As Charles has highlighted, the value of Asian currencies, especially the renminbi, makes little sense today. This is obvious to anyone visiting the region. Nice hotel rooms in Beijing go for RMB700 a night; mediocre ones in New York are US$700. In Beijing, a cab ride to the airport costs around RMB100; in New York the airport cab fare costs US$100 or more. This ratio of 1:1 in the “experienced” renminbi to US dollar exchange rate, instead of the 7:1 official exchange rate, is replicated in restaurant bills, train fares, subway tokens etc.

To any visitor to China (or South Korea, Japan, Taiwan and Hong Kong) there is little doubt that the pricing of Asian currencies is the “most wrong” price in today’s global markets. The question of how this massive mispricing gets resolved will likely be a key market driver in 2026.

Conceptually, this currency undervaluation can be resolved through a rise in domestic inflation (the latest Chinese inflation data did surprise on the upside), through a rise in domestic asset prices (China, Hong Kong, Korea and Taiwan have had a monster year), or through a rise in local currencies (with important consequences for the prices of precious metals, cryptocurrencies, and aggressive growth stocks around the world).

Having said that, while Asian currencies are by far the biggest and most obvious pricing anomaly in today’s global financial markets, they are not the only one. Other apparent anomalies include:

This is quite a departure from historical norms, which suggests several possible conclusions. Either (i) inflation is set to accelerate around the world in a way that ultimately leads precious metals to return to the forefront and fiat currencies to end up on the trash heap of history, or (ii) the way the world consumes energy is set for a revolution that will soon see oil relegated to irrelevance, or (iii) market positioning has reached extremes that will cause investors to rebalance from precious metals to energy in the coming quarters.

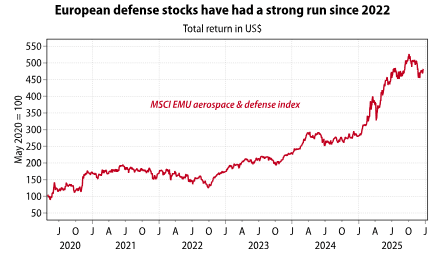

So why are defense stocks stalling? One possible explanation is that the fiscal situation in the bigger European countries, especially those with functioning armies like France and the UK, is deteriorating rapidly. This raises the question of how to fund expanding military budgets.

Another is that the Ukraine war has highlighted how much warfare has changed. Battlefields are no longer controlled by whoever controls the most and best tanks and fighter jets, but instead by missiles and drones. As a consequence, it is not a given that tomorrow’s defense contracts will go to the legacy companies that have dominated the space for decades.

To simplify with a quip: how long can European countries keep spending money they do not have, on weapons they do not need, for soldiers that do not exist?

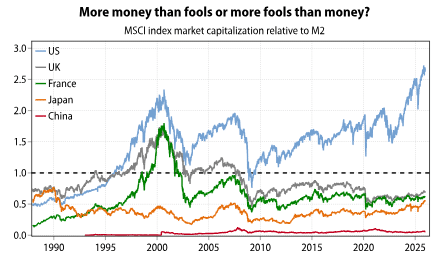

This brings us to today’s problem. For the last three years, the market has handsomely rewarded any announcement of AI-related capital spending. Now, this phase of excitement seems suddenly to have passed. In recent weeks, the market has punished both Oracle and SoftBank for capex plans that were light on details of future returns.

This shift casts serious doubts on the ability of companies such as OpenAI or Anthropic to go public in 2026. But these cash-burning companies will still need access to much more capital in the new year to keep the AI party going. And the US equity market itself may well need the AI party to continue in order to survive in the rarefied air at the altitudes it currently inhabits.

Of these four pricing anomalies, European defense stocks and US AI infrastructure plays have stalled in recent months. The other two—Asian currency undervaluation and the undervaluation of energy relative to precious metals—seem still to have the wind in their sails.

Of these four, one is fairly marginal; whether EU defense stocks rise or fall in 2026 will not have massive collateral implications. However, each of the other three can single-handedly drive the performance of global markets. And they could intertwine. For example, a scenario in which the excitement around AI fades would likely trigger a weaker US dollar as foreign capital leaves the US. In turn, rising Asian currencies would likely see a greater reflationary impetus for the world, which would be bullish energy, and probably less Asian retail flows into precious metals. How these anomalies get resolved will likely be a key driver of performance in 2026.

DISCLOSURE: Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation for these securities. Evergreen actively manages client portfolios and securities discussed in this communication may or may not be held in such portfolios at any given time. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions, recommendations, and assumptions included in this presentation are based upon current market conditions, reflect our judgment as of the date of this presentation, and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal. All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed and Evergreen makes no representation as to its accuracy or completeness.