“Ignoring MMT’s rising popularity would be about as smart (and effective) as a dog barking at the waves in the ocean.”

–KEVIN MUIR, author of the avant garde financial newsletter, The Macro Tourist

“I believe that all good things taken to an extreme become self-destructive and that everything must evolve or die. This is now true for capitalism.”

–RAY DALIO, founder of hedge fund behemoth, Bridgewater Associates

The final lap. It’s hard to believe that as recently as February, when I first brought up the concept of a new economic model that was poised to radically alter the world we’re living in, MMT was as obscure as an extra in an old Cecil B. DeMille bible film. Yet, a mere two months later, you have to try extremely hard to ignore Modern Monetary Theory and its swelling number of disciples.

Perhaps at this point, some of you who have read the three previous installments of our month-long series on MMT wish I’d never brought it your attention. You might even think it’s such a zany idea that it will never see the light of day. If so, you could be right—but I doubt it.

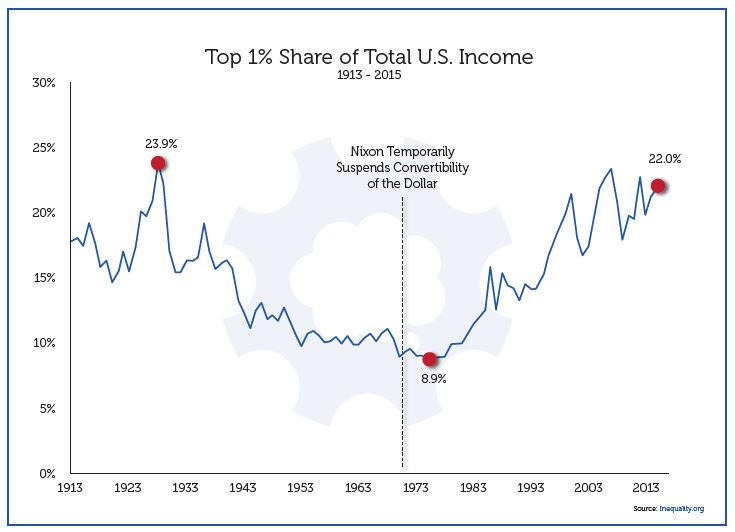

Prior issues of this series have made the point that ultra-low and, even, negative interest rates have led to a boom in asset prices at the expense of the real economy. This has created the most lop-sided income distortion since 1929.

Even after 10 years of a long and sluggish expansion—which happily has driven unemployment down to 50-year lows--there is an unmistakable whiff of outrage in the air. The non-1% or, perhaps more accurately, the non-5%, are coming to believe they’ve been stiffed by the reality revealed in the above chart.

Perhaps that’s why a number of the uber-rich (with thousands more of those soon to be created when Uber goes public) are suggesting MMT as a viable solution to this seemingly intractable problem of secular stagnation (i.e., a long period of sub-par economic growth) and income/wealth disparity. This realization has also caused Wall Street billionaires like Ray Dalio to openly warn of class warfare, including of the violent variety. As noted in the April 12th EVA on MMT, a number of Wall Street’s finest (is that an oxymoron?) are endorsing it as a way to break out of the current quagmire of low inflation and economic lethargy. But of course they would! After all, who is better on figuring out how to profit from a game-changing economic model like MMT than the Wizards of Wall Street.

That’s a good segue to this week’s MMT issue written by Charles Gave. Long-time EVA readers are well aware that Charles is one of my favorite economic thinkers. In his piece on MMT, he goes back in time to review some of the much earlier dalliances with the alluring theory that governments can spend almost at will. He particularly examines the experience his native country of France has had in this regard. What you will read is that the well-connected elites (the Wizards of Wall Street of their era) were able to make a killing—at least for those who managed to avoid being killed themselves--during the booms and inevitable busts that accompany such policies.

As the Chief Investment Officer of Evergreen Gavekal, way out in Seattle, I certainly don’t have any illusions about being part of the “in-crowd” of US policymakers. However, I do believe that by watching the way politics are trending, and drawing on our deep-knowledge contact base, we can help position our clients’ assets to protect them from what has the potential to reverse 40 years of falling interest rates and contained inflation. For those four decades, I have capitalized on the trend of receding yields and disinflation for Evergreen’s clients and my own portfolio. But nothing lasts forever and I’m becoming convinced that we’ve got one more interest rate decline coming during the next recession. After that, though, should something akin to MMT become a reality, it will be time for a massive portfolio reallocation.

As you read Charles’ words, I think it will dawn on you just how catastrophic an MMT “solution” would be, especially to older Americans living on a fixed income and/or holding large sums of fixed income…as in bonds. Just as in 18th century France, the unsuspecting middle class is likely to be MMT’s primary victim.

