“Those are my principles; and if you don’t like them, well, I have others” —Groucho Marx

The summer holidays did not come soon enough. To be sure, it has been a busy year: tariffs, fights between White House and Federal Reserve, war in Iran, war in Ukraine, India-Pakistan war, Deep Seek and other AI advances, Japanese, Korean and German elections, China’s fiscal stimulus and its attempts to curb rampant over-supply. Any one of these topics would be worthy of a book. Still, the markets are the final judge. And with more than half the year now behind us, taking stock of important trends probably makes sense.

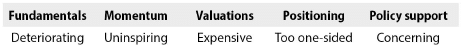

In this paper, I propose to review the key bull and bear markets of 2025; or at least, those in which I have the strongest levels of conviction. I propose to review these market trends through the five lenses of fundamentals, valuations, momentum, investor positioning and policy support.

Conviction #1: The US dollar is in a Bear Market

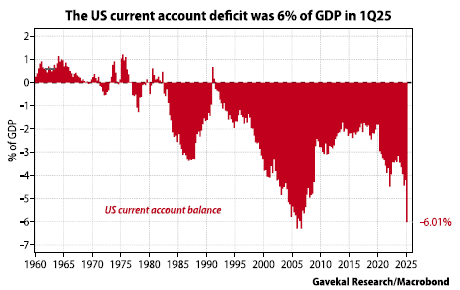

Fundamentals: Following 15 years of US equity market outperformance, most clients seem to start with the premise that “there is no alternative” for foreign investors but to take the excess dollars that the US consumer continues to push abroad and recycle them into US assets, so pushing the US dollar higher. However, a key development of 2025 is how the appetite among foreign investors for US assets has started to shift. Meanwhile, as US fiscal policy remains expansionary, the US current account deficit plunges to new depths.

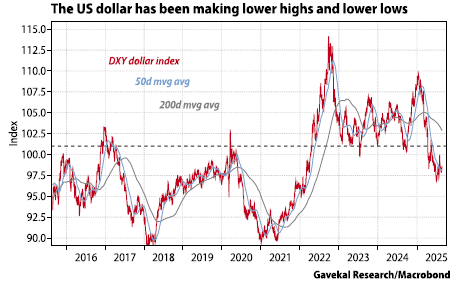

Momentum: For the first time since just after Donald Trump was sworn in as president in January, the US dollar (as measured by the DXY index) has broken back above its 50-day moving average. Still, since Trump’s inauguration, the US dollar has essentially made a series of lower highs and lower lows. With a Fed rate cut cycle likely around the corner, the Trump White House clearly eager to talk the US dollar down, and the DXY still trading below its 200-day moving average, it is hard to get too excited about the most recent rebound from oversold levels.

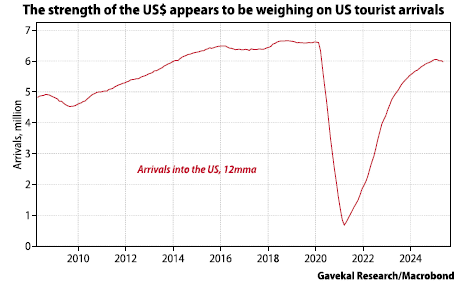

Valuations: The fact that the US current account deficit is sitting at 6% of GDP is probably testimony enough to the fact that the US dollar is now significantly overvalued against most other currencies. As is the fact that tourist arrivals are now down -7% year on year (admittedly, the drop in tourism could be linked to politics, but the fact that traveling around the US is no longer the bargain it once was is likely also having an impact).

Investor positioning: For 15 years, being overweight US equities, real estate, private equity and venture capital was the simplest path to outperformance. It seems highly unlikely that large institutions have even begun to adjust to a world in which the US dollar goes down instead of up.

Policy risk/support: For now, the Fed maintains among the highest short rates in the world. Will this continue? If so, Fed hawkishness should provide some level of support for the US dollar, perhaps once a somewhat more reasonable valuation is achieved. However, if—as seems likely—the Fed turns more dovish in the coming quarters, then the combination of easy fiscal policy and easy monetary policy should help push the US dollar lower. This is all the more likely since the Trump administration seems rather keen to talk the US dollar down. On this front, at some point Xi Jinping and Donald Trump will have to sit down with each other (most likely in October in Seoul at the APEC summit). A summit that is likely to give rise to anticipation of renminbi gains and further US dollar weakness?

