“The US as a net debtor is one of the oldest canards.”

-GaveKal Research’s Charles Gave

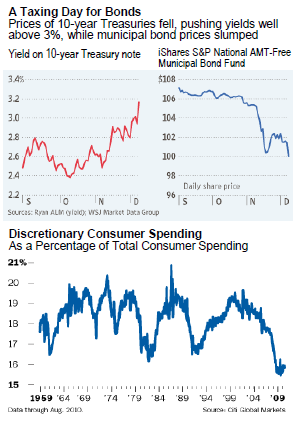

1. Due to both a negative reaction to the Fed’s second round of quantitative easing (QE II) and this week’s surprisingly pro-growth tax proposals by President Obama, yields on the 10-year Treasury note surged by precisely 100 basis points (1%) from early October to a peak of 3.33% on Wednesday. Municipal bond yields have also jumped, pummeling prices.

2. In another boost to investing against the herd, leading mutual fund evaluator Morningstar has found that the least popular fund categories have outperformed the most in-favor by nearly 5% per year over the past decade. Currently, blue-chip US stocks are held in lowest esteem while emerging markets and commodities are fund-investor favorites.

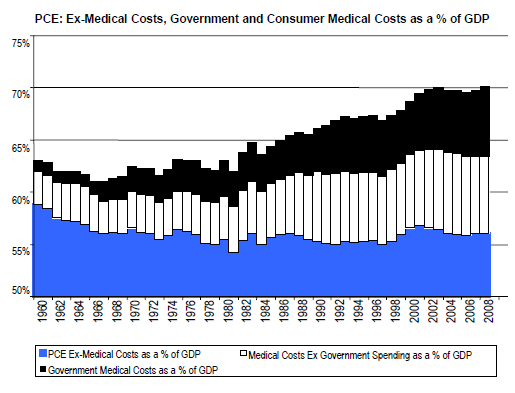

3. One persuasive bit of evidence undercutting the popular notion that Americans over-consume and under-save is that for the last 50 years discretionary consumer spending has actually declined somewhat. Higher medical expenditures are a growing portion of total outlays, much of which is reimbursed by the government.

4. Britain’s Guardian newspaper recently reported that German Chancellor Angela Merkel threatened to pull her country out of the European Union in late October, indicating the gravity of the current crisis. Such a move, should it occur, would almost certainly be the death knell of the economic federation.

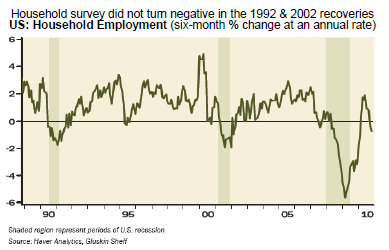

5. Past EVAs have highlighted the uneven but generally improving trend in US unemployment. One measure that is concerning, however, is the sudden drop in the household employment survey, usually considered the timeliest of the official jobs reports.

A December to Remember, too? Astute EVA readers (are there any other kind?) might recall the 11/19 EVA focused on several November events that I felt had significant implications. As it turns out, this month is looking to be no slouch in that regard either.

As I’m sure nearly all of have heard, on Monday evening President Obama made a series of tax-related announcements. Not only are these extremely pro-growth, in my opinion, they are further indication of a decided mind-set shift by Mr. Obama.

Many of you are aware that one of my forecasts from a year ago was that the policies the administration was pursuing at the time would lead to a rout in the November midterms (one of the key elements of the November to Remember). If I was right about that, my belief was that Mr. Obama’s political survival instincts would lead him to follow that successful act from the 1990s: Bill Clinton, the Reagan Democrat.

Truthfully, my forecasts have frequently been known to elicit generous amounts of scorn and disbelief, not to mention a few guffaws here and there. However, I think it’s safe to say the only other prognostication that produced as much skepticism as the Obama/Clinton call was my prediction the government would make money on TARP (and even AIG!).

It might be premature to characterize my belief in the Obama-to-Clinton conversion as a fait accompli, but the evidence from this week’s announcements is making it harder to refute. Of course, there is a victim in all of this: deficit reduction. Early estimates are that the tax package will add $1 trillion of federal red ink over the next two years. If not properly handled, that has the very real possibility of undermining confidence, which has already taken so many body blows over the last few years.

It could play out much more positively, however. By linking these growth-stimulating tax measures to a convincing long-term deficit control plan, these proposals could prove to be a most effective gambit. (There is a very real possibility, however, that the president’s own party could launch a filibuster in the Senate opposing it.)