Thanks to the extensive network of bright people whom I am privileged to read on a daily basis, I believe my team and I will be well-equipped to navigate the treacherous waters of an MMT-flooded world, should that be the way things evolve. One of my new favorites in that regard is Kevin Muir, author of The Macro Tourist. For those EVA readers who don’t have acute MMT fatigue, you might want to check out these two links to one of the most realistic views of MMT I’ve read thus far. (Practitioner’s Guide to MMT: Part I and Practitioner’s Guide to MMT: Part II). If you do, you’ll see that Kevin and Charles both agree, as do I, that the higher inflation rate central banks have so vainly chased in recent years is likely to be realized—in spades, if not in clubs, hearts and diamonds, too (the last one might be a nice MMT hedge, as a matter of fact).

Of course, among the most important nodes in our research network are my partners at Gavekal. Thus, I think it’s thoroughly appropriate to conclude this MMT series with one of their perspectives on what MMT is likely to unleash.

David Hay

Chief Investment Officer

To contact Dave, email:

dhay@evergreengavekal.com

NOT MODERN, NOT ABOUT MONEY, AND NOT REALLY MUCH OF A THEORY

By Charles Gave

Ronald Reagan used to say that there are two kinds of economists. The first, usually disliked by politicians, believe like Milton Friedman that there is no such thing as a free of lunch. The second, very much liked by politicians, believe that if only the government were to spend more, growth would accelerate for the greater good of all. Reagan would then go on to say that the first kind tend to believe in God, and the second kind believe in Santa Claus. Unfortunately, Santa Claus doesn’t exist.

With all the talk about Modern Monetary Theory, we appear to be back in Santa Claus territory. Even the name is a complete misnomer; the proposed policy is neither modern, nor is it truly about money, nor is it much of a theory.

MMT is not modern

Financing government spending by printing money is as old as paper money itself. The Song Dynasty did it. The Weimar Republic did it. And Robert Mugabe and Nicolás Maduro both did it. But perhaps the closest historical parallels to today’s MMT proposals are to be found in 18th century France— two of them in the same century!

The first attempt at what we might call Early Modern Monetary Theory came after John Law fled to France to escape justice in Britain (perhaps Perfidious Albion sent him to France to ruin what was then the predominant economic power in Europe?). John Law was a brilliant Scot and a professional gambler, with the mental ability to calculate all sorts of odds in a flash. Through gambling circles, he came to meet the Duke of Orleans, the young Louis XV’s uncle and Regent. This gave Law the opportunity to present what he called his “system”.

It worked like this. First, the French Treasury would issue paper money convertible on demand into gold. Second, a bank would be created (one of the first central banks in history) and this bank would issue shares allowing holders to participate in the guaranteed growth of a French colony in North America called Louisiana (at the time Louisiana stretched from New Orleans to the borders of French Canada). The shares could be subscribed for using the government debt at par (while the debt traded at 30% of face value, since it paid no interest). Or shares could be purchased using the paper money issued by the French Treasury and backed by a gold inventory (which would disappear over time).

The Regent was quick to catch on and realized that, with Law’s system, France’s debt (which had gone through the roof following years of over-spending under Louis XIV), would quickly evaporate. The system was launched. The share price of the central bank rocketed, and soon the whole of Paris was caught up by a speculative mania unprecedented in French history.

Unfortunately, Louisiana never paid a dividend and the share price collapsed. The French middle class, having traded government debt worth 30% of its face value for shares worth nothing, was wiped out. But at least the French government was solvent again.

Not everybody lost out. Richard Cantillon, an Irish economist living in France, made a fortune (it’s not every day that an Irishman gets to take all the money from a Scotsman’s wallet). Cantillon had sold short the shares of the bank, and for good measure also sold the French currency against sterling. In his Essay on Commerce (a must-read), Cantillon became the first scholar to explain the difference between the creation of money and the creation of wealth, and that the first did not automatically lead to the second.

Cantillon further understood and explained that if the government is intent on destroying the local currency, then those who are the closest to the central bank will make money, while the rest of the population will end up on the losing side. Since dubbed “the Cantillon effect”, this understanding foreshadowed the Wall Street versus Main Street debate ignited by the era of zero interest rate policies over the past decade.

France’s second attempt at EMMT took place during the French Revolution. Facing a cash crunch triggered by the upheaval in France’s institutions, the new revolutionary government elected to nationalize the assets (mostly land) of the French Catholic church and print “assignats” whose values were backed by the church lands. However, the temptation to print proved too strong. In short order the number of assignats grew far above the value of the underlying assets, triggering a collapse in the value of assignats.

Still, if one was connected to the new revolutionary government, one could buy the old church assets either in gold, or at the face value of the assignats. This provided a live example of the Cantillon effect in action. The connected bourgeoisie of Paris and other French metropolitan centers bought the former assets of the French church at one-tenth of their value. Eventually, when there were no more church assets left to buy, and when the value of assignats had collapsed to near zero, the revolutionary government organized a “bankruptcy of the two-thirds”. The government announced that France’s debt would not be paid back at face value. Instead, the holder of the debt would receive a perpetual piece of paper worth one-third of the original value of his holdings, paying a fixed rate of 4%.