Conclusion on the US Dollar

A few weeks ago, the US dollar was very oversold. Since then, it has bounced a little. However, this bounce could be starting to stall as pressure on the Fed to cut rates ramps up and the data coming out of the US is uninspiring. At this stage, it seems that to turn the tide on the US dollar bear market narrative, we would need to witness either a renewed crisis in Europe (which would precipitate capital flight out of the old continent) or another meaningful downturn in China. However, with fiscal and monetary policy being loosened in both Europe and China, an immediate crisis seems unlikely.

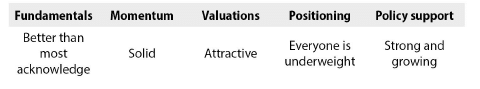

Conviction #2: China is in an Equity Bull Market

Fundamentals: Investing in Chinese equities is an exercise in weighing the very negative against the very positive. On the negative side of the ledger, most industries are still experiencing massive overcapacity. The downturn in real estate still weighs on animal spirits. And the demographic picture continues to deteriorate. However, at the same time, China is leapfrogging the West in industry after industry with evident productivity gains. Every year more graduates than ever leave Chinese universities with a degree in hand. China now has the lowest cost of electricity of any major economy. And to go along with the low cost and high productivity of labor and the low cost of electricity, China now has the lowest cost of capital in the world.

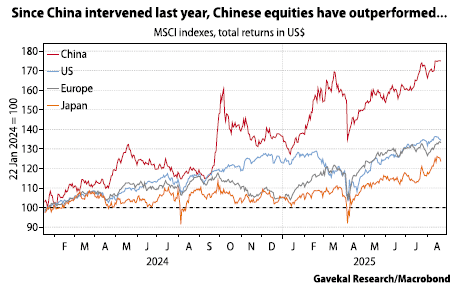

Momentum: Since the government stepped into the market in late January 2024, the Chinese equity market has outperformed all major equity markets. Granted, this out performance came after three dismal years (2021, 2022 and 2023). But the momentum of the past 18 months is now starting to look fairly solid.

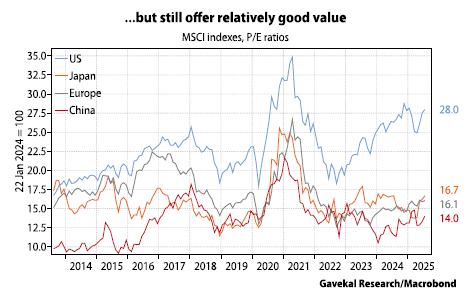

Valuations: By any conceivable measure, whether price-to-earnings, PEG ratios, price-to-sales, price-to-book, or dividend yields, the Chinese equity markets are among the most attractively valued major markets today.

Investor positioning: A year ago, the mantra among investors was that China was “uninvestible.” Given China’s recent outperformance, this belief is now starting to dissipate. Instead of talking about return of capital, investors are now willing to discuss future returns on capital. This is a very important shift. Still, few foreign investors are very exposed to Chinese equity markets.

Policy support: Chinese monetary and fiscal policies are as stimulative as they have ever been. Moreover, in the past 18 months the government has shown that it is not shy about stepping into the market to support equity prices when these take too much of a hit (a brand new “Xi put”?). Finally, on the policy side, the new buzzword seems to be the curtailing of “involution,” or excess competition that destroys margins. Of course, the anti-involution campaign may turn out to be a dud. Or perhaps it may lead to banks curtailing their lending to industries already experiencing overcapacity? An outcome that the market is clearly not pricing in today.

Conclusion on the Chinese Equity Bull Market

Chinese equities are in a bull market and there are no obvious signs of this bull market coming to an end. Short rates are not set to rise in the near future and for now Chinese policymakers seem very keen on pushing asset prices higher. To be sure, concerns around the impact of the unfolding trade war are very real. And a new IPO cycle could start draining some of the excess liquidity from other issues. But putting it all together, it still feels as if dips in Chinese equity markets are to be bought.