The reason I believe this pump-priming effort has higher odds of success than the prior stimulus package is that it directly stokes the private sector via powerful incentives like the 100% first-year deductibility of capital investments. Further, by extending the current tax rates, it removes an uncertainty that was weighing heavily, particularly on small business owners. And because there was such a widespread assumption that taxes were headed north in 2011 and 2012, just maintaining the current schedule will feel like a cut.

This should also take the heat off the Fed, which up till now felt compelled to print money like Hugo Chavez to keep the economy rolling. Admittedly, I didn’t think the government would issue a set of proposals that would drive up the deficit, no matter how commendable from a growth vantage, when the mood of the country is so clearly anti-debt proliferation.

That’s why I believe this tax packages works only if it combines iron-clad out-year measures to rein in the deficit along the lines of what the Bowles-Simpson commission proposed. Even though that panel’s recommendations were not approved (even by its own members), it is quite clear that many of the key sections have garnered serious bipartisan support.

You may have noticed that the president’s proposals also contain something I’ve been advocating: a much lower estate tax rate of 35% (for estate’s over $5,000,000). While this is a commendable start, I also believe it needs to go further and embrace the limited deduction/loophole model proposed for income taxes by the Bowles-Simpson commission.

We desperately need to find a way to dramatically pay down our accumulated national debt and I remain convinced that raising several trillion dollars or more over the next 10 to 15 years from radical estate tax reform will be an essential part of that immense task. (A bit later, we’ll see that we’ve got the collective net worth to make this a reality.)

In the meantime, our deficit status will deteriorate further, an occurrence that I’m not thrilled about. However, I do believe that there is an excellent chance Mr. Obama’s tax package, if passed, will accelerate the economy sufficiently that the government’s revenue shortfall will be much less than the anticipated $1 trillion. Based on the prospect of US GDP growing faster than expected next year—combined with an escalating confidence revival on the part of investors, households, and businesses—the outlook is brightening for America.

Unfortunately, the news from about 3,000 miles east of Washington, DC, isn’t as encouraging.

Irish stew. It was but a few years ago that Ireland was popularly known as the Celtic Tiger. The combination of a low tax structure and an educated populace with a strong work ethic (in contrast to many of its Continental peers) led many multinational corporations to establish and/or expand operations on the Emerald Isle. The result was a long-lasting economic boom, often referred to as the Irish Miracle.

Joining the European Union also helped, at least for awhile. It allowed Ireland to borrow at ever lower interest rates on the assumption that its debt was essentially as sound as Germany’s. In fact, for a number of years, it even appeared to be the better credit.

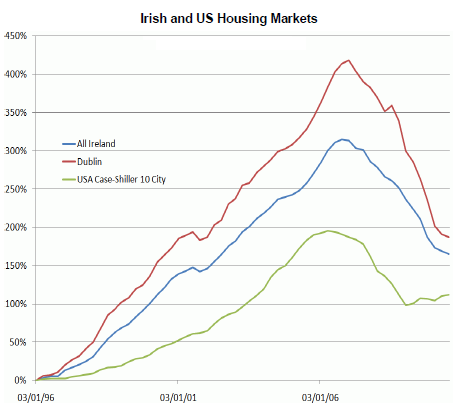

Years of spirited economic growth along with the pronounced drop in borrowing costs produced a spectacular real estate boom. In case you think I’m waxing hyperbolic, consider that from 1996 to 2006 Irish property values increased by 400%. In contrast, America’s epic real estate mania “only” saw prices double.

As is always the case, the banks were prime enablers of the bubble. Thus, when it burst, as all bubbles do, the Irish banking system also imploded. To avoid the kind of financial chaos seen in the US during the early 1930s, Ireland’s government elected to pump vast sums of public funds into its banks. This has caused it to run a mind-blowing deficit this year of more than 30% of GDP (three times our own horrifying number).

Recently, it became obvious that the country could not foot this bill on its own, necessitating a $110 billion bailout from the rest of the Eurozone countries. This infusion was meant to stem the panic and particularly to prevent it from infecting other tottering countries like Portugal and, especially, too-big-to-bail Spain.

Unfortunately, even this massive amount, particularly for a small country like Ireland, has not arrested the pandemic. Interest rates on sovereign debt from the “peripheral” countries (a much more polite term than PIIGS—Portugal, Italy, Ireland, Greece, and Spain) continue to hover at levels implying a material probability of defaults.

