“Tether’s claims that its virtual currency was fully backed by US dollars at all times was a lie.”

– NY State Attorney General, Letitia James.

"This is the golden age of white-collar crime.”

– Famed short-seller James Chanos, who was early to recognize past major corporate frauds.

______________________________________________________________________________________________________

Untethered by David Hay

Regular EVA readers know that Grant Williams is not only a frequent contributor to the Guest editions of our newsletter, he’s also among my closest friends. Thus, you should take what I’m about to say with a big shaker of salt: I think he should be nominated, along with his key sources, for a Pulitzer Prize in investigative reporting.

Before you start ROFL (the internet acronym for “rolling on floor, laughing”), please hear me out. My belief is that he has assembled an overwhelming and convincing body of evidence on a Ponzi scheme that eclipses the one pulled off by the not dearly, but very much departed, Bernie Madoff.

The subject in point is one that I’ve longed to take on in past EVAs, but was warned off doing so by some of my more prudent team members: the so-called stable coin known as Tether.* In case you don’t know, a stable coin is supposed to be backed one-to-one with something like US dollars or other very safe assets. For years, Tether insisted that was true in its case. Unfortunately for the planet’s leading stable coin, NY State Attorney General, Letitia James, begged to differ.

Having immersed myself in Grant’s recent stunning podcast with two men who have performed an extraordinary forensic dive into the Tether saga--and having just read his Things That Make You Go Hmmm regular newsletter (“Schrodinger’s Coin”) on the same subject--I am convinced Tether is a fraud. Moreover, I’m going to go further out on my usual cracking limb by speculating that either the US Department of Justice, or the SEC, or both, are on the verge of untethering it once and for all.

In case you weren’t aware, the NY Attorney General’s office secured an $18 million fine against Tether, as well as its incestuously related firm, Bitfinex. Further, it banned both from conducting business in the state of NY. Sadly, that leaves the other 49 states, and the millions of gullible crypto investors in them, at the mercy of this demonic duo--not to mention the rest of the world.

Back on April 30th, I wrote my “Bitcon No More” EVA in which I attempted to provide an objective look at the second massive bubble in the most popular crypto currency. The point of my title was that unlike when I attacked it as a de facto con job in late 2017—right before it plunged 80% in a matter of months—I was conceding that it had “arrived” as a legitimate asset class. My reasoning was based on its increasing acceptance by major Wall Street investment firms (and they never get sucked in by the latest fad, right?), as well as being utilized as a working capital reserve for some corporations.

In fact, earlier this year nary a day went by when there wasn’t some positive announcement from entities as influential as BlackRock about Bitcoin’s new-found prestige and increasing adoption. The further it rose in price—up to a peak of nearly $64,000, with a total market value in excess of $1 trillion—the more legitimized it became.

*Ironically, on Wednesday of this week, CNBC did a rare interview with Tether’s Chief Technology Officer and its general counsel (see below for more color on him); yesterday, the interviewer, Deirdre Bosa, said that she came away with more questions than answers. Tellingly, the CEO did not participate.

In my April 30th EVA, however, I did speculate that once the price started tumbling, which I expected, its many new fans might turn on it in a hurry. Tesla’s Elon Musk was one of those who jumped ship early on when he announced his firm was no longer accepting Bitcoin as payment for its cars. It additionally announced a large disposition of its Bitcoin holdings where it had parked some of its billions of cash (mostly produced by selling stock, not electric vehicles, by the way).

Both Wall Street and Corporate America appear to have followed Mr. Musk’s lead. It’s been months since I’ve seen any announcements of a large investment by an institution into Bitcoin (though Tesla continues to hold Bitcoin and Mr. Musk has reaffirmed his support for it despite his environmental concerns over its “mining”). In fact, the SEC is currently delaying a number of pending crypto ETFs.

But one remarkable aspect about Bitcoin’s reincarnation, which utterly flabbergasted me, was that it was able to triple its value from the 2017 zenith that many, including this author, felt represented the biggest bubble of all-time. Ok, much, much more than remarkable—like it’s never happened before in recorded history, an achievement I conceded in that April EVA. Once the object of an immense speculative bubble implodes by the usual 80%, it stays dead for many years, if not decades. But, thanks to Grant, I think we have an answer as to how this happened…

As you may have guessed, this EVA is dedicated to Grant’s exhaustive investigation that I’d like to share with all of our readers. However, both his podcast and his newsletter on this subject are on the longish side. But if you care about the crypto space—or you just want to learn more about one of the most surreal financial schemes ever—I’d urge you to invest the time. You can access both Grant’s podcast with two sleuths on the Tether story, Bennett Tomlin and George Noble, as well as his “Schrodinger’s Coin” on his website here. Normally, Grant’s work is for subscribers only, but, out of what I believe is a spirit of public service, he’s opened these two up to anyone who cares…and I think that should be almost every EVA reader.