Conviction #3: Financials are in a Bull Market

Fundamentals: The decade that followed the global financial crisis was a challenging one for financials. ZIRP and NIRP crushed margins. Policymakers eager to close barn doors once horses had bolted ramped up rules and regulations. And of course, the hangover from the massive equity wipeouts of 2007-08 left investors gun-shy. Managements could do little but try to control costs. Fast forward to today and the situation has changed. Instead of increases in regulation, most major countries are looking at renewed financial deregulation. In most countries, net interest margins have been expanding. And yield curves have been steepening. All of which combine to boost margin expansion.

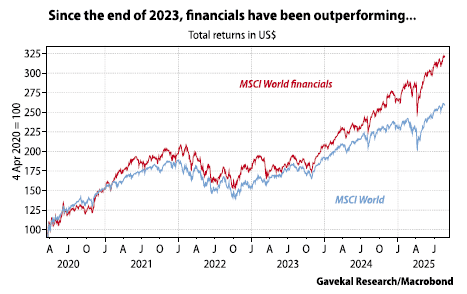

Momentum: Between 2007 and 2016 financials were dogs with fleas. From 2016through 2023, financials essentially performed more or less in line with broader markets. However, since the end of 2023, and especially in 2025 to date, financials have been outperforming (see chart below). This should probably not be surprising: with Europe, China, and the US all now following very lax fiscal policies and easier monetary policies, a reflationary environment seems most likely. Meanwhile, financials tend to thrive in reflationary periods.

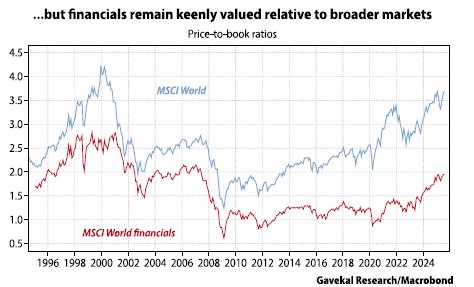

Valuations: Following the rerating of the past two years, valuations on financials are no longer extremely attractive. In fact, the price-to-book ratio of the sector stands roughly in line with its historical average. However, the valuation gap between financials and the rest of the market (which has rerated even more aggressively) stands at record highs.

Investor positioning: The out performance of financials only started some 18 months ago. So financials have yet to become an important theme in most investors’ portfolios. Instead, the focus of most investors remains on tech stocks. The financials bull market feels very much like a stealth bull market.

Policy support: The bias of policymakers in most countries today is towards financial deregulation. Moreover, over time easy monetary and fiscal policies should lead to steeper yield curves. A clear positive for most financials.

Conclusion on the Financials Bull Market

Leaving aside that financials are no longer as cheap as they once were, financials score highly on four of the five markers. This seems like a structural bull market that could have legs.

Conviction #4: LatAm Local Currency Debt is in a Bull Market

Fundamentals: Latin American debt tends to do well when the US dollar is structurally weak. At such times, LatAm central banks typically have a lot more freedom to cut rates. Moreover, to the extent that a weaker dollar usually also entails higher commodity prices (a weaker dollar is highly reflationary for most emerging markets), LatAm debt should be further supported.

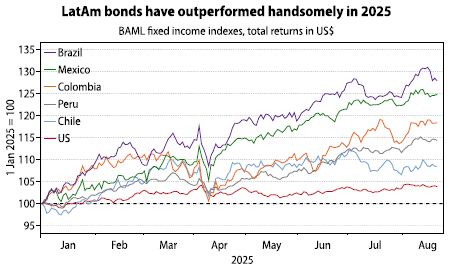

Momentum: LatAm debt had a rough 2024. But in 2025, LatAm debt has made back last year’s losses, and then some. Today, most LatAm debt markets are making new highs.

Valuations: Across the region, real rates typically start at 3% and rise from there Brazil, the largest market, offers the most attractive valuations with long-dated local currency debt yielding over 14% whilst the inflation rate hovers around 5.5%.

Investor positioning: Local pension funds, whose assets are growing fast, are keen on the asset class. But few others are. The asset class is not really on the radar of most investors.

Policy support: Policy shifts are likely to be the important catalyst for this asset class in the coming year. Following the successes of Nayib Bukele in El Salvador and Javier Milei in Argentina, right-wing candidates are faring well in polls across the region. In Bolivia’s presidential election first-round on August 17, the socialist candidate got eliminated—Bolivia’s first swing away from the left in two decades(admittedly, the economic situation in Bolivia has really been going from bad to worse). This augurs well for the upcoming elections in Chile, Colombia, Peru and Brazil; in LatAm right-wing governments tend to be more market friendly.

