“One of the surest signs that a bubble is close to bursting is when the retail investor piles in with leverage.”

– Societe Generale’s Head of Global Strategy, Albert Edwards

“Reasonable minds can disagree whether GameStop is worth $30 or zero, but not $200 or $300.”

– Wedbush analyst, Michael Pachter

“Wouldn’t it be ironic if GameStop stopped the gamification of financial markets. It probably won’t but it should.”

– A market strategist who requested anonymity

______________________________________________________________________________________________________

A number of years ago, I brought up a stock idea to our investment team because it looked undervalued to me at around $20. It had tumbled from the mid-50s a year or so earlier and was selling at a low price-to-earnings ratio. Due to the fact the S&P 500 had been rising for years, even back then, it was increasingly hard to find undervalued securities, but this company superficially appeared to qualify. The rest of my investment team was unimpressed, however.

Periodically, there would be a bullish story on it in publications like Barron’s causing me to re-suggest this name. Yet my analysts who follow the gaming world more closely were unmoved. They repeatedly told me its business model of operating physical stores to sell video games was a rapidly melting ice cube. They were right. It was a classic value trap-–cheap but likely to become even cheaper. Over the past five years, its revenue shrank by more than 40% and its formerly respectable profits turned into a gusher of red ink, losing more than $1 billion over the course of fiscal years 2019 and 2020 (on a GAAP, or official, basis). Last summer, it was trading around $4. As you may now have guessed that company was, and is still, GameStop. But the stock price most definitely is still not $4!

For years, the decision by my tech-focused team members to pass on this struggling retailer of increasingly obsolete products and focus on companies with significant competitive advantages was the correct one. However, in the summer of 2019, a young investor named Keith Gill began buying GameStop stock and options.

Because most millennials were aware that GameStop’s business model was dated and eroding, with online gaming and downloads being where the action was (i.e., similar to the views of my tech savvy analysts), his bullishness initially drew skepticism from his handful of online followers. By late last year, though, GameStop’s price was moving higher and Mr. Gill began to establish a reputation as a stock market “influencer” on Reddit’s WallStreetBets social media forum. (One of the more popular posts on that is “Buy High, Sell Never”, a meme that is certain to be eventually thoroughly discredited, if it hasn’t been already.)

