“Buy when there’s blood in the streets, even if the blood is your own.”

- Baron Nathan Rothschild, 18th Century British nobleman

SUMMARY

- Kinder Morgan’s 75% dividend cut has cast a dark shadow on master limited partnerships (MLPs), those companies that operate pipelines and other “midstream” facilities. Investors are panic selling as if no MLP distribution is safe. A number of MLP management teams are saying they will maintain payouts and insiders are accumulating shares, but most investors are not listening.

- While bearish sentiment on energy and other resource-related assets is as bad as we experienced in the worst days 2008 crisis, the market is plagued by cognitive dissonance. On one hand, energy prices are back to the lowest levels since the late 1990s because production has not fallen much thus far. On the other hand, MLPs have sold off because of expectations that US output will fall significantly in the coming year.

- We believe energy prices will recover over the next year or two as North American energy production declines, but a more rapid recovery is possible in the event of a geopolitical shock in the Middle East. It’s going to be challenging for MLPs, but this industry has been able to adapt and survive amid harsh conditions before.

- While energy has recently become one of the most hated asset classes, US energy producers are victims of their own success after ramping up production so successfully with innovations like hydraulic fracking and horizontal drilling. This is ultimately a positive development for America that ensures our energy independence. To that end, MLPs will be essential to maintaining the country’s energy gathering, transmission, and storage networks.

- While MLPs could continue to suffer from indiscriminate, ETF-driven selling, these kind of selling frenzies are becoming more common throughout the financial markets. High yield bonds have come under fire in recent weeks and the equity market could be next. At such times, we want to be rational buyers and not irrational sellers.

- At Evergreen GaveKal, our goals at this stage in the market cycle are to (1) provide livable cash flow for our clients while (2) protecting their portfolios against an equity bear market. Not only do high-yielding midstream MLPs help us in that effort, we believe they now offer compelling long-term return opportunities for disciplined investors who are willing to hold through the cycle as we did in 2008 and 2009.

- There is opportunity in chaos. And if you believe that, this is a good time to buy more MLPs.

EVERGREEN VIRTUAL ADVISOR

By David Hay, Chief Investment Officer

Don’t read my lips. Unless you’ve heard the name pronounced, you wouldn’t be aware that the “Kinder” in Kinder-Morgan*, the gigantic pipeline company, rhymes with the “kinder” in kindergarten. Based on the 75% dividend cut it just announced, it for sure doesn’t sound like kinder, as in kinder and gentler.

There was certainly nothing kind nor gentle about what Kinder just did to its shareholders after assuring the world not long ago that dividends would steadily increase—instead of being slashed like a sugarcane stalk at harvest time. This latest blow comes after socking many of its longtime owners with a fat tax bill by converting the company’s structure from master limited partnership (MLP) status to a regular C-corporation last year.

The Kinder shocker is just another gut-punch to all MLP investors, including your more-humble-by-the-day author of this week’s EVA. Yes, it’s fair to note that Kinder isn’t an MLP any longer and their debt levels are quite a bit higher than the norm despite their investment-grade rating and abundant cash flow. Nonetheless, this stunning about-face serves as a frontal assault on that most essential ingredient in financial markets—trust.

It’s now a fact of life that trust in MLPs is under siege. It’s going to take time—and probably a lot of it—for the sector to earn back investor confidence in the sustainability of payout levels. Yet markets overreact, often ferociously. This frequently creates a situation where even when bad news occurs, prices rally. In fact, Kinder’s share price is essentially unchanged since it announced its dividend devastation, despite that expectations were for “only” a 50% reduction.

However, prior to this cut, Kinder’s share price was down nearly 70%, as are many actual MLPs notwithstanding that, for most of the group, cash flow generation has been generally stable. Unquestionably, fear is in control. For those investors with MLP exposure, the urgent question is: When will this change?

Bleaker by the day. Let’s consider the bad news first. Besides the Kinder debacle, oil prices are threatening to break below their 2009 Great Recession lows. Crude inventories are bulging as production continues to exceed demand by at least 1 million barrels per day, according to most sources. The mercury is behaving more like early October than mid-December in many of the high energy-consuming parts of the US. Massive cutbacks in capital spending and drilling (the US rig count is now down 66% versus the 2014 apex), have only marginally reduced supply.