Consequently, there have been two enormously expensive bailouts—Greece and Ireland—and yet the situation continues to deteriorate. Therefore, rational folks are entitled to ask: What gives?

In my opinion, it comes down to E and E: Equity (or the lack thereof) and the Euro. Unlike in the US, European banks were never recapitalized with fresh equity. The capital infused has been almost exclusively loans and, as any economic neophyte can tell you, it’s hard to solve a problem of too much debt with more debt.

In Ireland’s case, it is being forced to pay nearly 6% for the privilege of reluctantly accepting this bailout. That’s a punitively high cost of money in an economy grappling with deflation.

And it’s not just the bad luck of the Irish; as noted in the last EVA, German banks are not exactly bastions of financial virtue. Nearly the entire Continental banking system is riddled with bad real estate loans and, more ominously, immense quantities of bonds from the PIIGS—sorry—the peripheral countries.

As a result, any attempt to reduce the amount owed by countries like Ireland and Greece (euphemistically known as debt restructuring) would pose a dire threat to the already reeling financial institutions throughout Europe. It’s now clear that the smaller governments can no longer prop up their banks, requiring the European “co-op” to perform that function. (In a telling move, Morgan Stanley quietly shifted the trading of government bonds issued by Eurozone peripherals to its distressed debt desk.)

But if the dominoes keep falling, will the richer countries, notably Germany, continue coughing up the dough? If they don’t, there could be a cataclysmic run on the banks in the struggling European countries (which now seems to include Belgium, an ominous encroachment into the supposedly healthy heartland of Europe).

On the currency front, it’s becoming painfully obvious that the PIIGs (there I go again) are in an excruciating vise with the euro. They need a much lower exchange rate to make their goods and services competitive, but the euro straightjacket won’t allow that to happen. Therefore, they need to reduce wages, further intensifying the deflationary pressures caused by the real estate meltdown most of these nations have suffered.

In summary, Europe is in a huge jam and I don’t believe most investors in the US appreciate the consequences given that the S&P is bouncing around close to its yearly high. There’s always hope, but thus far the measures taken strike me as just more liberal use of bailing wire and duct tape.

States of fear. Numerous pundits have noted that we’ve got our own PIIGS situation on our hands due to the precarious condition of our state and local governments. Recent tremors in the municipal bond market are making this view seem more credible.

As a consequence of this heightened anxiety, it is now possible to get tax-free returns on AA-rated municipal issues that are roughly comparable to the yield of BBB-rated taxable corporates. Longer term, A-rated tax-exempt zero coupon bonds are in some cases yielding close to 7%.

Yet, if our states and municipalities are truly in the same kind of shape as the peripheral European countries, could these turn out to be sinkholes for investors? After all, as Ireland and Greece are finding out, high interest rates make their financial survival even more problematic. The same thing could happen to a state like California where years of financial mismanagement have eroded its credit quality and driven up its cost of capital.

It’s the view of the investment team at Evergreen Capital that the domestic municipal bond market is very different than the sovereign debt situation in Europe. We have assiduously avoided buying bonds from countries like Greece because we are concerned that there is a real solvency risk (admittedly, we’re more tempted on Ireland but there is still the problem of an overvalued euro that could produce losses for US investors).

Comparing California’s financial status, as bad as it is, to Greece’s is an illuminating exercise. California’s current budget deficit is just 1% of its GDP versus 14% for Greece. Moreover, its accumulated debt to state GDP is just 3.9% versus 144% for Greece (a figure that was recently revised up once again). Moreover, S&P estimates that tax revenues in states such as Texas, New York, and California would have to fall 45% from already depressed levels to threaten their debt servicing abilities.

This is not to say that there isn’t serious trouble in MuniLand. The biggest threat comes from absurdly generous retirement packages provided to state and local workers. Estimates of the unfunded shortfall on these (including health care) are in the $1 trillion to $3 trillion range.

The good news on this is that local officials are finally confronting the impracticality of what they have promised to public employees. Even in ultra-liberal San Francisco, the situation has become so severe that leading Democrats are seeking to roll back inflated compensation agreements. Shamefully, in my view, the Democratic Party itself is fighting these essential efforts.