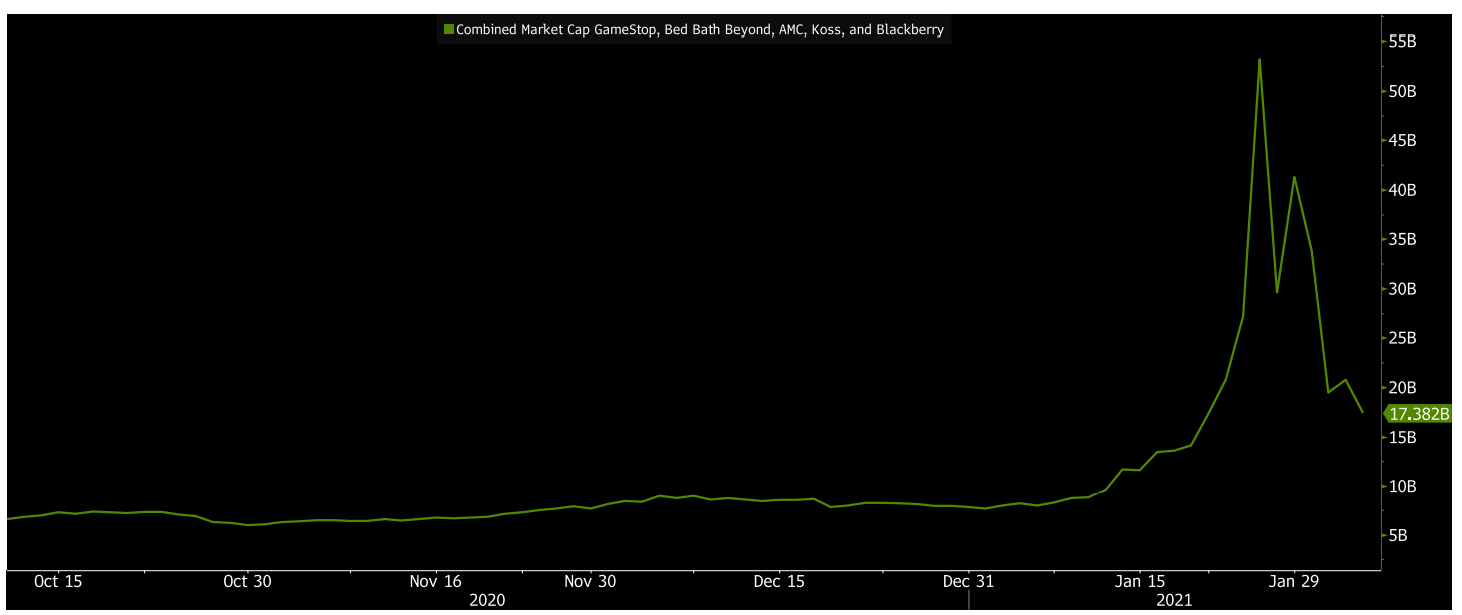

Outside of this forum, Mr. Gill was largely unknown—until late last month. From early August of last year through year-end, GameStop (ticker: GME) rose 500%. But that was just the warm-up act. After rising another 75% in the first two weeks of 2021, to $35, GME began one of the most breathtaking ascents in the history of the financial markets, which we Tweeted about last week.

Source: Evergreen Gavekal, Yahoo Finance (this screenshot was taken intraday on January 28th)

By Thursday, January 28th, it hit $470, representing a market capitalization of roughly $32 billion. All for a company that has been profit-free on a cumulative GAAP basis since 2015.

As the first month of 2021 came to a close, GME became THE financial market sensation of the young year. It has attracted scrutiny from key members of Congress, along with causing tremendous stress for the Robinhood trading platform upon which much of the GME buying frenzy occurred. To cope with the regulatory capital requirements of the spectacular volume explosion, it was forced to raise $3 billion almost overnight. Briefly, Robinhood, TD Ameritrade, and Charles Schwab suspended transactions of GME, attracting considerable criticism (with Robinhood taking the brunt of the blowback).

The GameStop rocket ride gravely wounded one of Wall Street’s most successful hedge funds, Citron Capital, run by famed short-seller Andrew Left. Citron’s disaster also brought out the short-hating side of Elon Musk, often a target of hedge fund bets against Tesla, to root on the rout of Citron, as well as Melvin Capital, another hedge fund with a big GME short position. (Once again, as chronicled in our “Stranger Things” EVA, had Citron and Melvin paid close attention to a multi-year breakout that happened in the low $20s in early January, a major disaster could have been averted. Lest I sound sanctimonious, this is a mistake I have made far too many times in my personal short portfolio but it’s a lesson I’ve learned…finally).

Supposedly, there were more GME shares sold short than were outstanding, a remarkable development that begs the question of how regulators allowed that to happen. Curiously, the SEC has been largely missing-in-action as the GME phenomenon has unfolded (other than a terse message late last week that markets should be allowed to function), perhaps because a new chief has just been appointed. Similarly, the Fed has done nothing to intervene, such as to raise margin requirements. Years back, when the Fed sought to interdict bubbles—rather than enable them—it frequently increased the amount of capital investors needed to put up to buy stocks when conditions became highly frothy and/or volatile.

As regular EVA readers know, this is a continuation of a mania that was in full swing last summer when the Robinhood/Reddit/Davey Day Trader crowd began touting stocks in bankrupt companies such as Hertz. Their social media cheerleading caused Hertz to rise 800% on huge volume despite the fact that, as even the company admitted, its shares were likely worthless (it is now back to $1.75, with zero the probable ultimate destination). How much money was lost on that nutty trade, and several others involving similarly busted companies, may never be known but it must have been considerable.

