“Everyone is talking about blockchain, and no one wants to be left behind.”

– PwC’s Global Blockchain Executives Survey from August 2018

“Bitcoin, and the ideas behind it, will be a disrupter to the traditional notions of currency. In the end, currency will be better for it.”

– Edmund Moy, 38th Director of the United States Mint

Two years ago to the month, bitcoin was in the midst of a surge that put some of the frothiest bubbles of all-time to shame. The unprecedented run saw the price of a single bitcoin swell from just under $1,000 at the beginning of 2017 to over $20,000 towards the end of the year. However, last year was an entirely different story as the price of one bitcoin plummeted to around $3,500 by the end of 2018.

To some, the precipitous rise and subsequent drop came as a swift reminder that nothing on planet earth goes up-up-and-away forever and that buying into the middle of a hype-driven event is ill-advised. To others who were fortunate enough to time both ends of the bubble, it came as a once-in-a-lifetime opportunity to capitalize on a once-in-a-millennium event. And yet, to others, it represented the flushing out of thousands of retail investors who flocked to cryptocurrency markets for a short time before licking their wounds and leaving digital coin markets in the hands of “true crypto believers.”

Whatever camp you might or might not have fallen into over the last several years, the frenzy likely grabbed your attention at one point or another. And while information about bitcoin hasn’t completely fallen out of the news cycle by any stretch, the digital currency has become a much less dominant conversation topic than it was 24 months ago. Despite this, relevant information about blockchain* and the digital currency space has persisted. Specifically, the following areas continue to be pertinent to markets:

In the rest of this article, we will provide some brief commentary on the aforementioned topics and their relevance to broader markets and the economy.

*Blockchain is a distributed, decentralized, public ledger that has also been termed “Web 3.0.” The goal of blockchain is to allow digital information to be recorded and distributed, but not edited. It is the technology underpinning cryptocurrencies such as bitcoin. However, there are many applications for blockchain technology outside of cryptocurrencies including uses in healthcare, property records, smart contracts, supply chain, banking, and voting.

China’s Support of Blockchain

One of the great ironies in the ongoing ‘Tech Cold War’ between China and the United States is Xi Jinping’s sudden support of blockchain. Recently, the Chinese president used blockchain as an example to explain where China should focus its efforts to push economic progress forward. As a result of the proclamation, the price of bitcoin jumped from $7,500 to $10,500 within hours. Li Wei, the head of the technology department at the People's Bank of China, doubled down soon after, stating that China should “embrace digital finance.”

The reason these comments are so rich in irony is because they signal a nearly 180-degree turn in Chinese policy. Earlier in the year, China announced it would aim to squash cryptocurrency transactions to limit the amount of capital outflows from the country. We believe the reason behind the policy reversal is two-fold.

First, there is no doubt that Li and Xi’s comments should be viewed as part of the wider “Tech Cold War” between the United States and China, in which the two are competing to gain the upper hand in a broad range of emerging technologies. Xi has expressed interest in deepening the integration between blockchain and other information technologies such as the Internet of Things (IoT), Artificial Intelligence and Big Data. While the US government has taken a softer stance toward cryptocurrency exchanges than China, it has not fully embraced the role of digital currencies and blockchain in the broader global financial system. The comments by Li and Xi come after Facebook CEO Mark Zuckerberg warned the US would cede dominance over the global financial system to China if it does not embrace these emerging technologies. China’s pivot towards embracing these technologies is another salvo in the pursuit of increased control over the global financial system.

Second, we believe that China’s reversal may also be motivated by a plan to stealthily manipulate prices and turn massive profits as it controls the news cycle and price fluctuations of bitcoin and other cryptocurrencies. Earlier this week, Bloomberg published an article titled, “A Lone Bitcoin Whale Likely Fueled 2017 Surge, Study Finds.” We believe that markets are still very prone to manipulation by dark pools of enormous capital, and the recent price spike of bitcoin shows that any support from the People’s Republic will likely send the price of bitcoin and other cryptocurrencies higher.

Facebook’s Plan to Unveil Libra

Earlier this year, Facebook unveiled a plan to rollout a new blockchain-based global currency called Libra. The news immediately incited pushback from countless critics including worldwide regulators, US attorney generals and Congress. Yet, despite all the pushback, Mark Zuckerberg and Facebook have remained committed to their long-term vision for building a new financial services product that would allow users to send money over Facebook Messenger and WhatsApp without a banking intermediary.

Facebook states that its primary objective with Libra is to create a new ecosystem where anyone can build and use financial products that are not controlled by any single commercial entity. To this end, Facebook claims that it wants to reach the 1.7 billion people around the world who do not have access to a bank account – but do have access to the internet and a Facebook account. However, lawmakers see Libra as much more of a risk than value-add and argue that the cryptocurrency would threaten government-backed currencies and consumer privacy, while giving Facebook reign over an unprecedented global financial system.