Conclusion on the LatAm Debt Bull Market

As I write, LatAm debt markets tick four out of five boxes. The policy support box is still uncertain but that should most likely change for the better in the coming year. As a result, upcoming elections could provide a further positive catalyst for this unfolding bull market.

Conviction #5: Precious Metals are in a Bull Market

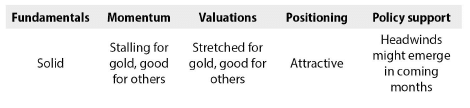

Fundamentals: The freezing of Russian assets following the start of the Ukraine war changed the perception among global central banks and rich individuals about the “risk-free” nature of some assets. Combine this with constrained supply, easy fiscal and monetary policies in all the major economies, a weaker US dollar and renewed economic growth across most emerging markets, and the stage was set for a significant rally in almost all precious metals.

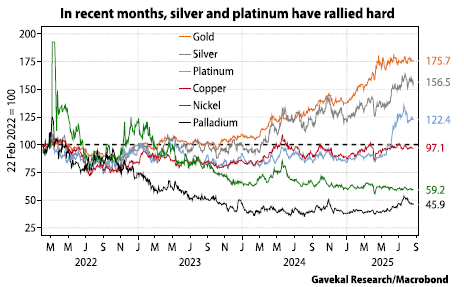

Momentum: In spite of great headlines, the momentum of gold has stalled since late April. Meanwhile, silver, platinum and palladium have started to rally hard, as have gold miners. So is the stalling gold price a sign of market exhaustion? Or the pause that refreshes?

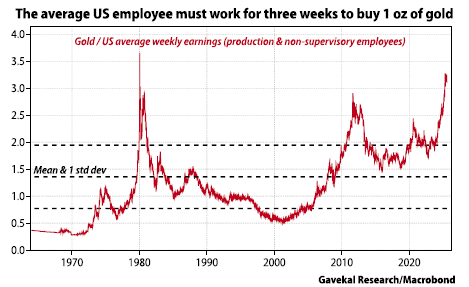

Valuations: By almost all measures—the price of gold relative to oil, silver, platinum, wages, real estate—gold is now expensive. Meanwhile, silver, platinum and palladium appear very attractively priced.

Investor positioning: Even though gold has been on a terrific run, and grabbing headlines, normal indicators—ETF inflows, futures trading—do not seem to show that average investors are overly allocated to precious metals.

Policy support: Fiscal and monetary policies across most markets remain supportive of higher prices. However, a few near-term developments could weigh on the gold price. First is the prospect of some peace deal over the Russia-Ukraine war that would see previously frozen assets unfrozen. Second is the possibility that an upcoming Xi-Trump meeting triggers a revaluation of the ridiculously undervalued renminbi. Given that China accounts for almost a third of physical gold demand, a structurally stronger Chinese currency could see Chinese savings shift away from gold, and towards assets denominated in renminbi.

Conclusion on Precious Metals

Given the slowing momentum and stretched valuations, gold may no longer be the “slam dunk” that it was until recently. However, other precious metals—platinum, silver, palladium—seem to have picked up the performance baton. Given the relative differences in valuations, this makes sense. It also makes sense if one assumes that the easy fiscal and monetary policies followed by China, the eurozone and the US will lead to a global reflationary impetus.

Overall Conclusion

This list is not exhaustive. Other markets have seen powerful trends. For example, health care stocks have suffered everywhere on the back of rising bond yields, more predatory governments, and post-Covid defiance among consumers. Staples have also broadly struggled, as have OECD government bonds. And semiconductor stocks have soared, as have all things crypto.

But in most of these other trends, the clash between valuations and momentum is sometimes challenging to get over. Investor positioning and/or policy support may also not be quite as favorable. Building up a high level of conviction is therefore amore daunting task. Meanwhile, when it comes to the downtrend in the US dollar, the uptrend in precious metals, and the outperformance of financials, Chinese equities and LatAm debt, most, if not all, the key drivers of performance seem to be well aligned.

DISCLOSURE: Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.