Yet, the highest market value Hertz rose to last summer was around $1 billion, about 1/30th of what GME recently hit. As usual, trading activity goes crazy during the lift-off phase of these events, meaning the Johnny- and Jaynie-come-latelys pile in at higher and higher prices, magnifying their eventual losses. You might be wondering where these small punters, often millennials trading from home, get the money to play these games. Often, it’s from those stimulus checks that so commonly go to people still earning a paycheck. Accordingly, hundreds of billions of taxpayer money may be funding these outrageously speculative trades.

In case you’re bemused as to how a rag-tag informal army of online traders like Mr. Gill—whose rallying cry is YOLO (You Only Live Once)—can overwhelm multi-billion dollar hedge funds, it is due to a confluence of factors. First, many, if not most, of these players (and for many of them it truly is a game) use margin debt, often combined with options. Thus, they can control far more market value than they actually put up in cash.

To maximize their option leverage, they often purchase far-out-of-the money calls (meaning, the right-to-buy, or exercise, price is way above the current stock price; thus, they can be bought for chump change with lottery-like payoffs in the case of a GME-type move). As the swarm of call options (bullish bets on the underlying stock) swells, option market-makers are forced to buy the underlying shares to be hedged. (This was a point made in our EVA titled ‘Take Me Out to the Call Game’.)

This buying naturally further reinforces the share price’s upward trajectory which, in turn, creates even more of a feeding frenzy of buyers—particularly when they smell short-sellers’ blood in the water. One pundit appropriately referred to this as the “weaponization” of call options. (As an intriguing side note, when GME was on its way to almost $500 there were roughly twice as many put options bought than call options; thus, perhaps late in the moonshot some serious smart money took the other side.)

Second, the “Reddit Rebels” often move in concert, egging each other on with frequently obscene and boastful verbiage. Screenshots of their brokerage accounts show multi-million-dollar gains, inciting intense greed and FOMO—Fear Of Missing Out. Influencers like Mr. Gill are shrewd enough to target stocks such as GME with high short positions. As the shorts take huge hits, often triggering margin calls, the share price typically goes straight up. Any connection to true intrinsic value is severed and, for a time anyway, becomes totally meaningless.

Third, social media platforms like Facebook, Twitter and YouTube use algorithms and, as we should all know, these select the most compelling content based on past user activity. These “algos” then push fresh material along similar lines to countless other interested parties. As a result, a powerful digital amplification process occurs, accentuating the hysteria in the case of short squeezes. The Wall Street Journal’s Christopher Mims wrote about this phenomenon last weekend: “Ample research has described the addictive potential of social media and apps like Robinhood, which make trading stocks feel like gambling…drop them into a stew of sensation-seeking young people with limited entertainment options during a pandemic, and it’s hardly surprising that all of this has come to pass.”

In such situations, short-sellers like Citron become trapped by wave upon wave of leveraged, self-reinforcing buying. They learn the hard way about the old market adage that “He who sells what isn’t hissen’, buys it back or goes to prison.” These days, it’s either put up (as in cash to meet the margin calls) or get sold out. Despite a multi-billion dollar loan from two of the most successful hedge funds of all-time, Point 72 and Citadel, Melvin was forced to cover its GME position, thereby locking in a monstrous hit. For the month of January, it lost a stunning 53%. It will be interesting to see if the fund survives this horrific experience at the hands of what my partner Louis Gave refers to as a “flash mob”.

On January 27th, Louis wrote about their sudden power that has mainstream Wall Street reeling: “This ability to organize market ‘flash mobs’ is as much of a threat to financial systems as the real thing is to retail stores. This effect means that out of nowhere, price discovery for an asset can suddenly become irrelevant…This is a problem for capitalism.”

