Since nearly the beginning of the Covid-19 pandemic, we have all hoped for an end to the harsh restrictions and a return to the way of life we had previously taken for granted. This new way of life, however, has led to some notable changes in the way we approach virtually everything.

For example, if you've dined at a restaurant recently, you likely viewed the menu by scanning a QR code instead of reading on paper. You may have also utilized telemedicine this year to connect with a provider and minimize in-person interaction. And, if you have been to an airport, it’s possible that you were evaluated by thermal scanners that digitally look through crowds for people who may be sick. Credit card machines, most of which still required you to insert a physical card and often sign your receipt prior to Covid, have largely adopted contactless payment via NFC (near field communication). Film studios have shifted to delivering content via online platforms, thereby bypassing previously required theater releases. Realtors have turned to virtual showings instead of face-to-face appointments. Schools have moved to collaborative remote learning software to engage students virtually. I could go on, but the point is that the businesses capable of adapting have done so, dynamically changing their workforces and the way they interact with customers to remain operational during this time.

Most of these changes were enabled by the utilization and rapid advancement of technology. In some cases, we’ve developed new technologies to address the curve balls that have been thrown our way, as a result of the virus. In other instances, technology that was already in existence but unused for one reason or another has seen forced adoption. What’s clear is that with the help of technology, society is experimenting with unprecedented changes in our lifestyle, behavior, and policies. The long-term viability of these solutions is anyone’s guess, but the topic does deserve our attention because the ramifications of changes (both permanent and transient) will mean profits for those who get it right and losses for those who are wrong.

The following sections are some of my thoughts and considerations, with regards to the major areas of change over the past year.

Workforce changes:

Prior to COVID, the flexibility to work from home was considered a job perk. Social scientists have often argued that employers should embrace it as a means to boost productivity and job satisfaction. Businesses that are able to function with remote workers have already been dipping their toes into the water for years. Maybe it was a stellar employee who held leverage and made working from home a requirement. Maybe it was an employer who bought into the notion that productivity wouldn’t evaporate if their employees weren’t physically sitting in the office. Or, perhaps a business outsourced a portion of their jobs to another country to lower costs. Regardless of what prompted firms in the past to accommodate remote work, we are in a different position today, given that there is no choice. The broad adoption of remote work across industries for such a long period of time means that we are incidentally conducting the most significant workforce social experiment in human history.

Needless to say, the new way of working isn’t without its critics. In September, Jamie Dimon (CEO of JP Morgan), said that his company was observing productivity declines across all levels of the company, particularly on Mondays and Fridays. As the vaccine emerges and businesses reflect on how their workforce performed remotely, a lot is at stake. Perhaps some firms realize that they don’t need as many employees and that certain jobs are more expendable than once thought. A recent WSJ article went as far as to forecast a permanent reduction in corporate travel of 36% as businesses rethink the necessity of these inefficiencies. At the root of all of the workforce decisions is one central question: How much more productive can businesses be by leveraging technology and replacing in-person interaction with digital collaboration?

Investors will fall into two camps. Those who do not believe that workers can be sufficiently productive without an in-office presence and those who believe that doing business virtually will remain the status quo, to some extent. The first group should be buying depressed securities within the commercial real estate sector that will bounce back as the vaccine is more available giving way to a “return to work” movement. The second group who believes we may not go back to the pre-covid ‘normal’, may want to avoid airlines, hotels, or other commercial real estate with office or retail exposure. Regardless of which camp you fill into, the potential adoption of new business practices and technologies should cause investors to re-think past investment assumptions.

Real Estate: second homes, urban exodus, rural boom

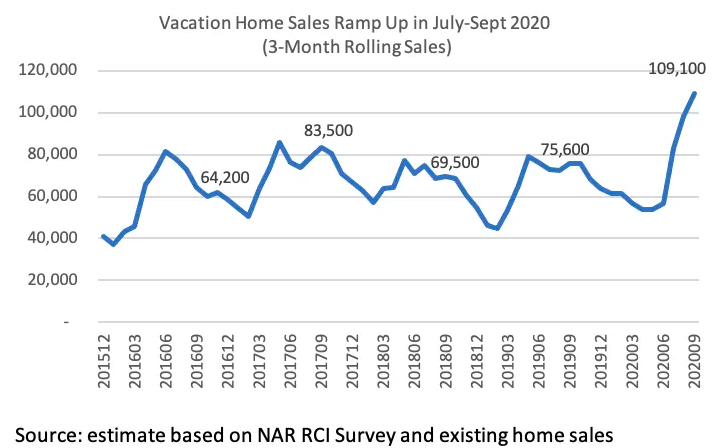

For a whole host of reasons, there has been a spike in interest in second homes and real estate located outside of urban zones. It is no surprise that many people who were able to purchase a second residence (likely in a warm weather climate) became highly motivated to do so during the series of lockdowns we’ve experienced. I’ve heard countless stories about second home communities shattering sales records during the pandemic.

Source: National Association of REALTORS (2020)

However, the ability to escape to a second home isn’t an option for everyone. What would be far more disruptive to the status quo, would be a migration out of dense urban locations to more rural ones. If people are living farther from their place of employment, then they must either work from home or commute longer distances. Could this be bullish for energy demand, specifically gasoline? Could it be bullish for automakers? Tire companies? Work from home technology companies? Alternatively, if you don’t think people will, in the medium- to longer- term, be changing their proclivity to urban living, then you may want to avoid those companies and buy retail stocks located in core urban areas. I’d also add that food delivery companies (UberEATS, Doordash, Postmates, etc.) could also be winners should urban living see a revival. These companies’ business models are constructed around a driver being able to make many deliveries in a small area. As people spread out, this becomes less and less efficient.

