“Pessimism is so often wrong because people assume a world where there is no change or innovation. They simply extrapolate from what is going on today, failing to recognize the new developments and insights that might alter current trends.”

-Bill Gates

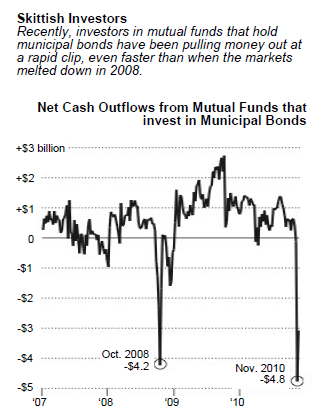

1. Year-end supply pressures and credit fears continue to hit the tax-free bond market, driving yields on some gilt-edged issues with intermediate maturities up to 5%. Predictably, retail investors, who own roughly 70% of all municipal debt, are fleeing at a rate not seen since the outstanding buying opportunity seen in 2008.

2. Canada’s residential real estate market has fully recovered partially due to an influx of wealthy Asian buyers. Its “Business Immigration Program,” requiring an upfront investment of $400,000, is cited as one reason the average home price in Vancouver, BC, is nearly $1 million.

3. As noted in prior EVAs, California voters failed to boot big spending politicians out of office, resisting the national anti-incumbent trend. One encouraging outcome, however, was the passage of a bill authorizing a non-political commission to redraw political districts, hopefully ending California’s notorious gerrymandering.

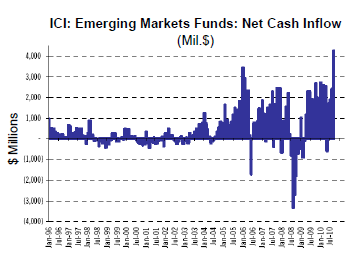

4. In vivid contrast to the pronounced outflows now impacting municipal bond funds,

investors continue to pump money into emerging stock markets. It is interesting to note that past episodes of extreme in-flows were followed by sharp corrections, causing investors to redeem at depressed prices.

5. By 2025, Europe is projected to have 35 cities with populations in excess of 1 million. However, China is expected to have 221 cities of that size or greater.

6. Based on a recent study of air pollution in Northern California, it’s estimated that 29% of the fine airborne particles in the Bay Area come from Chinese coal fired power plants.

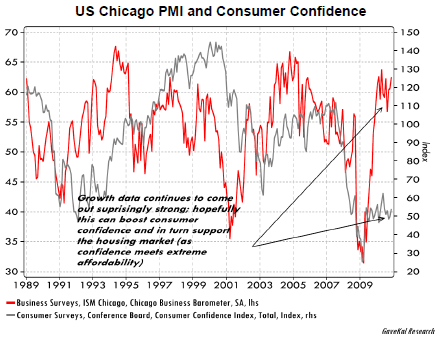

7. Historically, the Chicago Purchasing Manager Index (PMI) has been a reliable leading indicator of consumer confidence. Yet, for nearly a year, the gap between these two measures has remained cavernously wide.

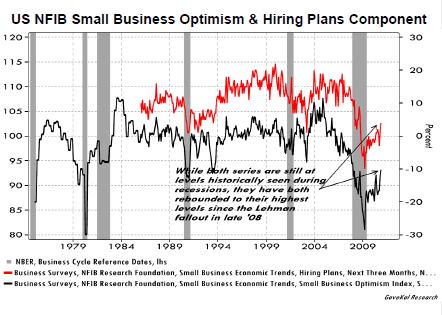

11. Further illustrating the importance of small enterprises to employment, since 1977 net job creation

would have been negative in most years without their hiring efforts. Additionally, young firms (those less than 5 years old) generated nearly two thirds of all jobs.

12. One of the many reasons the US is unlikely to retrace the staggering economic footsteps of Japan over the last twenty years is that our real estate bubble was much smaller. At the peak of the Japanese property mania, the 7.4 square kilometers underneath the Imperial Palace was valued in excess of the entire state of California.

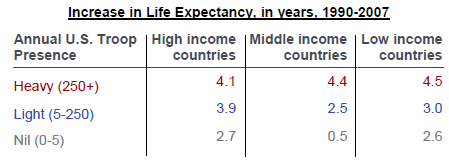

13. A somewhat offbeat, but fascinating, factoid is the discovery of a correlation between improved life expectancies from 1990 to 2007 in countries with higher concentrations of US troops.

OUR CURRENT LIKES & DISLIKES

IMPORTANT DISCLOSURES: This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Evergreen Capital Management LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.