A problem indeed, especially when the inevitable reckoning comes to these millions of new and highly confident rank speculators investors. As SocGen’s Albert Edwards told the Financial Times this weekend “If the retail warrior millennial mob are angry now, wait until they lose their shirts in any market collapse”. Based on the carnage in many of the most popular flash mob stocks this week, the wait may be surprisingly brief. As of today, GME is trading at $60, an 87% meltdown in seven trading days from its absurd apex last week. (The extreme volatility is continuing with the stock swinging wildly this morning between $52 and $88.) Based on the massive volume that occurred at far higher prices, nearly all of those who drank the “it’s going to $1000” Kool-Aid probably now feel like they were served it by the ghost of Jim Jones.

To me, this is one of the biggest risks of this latest and most frenetic phase of what I’ve long called Bubble 3.0. When the Fed’s Magical Money Machine can no longer pump-up asset prices and a true bear market ensues, millions upon millions of investors—and not just the “warrior millennial mob”—are going to be livid, if not border-line homicidal. Unfortunately, I’m pretty sure capitalism will get the blame despite the reality the US hasn’t engaged in anything close to pure capitalism in a great many years.

There are some astute folks who believe the flash market mob phenomenon may trigger a serious correction in the overall market. Kevin Muir publishes The Macro Tourist, a frequently humorous and always insightful financial newsletter. He graciously allowed Evergreen to Tweet out a link to his recent note “Can A Short Squeeze Crash The Market?” (A quick but shameless promotion: Evergreen’s Twitter feed is becoming far more active; for EVA readers who would like to track events like this on nearly a daily basis, click here).

Kevin’s point is that the pain suffered by several key hedge funds, much more than just Citron and Melvin, is causing liquidations of a multitude of stocks. This pattern was evident last week as the market slid 3%, turning January into a down month for the S&P. Further, and more ominous, the extraordinary volatility in GME and many other mob squeeze targets is elevating overall market volatility. Because most big institutions use volatility as the key in-put in their Value-At-Risk (VAR) calculations, this forces them to reduce risk. In other words, they become forced sellers.

Actually, stock market volatility, or vol, was surprisingly elevated even before Citron’s and Melvin’s Little Big Horn experience. This is perplexing since “vol” usually falls in a rising market, such as the one we’ve had since the vaccine news was announced in late October. Louis Gave is quite concerned about this development, as is his Paris-based team that has extensively researched the market risks present even when high volatility is to the upside. Obviously, I am, too, for any EVA readers who missed my January 1st “Take Profits” issue.

Clearly, this week has seen a powerful upside reversal in the broad market even as the Robinhood playthings were taken to the woodshed. A bullish argument could be made that short selling has become too dangerous and that most hedge funds are reducing or closing out their bearish bets altogether. Moreover, if shorting is basically going the way of the dodo bird, then a big collective seller is now mostly sidelined. Both of those are valid considerations but it also means that there won’t be the deep pool of institutional buyers who step in during severe market downdrafts to cover their shorts and bank their gains.