The days of public employees’ unions heavily contributing to politicians, usually Democrats, with the understanding that those elected will push through ever more lavish benefits for the unions are waning. As noted in past EVAs, public employees now earn roughly twice the average compensation of private-sector workers when all benefits are considered. That gap is almost certain to narrow.

Thus far, most of the efforts have been to slash pay and other “benies” for new hires, but in some cases states, counties, and cities are attempting to renegotiate (the recipients would say renege on) contracts for existing workers. A few are even threatening to go through bankruptcy to achieve this outcome.

It’s going to be hand-to-hand combat on this issue for sure but the ultimate reality is there simply isn’t enough money to go around to pay what reckless—and I would even say corrupt—politicians have promised in return for campaign funding. (By the way, the influential Democrat, Mort Zuckerman, editor of US News and World Report, is one of the fiercest critics of this unholy bargain.)

Another reason that my team and I believe municipal bonds don’t deserve to be lumped in with the PIIGS is that much of the $1.6 trillion tax-free debt market is supported by service fees, such as tolls, gas pump taxes, and water and sewer usage charges. Many of these have cash flow that very comfortably covers the debt service requirements, even now

Despite all of this supportive data, however, there is still a very real possibility of the recent mini-panic we’ve seen with munis escalating into the maxi variety. Tax-free bonds tend to be heavily owned by retail investors either directly or through funds. And, as I’ve repeatedly discussed in past EVAs, this cohort doesn’t always behave calmly and rationally.

There are almost certain to be some extremely ugly headlines about states like California in the months ahead and that could easily trigger another selling paroxysm.

In fact, once prices start dropping, this often causes a “get me out” reaction that drives values down to stupid-cheap levels. We certainly saw that with corporate bonds a couple of years ago and it could definitely replay with munis.

If it does, you can be assured we will be very aggressive buyers of those issues that we believe are, as bond traders refer to sound credits, “money good.” The reality is, and always has been, that buying into panics is one of the best ways to make good money, if not big money.

Lies, damn lies, and accounting. A number of you are aware that I’ve been doing an increasing amount of public speaking over the last few years. Some of you have even subjected yourselves to my ramblings, in many cases more than once (I’ll attribute repeat attenders to the good grub and copious wine we serve at those functions).

As always, the best part of these affairs is when I move beyond my PowerPoint crutch and begin to answer questions from the audience. Many of these queries are often triggered by my slides and, at a recent event, one in particular aroused considerable interest, bordering on disbelief.

It centered on a factoid that I have mentioned a few times in prior EVAs and, frankly, I’ve been surprised I haven’t received any emails challenging its validity. In my opinion, it is one of the most overlooked positives I’ve ever come across.

Lest your heart is beating too fast with anticipation, I’m talking about the myth that America is a nation of spenders not savers. This fallacy links closely with another which asserts that we are pathetically reliant on the kindness of foreigners to fund our mammoth federal deficits.

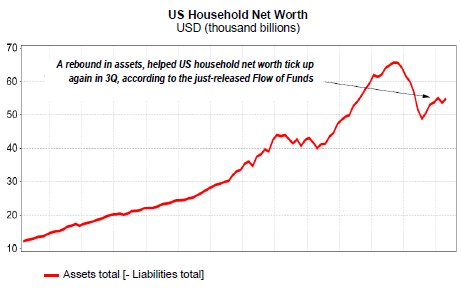

As I’ve noted before, the indisputable fact that US households possess in the neighborhood of $55 trillion (note that this is after deducting debt) should be a big clue that somehow the official savings rate is a joke. While it’s true that since the crisis hit Americans are saving more, the government’s numbers indicate the current annual rate is only about $600 billion. It’s hard to get up to $55 trillion at the rate of $600 billion per year.

Furthermore, for most of the last 20 years, we’ve been squirreling away much less than that—again, according to the generally accepted statistics. Then, when you consider how poorly stocks and home values have performed for years, as well as how low interest rates have been, it’s impossible to make a case that this astounding wealth accumulation has been driven by bountiful investment earnings.

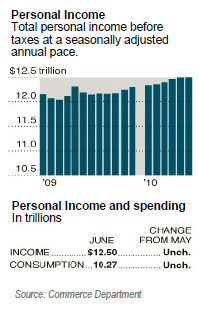

So let’s do some number crunching. First of all, American households generate around $12.5 trillion per year in what is known as personal income. Against this is a government-created figure called personal consumption expenditure, or PCE. That comes to $10.27 trillion. Those of you agile with math will quickly notice that the gap is about $2.2 trillion, seemingly justifying my point right there—but there’s a but.