Unquestionably, it’s a grim picture… at least near-term. And it’s not just for energy issues. Pretty much everything that is resource-related has been crushed. The fact that this is happening after years and years of binge-printing by the world’s central banks is a supreme irony. Yet, it’s not the only one. Oil and gas prices are plumbing new lows because production isn’t down much so far. On the other hand, MLPs have been obliterated because of expectations that US output will collapse. Talk about cognitive dissonanance!

The Evergreen view is that North American energy production is going to come down considerably. If we’re right, it is going to be challenging for MLPs. However, this industry has been extremely agile when it comes to adapting to harsh conditions. Many of them are more heavily engaged in natural gas than oil. “Nat gas” prices fell from $14 (per mmbtu or millions of British Thermal Units) in 2008 to the $2 dollar range in 2009 and they have remained depressed ever since. Regardless, gas-oriented MLPs have performed admirably from an operational standpoint.

Admittedly, it’s going to be tougher sledding this time as low oil prices negatively impact pricing for natural gas liquids (think propane, butane, ethane, etc). But here’s the key thing: We’ve been listening closely to the commentary coming out of the various MLP management teams in the wake of the Kinder bombshell and most of them are vehemently stating their intent to maintain payouts. A number of them are actually forecasting continued, though slower, distribution increases.

Ah, yes, but there is that trust issue again. Under normal circumstances, these reassurances would be calming and might help put in a bottom for this shell-shocked sector. But right now, after the Kinder team has so badly misled the marketplace, the soothing words are ringing hollow.

(Further aggravating this, yesterday two MLP and MLP-like companies, Teekay LNG and Teekay Offshore1, drastically reduced their distributions, as well. While Evergreen didn’t own Kinder shares, we did hold the two Teekay’s. After listening to the CEO, and reading several analysts’ commentary, it does appear probable the distribution will be rapidly raised over the next two years, unlike in the Kinder situation. In our view, this is likely contingent on less panic-stricken conditions, including among bank lenders and the bond market.)

The extreme negativity goes well beyond MLPs. The entire US energy industry has become a cross between a laughing stock and whipping boy. And this is where we strongly disagree.

*The specific securities identified and described do not represent all of the securities purchased, held, or sold for advisory clients, and you should not assume that investments in the securities were or will be profitable. Kinder Morgan, Teekay LNG and Teekay Offshore are used as examples to illustrate the well publicized distribution cuts of the former (Kinder Morgan) and current (Teekay LNG and Teekay Offshore) MLPs. You should not assume that an investment in any of these securities was or will be profitable. ECM currently holds Teekay Offshore, and purchases it for client accounts, if ECM believes that it is a suitable investment for the clients considering various factors, including investment objective and risk tolerance. Please see important disclosures included following this letter.