Needless to say, ahead of the announcement, those “in the know” rushed to buy up the paper, which was trading at 5% of its face value or less, in massive volumes. Once again, the well-connected made a fortune, when the paper was exchanged at 33%. Again, the Cantillon effect, and again the objective was achieved: the French state was restored to solvency. And in the process a whole class of nouveaux riches had been conjured into existence, while the rest of the population, especially the middle class, was left much poorer.

Funnily enough, this appears to be the outcome of every historical example of massive monetary printing: a solvent state, a new class of nouveaux riches, and a wiped-out middle class. These examples lead to my second point: MMT cannot be described as a monetary theory. The reason is simple: its proponents do not understand what money is.

It’s not really about money

MMT proponents seem to believe that issuing money is, and will always remain, a state monopoly. But when one considers money, one looks at it first as a means of payment (which can be, and often is, organized by the state). And second, one looks at the value of this money. This second aspect (at least outside totalitarian communist states) can never be determined by the state. The value of money is, and has always been, determined by myriads of transactions, each taking place freely between two or more individuals. Thus, the supply of money can be controlled by the government, but its value cannot. This implies that money is a common good, and can never be a tool of the government.

In fact, of the three functions of money—means of payment, unit of account, and store of value—the only one that MMT proponents seem to consider is the means of payment, which the government guarantees by using brute force. This probably explains why previous examples of MMT—Venezuela, Zimbabwe, the Weimar Republic, Revolutionary France—have tended to lead to tyranny or economic collapse, or both.

Economic collapse follows because, in such a system, the unit of account function breaks down, leaving the population to resort to barter. But economic collapse also happens because the main damage is sustained by the store of value function, especially when it comes to international transactions. It’s as safe a bet as you can make that foreigners will not be very keen to stockpile the bank notes (or government debt) of a country openly embracing MMT.

As a result, any country implementing MMT will have to maintain a current account surplus at all times. Very likely, international trade with the country will tend to drift towards barter. Inside the MMT country, a black market in foreign bank notes, gold and diamonds will spring up almost immediately. And corruption will go through the roof, because when civil servants are in charge of awarding import permits, the first thing any importer has to buy is the civil servant.

For proponents of MMT, money is simply the unit of payment they program into their computers to build their theoretical model of the flows in the economy. Like typical Keynesians, they pay no attention to the balance sheet effects of their policies. Unfortunately, a real economy, or a business, is not the end sum of positive “rates of change” differentiations in the short term, but the result of “area under the curve” integrations over the long term. This brings us to the theory aspect of MMT.

MMT is not much of a theory

Frédéric Bastiat used to say that, when it comes to economics, there is always “what you see, and what you don’t see”. In this respect, any theory which looks solely at a country’s, or a company’s, income statement, without also looking at the potential damage done on the balance sheet side of the equation, is not much of a theory at all. Such a “theory” would focus solely on the “what you see”, and moreover on the “what you see right now”.

Take a decline in interest rates as an example. At first glance, lower interest rates should be good for economic activity. They lead to more consumption, more capital spending, and so on. But if that were really all there was to it, wouldn’t our ancestors have figured things out long ago, and adopted ZIRP forever? And wouldn’t Medieval Europe, with its laws against usury, have been a hotbed of economic dynamism?

Perhaps the answer is that abnormally low interest rates destroy the long-term savings industry. And since, in a closed economy, savings equals investment, low interest rates lead to a collapse in capital spending, which leads to a collapse in productivity, which in turn implies a lower standard of living. Meanwhile, because of the Cantillon effect, the rich get richer, while the poor do not. In a democracy, this usually results in the replacement of the ruling elite by somebody else, even by somebody described as a “populist”. And populists sometimes do things that are even stupider than economists’ recommendations, such as increasing the weight of government spending in GDP.

All of which brings us to the populists advocating today’s MMT. True MMT believers aim to manage something they call “aggregate demand” by guaranteeing incomes for all. This will eliminate poverty and restore humanity to the Garden of Eden. In short, the solution to all our economic problems is to pay people not to work, with money that didn’t exist a week ago. It is amazing that no one ever thought of this before. Undeniably, such a scheme will boost demand.

The problem will be supply. Efficient supply comes through a mechanism described by Joseph Schumpeter and called Creative Destruction. But in our MMT paradise, no destruction will be allowed. And no destruction means little, if any, creation. The result will be something akin to North Korea, Maoist China, or even France, where government spending as a proportion of GDP has been going up relentlessly for 40 years under the direction of people who specialize in managing aggregate demand.

The conclusion is simple: MMT proponents know nothing about economic history, do not understand the nature of money, which is not a state monopoly but a common good, and believe unquestioningly in their theories without pursuing them to their logical conclusions.

DISCLOSURE: This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time.