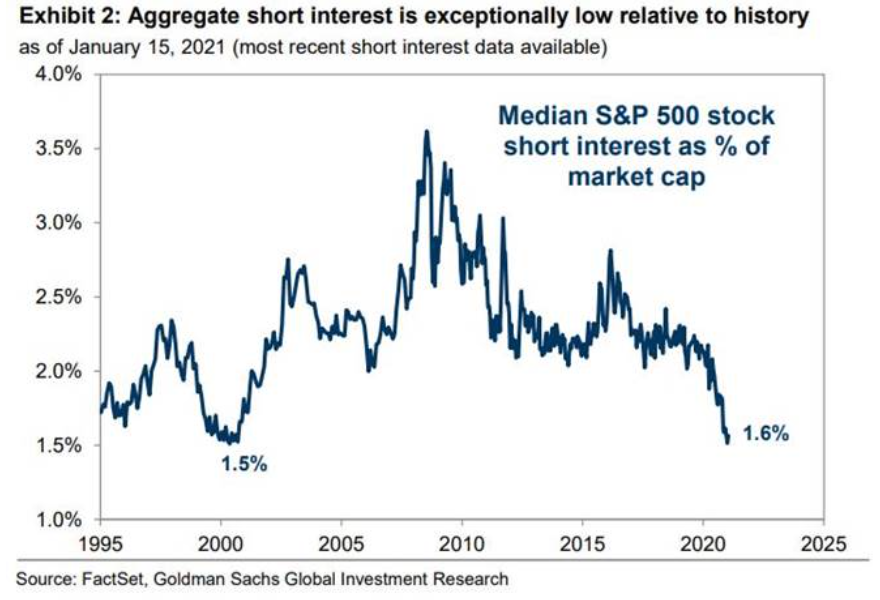

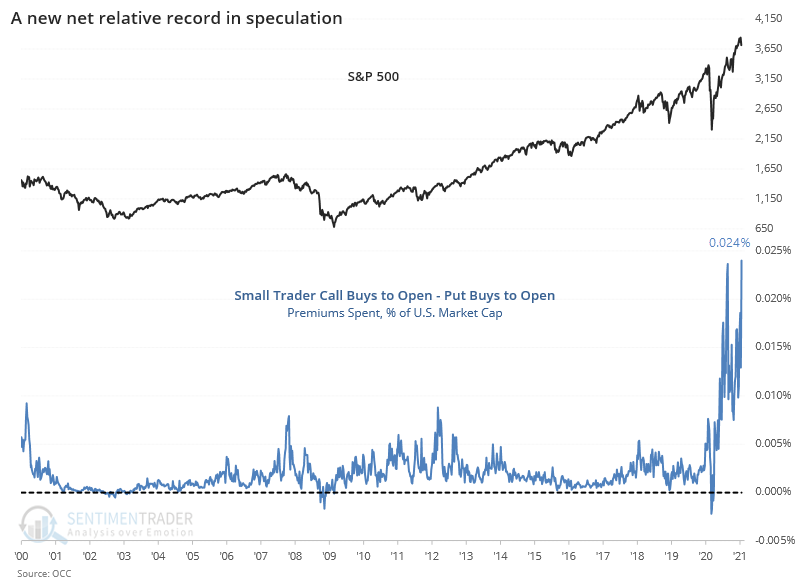

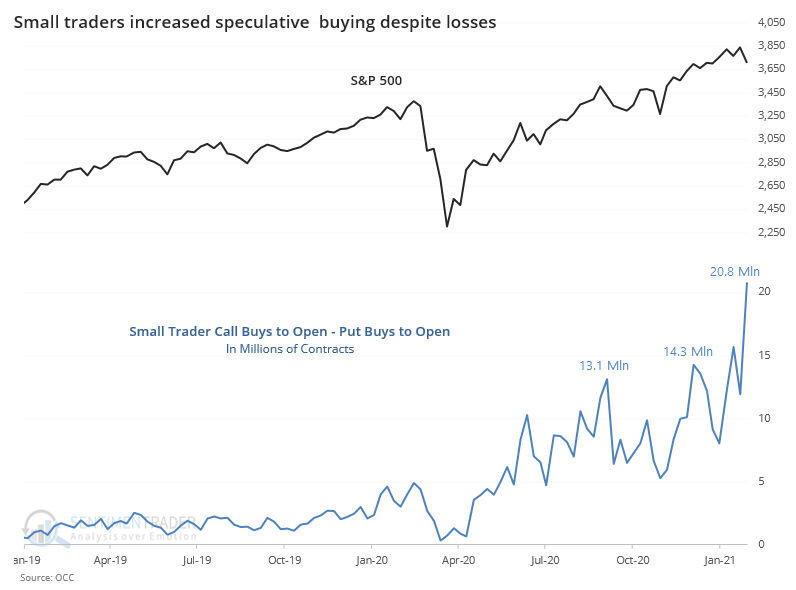

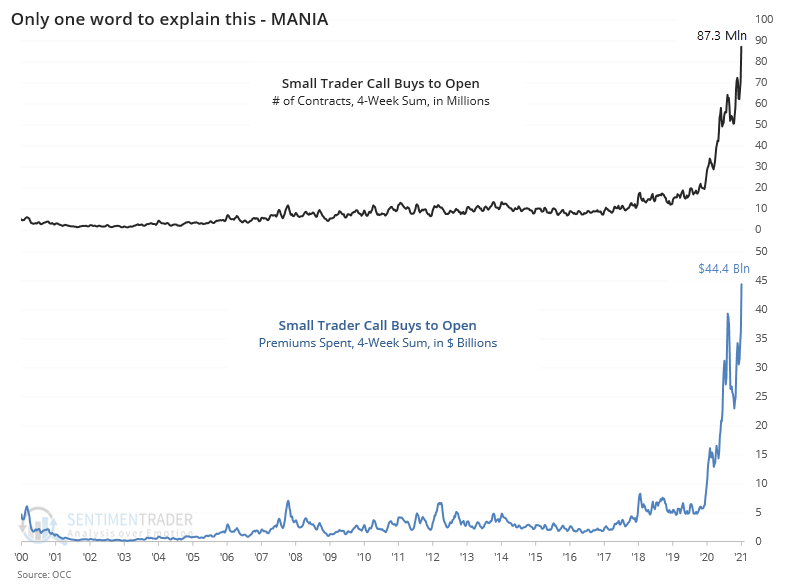

Putting aside that down-the-road concern, one of the most troubling aspects to me, along with the crazed speculation by millions of newbie investors, is super-intense insider selling. Major market tops typically involve a final buying orgy by the public concurrent with insiders rushing for the fire exits. And if you think I’m being hyperbolic by using “crazed”, check out these charts on option activity.

Source: SentimentTrader

Another display of hyper-speculative behavior that is almost certain to go down in the history books, when this spectacular bubble is chronicled for future generations, is new account openings at Reddit where the WallStreetBets forum resides. In the short time that the GME insanity has been underway, Reddit has added six million new users. No wonder short-sellers were in liquidation mode. Clearly, this is a market force to be reckoned with and, despite the drubbing the YOLOers have taken this week, I seriously doubt they are going away anytime soon (that will probably take a long and grueling bear market).

The forced covering of billions of dollars in short positions last week is similar to what occurred back in March when global markets were in the midst of a worldwide margin call. Forced liquidation hit almost everything, including the normally bullet-proof (at least in a panic) US treasury bond market. It was, of course, a great time to be a buyer which this newsletter strongly endorsed. In fact, I can’t recall a period when there was involuntary selling (or, in the case of the shorts, buying), that wasn’t a silver-platter opportunity to make a killing for those with the capital and courage to go against the flow—admittedly, much easier said than done.

Last week, when GME hit nearly $500 it may have been one of the greatest shorting opportunities ever. As it has turned out, that was the case even at $250…if one could stomach the vertiginous leap to $470. The buying avalanche clearly had nothing to do with underlying value which may be $30, at best. (GME insiders thought so as they sold large quantities around that level; at last week’s peak price, one insider had let a cool $240 million get away.)

In full disclosure, I am now short GME personally though, as of yesterday, I’ve largely covered. During the frenzy, I waited until it was in triple digits and moved slowly, in a dollar-cost-averaging fashion prepared to put up a lot of cash if it went far higher. My wait was a short one…like two days. But I did continue to methodically short small amounts as it zoomed upward and I’ve just as deliberately been covering my shorts as GME has crashed back toward terra firma.

With that disclaimer out of the way, I do believe—obviously, putting my money where my mouth is—that Kevin Gill and his followers are as trapped as the shorts were last week. Based on their Sasquatch-like footprint in the stock, I believed they couldn’t get out—at least not in size—without crushing the stock. This week’s stunning drop would seem to indicate that most of them were truly in a no-win situation. (Note, I wrote these words last weekend when GME had closed at $328.)