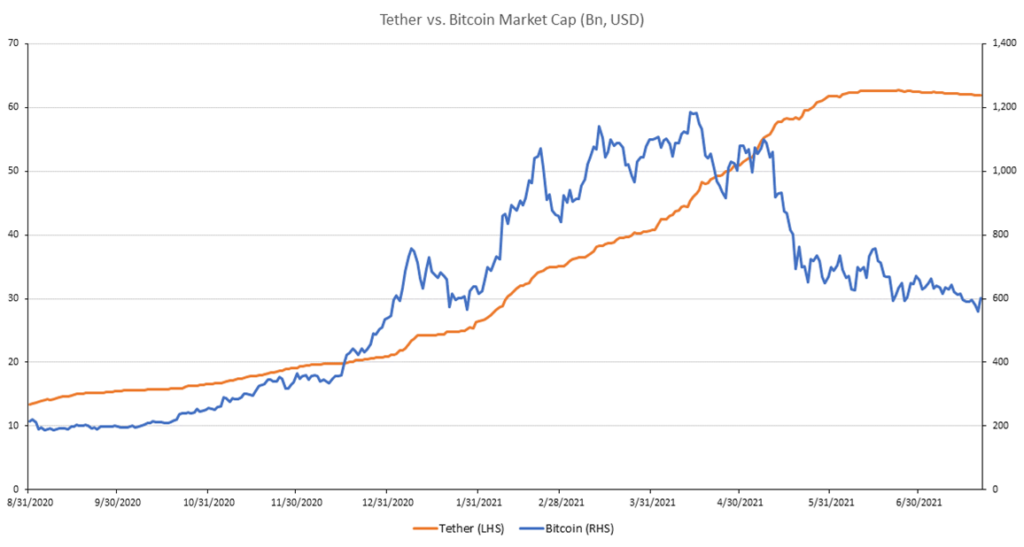

To borrow one of Grant’s favorite words, hmmm (if that’s a word, not just a sound). Regardless, even a casual observer might wonder if there wasn’t a causal relationship. In my mind, the fact that Tether went from $2 billion coins outstanding (remember, these are supposed to be backed one-to-one by real assets) to $64 billion at the same time that Bitcoin went up by 450% are closely linked. (As a side note, I find it intriguing that Tether’s market value has stayed near its peak despite the serious recent carnage in the crypto realm, including Bitcoin. To me, this raises further suspicions about the reality of its valuation.)

Skeptics about this linkage would point out that even Bitcoin’s starting value last fall of around $150 billion would be tough to move—certainly, all the way to $1 trillion—with just $60 billion of Tether (not all of which went into Bitcoin, by the way). However, this ignores two things: first, only about 20% of Bitcoin is estimated, on the high side, to actually trade; second, prices are set by the marginal transaction which is, even for US large cap stocks, usually just a tiny fraction of the total market value. Thus, $60 billion of fresh “capital” coming in can have a huge impact, particularly if there is a lot of leverage involved which, in the case of Tether and Bitcoin, is a given.

Because I realize most EVA readers are unlikely to listen to either the Tether podcast in full or read all of Grant’s Things That Make You Go Hmmm, I am once again using a summary, as I did in my April Bitcoin EVA, to recap what I found to be the most salient points. (I’d suggest that you listen to at least the last twenty minutes of the podcast; after that, you may crave more—fair warning.)

Does all the above conclusively prove fraud? No. Does it indicate an extremely suspicious and perilous situation? Absolutely! Since, as Yogi Berra said, “It’s always hard to make predictions, especially about the future,” the best a financial forecaster, like me, can do is to weigh the odds. In this case, my view is that the odds heavily favor fraud.

Many crypto fans concede that Tether smells bad. But their common rationalization is that it really doesn’t matter to Bitcoin and the other digital “currencies”. Some even think Bitcoin would go up as money flows from Tether into Bitcoin directly, should the former implode.

They might be right but, again, I don’t think that’s what the odds favor. As CNBC’s John Ford said in regard to this week’s segment on Tether (paraphrasing slightly), any collapse by it would threaten the entire crypto ecosystem. Because so much funding of cryptos has been via Tether and other “stable coins”, anything causing millions of investors to question their backing seems to me a cataclysmic event in crypto-space.

The crypto exchanges like Coinbase also would almost certainly come under intense pressure due to any broad crisis of confidence. Per George Noble in Grant’s podcast, even some ardent crypto fans are advising extracting investors’ coins from the crypto exchanges to avoid what could essentially be a run on them.

My basic point in this regard is that a Tether collapse could set off a contagion effect that might produce another 80% decline in Bitcoin (from its April peak), though an even deeper plunge can’t be ruled out. If 80% is roughly the ultimate downside destination, that would imply around $13,000 or down another 60% from here. Given how many retail investors (and some institutional players) have been caught up in the latest Bitcoin mania, that is likely to be a very painful event…should it happen.

The other question is if a loss of confidence in this area spills over into the broader market. On that score, I’m ambivalent. One could argue it might drive even more money into the blue-chip names, including the once again adored FANGM stocks.

However, I am sympathetic to the view, as expressed by Grant and his podcast’s guests, that the Tether saga is reflective of a severe and on-going regulatory breakdown. This has been true not only in the US but in Europe, where major corporate frauds such as Wirecard and Greensill have been unveiled, causing huge investor losses.

In the US, thus far, the damage has been negligible. There haven’t been any Worldcoms, Enrons, Lehmans, AIGs, or Madoffs of late. But it does feel like there are a lot of shenanigans going on that are being swept under the rug by a tsunami of liquidity. It’s possible that the Tether fraud, should it be revealed as such, will lead to a far more muscular regulatory response. Considering how much reckless behavior is going on currently (see the meme stocks), fed by the Fed’s endless trillions, one has to believe that there are copious “bezzles” out there right now, primed to be exposed by intrepid folks like Grant. We should all be grateful for their willingness to call out these schemes and the questionable characters who perpetrate them. Hopefully, a number of EVA readers will heed their well-reasoned warnings.

David Hay

Chief Investment Officer

To contact Dave, email:

dhay@evergreengavekal.com

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.