Mark Zuckerberg has stated that he will not greenlight the rollout of Libra without approval from US regulators. Given the cynicism towards big tech these days, increased antitrust concerns, and loud calls to break up some of tech’s biggest names, it is unlikely that Zuckerberg will get the stamp of approval he is looking for from Congress anytime soon. The one wild card in the storyline is whether US regulators soften their approach on blockchain-related tech due to the above-mentioned policy-reversal in China. If so, Zuckerberg might start to gain the traction he needs for his ambitious Libra plan. If not, he’ll likely be waiting years, decades or longer.

Bitcoin as a Hedge

It’s no secret that Evergreen has been extremely negative on the impact of central bank policy in recent years. In a February 2018 newsletter, we urged investors to consider a gold-backed hedge in case the radical policies of global monetary mandarins ended poorly. While markets have continued to rise as they are artificially propped up through the fabrication of money from nothing and low interest rates, gold has also rallied over the course of the last year to new multi-year highs on news of escalating geopolitical conflicts.

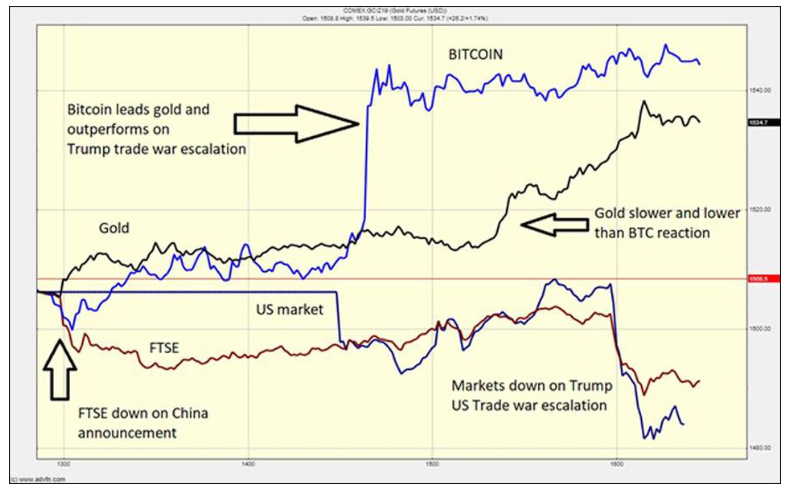

Bitcoin has been compared to gold in that it is has no intrinsic value, other than the value humans have attached to it. Over the course of the last year, the coin has moved synchronously at times with the shiny metal object, especially during geopolitical conflicts such as the trade war between the US and China (as shown in the image below).

Source: Forbes

Source: Forbes

While we have not and would not advocate for investing in bitcoin due to the fact that its extremely volatile and prone to manipulation (plus several other reasons listed in our December 2017 newsletter), there is an interesting case to be made for its ability to store value in a decelerating economy, risk-on geopolitical climate and as the value of fiat currency declines due to radical theories such as Modern Monetary Theory (MMT). Having said that, as we have advocated for ad nauseum, we believe gold is a much wiser hedge with a much longer track record of storing value during perilous times.

Companies Investing in Blockchain

In 2018, PwC published a report that found 84% of executives surveyed said their companies are “actively involved” in researching and/or implementing blockchain technology. One of the companies surveyed was IBM, who state on their website that:

“Similar to how the internet changed the world by providing greater access to information, blockchain is poised to change how people do business… The benefits of blockchain for business are numerous, including reduced time (for finding information, settling disputes and verifying transactions), decreased costs (for overhead and intermediaries) and alleviated risk (of collusion, tampering and fraud).”

For all of its complexity and misunderstanding, the number of potential use cases for blockchain in business are nearly endless, as underscored by the sheer number of companies in different industries investing in the technology. Even the likes of Warren Buffett and Jamie Dimon, who have been extremely critical of bitcoin and cryptocurrencies, have advocated for the benefits of blockchain.

Yet, despite all of the excitement around the emerging technology, the question remains whether it will be as transformative as the internet has been – which goes without saying is an extremely high bar. For all of its advocates, there remain plenty of skeptics that doubt that the underlying technology will significantly alter the way businesses and individuals operate. However, there is clearly an advantage for early adopters of blockchain tech, even if the reality doesn’t fully live up to the hype.

Conclusion

The widespread adoption of blockchain technology will create numerous winners and losers in the years to come. For example, credit card processors with deeply entrenched networks will likely be able to seamlessly incorporate blockchain to improve security, reduce fraud, and accelerate transaction processing. Other winners in the blockchain revolution will be early-adopters and large technology companies, financial institutions, logistics companies, and healthcare firms who have the resources to invest in the technology. Additionally, data center operators and cloud hosting companies that are building decentralized clouds will also have a leg-up as demand grows for data centers with the right infrastructure to support a wave of new blockchain tech. On the other hand, smaller institutions that lack the resources to be on the leading edge of this revolution will likely struggle to keep up with a quickly evolving space. Wherever you land on the topics of bitcoin and cryptocurrencies, there is plenty of agreement that blockchain will improve many of the security, transparency, accuracy, and affordability shortcomings that exist within today’s non-decentralized ecosystem. The extent to which this emerging tech will be truly revolutionary is still up for debate – but at the very least it’s time to start paying attention.

Michael Johnston

Tech Contributor

To contact Michael, email:

mjohnston@evergreengavekal.com

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.