Has all this been illegal, akin to a social media pump-and-dump? For key influencers like Mr. Gill, it likely heavily depends on if they have been selling large amounts of their shares before telling their YOLO acolytes to take profits. According to the Wall Street Journal, which saw a screenshot of his E*Trade account as of January 27th, his stock and option position in GME was worth $48 million as of that day. (These YOLOers love to brag!) Not bad for an unemployed 34-year-old living in a rental house. It will be fascinating to find out if he sold a large portion before GME began cratering. (Per Zero Hedge, on January 27th, at GME’s high point, “only” $34 million of his account was in GME stock and options and $14 million was in cash. As a side note, the SEC might be very interested in how he accumulated that much cash. But as of yesterday, his GME holdings had evaporated all the way down to around $5 million. Easy come, easy go, but, hey, you only live once!)

The ex-enforcement chief at the Financial Industry Regulatory Authority summed it up well, also per the Journal: “If it is just folks whipping each other into a frenzy on the internet, it is hard to find a violation. But if you have people putting information out on a website, and these are stock pickers selling into the frenzy and they are not disclosing that, it can be fraud.” (Emphasis mine) Be careful, Mr. Gill, even if YOLO is your clarion call.

Politicians like Sen. Elizabeth Warren also said events such as this make the stock market appear to be a casino. My sentiments exactly except that I’d add it’s now a totally out-of-control casino (well done, Fed!). The hockey-stick up-moves and then the equally precipitous plunges in long-struggling companies like GME, and several others, clearly indicates a market that has lost its integrity.

Source: Bloomberg, Evergreen Gavekal

Ok, I hear the laughing. What integrity, right? The attitude that the market has long been a stacked deck in favor of the big institutions and hedge funds is for sure behind much of the “Reddit Rebellion”. It’s the little guys versus the establishment, modern day Robinhoods stealing from the rich to give to the poor. But is that really happening? Isn’t it more a case of one set of mavericks taking from another set, those who came in after the easy money was made and just in time to get a bunch of arrows in the back?

Spectacular price increases have always attracted a crowd, usually at the worst possible time. It was bad enough when you had traditional media sources like CNBC pouring gasoline on the speculative fire. Now, though, social media giants and message boards are luring millions of inexperienced lambs into the eventual market slaughter. Per the above chart, the eventual might be right now for many of them.

The sad and very costly reality is that most retail investors are attracted to bubbles--the bigger, the more enticing. It’s a pattern that keeps repeating, these days with increasing frequency and across a much larger number of asset classes. This is one reason why I think most of those playing the crypto currency game will end up getting clobbered…again. The exception, in my view, will be the precious few who have a disciplined dollar-cost-averaging sell plan. In other words, those who methodically sell into the madness of crowds, rather than buying as prices go vertical.

One of my main motivations in writing this newsletter for over 15 years is to keep my readers from being sucked into this trap. Presently, there are a slew of dangers, toils, and snares out there in the market, far too many for me to identify. As I’ve written before, it’s not just Bubble 3.0, it’s the Biggest Bubble Ever but—and this is a huge “but”—it’s not a bubble in everything. There are still many reasonably priced securities around, just as was the case during the epic tech/dotcom bubble twenty-one years ago.

Because Evergreen sees an economic boom unfolding in the months ahead, it could be a particularly rewarding time for those cyclical companies that are still well below their pre-Covid trading levels. Yet, as I’ve previously conveyed, I am surprised at how many “old economy” stocks such as Paccar, Union Pacific, Deere and Cat are selling for what used to be growth tech type valuations (of course, the latter are, in most, not all, cases, trading at truly head-spinning multiples).

So, as they say, be careful out there. Remember old and wise sayings like “The bigger the bubble, the bigger the bust” and “Be fearful when others are greedy”. Social media, Reddit rebels and flash mobs haven’t discredited them. In fact, in an era of “You Only Live Once” and “Fear Of Missing Out” they are likely more true—and vital—than ever.

David Hay

Chief Investment Officer

To contact Dave, email:

dhay@evergreengavekal.com

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.