Let me be the first to admit, the full-on invasion of the Ukraine is not what I thought was the most likely outcome to this crisis. It seemed to me, and still does, that this an exceptionally risky military adventure by V. Putin. The Ukraine is home to some 43,000,000 people who occupy an enormous land mass. Mr. Putin planning to subdue this country with fewer than 200,000 troops strikes me as recklessly ambitious, similar to the invasion of this region by another despot eighty years ago. But it is what it is — terrible!

This is definitely not how I like to have one of the main themes of “Bubble 3.0” – that we are in the midst of the third energy crisis of the last 50 years – affirmed. However, it definitely underscores the immense risks of The Great Green Energy Transition (GGET). Regular EVA readers may recall that we actually ran a preview of this chapter back in two parts on October 8th and October 15th. We then followed up on that with a podcast I did on what I believe to be the latest energy crisis with Macro Voices’ Erik Townsend on November 5th. Our reason for the pull-forward was that we were watching what was already a developing energy disaster in Europe last fall.

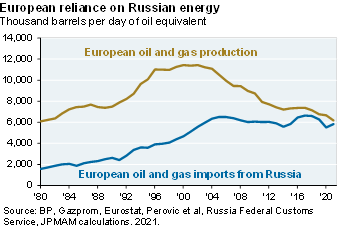

Sadly, much of this is self-inflicted. This is particularly true on the Continent which has shrunk its fossil fuel output even as the US has dramatically increased its own—despite increasingly hostile government policies toward our domestic energy industry. Europe is now exceptionally reliant on Mr. Putin’s oil and gas wells, as well as his pipelines.

Some of the points I make in this chapter do not toe the politically correct line, but I’d rather convey what I believe than what is currently popular. My closing comments are particularly un-PC, but I think what we are witnessing in Europe today validates my suspicions. Frankly, I think world events have drastically changed the energy debate almost overnight. The below headline from yesterday’s New York Times reflects that shift.

"Climate Fears on Back Burner as Fuel Costs Soar and Russia Crisis Deepens"

It’s my belief our nation needs to wake up to the threat we are facing with regard to our energy security and our economic vitality. This is not to say we should give up on renewables, EVs, and aggressive anti-emissions efforts. However, we also need to be realistic and willing to consider emission mitigation technologies for high-density energy sources as opposed to outright bans.

We should also make it a national priority to develop safe, small-scale modular nuclear power reactors. There are several promising technologies emerging in that regard and I’m closely tracking one of them. It’s long been my contention that we need peaceful coexistence between traditional and new-age energy rather than the prevailing “it’s us against them” mindset. This adversity is often accompanied by a shocking degree of stridency, bordering on malicious hostility (and often crossing over that border).

My closing comment is that I think we should be profoundly grateful for the shale miracle that has allowed America to move from being a major natural gas importer to the world’s largest exporter. It’s our shipments of liquified natural gas (LNG) that are helping to keep the heat and lights on in Europe right now.

DISCLOSURE: This material has been distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, are subject to change, and reflect the personal opinions of David Hay (an employee of Evergreen Gavekal) as of the date of this publication. This publication does not necessarily reflect the views of Evergreen’s Investment Committee as a whole. All investment decisions for Evergreen clients are made by the Evergreen Investment Committee. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed, and Evergreen makes no representation as to its accuracy or completeness. Securities highlighted or discussed in this letter have been selected to illustrate the author’s investment approach and/or market outlook and are not intended to represent Evergreen’s performance or be an indicator for how Evergreen or its clients have performed or may perform in the future. Each security discussed in this letter has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. The securities discussed herein do not represent an entire portfolio and, in the aggregate, may only represent a small percentage of a Evergreen’s client holdings. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. Before making an investment decision, the reader should do their own research and/or consult with their financial advisor. Past performance is no guarantee of future results. All investments involve risk, including the loss of principal.