This is before federal income taxes which come to roughly $1.1 trillion. State taxes consume another $300 billion, and presumably other government levies account for the difference between the alleged $600 billion savings number and the $2.2 trillion spread between income and expenses.

Understanding how the PCE is calculated is a journey into the murky realm of government accounting (or what passes for accounting). One glaring example of this is that all medical expenditures are counted as consumer spending. Yet according to one of Citigroup’s brightest economists, Steven Wieting, roughly half of that is reimbursed by the government.

This aspect alone means that actual consumer spending is hugely overstated, potentially by as much as $1 trillion. Health care costs represent 20% of total consumer spending and a stunning 14% of GDP. Doing some simple math, this bizarre accounting treatment means that consumer spending is inflated by around $1 trillion (7% of the current overall $14 trillion US GDP). In turn, this means consumer savings is underreported by the same amount.

As massive as this distortion is, another one is even greater. The PCE also includes a $1.5

trillion expense line item for “rental of owneroccupied housing.” The Census Bureau tracks rents on equivalent housing stock throughout the country and assumes homeowners spend this amount to live in their own residences. In other words, if your neighbor rents out his or her home for $1,500 per month, and your casa is roughly comparable, the bookkeeping treatment is that you are actually spending that amount.

The remarkable part of this is that it isn’t based on mortgage payments or any other actual cash costs. It applies even if a home is owned free and clear. These “imputed services” do not represent actual household cash outlays. Yet they amount to $1.5 trillion of alleged spending which is in reality just an accounting entry.

Putting these two numbers together means that as much as $2.5 trillion of household savings is being overlooked. That’s kind of a big deal, don’t you think? Especially since we are constantly bombarded with media reports that we are an over-consuming, under-saving, destined-for-financial-oblivion nation.

It also explains how we can still have $55 trillion of household net worth even after enduring a horrific $10 trillion loss of wealth since the financial crisis struck. (By the way, around 60% of this asset trove, or $33 trillion, is in financial assets such as cash, stocks, bonds, annuities, etc.)

While I’m in the myth-busting mood let me address another one. We’re also continually told that the US is deeply in hock to overseas countries, particularly China. Though it is true that China owns close to $1 trillion of US Treasury debt, and other foreign nations own approximately half of all of our outstanding obligations, this doesn’t consider what we hold overseas.

To this point, from 2000 through 2009, US foreign direct investments increased by nearly $2 trillion. More significantly, the US actually earns $125 billion more on its overseas investments than it pays out on its debt. This positive differential has been steadily rising over the last decade.

With these inherent (and unsung) strengths, the potential for an American renaissance in the years ahead is very real—particularly if we can fuse pro-growth tax policies with a persuasive plan to throttle the deficit monster.

In the next full-length issue, a fortnight hence, it’s my intention to discuss the most interesting proposal I’ve seen on how Europe can extricate itself from its present pickle. A big clue:

It’s possible the continent needs to cover its debt TRAP with a made-in-America TARP.

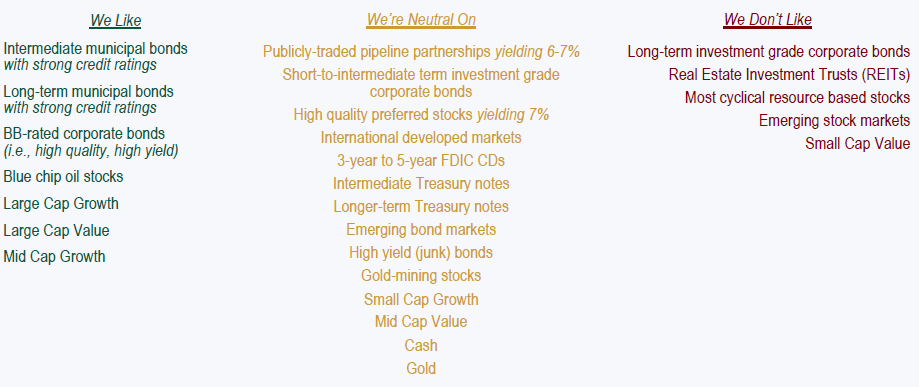

OUR CURRENT LIKES & DISLIKES

IMPORTANT DISCLOSURES: This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Evergreen Capital Management LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.