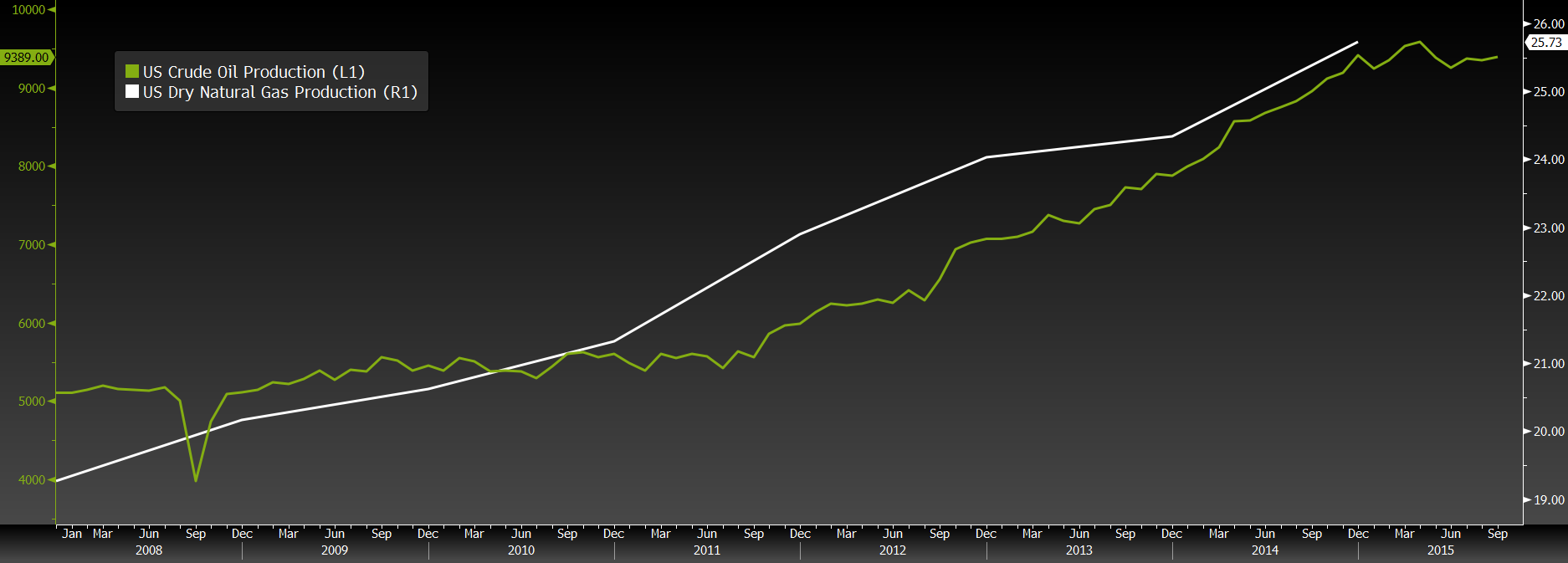

Victims of their own success? Outside of technology, few industries have repeatedly demonstrated their ingenuity and adaptability better than has the US energy sector. It has nearly doubled oil output over the past decade and gas production has surged as well. This is contrary to the overwhelming consensus belief 10 years ago that US energy supplies could only dwindle.

FIGURE 1: US OIL AND NATURAL GAS PRODUCTION Source: Evergreen GaveKal, Bloomberg

Source: Evergreen GaveKal, Bloomberg

For the first time in decades, the US had been looking at the very real possibility of being energy independent—at least with Canadian and Mexican production included. This was viewed as a remarkable and laudable achievement as recently as last year. But these days it is considered to be more of a negative than a positive, as it has helped bring about another energy bust. Meanwhile, the entrepreneurs who achieved this supply gusher via breakthroughs such as horizontal drilling and hydraulic fracturing of shale formations, are now considered reckless wildcatters who never saw a prospect they wouldn’t drill.

This may seem like a reasonable attitude in a world drenched in crude. But we remain adamant that you can’t have prices far below the production costs necessary to induce new exploration and production and expect the oversupply to continue. As Worth wrote last week, the further oil prices crash, the greater the odds are of another shortage in the not too distant future.

Few Americans seem to be aware of the threat posed to Saudi Arabia’s oil production by Yemen’s Houthi rebels—who have been firing scud missiles at Saudi military bases and threatening to attack the Kingdom’s oil fields on the southern Arabian Peninsula —but it has been escalating for months. Additionally, Russia and Iran—two countries that would love to see oil prices rip higher— are increasingly assertive in the Mid-East, and they have been rumored to be behind the Houthi incursions.

With such developments in mind, it’s not a stretch to believe something could interrupt the Saudi’s ability to continue saturating the oil market. If so, having a secure domestic energy supply—and the infrastructure that is essential to support it—could, once again, become extremely valuable almost overnight.

Consequently, we are not going to join in the bashing party against the US energy industry. Personally, I am proud of what it has accomplished and grateful that we no longer have to feel like we are at the mercy of regimes that regard us with distrust and disgust.

Over my 36-year career, I’ve seen several times when oil and gas prices have crashed. These have always been buying opportunities. At Evergreen, we actually sold most of our traditional energy issues, such as producers and oil service companies, last year and earlier this year at much higher prices. And, as Worth conveyed last week, we also reduced MLPs to our lowest level in at least a decade by the summer of 2014.

For sure, we have been guilty of premature accumulation syndrome as we have been dollar-cost averaging into this record-tying slaughter of MLPs (not to mention Canadian real estate investment trusts). But we have almost totally stayed away from direct energy plays, preferring the cash flow stability and high yields of issues like pipeline and storage facility operators.

So far, that hasn’t provided us any shelter as this month has brought another round of frenzied selling. We suspect that we are now seeing the dark side of the uber-popularity of Exchange Traded Funds (ETFs), as wholesale liquidation of MLP ETFs crushes the underlying prices—regardless of fundamentals. By the way, this appears to be spreading to other realms of the financial world, most notably the riskiest corners of the bond market (“high-grade, high-yield” is, thus far, holding up far better). We suspect additional areas of the financial market will fall victim to a frantic exodus from ETFs–maybe even the one investment that never seems to crack.

