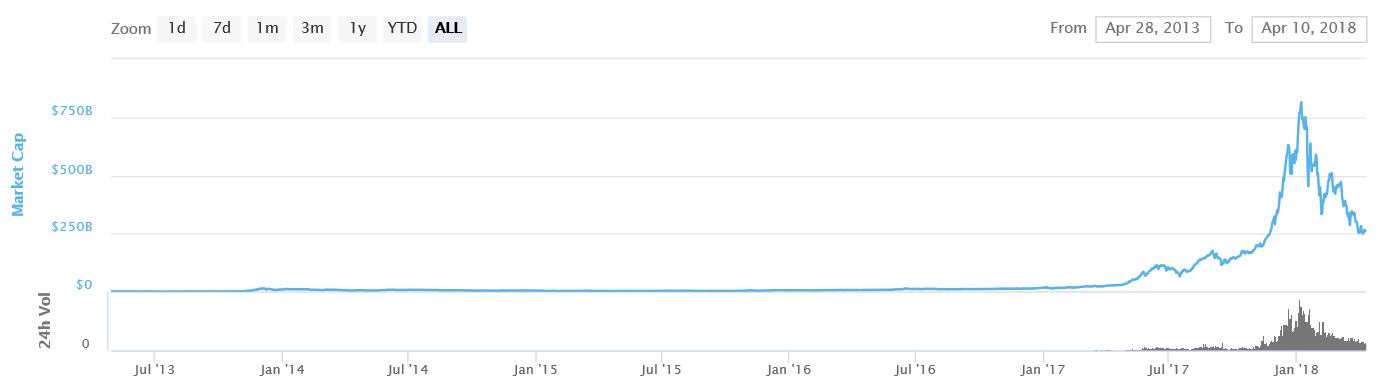

As shown in the chart below, the overall market cap of cryptocurrencies started 2017 at $18 billion. During the first week of 2018, the market cap plateaued around $813 billion. Today, the market cap is roughly $254 billion. (Also, during the daffiest phase of the crypto bubble, stocks linked to Bitcoin, et al, were valued at over $1 trillion, highlighting the utter insanity of that episode.)

Source: Coinmarketcap.com

Source: Coinmarketcap.com

Even after a significant correction, the market cap is 14x higher than it was a little over one year ago. We expect it to continue to fall further as FOMO players take losses, but would recommend readers do their homework as blockchain technology is here to stay, and there will be worthwhile investment opportunities at some point in time in the crypto space – just probably not in Bitcoin.

Facepalm, Part II.

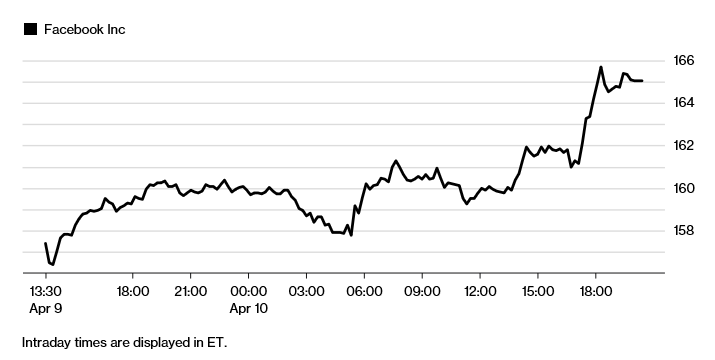

Last week, we wrote briefly on the technology sector and our belief that there has been a shift in sentiment around the big-tech stocks, which have been a key catalyst in this lengthy bull run. This week, Mark Zuckerberg testified before congress on Facebook’s role in the Cambridge Analytica scandal and he was graded highly across the board for his display of confidence in the face of scrutiny. As a result, Facebook stock rallied 4.5% on Tuesday – its best day in two years.

Source: Bloomberg, Evergreen Gavekal

Source: Bloomberg, Evergreen Gavekal

Despite the confidence-backed reprieve, one key takeaway from the hearings is that Facebook and other big-tech stocks will likely face the threat of regulation in the months and years ahead. And it isn’t particularly partisan. Both sides of the aisle agree that change is coming. Republican Senator Lindsey Graham said the following after Tuesday’s hearing: “It would be difficult for members of Congress to tell their constituents we trust Facebook to continue to self-regulate given the problems we have seen.” While Senator Amy Klobuchar, a Democrat from Minnesota, stated: “We’re going to have to do privacy legislation now.”

Should this regulation pass, it will likely dampen the ability for social media, search engines, and other internet companies to freely leverage and monetize a precious modern-day commodity – user data. While the European Union has put in place the General Data Protection Regulation (GDPR) to safeguard individual privacy – rules that will go into effect this year – the U.S. has avoided these types of laws. Those days may be numbered.

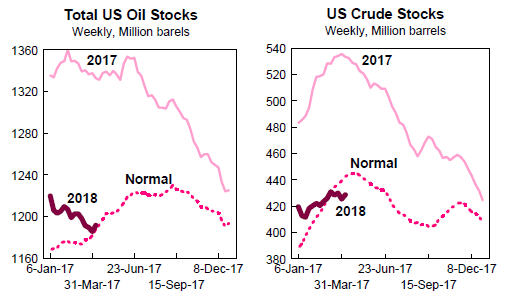

Threats of War. As Ray Dalio aptly noted in the quote at the top of this piece, the threat of a trade war is not the only “threat of war” facing the world. There is Saudi Arabia and Yemen, with the latter’s missiles hitting near the Saudi Arabia capital, Syria with Russia threatening to shoot down US missiles or planes, and the possibility of a civil war in Venezuela as the country continues to implode. And all have implications for the price of oil.

Last summer, we predicted that oil would rebound (as has been the case), but have been surprised at how energy equities have continued to lag.

Source: Bloomberg, Evergreen Gavekal

Source: Bloomberg, Evergreen Gavekal

Should any of the flash points mentioned above erupt into a full-blown conflict, oil could very well continue running. Much will depend on how global leaders and local coalitions respond to these threats in the coming days. Regardless, energy securities are overdue to play a serious game of catch-up. And, despite very bullish speculative positioning on oil, if inventories continue to crash, it will also support higher prices.

Michael Johnston

Marketing and Communications Manager

To contact Michael, email:

mjohnston@evergreengavekal.com

OUR CURRENT LIKES AND DISLIKES

No changes this week.

LIKE

NEUTRAL

DISLIKE

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.