Quote

"The near-term outlook for the IPO market is foggy heading into the second quarter, though one thing is clear: recent IPO returns, and risk appetite will need to rebound before activity resumes."

- Renaissance Capital, an IPO research and ETF company

Introduction

The new HBO series “And Just Like That…” is one of pop-culture’s latest sensations. The show, which follows the same cast of characters as the hit series Sex and The City, has sparked several memes, cultural moments, and even stock frenzies in its relatively short time on TV.

In case you missed it, the series started off with a bang as Mr. Big, played by Chris Noth, had a heart attack after riding his Peloton in the show’s first episode. The real-world implication was furor by adoring fans and a selloff in Peloton Interactive (PTON), which faced PR nightmare after PR nightmare.

Now is probably the time to admit that I’ve never actually seen “And Just Like That…”, which speaks more to the show’s cultural moment than to my taste in TV shows. It’s also likely time to acknowledge that you’re probably asking yourself what the HBO hit “And Just Like That...” has to do with a financial newsletter.

I’m glad you asked…

And Just Like That…

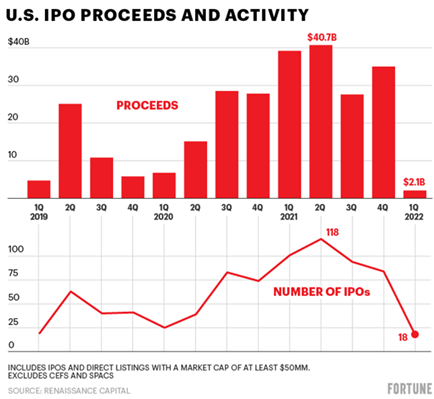

Through the first half of 2021, the US Initial Public Offering (IPO) market hit record after record, as proceeds and activity went gangbusters. At its peak, nearly $40.7 billion of capital was raised via initial public offerings across 118 deals in the second quarter of 2021 (see chart below). However, the landscape looks completely different for companies seeking to go public today. Over the past twelve weeks, 18 companies raised a mere $2.1 billion, which is the slowest quarter for the IPO market in six years.

And just like that, the high-flying IPO market reversed course in an instant. Macro-economic factors such as rising inflation and interest rates, fears of World War III, and uninspiring IPO/SPAC returns are obvious scapegoats that help explain the dramatic slowdown in IPO activity.

What’s more telling is what lies below the surface in private markets. Grocery-delivery unicorn Instacart, which had been eying its own IPO, made waves by announcing that it slashed its private-market valuation by nearly 40% to “better align itself with public competitors and give an edge to its employee stock plan.”

Instacart isn’t alone, as many private companies seeking capital in this new environment have been forced to change growth plans and/or take discounts to access fresh capital. However, the pain of this wavering risk-off environment has been disproportionately felt by companies like Instacart, who are in the latter-stages of growth.

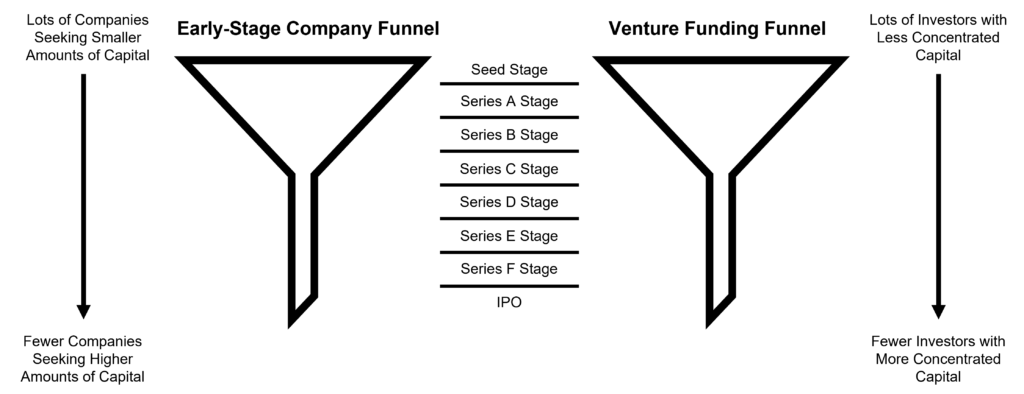

Parallel Funnels: Startups and Investors

Think about the growth ecosystem as parallel funnels. Within one funnel, you have lots of companies seeking capital to become the next billion-dollar company. Within the other funnel, you have lots of investors seeking to back the next billion-dollar company. As companies progress through their lifecycle, some succeed and some fail. The ones that succeed move down the funnel and the ones that fail drop out of the funnel completely (perhaps reemerging at the top of the funnel to try again). Similarly, venture funds tend to raise larger and larger funds as they successfully back “winning” companies. As a result, pools of capital get deeper for those funds, and they’re able to back companies at later stages of growth.

The problem is that when public markets cool off and IPO activity slows down, companies at the bottom of the funnel experience a disproportionate amount of pain, because:

Admittedly, the above is a simplification and generalization of a very complex environment that has plenty of layers and exceptions. However, generally speaking, the environment we find ourselves in today is doing less to impact early-stage growth companies at the top of the funnel (think Series Seed, A, B, and C), than later-stage growth companies at the bottom of the funnel (think Series D, E, F, and beyond).

Conclusion

Since the birth of the VC asset class, there have been four major epochs marked by three boom and bust cycles. Until recently, the VC boom spanned across every stage of growth in both of the funnels described above. Today, we find ourselves in a different environment where the bottom of the VC funnel is struggling to mint new public companies. As a result, an already elongated IPO timeframe will likely stretch beyond what has become a +/- 10-year founding-to-IPO cycle for many companies.

It also means that successful and fast-growing companies in early stages of growth (Seed A and B in particular) will likely benefit from the market cycle and be in the position to access ample capital today while remaining on a “more standard” funding and IPO trajectory.

The macro environment has undoubtedly changed over the past several months, but what’s clear is that innovative software and technology companies that are pushing the digital future forward have a place in any market environment. Some pundits have compared the recent selloff in publicly traded technology companies to the dotcom bubble of the early 2000s, but a major flaw in that comparison is that infrastructure, communications technologies, consumer behavior, and real-world business applications were nascent during that period (more reminiscent of this era’s blockchain tokens, NFTs, etc.).

Today, the modern world is dependent on an ecosystem of hybrid networks, software, and technology that is entrenched into every fabric of society. So, while there might still be road bumps ahead, those waiting for a true dotcom moment to replay itself in the 2020s will likely be disappointed. As companies in the early stages of growth continue to solve real-world challenges and see real returns, capital will continue to pour into these businesses, reloading the bottom of the funnel and eventually resurrecting the IPO market from its recent “And Just Like That…” moment.

Michael Johnston

Tech Contributor

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.