The twin goal dilemma. As also noted by Worth Wray in last week’s EVA, it has been Evergreen’s objective over these past two or three years to protect against a bear market in stocks while simultaneously insulating our clients’ cash flow from the Fed’s war on interest rates. Somehow, it seems like many heard the first part of our message and not the second.

In some ways, we are in a quandary not unlike our precious central bank’s dual mandate of both low unemployment and low inflation. In other words, the two can be somewhat at odds with each other. If the Fed seeks to push the jobless rate down too much, that can create inflation (though not lately). And if we attempt to keep portfolio cash flows at a level roughly equivalent to times past—when 4% type returns were available on CDs—we are exposed to downside risk in the event of something like a meltdown in MLPs.

Based on this year’s experience, it has dawned on me that there is a segment of supposedly yield-needy investors who would rather see their portfolio values rise and their cash flows fall. Maybe this makes some sense in the short-run but in the long-run it’s a recipe for disaster should we remain in a world with risk-free interest rates staying close to zero. Considering where yields are now in most other developed countries, this could get worse, not better, especially if there is a crisis that drives risk-free returns on five-year and longer bonds even lower.

Should the present panic spread beyond energy and the lowest-rated junk bonds into investment grade corporate bonds, the situation could turn ugly quite rapidly. There is some evidence this is happening. We’re not to the point of 2008, when even high-grade corporate bonds fell 30% to 40% in a matter of weeks, and we don’t believe we will see those days again. But we could certainly see a decline that shocks investors in investment grade bond ETFs, causing them to liquidate en masse. This necessarily produces selling pressure on the underlying bonds, forcing their prices down, and further terrifying conservative income-focused investors. The domino effect plays out until finally prices are low enough to bring in cash-heavy contrarians.

Even as we have been buying into crushed MLPs—and to a lesser degree Canadian REITs—Evergreen has been sitting on a huge stash of cash and US Treasuries. The fact that we have been able to largely maintain or even increase client income versus 18 months ago with such high cash/treasury holdings has been challenging, to say the least. But it has put us in a position to be buyers of MLPs at extraordinarily high yields (right now, it feels like we’re the only ones but I know there must be a buyer for every seller!). We also have the ability to be on the buy-side should the panic spread into other corners of the income world.

Without a doubt, it’s been embarrassing and frustrating to have a vicious bear market hit parts of our income portfolios while the stock market looks to be doing fine, making us also appear silly for being worried about the next bear market. But one actually may have started back almost a year and half ago.

Since the summer of last year, the NYSE composite is now down 6.5% including dividends. The S&P has done better up about 4%, with dividends, but the former index is broader and has not been as heavily influenced by a handful of Netflix/Amazon/Facebook**-type stocks. A number of these “cult” names have done moon-shots, making the S&P 500 look healthier than it really is.

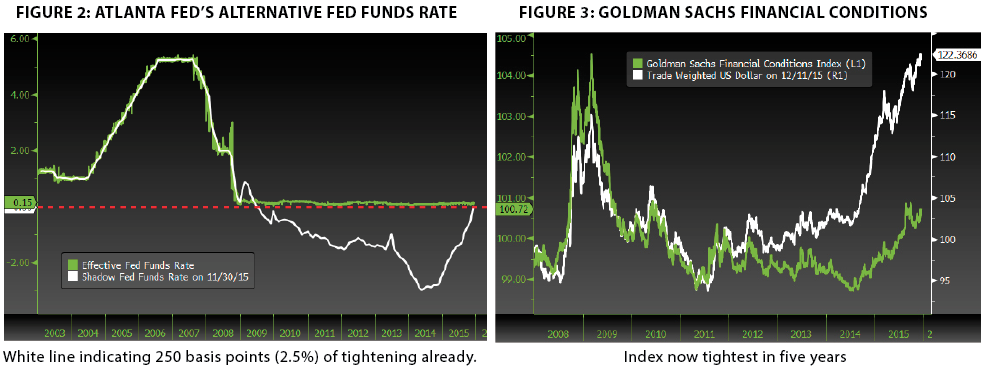

This is typical action seen at the end of bull markets. Based on the kind of financial stress indicated in the charts on the next page, we could well be on the verge of a major market break—one that has been delayed for so long, mostly due to the $10+ trillion created by the world’s big central banks.

**Netflix, Amazon and Facebook are use as examples to illustrate the lack of market breadth in the S&P 500. You should not assume that an investment in any of these securities was or will be profitable. Please see important disclosures included following this letter.