Financial Services: The death of suits in a mahogany office?

I’ve mentioned that our company has already began re-examining our workplace requirements and how we engage with clients, but we aren’t alone. UBS COO, Sabine Keller-Busse, said in July that they estimate one-third of their employees may work remotely on a permanent basis. Certainly, they will not be alone in their thinking. Have clients and advisors permanently changed the nature of the advisor-client interaction? Will this mean advisors and clients do not forge the same degree of relational bonds, making clients more likely to jump from advisor to advisor? Could it have the opposite effect? Will clients be less likely to meet a new advisor at a dinner, golf tournament, or seminar because the nature of interaction has changed? Will clients opt to replace human advisors with “robo advisors” as human contact has been reduced? Do firms who commit to “re-engaging” clients in a post-Covid world prosper as people still prefer to form a deeper connection over matters related to their financial situation? As a bit of a silver lining, the financial services industry has been in the dark ages compared to so many other industries and leveraging technology may be a beneficial adjustment. As an example, the purchase of a home is often the largest financial transaction one will make. The process of buying a home, in many cases, has already been made easier than opening a brokerage account. Out of necessity, many financial institutions have been forced to ‘get with the times’ and rely more on technology to streamline the client experience in a way that should have been done years ago.

Cyber security:

E-commerce has surged during Covid. Exercise junkies have bought Pelotons. Students are online, thanks to Zoom and Microsoft Teams. In countless ways, our life has become so much more digital than it already had been. All this means that more of our information is floating around in Cyberspace. Therefore, shouldn’t we expect an added focus to securing all that data? It seems plain to me that if we are conducting more of our lives in this fashion, firms that offer cyber security to individuals and businesses will become an increasingly critical part of our national infrastructure. We as citizens take comfort in knowing that we have Police, Fire and Medics ready should they be called upon. Now, will our lives need the cyber equivalent to ensure our safety and privacy? Will this be a national agency? And if so, how will it be funded and how will people respond to the government’s role? Or perhaps it will be driven be a capitalistic private sector that emerges. Certainly, this has geopolitical implications. What if the industry leaders in cyber security companies emanate of out China? How would the Western World handle such a development? While technology is doing many wonderful things for society, it doesn’t come without a cost or risk. The wars of future generations will not be fought with guns, bombs, tanks, and planes, but from behind a keyboard. As COVID has forced us to rely more on technology than ever, I wonder if companies’ efforts to move us as a society to a digital world have been matched by a sufficient approach to securing this data and information.

Medical Breakthroughs:

China made the genetic code of the virus publicly available so that companies around the world could expeditiously begin their response. As I write this, the vaccine development known as “Operation Warp Speed” has made astounding progress, delivering remarkable results. It is worth noting the speed at which the response has come. Prior to these vaccines, the fastest delivery was for the Mumps and it took 4 years. The Covid Vaccine is arriving 11 months after the virus genetic code was made publicly available. The efficacy estimates for the vaccine had an estimate of 50%, the current results appear to be north of 90%. Pfizer and Moderna are leading the charge, with others likely to follow. While many people have viewed the Coronavirus as a horribly timed global health crisis, I find myself seeing it through a different lens. Now, more so than ever before, we have the technological prowess to sequence the virus. We can develop tests to detect it and track it. I happened to be talking with a friend recently who founded a VC firm in the Bay Area with the first fund focusing, specifically on sleep. He told me that the PGA tour began issuing wearable devices called “Whoop” that track sleep disruption. A number of players noticed spikes in their respiratory rate during sleep, prior to testing positive for COVID-19, or even showing a single symptom. While anecdotal, this illustrates one of the many ways we are able to employ technology, in the fight against this pandemic. The computing power alone that’s been used to help develop the vaccines simply didn’t exist previously. While the battle has been horrific and created lasting health and economic damage, it seems clear that we have never been better positioned to fight it.

Summary:

I have a difficult time seeing a return to the world we knew before. It takes meaningful events to create meaningful changes. Few would say that this global pandemic hasn’t caused societies and individuals to reevaluate the way we think about many things. Some of these things will have personal effects. Will people go back to shaking hands, hugging, and kissing? Will masks in public, once reserved for hypochondriacs, become a common sight? Will companies accelerate the move away from a people-based labor force in favor of automation? What will the reaction be to the next “Swine flu”, Ebola, SARS, etc? Will we be more cautious or even nervous about the next COVID-type outbreak, prompting businesses and people to live constantly with a contingency plan? I’d argue that the world as we know has changed, some of it permanently, some of it temporarily. Those who can most effectively see the difference between those two things will make a lot more money than those who are expecting to wake up one day with all this being one long bad dream.

Tyler Hay

Chief Executive Officer

To contact Tyler, email:

thay@evergreengavekal.com

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. The yields mentioned are yield to worst (YTW). YTW is the lowest potential yield that can be received on a bond without the issuer defaulting. Many corporate bonds have yields which are higher or lower than 5-6%. There is no guarantee that projected yields will be realized or that an investment strategy will be successful. These yields do not reflect the deduction of advisory fees, brokerage or other commissions, and any other expenses that a client may pay. There are other facts the will impact the return including price appreciation or depreciation.