Source: Evergreen GaveKal, Bloomberg

Source: Evergreen GaveKal, Bloomberg

As I’ve written before in prior EVAs, Evergreen’s income portfolios often act like smoke detectors, going off before the stock market erupts in flames. This occurred in 2007/2008 and again this summer. I’ll be very surprised if the same isn’t true as we move into 2016. It actually appears to be happening already despite the fact that December is typically a friendly month for stocks. (There’s an old market saying: “If Santa Claus should fail to call, bears may come to Broad and Wall.”)

If trouble is coming, it might be best to be where prices are approaching bedrock levels.

Been here, done this. Returning back to the energy area to conclude this week’s EVA, we seriously doubt Kinder and now TeeKay will be the only MLP-like entities to cut its distribution. However, we also believe that most of the mid-stream/pipeline MLPs will maintain their payouts barring a severe global recession. Even then, we’re not sure there will be widespread reductions.

Unlike many MLP investors, we are not new to this space. In my case, I’ve owned MLPs personally and for clients since the late 1980s. They’ve been very good to us, including over the last decade, notwithstanding this year’s implosion.

It’s encouraging that MLP insiders are stepping up and buying substantial amounts of their own units. Barron’s reported this week that insiders bought $10 million in market value of one of the largest MLPs. To us, money speaks much more loudly than words. Similarly, I have been buying MLPs in my own account at the fastest clip since late 2008, early 2009. Numerous other Evergreen Investment Team members are active buyers, as well.

Nevertheless, almost every article I read on MLPs is now bearish. These almost always make the point that MLPs need to issue equity (now, nearly impossible due to yard-sale prices) in order to fund their capital spending. However, none of these critiques mention that this has been the model the US utility industry has followed for years, as has the real estate investment trust sector. MLPs often have the ability to slow down their capital projects and stretch out when they need to commit equity capital, among other tactics they’ve employed in past downturns.

There is also precious little mention that over the next 10 years, vast sums will need to be spent to maintain and expand America’s energy gathering, transmission, and storage system. MLPs have been, and will remain, essential to this effort.

Then there is the matter of time. The bear market for all things energy-related has been going on for almost 18 months. Per Barron’s, this has been one of the longest down phases ever for the oil and gas industry and certainly one of the most intense. Consistent with a long and merciless bear market, we are seeing myriad signs of capitulation and revulsion on the part of investors, particularly of the retail persuasion. Year-end tax-loss selling and portfolio positioning (aka, “window dressing”) are undoubtedly aggravating this carnage.

For anyone with much in the way of energy holdings, 2015 has been a year to forget. But Evergreen is convinced that investors in need of yield—and we’re talking millions and millions of Americans--will kick themselves for not pouncing on this opportunity should they stay on the sidelines. This includes the shares of blue-chip energy companies yielding as much as 8% whose management teams are fanatically committed to the safety of their dividend—unlike that not-so-kind-to-its-shareholder company mentioned at the outset.

Evergreen suffered like almost all money-managers during the 2008/2009 disaster. Our pain might have been a bit greater because we had been warning of trouble coming, notably from sub-prime mortgage debt and a collapse of the housing bubble. But we used that agonizing time to add to our MLPs and other income securities that were trading with huge yields. When they recovered, this powered our returns for several years between the high cash flows and the significant price appreciation.

As we have been highlighting the increasing attractiveness of MLPs over the last few quarters, we have consistently urged investors to go slowly. We have done exactly that for our clients, gradually dollar-cost-averaging into the pummeling. While, even now, we wouldn’t suggest going all-in, it may be time to go almost all-in. (By the way, we think most clients should limit MLPs to 15% of their portfolio value.)

The safest way to do this, in our view, is to target those with the least energy price sensitivity. These aren’t down as severely but most of them have still been clipped 35% or more. With these, it’s possible to get 8% cash flow returns with a high degree of comfort in the sustainability of the yield. But there are also some MLPs where the perceived commodity price-risk is absurdly exaggerated.

There is always—always—opportunity in chaos. As we’ve noted before, doing the hard thing is often doing the right thing. These days, there’s almost nothing harder to do than to buy MLPs.

DAVID HAY / Chief Investment Officer

To contact Dave, email:

dhay@evergreengavekal.com

OUR LIKES AND DISLIKES.

Changes are bolded below.

DISCLOSURE: This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Evergreen Capital Management LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.